Saudi Arabia Lentil Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

Saudi Arabia Lentil Market Overview:

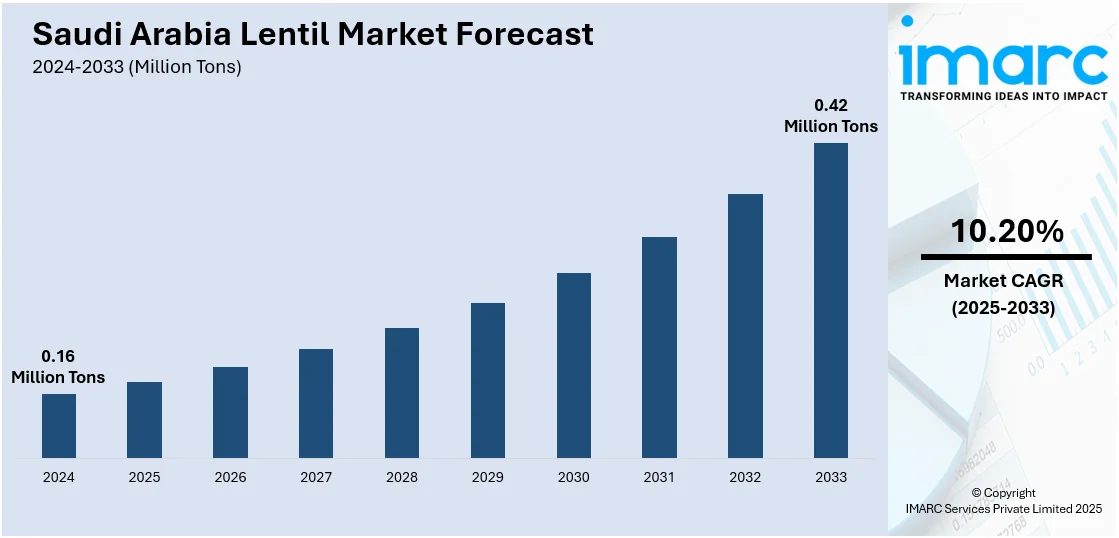

The Saudi Arabia lentil market size reached 0.16 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 0.42 Million Tons by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The market is being driven by the rising health consciousness, increasing vegetarian and plant-based dietary preferences, population growth, and strong import reliance supported by government initiatives to enhance food security and diversify dietary staples.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.16 Million Tons |

| Market Forecast in 2033 | 0.42 Million Tons |

| Market Growth Rate 2025-2033 | 10.20% |

Saudi Arabia Lentil Market Trends:

Rising Health and Nutrition Awareness

One of the main factors propelling the growth of the lentil market is Saudi consumers' growing awareness about nutrition and healthy eating. Because lentils are low in fat and high in protein, fiber, vitamins, and minerals, they are a popular nutritional choice in a population that is growing more health-conscious. People are looking for better, plant-based protein substitutes as the nation's obesity, diabetes, and cardiovascular disease rates are rising. The fact that lentils may be incorporated into diabetic-friendly meal plans and weight-management diets adds to their allure. People are also being encouraged to shift towards balanced meals by government and corporate health initiatives, which advocate lentils as inexpensive, nutrient-dense staples. The expanding fitness trend, along with the increasing appetite for superfoods, has led to lentils becoming more prominent in restaurants and home cooking throughout Saudi Arabia. As per the IMARC Group, the Saudi Arabia superfood market is set to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033.

To get more information on this market, Request Sample

Expanding Retail and Online Distribution Channels

The rapid expansion of modern retail infrastructure and e-commerce platforms in Saudi Arabia is boosting lentil availability and accessibility. As per industry reports, In Q3 2024, the KSA retail market had modest growth, with sales of SAR 37.4 Billion. Hypermarkets, supermarkets, and specialty food stores stock a variety of lentil types, including red, green, yellow, and black lentils, catering to diverse consumer preferences. E-commerce and online grocery platforms are also making it easier for urban consumers to shop for packaged and bulk lentils with the convenience of home delivery. Promotions, discounts, and product information available online encourage trial and repeat purchases. Additionally, international lentil brands and local suppliers are using digital platforms to reach wider audiences, supported by rising smartphone penetration and online payment adoption.

Growing Urbanization and Lifestyle Changes

Urbanization in Saudi Arabia is bringing significant lifestyle changes that are positively impacting lentil consumption. As more people are migrating to urban centers, their diets are increasingly shifting towards convenient, quick-to-cook, and nutritious foods. Lentils, which cook relatively fast compared to other legumes, fit perfectly into the busy schedules of working families and professionals. Ready-to-cook lentil mixes, packaged pulses, and frozen lentil-based meals are also gaining traction in urban supermarkets. Moreover, the growing exposure to global cuisines through travel activities, media, and food delivery platforms is encouraging consumers to experiment with lentil-based recipes, such as soups, stews, salads, and Indian or Mediterranean dishes. Around 116 Million domestic and foreign visitors visited Saudi Arabia in 2024, a 6% increase from 2023, according to the Kingdom's 2024 Annual Statistical Report on the Tourism Sector. This evolving urban lifestyle, where convenience and nutrition are equally important, ensures that lentils remain a staple food choice.

