Saudi Arabia Logistics Technology Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Saudi Arabia Logistics Technology Market Overview:

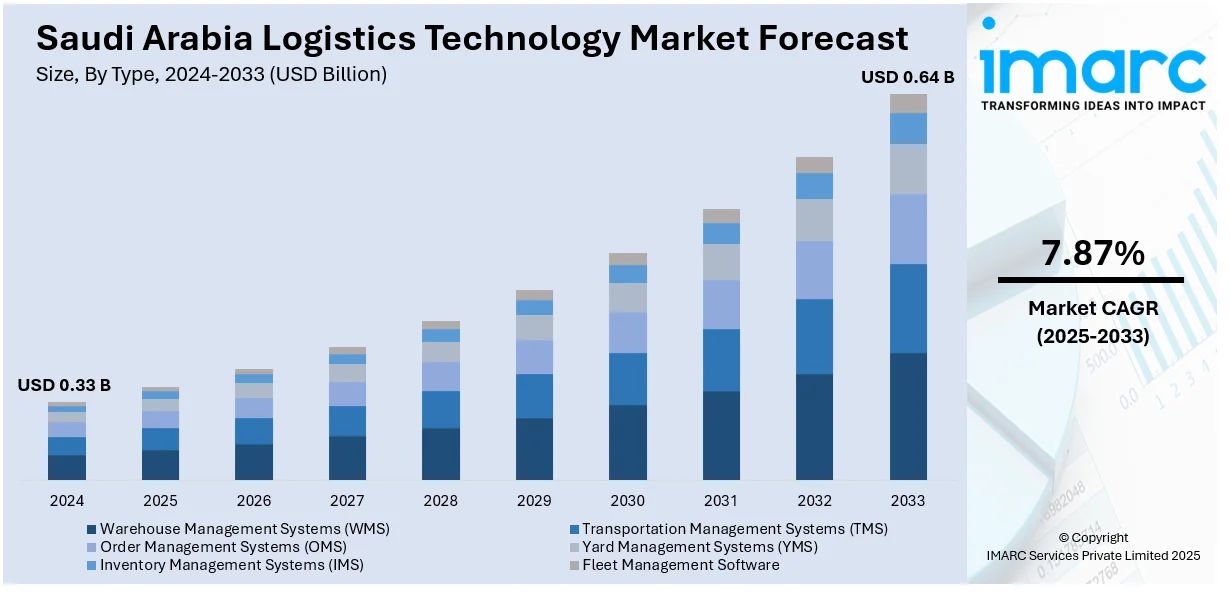

The Saudi Arabia logistics technology market size reached USD 0.33 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.64 Billion by 2033, exhibiting a growth rate (CAGR) of 7.87% during 2025-2033. The market is experiencing rapid growth driven by the country’s Vision 2030 plan, significant boom in e-commerce, widespread adoption of smart warehousing, increasing demand for robotics and automation, and rising integration of the Internet of Things (IoT) and artificial intelligence (AI).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.33 Billion |

| Market Forecast in 2033 | USD 0.64 Billion |

| Market Growth Rate 2025-2033 | 7.87% |

Saudi Arabia Logistics Technology Market Trends:

Vision 2030 Initiatives

The Vision 2030 has reshaped the Saudi Arabia logistics technology market share by establishing definite objectives to diversify the economy and make the country a major global logistics hub. Under this vision, the Saudi government has adopted policies and investments in updating the logistics industry, including the National Industrial Development and Logistics Program (NIDLP). It focuses on leveraging technology to drive efficiency, connectivity, and service quality. Vision 2030 also focuses on the role of public-private partnerships, inviting private players to invest in state-of-the-art logistics technologies and infrastructure. Additionally, legal reforms facilitate the operations of foreign logistics companies in the nation, inviting good competition and hiring advanced logistics solutions.

E-Commerce Boom

Saudi Arabia's online shopping market is witnessing unprecedented expansion, which requires advanced logistics technology on a very large scale. With a very young, connected population and widespread smartphone penetration, online buying has exploded, most notably in the electronics, clothing, and grocery categories. This online expansion requires speedy and precise order delivery, which necessitates the implementation of sophisticated technology by logistics service providers to accommodate more orders and deliveries. Warehouse automation, real-time stock monitoring, and route optimization solutions are becoming trendy as e-commerce companies try to match customer expectations of quicker and more dependable shipping. In addition, the demand for "last-mile" shipping has prompted enterprises to invest in technology solutions with increased delivery speeds and accuracy, especially in cities where population densities are high. These advancements have helped in rapidly shifting the Saudi Arabia logistics technology market outlook, toward steady expansion and development.

Smart Warehousing

By harnessing the power of automation, robotics, and IoT, smart warehousing solutions are redefining logistics with enhanced efficiency and accuracy. In Saudi Arabia, logistics providers are investing in smart warehousing technologies to better inventory management and cut operational costs. These offer IoT sensor capability and real-time data analysis that provide high visibility into stock levels and asset locations allowing businesses to make informed decisions and lower inventory discrepancies. Robotics and automated guided vehicles (AGVs) have become vital assets in Saudi Arabia warehouses for accelerating processes such as picking, packing, and sorting of goods. The technologies help in reducing labor costs but improving the accuracy and speed, which are utmost in a highly competitive environment. Hence, as e-commerce demand spikes and the delivery timeframes shorten, logistics providers are making use of smart warehousing to meet efficiency and reliability expectations. These techniques are thereby ensuring a steady pace is maintained for Saudi Arabia logistics technology market growth.

