Saudi Arabia Lighting Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Saudi Arabia Lighting Market Overview:

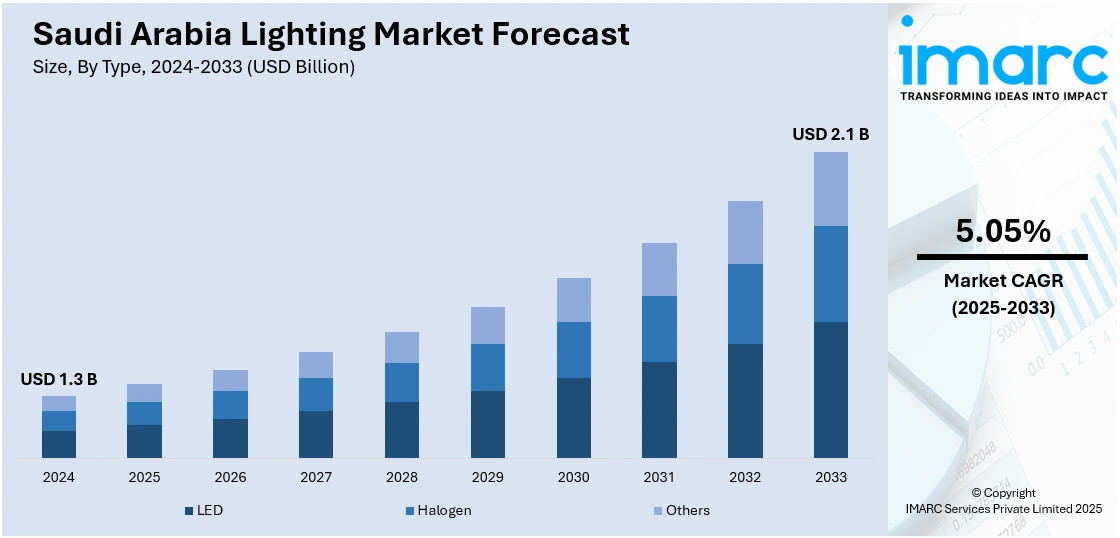

The Saudi Arabia lighting market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.05% during 2025-2033. The market share is expanding, driven by rising expenditure on smart city projects, which is creating the need for modern lighting systems to ensure safety and energy efficiency, along with increasing travel activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Market Growth Rate 2025-2033 | 5.05% |

Saudi Arabia Lighting Market Trends:

Rising infrastructure development

The ongoing infrastructure development is fueling the Saudi Arabia lighting market growth. As the country is investing in large-scale construction projects, there is a consistent demand for various lighting solutions across residential, commercial, and industrial spaces. In January 2025, the governmental authorities of Saudi Arabia revealed 73 projects focused on the environment, water, and agriculture valued at SAR 4.7 Billion (over USD 1.2 Billion). The initiatives corresponded with Saudi Arabia’s Vision 2030, striving to boost sustainability, upgrade infrastructure, and deliver improved services to citizens. Projects like smart cities, entertainment hubs, and business zones need modern lighting systems to ensure safety, aesthetics, and energy efficiency. With infrastructure expanding into new areas, the need for street lighting, highway illumination, and public lighting systems is increasing steadily. Lighting is becoming essential for indoor use in new malls, hospitals, schools, and transport hubs that are being built to serve the growing population. Additionally, modern infrastructure focuses on sustainable and smart technologies, so developers prefer light emitting diode (LED) and intelligent lighting systems that align with energy-saving goals. The integration of lighting into smart city planning is positively influencing the market, as connected lighting offers better control and maintenance. The construction of housing units and commercial centers is driving the demand for ambient and task lighting products.

