Saudi Arabia Loaders Market Size, Share, Trends and Forecast by Type, Engine, Fuel, and Region, 2026-2034

Saudi Arabia Loaders Market Overview:

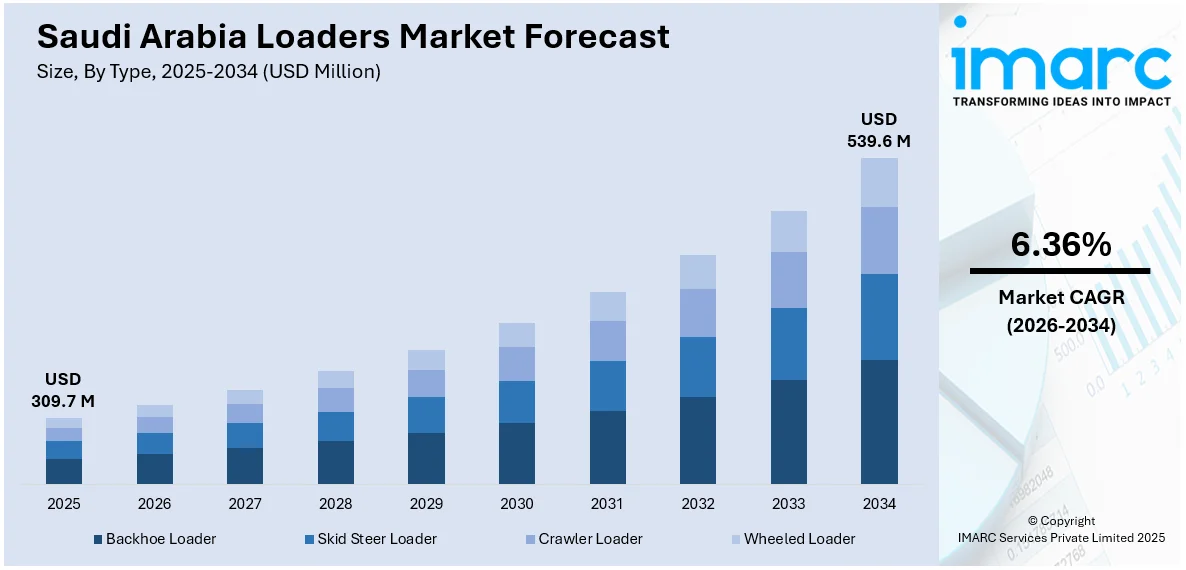

The Saudi Arabia loaders market size reached USD 309.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 539.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.36% during 2026-2034. Increasing infrastructure development and urbanization in Saudi Arabia, driven by Vision 2030 projects, are some of the factors contributing to Saudi Arabia loaders market share. Economic diversification, rising construction activities, technological advancements, and stricter environmental regulations further drive market growth by boosting efficiency and sustainability in the loaders sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 309.7 Million |

| Market Forecast in 2034 | USD 539.6 Million |

| Market Growth Rate 2026-2034 | 6.36% |

Saudi Arabia Loaders Market Trends:

Expanding Construction Activity

Saudi Arabia's construction equipment sector is undergoing a notable expansion, fueled by significant infrastructure endeavors. A recent substantial agreement exemplifies this growth, with numerous excavators and wheel loaders being provided to major construction firms for a prominent road development initiative in the capital. This considerable procurement includes a variety of large and medium-sized excavators, alongside a substantial number of large wheel loaders. The deployment of such an array of heavy machinery emphasizes the escalating need for powerful and adaptable equipment to meet the aggressive schedules of the kingdom's development blueprints. This vigorous activity signals a thriving and growing market for construction machinery across the region. These factors are intensifying the Saudi Arabia loaders market growth. For example, in August 2024, South Korea’s HD Hyundai Infracore Co. signed a contract to supply 100 excavators and wheel loaders to Saudi Arabia’s top construction firms, Saudi Pan Kingdom Company (SAPAC) and Nesma & Partners Contracting. The equipment includes 20 large 50-ton excavators, 40 medium 20-ton excavators, and 40 large wheel loaders. These machines will support the Riyadh Ring Road project, aimed at constructing an outer ring road around Riyadh by 2027.

