Saudi Arabia Limestone Market Size, Share, Trends and Forecast by Type, Size, End Use Industry, and Region, 2026-2034

Saudi Arabia Limestone Market Overview:

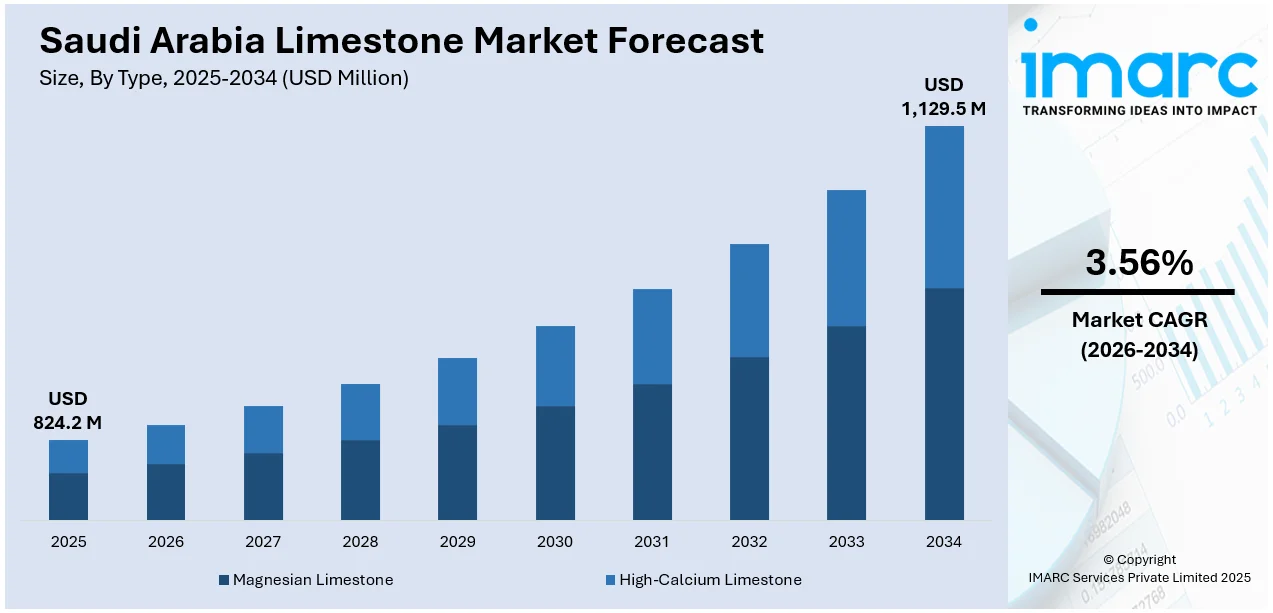

The Saudi Arabia limestone market size reached USD 824.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,129.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.56% during 2026-2034. The market is driven by extensive infrastructure development and urban expansion projects that require durable construction materials. Cement and steel industries depend on high-quality limestone for production efficiency and industrial growth. Increasing use in environmental remediation and agricultural soil treatment further strengthens and broadens the Saudi Arabia limestone market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 824.2 Million |

| Market Forecast in 2034 | USD 1,129.5 Million |

| Market Growth Rate 2026-2034 | 3.56% |

Saudi Arabia Limestone Market Trends:

Accelerated Infrastructure Development and Urbanization

Saudi Arabia’s limestone market is significantly propelled by the kingdom’s ambitious infrastructure projects and rapid urbanization. Large-scale initiatives such as NEOM, the Red Sea Project, and Qiddiya Entertainment City require substantial quantities of limestone for cement production, concrete aggregates, and construction materials. These developments focus on sustainable, resilient infrastructure, where limestone is valued for its durability and thermal properties. Additionally, the expansion of residential, commercial, and industrial zones in Riyadh, Jeddah, and Dammam boosts demand for high-quality construction aggregates and architectural stone. Government investment in transportation networks, including highways, railways, and airports, further supports limestone consumption. The local availability of limestone quarries across key regions reduces logistics costs and ensures timely supply for ongoing projects. The combination of mega infrastructure programs and urban growth drives Saudi Arabia limestone market growth by continuously stimulating demand for construction-grade materials.

To get more information on this market Request Sample

Cement and Steel Industry Expansion

Limestone plays a critical role in Saudi Arabia’s cement and steel sectors, both essential to the kingdom’s economic diversification under Vision 2030. The material is a primary raw input in cement clinker production and a fluxing agent in steel manufacturing, helping to remove impurities during smelting. Saudi Arabia’s domestic cement producers, such as Saudi Cement Company and Yamama Cement, depend heavily on limestone supplies to meet rising construction needs. Similarly, steel producers engaged in supplying materials for construction, oil and gas infrastructure, and manufacturing require consistent limestone quality. Efforts to adopt cleaner production technologies and enhance industrial efficiency maintain steady limestone demand. Furthermore, the kingdom’s focus on increasing local content in industrial supply chains strengthens the importance of domestic limestone sources. These factors contribute to sustained limestone consumption in metallurgical and construction material industries.

