Saudi Arabia Lightweight Building Materials Market Size, Share, Trends and Forecast by Type of Material, Density, Application, End User, and Region, 2026-2034

Saudi Arabia Lightweight Building Materials Market Summary:

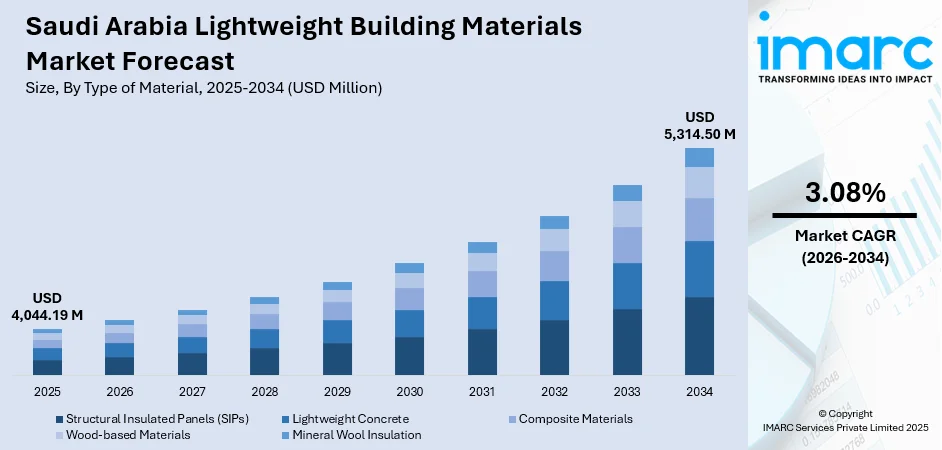

The Saudi Arabia lightweight building materials market size was valued at USD 4,044.19 Million in 2025 and is projected to reach USD 5,314.50 Million by 2034, growing at a compound annual growth rate of 3.08% from 2026-2034.

The market is witnessing robust expansion driven by the Kingdom's ambitious Vision 2030 initiative, which emphasizes economic diversification through large-scale infrastructure development and sustainable construction practices. Rapid urbanization across major cities, combined with government-mandated energy efficiency standards, is propelling the demand for advanced lightweight solutions. The proliferation of giga-projects requiring accelerated construction timelines and reduced structural loads is further strengthening the market share.

Key Takeaways and Insights:

- By Type of Material: Lightweight concrete dominates the market with a share of 34% in 2025, driven by its superior thermal insulation properties suitable for the Kingdom's extreme climate conditions, cost-effectiveness compared to traditional construction materials, and widespread adoption across residential and commercial developments.

- By Density: Medium-density leads the market with a share of 38% in 2025, owing to the optimal balance between structural strength and weight reduction, versatility across diverse construction applications, and compliance with Saudi Building Code requirements for energy-efficient buildings.

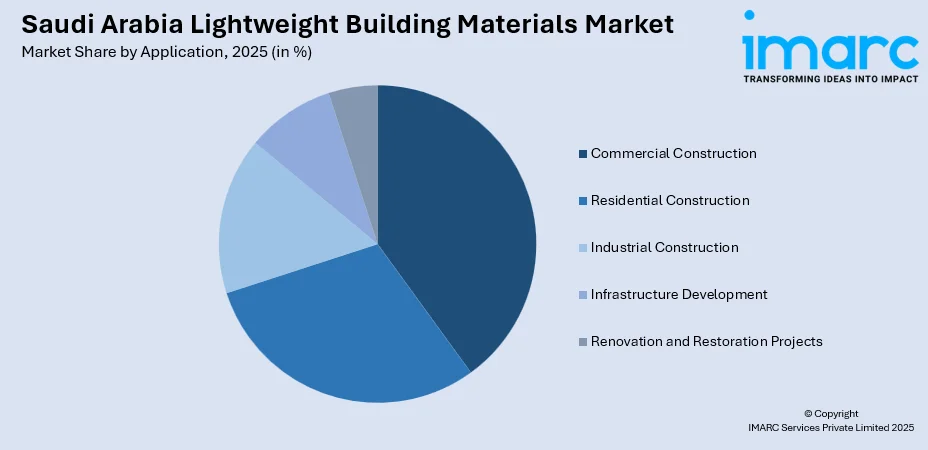

- By Application: Commercial construction represents the largest segment with a market share of 32% in 2025. This dominance is driven by the surge in retail, hospitality, and office developments under Vision 2030, with mixed-use projects demanding lightweight solutions for faster completion timelines.