Saudi Arabia Logistics Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Warehouse Management Systems (WMS)

- Transportation Management Systems (TMS)

- Order Management Systems (OMS)

- Yard Management Systems (YMS)

- Inventory Management Systems (IMS)

- Fleet Management Software

The report has provided a detailed breakup and analysis of the market based on the type. This includes warehouse management systems (WMS), transportation management systems (TMS), order management systems (OMS), yard management systems (YMS), inventory management systems (IMS), fleet management software.

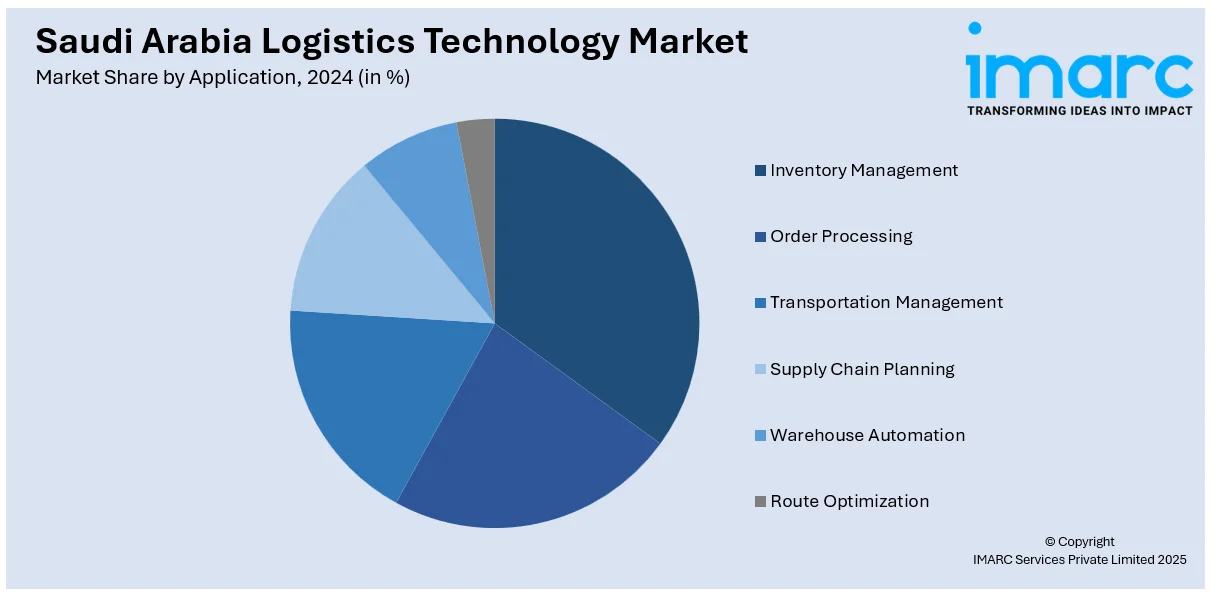

Application Insights:

- Inventory Management

- Order Processing

- Transportation Management

- Supply Chain Planning

- Warehouse Automation

- Route Optimization

The report has provided a detailed breakup and analysis of the market based on the application. This includes inventory management, order processing, transportation management, supply chain planning, warehouse automation, and route optimization.

End User Insights:

- Retail and E-commerce

- Manufacturing

- Healthcare

- Automotive

- Food & Beverage

- Pharmaceuticals

- Third-Party Logistics (3PL)

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail and e-commerce, manufacturing, healthcare, automotive, food & beverage, pharmaceuticals, and third-party logistics (3PL).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Logistics Technology Market News:

- In September 2024, Smartlog and Tamer Group formed a strategic relationship to automate its new logistics park in Saudi Arabia. Tamer New Logistic Park will use AutoStore and Galys Monitor technology to improve storage and order pickup operations.

- In July 2024, DB Schenker collaborated with Kaden to enhance logistics services in Saudi Arabia. This collaboration emphasizes the creation of custom warehouses designed to meet DB Schenker’s operational requirements. The project will advance through multiple stages, each tailored to support diverse verticals, different storage types, and climate-controlled areas.

Saudi Arabia Logistics Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Warehouse Management Systems (WMS), Transportation Management Systems (TMS), Order Management Systems (OMS), Yard Management Systems (YMS), Inventory Management Systems (IMS), Fleet Management Software |

| Applications Covered | Inventory Management, Order Processing, Transportation Management, Supply Chain Planning, Warehouse Automation, Route Optimization |

| End Users Covered | Retail and E-commerce, Manufacturing, Healthcare, Automotive, Food & Beverage, Pharmaceuticals, Third-Party Logistics (3PL) |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia logistics technology market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia logistics technology market on the basis of type?

- What is the breakup of the Saudi Arabia logistics technology market on the basis of application?

- What is the breakup of the Saudi Arabia logistics technology market on the basis of end user?

- What is the breakup of the Saudi Arabia logistics technology market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia logistics technology market?

- What are the key driving factors and challenges in the Saudi Arabia logistics technology market?

- What is the structure of the Saudi Arabia logistics technology market and who are the key players?

- What is the degree of competition in the Saudi Arabia logistics technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia logistics technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia logistics technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia logistics technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)