Environmental and Agricultural Applications

Limestone is increasingly utilized in environmental management and agricultural sectors in Saudi Arabia. Its use in neutralizing acidic soils is important in enhancing agricultural productivity, particularly in regions with challenging soil conditions such as Al-Qassim and Asir. Agricultural lime improves soil pH and nutrient availability, supporting the kingdom’s goals for food security and sustainable farming practices. Additionally, limestone is employed in environmental remediation processes, including flue gas desulfurization at power plants and wastewater treatment facilities, to reduce harmful emissions and comply with stringent environmental regulations. Municipal water treatment plants also use limestone filtration for pH stabilization and contaminant removal. These growing applications contribute to the diversification of limestone demand beyond traditional construction and industrial uses. Environmental and agricultural needs are thus vital components supporting the resilience of the Saudi Arabia limestone market.

Saudi Arabia Limestone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, size, and end use industry.

Type Insights:

- Magnesian Limestone

- High-Calcium Limestone

The report has provided a detailed breakup and analysis of the market based on the type. This includes magnesian limestone and high-calcium limestone.

Size Insights:

- Crushed Limestone

- Calcined Limestone (PCC)

- Ground Limestone (GCC)

The report has provided a detailed breakup and analysis of the market based on the size. This includes crushed limestone, calcined limestone (PCC), and ground limestone (GCC).

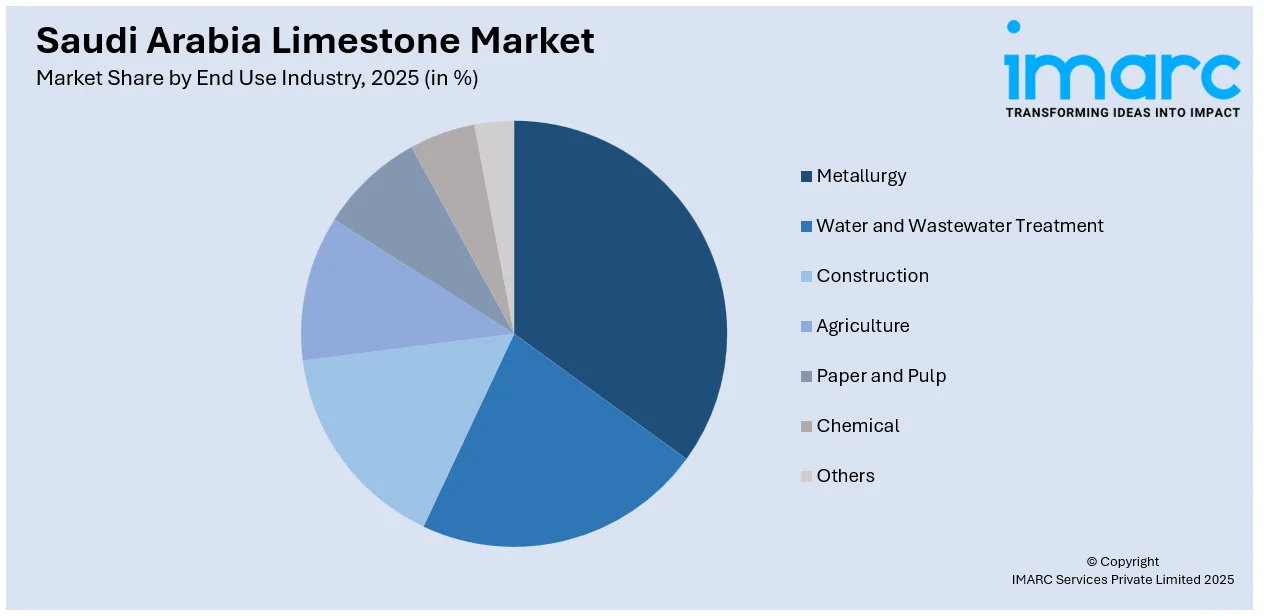

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Metallurgy

- Water and Wastewater Treatment

- Construction

- Agriculture

- Paper and Pulp

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes metallurgy, water and wastewater treatment, construction, agriculture, paper and pulp, chemical, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Limestone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Magnesian Limestone, High-Calcium Limestone |

| Sizes Covered | Crushed Limestone, Calcined Limestone (PCC), Ground Limestone (GCC) |

| End Use Industries Covered | Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia limestone market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia limestone market on the basis of type?

- What is the breakup of the Saudi Arabia limestone market on the basis of size?

- What is the breakup of the Saudi Arabia limestone market on the basis of end use industry?

- What is the breakup of the Saudi Arabia limestone market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia limestone market?

- What are the key driving factors and challenges in the Saudi Arabia limestone market?

- What is the structure of the Saudi Arabia limestone market and who are the key players?

- What is the degree of competition in the Saudi Arabia limestone market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia limestone market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia limestone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia limestone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)