- By End User: Construction companies prevail the market with a share of 33% in 2025, reflecting their pivotal role as primary procurers and implementers of lightweight building materials across mega-projects and urban developments.

- Key Players: The Saudi Arabia lightweight building materials market exhibits moderate-to-high competitive intensity, with established regional manufacturers competing alongside international suppliers to serve the Kingdom's ambitious construction pipeline.

To get more information on this market Request Sample

The market growth trajectory is underpinned by substantial government investments in construction projects over the coming years. In October 2024, NEOM, the quickly advancing sustainable area in northwest Saudi Arabia, revealed a collaboration with Asas Al-Mohileb to develop and manage a SAR 700 Million ready-mix concrete plant. The multi-plant facility, focused on concrete production, would primarily support the building of THE LINE. The Saudi government's emphasis on developing domestic manufacturing capabilities continues to accelerate through licensing initiatives and strategic investments in local supply chains. This regulatory support, combined with mega-project requirements for efficient construction solutions, is driving the adoption of lightweight building materials across all application categories. The Kingdom's focus on green building certifications is creating sustained demand for advanced lightweight solutions meeting both performance and environmental requirements.

Saudi Arabia Lightweight Building Materials Market Trends:

Accelerated Adoption of Prefabricated and Modular Construction

The Kingdom is experiencing a fundamental shift towards prefabricated construction methodologies that leverage lightweight building materials for rapid project delivery. China Harbour Engineering Company's 200,000 square meter modular production facility in Riyadh commenced operations in March 2025 to support large-scale housing projects, employing robotics and digital technologies to refine modular construction efficiency. This trend is particularly pronounced in mega-projects where ambitious timelines necessitate factory-built components, with developers increasingly mandating prefabrication across their developments to achieve carbon-neutral operations while meeting accelerated completion schedules.

Integration of Sustainable and Low-Carbon Materials

Sustainability imperatives are reshaping material selection across Saudi construction projects, with lightweight solutions increasingly favored for their reduced carbon footprint and enhanced energy performance. In October 2024, City Cement's subsidiary Nizak Mining Company entered into an agreement with Next Generation SCM to establish the Kingdom's first calcined clay supplementary cementitious material plant with an initial production capacity of 350,000 Tons per annum. This milestone in low-carbon construction reflects the broader industry transition towards environmentally responsible building practices aligned with Vision 2030 sustainability objectives and the Kingdom's carbon neutrality targets.

Digital Transformation and Smart Manufacturing Technologies

Advanced technologies are revolutionizing lightweight materials production and application across the Saudi construction landscape. In December 2024, NEOM entered into a joint venture (JV) agreement with Samsung C&T Corporation, aiming to enable an initial investment exceeding SAR 1.3 Billion in construction robotics. The pact would expedite the advancement and implementation of innovative construction automation technology in Saudi Arabia. Building Information Modeling integration and AI-powered project management tools are enabling real-time tracking and predictive maintenance, transforming how lightweight building components are designed, manufactured, and installed across the Kingdom's mega-projects requiring sophisticated coordination and quality assurance systems.

Market Outlook 2026-2034:

The Saudi Arabia lightweight building materials market is positioned for sustained expansion throughout the forecast period, supported by the government's unwavering commitment to infrastructure modernization and economic diversification. The market generated a revenue of USD 4,044.19 Million in 2025 and is projected to reach a revenue of USD 5,314.50 Million by 2034, growing at a compound annual growth rate of 3.08% from 2026-2034. The growing emphasis on green building certifications and energy-efficient construction practices, combined with expanding domestic manufacturing capabilities, will further accelerate revenue growth across all material segments and application areas.

