Saudi Arabia Luxury Furniture Market Size, Share, Trends and Forecast by Raw Material, Application, Distribution Channel, Design, and Region, 2026-2034

Saudi Arabia Luxury Furniture Market Overview:

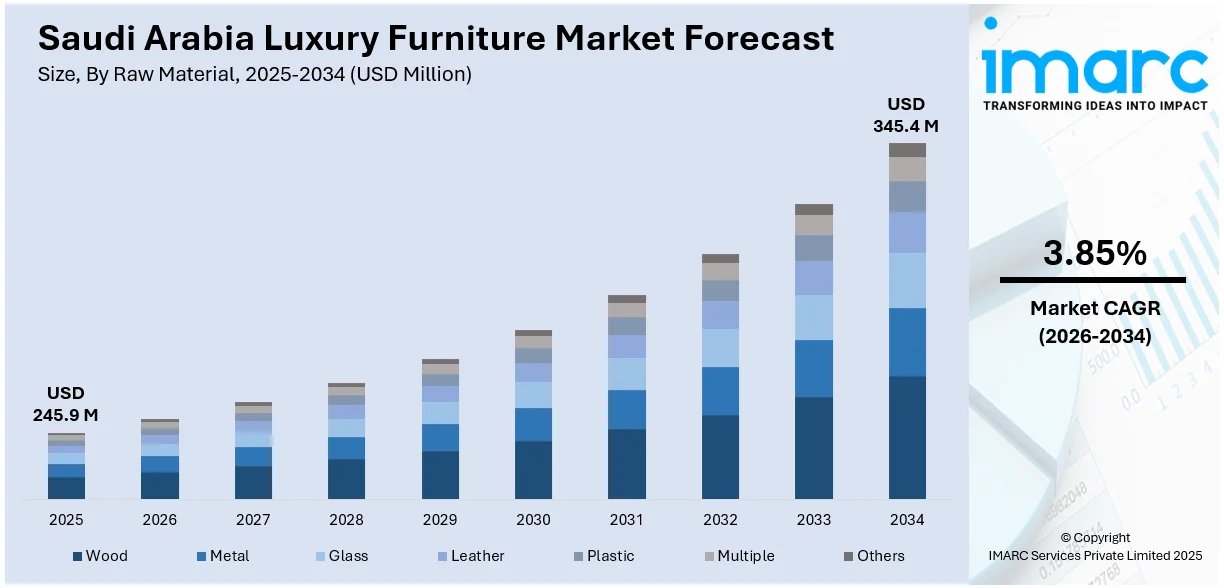

The Saudi Arabia luxury furniture market size reached USD 245.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 345.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.85% during 2026-2034. The market is driven by rising disposable income, rapid urban development, an expanding hospitality sector, and a growing preference for premium home décor. Government-led infrastructure initiatives and Vision 2030 reforms further boost demand for high-end furnishings in residential, commercial, and hospitality applications across the Kingdom.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 245.9 Million |

| Market Forecast in 2034 | USD 345.4 Million |

| Market Growth Rate 2026-2034 | 3.85% |

Saudi Arabia Luxury Furniture Market Trends:

Rising Demand for Premium Lifestyle and Aesthetic Interiors

People are progressively perceiving luxury furnishings as a reflection of taste, social status, and cultural elegance. This change in perspective is resulting in an increase in the appreciation for design excellence, genuine materials, and skilled craftsmanship. Affluent buyers and style-aware households are looking for furniture that combines comfort with uniqueness, promoting the use of items featuring distinctive finishes, refined details, and eco-friendly materials. This inclination extends beyond living spaces to upscale offices, retail shops, and hospitality locations, where interiors represent symbols of status and professionalism. With the growing awareness about international design trends among individuals, the demand for custom and exclusive collections is rising. The combination of artistic creativity and classic designs is enhancing the market's attractiveness, forming a niche that appreciates both tradition and contemporary elements. This increasing preference for curated interiors and timeless design quality is emerging as a critical factor contributing to the market growth.

To get more information on this market Request Sample

Expansion of Real Estate, Hospitality, and Commercial Developments

Recent advancements in residential high-rises, upscale resorts, corporate buildings, and luxury retail areas are driving the demand for high-quality interior designs that embody contemporary architectural elegance. With Saudi Arabia's ongoing urban development, builders and designers are focusing on custom craftsmanship, visual cohesion, and high-quality materials to create spaces that reflect comfort, status, and modern sophistication. High-end furniture is emerging as an essential element in crafting sophisticated interiors that improve the resident experience and comply with higher building standards. The growing significance of lifestyle-oriented communities and mixed-use projects is creating opportunities for specialized furnishings designed for wellness, leisure, and professional environments. A significant advancement supporting this trend is Retal Urban Development’s 2025 declaration of a $160 million real estate fund aimed at building a 28-story residential tower in Makkah’s Masar area, showcasing robust investor confidence in premium properties. As these projects increase, furniture providers are broadening their offerings to fulfill rising demands for creativity, usability, and lasting quality, reinforcing the basis of Saudi Arabia's upscale furniture sector.