Increasing tourism activities

Rising tourism activities are offering a favorable Saudi Arabia lighting market outlook. In January 2025, the Saudi Minister of Tourism announced that the kingdom experienced 30 Million international arrivals in 2024, setting a new record for the nation. As the government is actively promoting tourism through mega projects and international campaigns, the construction of new hotels and resorts is increasing rapidly. These places need high-quality lighting systems for both aesthetic appeal and functional purposes. With landmarks and historical sites being upgraded to attract tourists, outdoor and decorative lighting play a key role in enhancing their visual impact, especially during night hours. The tourism sector also supports events, festivals, and cultural gatherings, which require advanced lighting setups for ambience and performance. Airports, train stations, and other transport facilities that handle tourist traffic are also expanding, demanding reliable and energy-optimized lighting. The hospitality industry focuses on mood lighting and smart lighting systems to offer a premium experience to visitors. As more international visitors are exploring the kingdom, cities and tourist zones are wagering on improved street lighting and public area illumination to boost safety and visibility.

Saudi Arabia Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- LED

- Halogen

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes LED, halogen, and others.

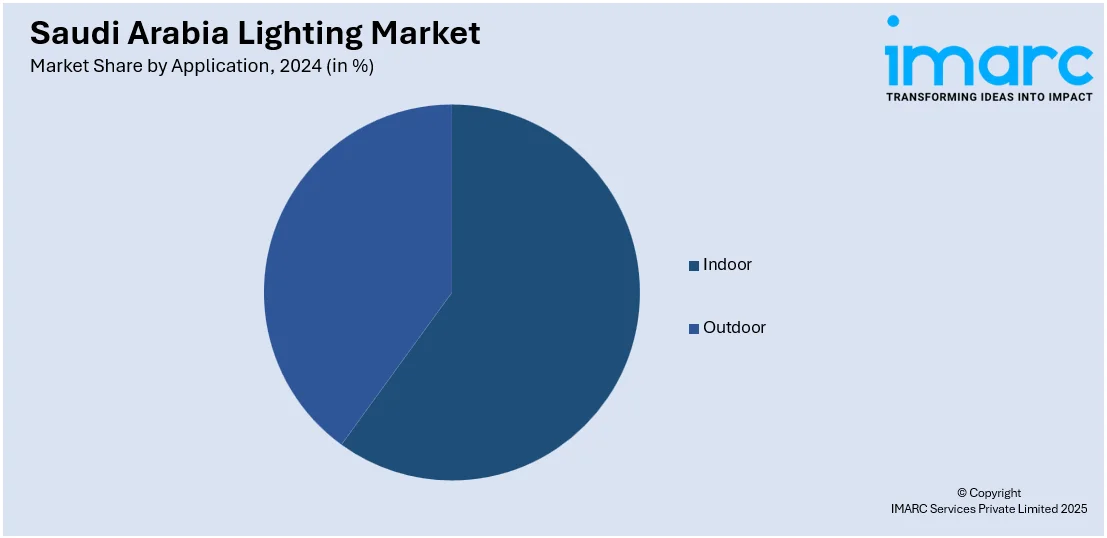

Application Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes indoor and outdoor.

End User Insights:

- Residential

- Commercial

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, industrial, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Lighting Market News:

- In December 2024, Automechanika Dubai 2024 celebrated its 21st edition, where OSRAM introduced innovative lighting products designed for Middle Eastern landscapes. The range inculcated various LEDr retrofit options for halogen and Xenon bulbs. The company also launched accessories for construction vehicles and off-road enthusiasts in Saudi Arabia, featuring working lights, safety lights, and tire care items, including powerful LED work lights and sophisticated safety beacons.

- In January 2024, Versatile International, revealed the creation of a new firm to produce lighting technologies in Saudi Arabia. Asheil Versatile Lighting Technologies was a comprehensive lighting manufacturing facility that offered consulting and planning services for extensive lighting installations. Asheil would cater to destination-scale initiatives, encompassing the Saudi mega-projects and the regional wholesale market.

Saudi Arabia Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | LED, Halogen, Others |

| Applications Covered | Indoor, Outdoor |

| End Users Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia lighting market on the basis of type?

- What is the breakup of the Saudi Arabia lighting market on the basis of application?

- What is the breakup of the Saudi Arabia lighting market on the basis of end user?

- What is the breakup of the Saudi Arabia lighting market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia lighting market?

- What are the key driving factors and challenges in the Saudi Arabia lighting market?

- What is the structure of the Saudi Arabia lighting market and who are the key players?

- What is the degree of competition in the Saudi Arabia lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)