Saudi Arabia Lightweight Building Materials Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Material | Lightweight Concrete | 34% |

| Density | Medium Density | 38% |

| Application | Commercial Construction | 32% |

| End User | Construction Companies | 33% |

Type of Material Insights:

- Structural Insulated Panels (SIPs)

- Lightweight Concrete

- Composite Materials

- Wood-based Materials

- Mineral Wool Insulation

Lightweight concrete dominates with a market share of 34% of the total Saudi Arabia lightweight building materials market in 2025.

Lightweight concrete has emerged as the preferred material solution across Saudi construction projects due to its exceptional thermal insulation properties, which are critical for reducing cooling loads in the Kingdom's extreme desert climate. The material offers lower carbon footprint compared to traditional concrete while maintaining structural integrity.

The segment's growth is further propelled by cost advantages in transportation and installation, as reduced weight translates to lower freight expenses and simplified handling on construction sites. Saudi Arabia's Vision 2030 is spearheading an astonishing USD 1.3 Trillion in investments throughout the kingdom's real estate, infrastructure, and transportation industries, with USD 164 Billion in real estate contracts issued, the most significant of which is for Neom (USD 28.7 Billion), according to an industry report. This has created sustained demand for lightweight concrete across residential complexes, commercial structures, and transportation infrastructure. Projects requiring rapid construction timelines, such as the Red Sea Development and Qiddiya Entertainment City, increasingly specify lightweight concrete for its faster curing times and ease of prefabrication, enabling developers to meet ambitious completion schedules while maintaining quality standards.

Density Insights:

- Low Density

- Medium Density

- High Density

- Ultra Lightweight

Medium-density leads with a share of 38% of the total Saudi Arabia lightweight building materials market in 2025.

Medium-density lightweight building materials have captured the dominant market position by offering the optimal combination of structural performance and weight reduction required for diverse construction applications across Saudi Arabia. These materials satisfy stringent load-bearing requirements while providing sufficient thermal mass for temperature regulation in the Kingdom's climate. The balanced density profile enables use in both structural and non-structural applications, from load-bearing walls in residential developments to interior partitions in commercial complexes.

The segment benefits from versatility across application types, accommodating requirements from high-rise residential towers to sprawling logistics facilities without requiring specialized handling equipment. Construction companies prefer medium-density materials for their predictable performance characteristics and compatibility with standard installation methods, reducing training requirements and project risks. The ongoing expansion of ROSHN's residential communities, including the 30,000-unit Sedra project spanning 20 Million square meters, demonstrates the sustained preference for medium-density solutions in large-scale housing developments where cost efficiency and performance must be balanced effectively.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Development

- Renovation and Restoration Projects

Commercial construction exhibits a clear dominance with a 32% share of the total Saudi Arabia lightweight building materials market in 2025.

Commercial construction has emerged as the primary application segment for lightweight building materials, driven by the unprecedented surge in retail, hospitality, office, and mixed-use developments across Saudi Arabia. In February 2024, contracts totaling SAR 12 Billion were granted for the first phase of Jeddah Central, which included the construction of the opera house, stadium, and oceanarium, as well as essential infrastructure.

The segment benefits from stringent project timelines requiring efficient construction solutions, as commercial developers increasingly specify lightweight materials to accelerate occupancy schedules and reduce structural loads on complex architectural designs. The commercial segment's dominance reflects the transformative impact of mega-projects on material demand patterns across the Kingdom. Office demand has surged significantly in major cities, spurring premium commercial development that prioritizes modern construction methodologies, incorporating lightweight building systems, for faster completion and enhanced energy performance throughout building lifecycles.

End User Insights:

- Contractors

- Construction Companies

- Architects and Designers

- Homeowners

- Real Estate Developers

Construction companies represent the leading segment with a 33% share of the total Saudi Arabia lightweight building materials market in 2025.