Technological Integration and Sustainable Design Innovations

Producers are adopting digital design software, precision engineering, and automated manufacturing methods to improve quality uniformity, personalization, and efficiency. The combination of intelligent features, ergonomic design, and modular ideas signifies a move towards interiors that are both functionally advanced and visually refined. Alongside technological advancements, awareness about environmental issues is influencing the choice of materials and manufacturing techniques, encouraging the use of ethically sourced timber, reclaimed metals, and sustainable textiles. Sustainable design principles are becoming more significant for both manufacturers and individuals, highlighting the need for long-lasting value and minimized environmental effects. These developments enable brands to align with changing user demands focused on accountability and creativity. The growing need for products that combine creativity, technology, and ecological responsibility is encouraging businesses to allocate resources towards research, product evaluation, and certification. By aligning innovation with sustainability, the luxury furniture market in Saudi Arabia is transforming into a future-focused industry marked by quality, intelligence, and ecological balance.

Saudi Arabia Luxury Furniture Market Growth Drivers:

Strong Retail Networks and Interior Design Ecosystem

The luxury furniture market in Saudi Arabia is growing, supported by the swift expansion of retail networks and a more developed interior design environment. Flagship showrooms, design studios, and concept stores provide immersive settings that enable clients to personally engage with craftsmanship, texture, and aesthetics. Improved retail infrastructure in key urban areas is boosting accessibility, while partnerships between local suppliers and global brands are expanding product offerings with internationally influenced designs. The growth of design consultancies and interior styling companies is influencing knowledgeable individual decisions, assisting clients in choosing furniture that matches architectural vision, lifestyle requirements, and spatial effectiveness. Digital transformation is reshaping the retail experience with enhanced visualization technologies, augmented reality (AR) tools, and virtual showrooms that make decision-making easier. The International Trade Administration (ITA) predicted that by 2024, 33.6 million internet users in Saudi Arabia will engage in e-commerce, highlighting the increasing importance of online shopping. Collectively, these advancements are enhancing trust, personalization, and design consciousness, establishing the Kingdom as a prominent regional center for luxury furniture innovation.

Growing Affinity Toward Artisanal Craftsmanship and Heritage Design

Individuals are appreciating authenticity, storytelling, and craftsmanship, which is catalyzing the demand for furniture that showcases careful detailing and cultural representation. This movement is encouraging producers to integrate traditional designs, artisanal touches, and regionally influenced styles into contemporary structures, connecting heritage with modernity. By merging traditional methods with modern practicality, producers are developing items that appeal to both emotional and visual importance. Artisanal furniture aligns with the larger trend of slow design and sustainable manufacturing, emphasizing craftsmanship as a symbol of quality and uniqueness. The acknowledgment of cultural identity through furniture design bolsters national efforts focused on safeguarding artistic heritage and advancing creative industries. As a result, the demand for artisanal luxury items remains strong, establishing craftsmanship as a key feature of Saudi Arabia's high-end furniture environment and its pursuit for timeless design genuineness.

Influence of Luxury Tourism and Hospitality Development

The swift expansion of Saudi Arabia's luxury tourism and hospitality industry is driving the demand for high-end furniture that represents elegance, comfort, and uniqueness. As the Kingdom solidifies its role as a global center for luxury travel, high-end resorts, boutique hotels, and serviced accommodations are focusing on sophisticated interiors that elevate guest experiences and embody brand identity through exceptional design and craftsmanship. Custom furniture is becoming essential for crafting immersive environments that blend aesthetics with practicality, guaranteeing longevity, comfort, and visual attractiveness. As government-driven tourism initiatives encourage cultural, leisure, and wellness locales, hospitality developers are allocating funds to furnishings that uphold top-tier elegance and ergonomic efficiency. As per industry insights by the IMARC Group, the luxury travel market in Saudi Arabia hit USD 12.9 Billion in 2024, highlighting strong expansion in high-end hospitality investments. This trend is fostering enhanced collaboration among designers, manufacturers, and investors to provide tailored interior concepts.

Saudi Arabia Luxury Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on raw material, application, distribution channel, and design.

Raw Material Insights:

- Wood

- Metal

- Glass

- Leather

- Plastic

- Multiple

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes wood, metal, glass, leather, plastic, multiple, and others.