Key Growth Drivers of Saudi Arabia Lentil Market:

Growing Shift Towards Plant-Based Diets

Rising trend of plant-based eating is strongly influencing consumer choices in Saudi Arabia, with lentils becoming a central part of this dietary shift. As more people are reducing meat consumption for health, ethical, and environmental reasons, the demand for protein-rich plant alternatives like lentils is increasing. The younger population, in particular, is embracing vegetarian and vegan diets, inspired by global wellness trends and social media advocacy. Restaurants, cafés, and foodservice outlets are expanding their vegetarian offerings, often incorporating lentil-based dishes to cater to this demographic. Lentils are versatile enough to replace meat in soups, salads, curries, and snacks, making them a practical choice for individuals exploring flexitarian or fully plant-based diets. This cultural shift towards sustainable and healthier lifestyles aligns well with lentil consumption, ensuring a steady increase in demand within Saudi households, foodservice channels, and retail spaces.

Government Initiatives for Food Security

Saudi Arabia’s strong focus on food security and diversification of dietary sources is propelling the market growth. The government is actively promoting the consumption of affordable, nutrient-dense food items to ensure a stable supply of essential nutrients to its population. Lentils, being cost-effective and protein-rich, are often included in these initiatives and public awareness campaigns. Moreover, partnerships with international exporters and investments in food storage infrastructure ensure that lentils remain accessible during times of global supply chain disruptions. Programs targeting healthier diets in schools, workplaces, and healthcare institutions also emphasize legumes, including lentils, as vital dietary components. By positioning lentils as part of the national food security strategy, the government ensures sustained demand across different segments of society.

Thriving Foodservice and Hospitality Industries

The burgeoning foodservice and hospitality sectors in Saudi Arabia plays a vital role in driving lentil demand. Restaurants, cafés, hotels, and catering services are increasingly incorporating lentil-based dishes into their menus to meet the diverse preferences of both locals and international visitors. Lentils are cost-effective, versatile, and can be used in traditional Middle Eastern recipes as well as global cuisines, making them an attractive option for chefs and foodservice operators. The rise of casual dining, quick-service restaurants, and international franchises has further boosted the inclusion of lentil soups, stews, and salads in everyday offerings. With the hospitality industry continuously innovating to meet global standards, lentils benefit from stronger menu presence, ensuring increased institutional demand and broader market growth in Saudi Arabia.

Saudi Arabia Lentil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on end use.

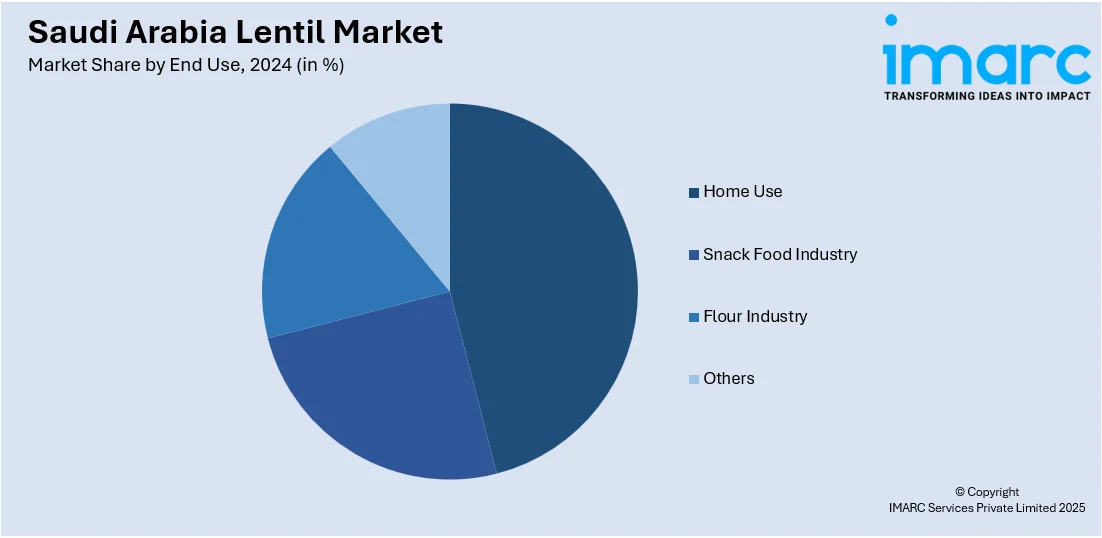

End Use Insights:

- Home Use

- Snack Food Industry

- Flour Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes home use, snack food industry, flour industry, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Lentil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Home Use, Snack Food Industry, Flour Industry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia lentil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia lentil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia lentil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lentil market in Saudi Arabia reached a volume of 0.16 Million Tons in 2024.

The Saudi Arabia lentil market is projected to exhibit a CAGR of 10.20% during 2025-2033, reaching a volume of 0.42 Million Tons by 2033.

The growing popularity of vegetarian and vegan diets, coupled with lentils’ nutritional benefits, is encouraging wider consumption. Imports play a key role in meeting domestic demand, while retail and online distribution channels are expanding accessibility. Additionally, rising influence of healthy eating trends is fueling the market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)