Construction companies serve as the primary channel for lightweight building materials procurement, leveraging their scale advantages and technical expertise to specify and implement advanced solutions across Saudi mega-projects. Major firms, including Saudi Binladin Group and Al Bawani, are investing in local talent through structured training programs while maintaining strategic partnerships with international suppliers, aligned with Saudization goals. These organizations possess the project management capabilities and supplier relationships necessary to coordinate complex material deliveries for large-scale developments.

The segment's leadership reflects construction companies' integrated approach to project delivery, from design optimization through material installation and quality assurance. Government initiatives, including the issuance of 3,800 construction licenses in 2024, demonstrate strong industry activity levels supporting sustained material demand. Construction companies benefit from bulk procurement economics and technical support arrangements with manufacturers, enabling competitive pricing and consistent supply security.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region is driving the demand for lightweight building materials through urban development and residential construction projects. New cities, industrial hubs, and infrastructure expansion require efficient, durable materials to reduce construction time and costs while improving energy efficiency across buildings.

The Western Region sees growth in lightweight materials due to tourism, commercial, and religious infrastructure projects. Cities like Jeddah and Mecca require durable, fast-to-install materials for hotels, malls, and public facilities. Lightweight solutions support cost-efficient construction while accommodating high footfall and environmental conditions.

The Eastern Region’s industrial and oil-based economy is fueling the demand for lightweight building materials in factories, offices, and residential developments. Materials that enhance structural efficiency, thermal insulation, and fire safety are prioritized to meet industrial standards and urban expansion needs.

In the Southern Region, urban centers and infrastructure projects are creating the demand for lightweight construction materials. Builders focus on energy-efficient and durable materials suitable for hot and humid climates, supporting residential, commercial, and municipal construction while minimizing maintenance and lifecycle costs.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Lightweight Building Materials Market Growing?

Unprecedented Government Investment in Vision 2030 Mega-Projects

Large-scale government investment under Vision 2030 is accelerating Saudi Arabia’s lightweight building materials market by creating massive demand for fast, efficient, and sustainable construction solutions. According to the contracting sector regulator of the Gulf Kingdom, almost 18,000 projects are anticipated to be executed in Saudi Arabia from 2025 to 2030, as part of Vision 2030. Mega-projects, such as new cities, tourism hubs, and industrial zones, require materials that reduce construction time and structural load. Lightweight materials support modular construction and rapid installation, helping developers meet project deadlines. Their transport efficiency also lowers logistics costs across large sites. As developers focus on innovation and modern design, demand rises for advanced panels, insulation systems, and prefabricated components. Government-backed infrastructure projects encourage private sector participation, expanding supplier networks. These developments create long-term demand and encourage manufacturers to expand production capacity, making large public investment a central growth engine for lightweight building materials.

Stringent Energy Efficiency Regulations and Green Building Mandates

Energy efficiency policies are driving the market expansion by promoting better insulation, heat resistance, and reduced energy consumption. The Ministry of Municipalities and Housing's Building Sustainability Assessment System evaluated 75 projects covering approximately 47 Million square meters in 2024, with momentum continuing in early 2025 with an additional 7 million square meters assessed. Green building requirements are encouraging developers to select materials that improve thermal performance and lower cooling needs. Lightweight insulation systems, eco-panels, and advanced composites help builders meet sustainability standards. Developers increasingly choose energy-efficient materials to qualify for certifications and regulatory approvals. This shift is also driven by rising electricity costs and environmental awareness. Lightweight materials support eco-friendly construction through reduced raw material usage and improved building performance. As compliance is becoming stricter, construction companies are investing more in sustainable material alternatives. This regulatory environment is transforming lightweight materials into mandatory solutions rather than optional upgrades, strengthening long-term market demand.