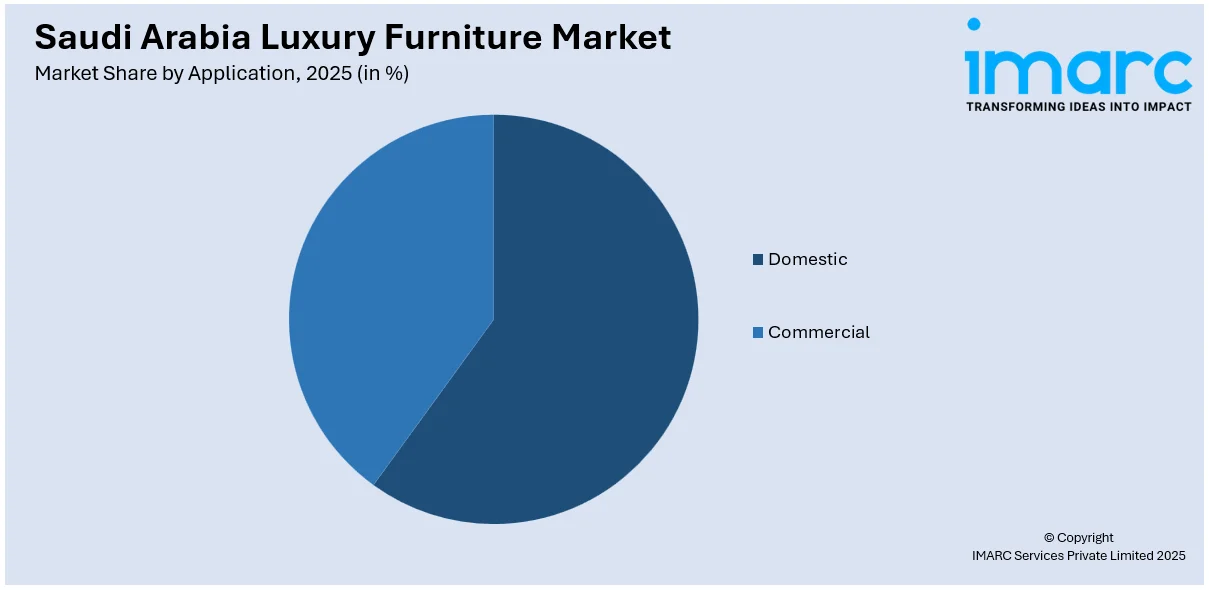

Application Insights:

Access the comprehensive market breakdown Request Sample

- Domestic

- Living Room and Bedroom

- Kitchen

- Bathroom

- Outdoor

- Lighting

- Commercial

- Office

- Hospitality

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes domestic (living room and bedroom, kitchen, bathroom, outdoor, and lighting) and commercial (office, hospitality, and others).

Distribution Channel Insights:

- Conventional Furniture Stores

- Specialty Stores

- Online Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes conventional furniture stores, specialty stores, online retailers, and others.

Design Insights:

- Modern

- Contemporary

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes modern and contemporary.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Luxury Furniture Market News:

- In May 2025, Majid Al-Futtaim opened Poltrona Frau’s first standalone store in Saudi Arabia at Centria Mall in Riyadh, marking a significant milestone in the brand’s regional expansion. The 320-square-meter store features a curated lifestyle setting, a material library, and exclusive furniture pieces. This opening supports the growing demand for premium, design-led living in the Kingdom.

- In October 2024, Fendi Casa opened its first flagship store in Riyadh, Saudi Arabia, marking a significant milestone for the brand in the region. The 350-square-meter boutique, located on the prestigious Tahliya Street, showcases Fendi’s luxury furniture and home accessories, blending Italian craftsmanship with modern design. The store is part of Fendi Casa’s partnership with Dar Al Arkan Interiors to meet the growing demand for high-end interiors in Saudi Arabia.

- In December 2024, Bentley Home opened two new showrooms in Riyadh and Jeddah, strengthening its presence in the Middle East’s luxury furniture market. Set up inside Dar Al Arkan Interiors, these stores feature well-known designs along with new pieces from the 2024 collection, including the Styal desk, Camden table, and Solstice outdoor set. The showrooms reflect Bentley’s focus on detail, quality, and style, drawing influence from its car design background. The expansion highlights Dar Al Arkan Interiors’ growing role as a major name in the country’s premium furniture segment.

- In January 2024, First Furniture Company (FFC), part of Naif Alrajhi Investment Group, has opened a new Italian furniture showroom in Saudi Arabia. It features brands like Sitia, Codutti, Olev, and Matteo Pala, offering office and hospitality pieces with a mix of classic and modern styles. The launch welcomed guests from various sectors and supports Saudi Arabia’s Vision 2030 goals. FFC aims to improve office spaces with quality design and efficient service.

Saudi Arabia Luxury Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Glass, Leather, Plastic, Multiple, Others |

| Applications Covered |

|

| Distribution Channels Covered | Conventional Furniture Stores, Specialty Stores, Online Retailers, Others |

| Designs Covered | Modern, Contemporary |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia luxury furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia luxury furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia luxury furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury furniture market in Saudi Arabia was valued at USD 245.9 Million in 2025.

The Saudi Arabia luxury furniture market is projected to exhibit a CAGR of 3.85% during 2026-2034, reaching a value of USD 345.4 Million by 2034.

The Saudi Arabia luxury furniture market is growing owing to rising demand for premium interiors, increased investments in real estate, and expanding hospitality and residential projects. User preference for high-quality, customizable, and design-oriented furnishings, along with supportive government initiatives promoting modern living spaces, is encouraging manufacturers to introduce innovative, sustainable, and aesthetically refined furniture solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)