To get more information on this market Request Sample

Strong Market Expansion in the Construction Equipment Sector

The Saudi Arabia market for heavy construction machinery, particularly earthmoving equipment, is experiencing a robust period of expansion. Data from the past year indicates a substantial uptick in orders for excavators and wheel loaders, demonstrating a significant increase in demand for these vital tools. This surge reflects the intensifying pace of construction and infrastructure development across the Kingdom, driven by ambitious national projects and urban growth initiatives. The heightened procurement activity underscores a dynamic and highly active period within Saudi Arabia's construction landscape, signaling sustained investment and vigorous development efforts. For instance, as per industry reports, Hyundai Infracore saw a significant boost in excavator and wheel loader orders in Saudi Arabia during 2024. Orders jumped by 51.6%, reaching 846 units compared to 558 units the previous year. This indicates a strong growth in demand for Hyundai's construction equipment in the region.

Saudi Arabia Loaders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, engine, and fuel.

Type Insights:

- Backhoe Loader

- Skid Steer Loader

- Crawler Loader

- Wheeled Loader

The report has provided a detailed breakup and analysis of the market based on the type. This includes backhoe loader, skid steer loader, crawler loader, and wheeled loader.

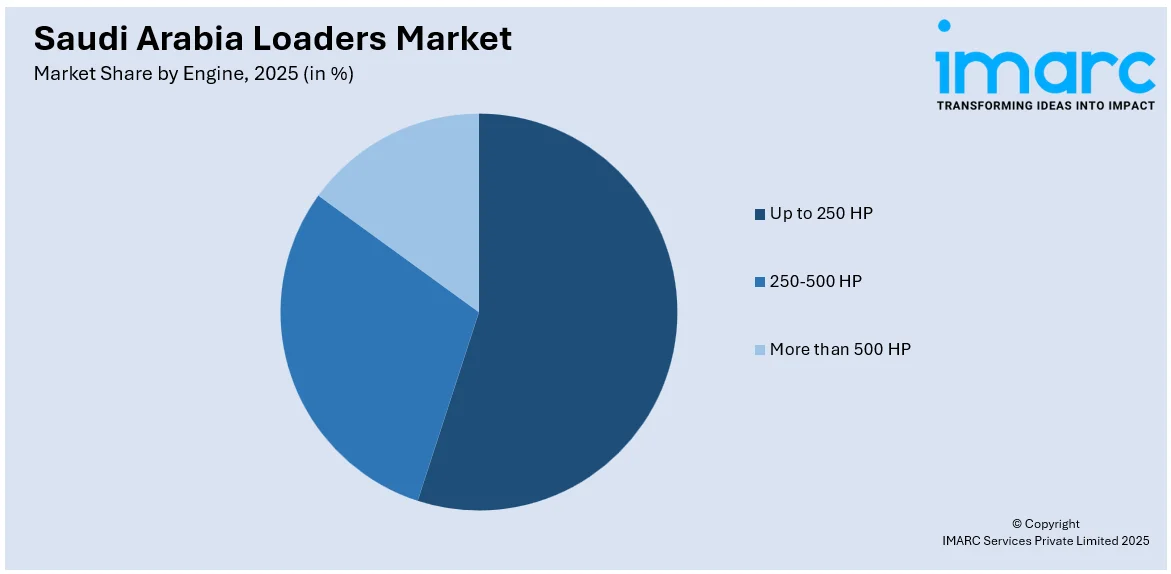

Engine Insights:

Access the comprehensive market breakdown Request Sample

- Up to 250 HP

- 250-500 HP

- More than 500 HP

A detailed breakup and analysis of the market based on the engine have also been provided in the report. This includes up to 250 HP, 250-500 HP, and more than 500 HP.

Fuel Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the fuel have also been provided in the report. This includes electric and ICE.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Loaders Market News:

- In August 2024, Hitachi's BX100 Backhoe Loader successfully launched in Saudi Arabia, boosting the nation's loaders market. Arabian Trucks & Construction Equipment Co. (ATEC) hosted events in Dammam, Jeddah, and Riyadh, drawing over 320 customers. Attendees witnessed the BX100's innovative features, superior performance, fuel efficiency, and operator comfort, signaling a positive development for the Saudi construction machinery sector.

Saudi Arabia Loaders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Backhoe Loader, Skid Steer Loader, Crawler Loader, Wheeled Loader |

| Engines Covered | Up to 250 HP, 250-500 HP, More than 500 HP |

| Fuels Covered | Electric, ICE |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia loaders market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia loaders market on the basis of type?

- What is the breakup of the Saudi Arabia loaders market on the basis of engine?

- What is the breakup of the Saudi Arabia loaders market on the basis of fuel?

- What is the breakup of the Saudi Arabia loaders market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia loaders market?

- What are the key driving factors and challenges in the Saudi Arabia loaders market?

- What is the structure of the Saudi Arabia loaders market and who are the key players?

- What is the degree of competition in the Saudi Arabia loaders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia loaders market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia loaders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia loaders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)