Population Growth and Urbanization Activities

Rapid population growth and urban expansion are driving the demand for housing, commercial space, and infrastructure across Saudi Arabia. The total projected population for Saudi Arabia in 2025 is 37,989,969, reflecting a 1.38% growth from 2024. New residential developments, schools, hospitals, and offices create rising demand for cost-efficient and scalable building materials. Lightweight materials allow faster construction and easier transportation, supporting high-volume urban development. Their use also enables vertical expansion in crowded cities by reducing structural load. Urban lifestyles increase expectations for energy efficiency and interior comfort, encouraging the utilization of modern construction materials. As cities are expanding and housing projects are multiplying, builders continue to prioritize speed and sustainability. This urban development trend ensures continuous growth in lightweight building material demand across rapidly developing regions.

Market Restraints:

What Challenges is the Saudi Arabia Lightweight Building Materials Market Facing?

High Initial Cost of Advanced Materials

Lightweight building materials, such as high-performance composites, insulated panels, and specialized concrete, frequently entail greater initial expenses relative to conventional materials. Developers may hesitate to adopt these solutions, especially for large-scale residential or commercial projects with tight budgets. While these materials offer long-term benefits like reduced structural load and energy efficiency, the initial capital requirement can limit adoption. Price-sensitive segments may prefer conventional materials, slowing market penetration despite technological advantages.

Limited Awareness and Technical Expertise

Many contractors, builders, and end-users lack knowledge about the benefits and proper installation of lightweight materials. Improper handling can reduce performance, durability, and safety. Limited training and technical expertise in the construction workforce hinder adoption, as developers may prefer familiar traditional materials. The market growth is affected when stakeholders cannot fully evaluate long-term advantages, such as energy savings, faster construction, and reduced structural loads. Awareness campaigns and professional training programs are essential to overcome this barrier.

Supply Chain and Raw Material Constraints

The production of lightweight building materials depends on specialized raw materials, many of which are imported. Supply chain disruptions, transportation delays, or price volatility of key inputs can impact manufacturing consistency and project timelines. Smaller regional manufacturers may struggle to maintain steady supply, affecting construction schedules. These challenges can deter developers from committing to lightweight materials. Ensuring reliable sourcing, local manufacturing, and diversified supply chains is critical to overcome logistical and material-related risks in the Saudi market.

Competitive Landscape:

The Saudi Arabia lightweight building materials market features a competitive environment, characterized by both established regional manufacturers and international suppliers positioning for growth opportunities under Vision 2030. Market participants differentiate through product innovation, manufacturing capacity investments, and strategic partnerships with mega-project developers. Companies are increasingly investing in domestic production facilities to reduce import dependence and strengthen supply chain resilience. The competitive landscape is evolving, as foreign manufacturers are establishing local operations through joint ventures with Saudi partners, responding to government localization initiatives. Technology partnerships between Saudi firms and international specialists are accelerating knowledge transfer in advanced manufacturing processes and sustainable material technologies, reshaping competitive dynamics across market segments.

Saudi Arabia Lightweight Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Materials Covered | Structural Insulated Panels (SIPs), Lightweight Concrete, Composite Materials, Wood-based Materials, Mineral Wool Insulation |

| Densities Covered | Low-density, Medium-density, High-density, Ultra-lightweight |

| Applications Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development, Renovation and Restoration Projects |

| End Users Covered | Contractors, Construction Companies, Architects and Designers, Homeowners, Real Estate Developers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia lightweight building materials market size was valued at USD 4,044.19 Million in 2025.

The Saudi Arabia lightweight building materials market is expected to grow at a compound annual growth rate of 3.08% from 2026-2034 to reach USD 5,314.50 Million by 2034.

Lightweight concrete dominates the market with 34% share, driven by its superior thermal insulation properties, cost-effectiveness, and widespread adoption across Vision 2030 mega-projects requiring sustainable and energy-efficient construction solutions.

Key factors driving the Saudi Arabia lightweight building materials market include unprecedented government investment in Vision 2030 mega-projects, stringent energy efficiency regulations mandating thermally efficient construction materials, and rapid urbanization generating sustained residential and commercial construction demand.

Major challenges include volatile raw material prices, limited domestic manufacturing capacity requiring imports from Europe and Asia, supply chain disruptions from Red Sea shipping issues, and high upfront costs for advanced lightweight solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)