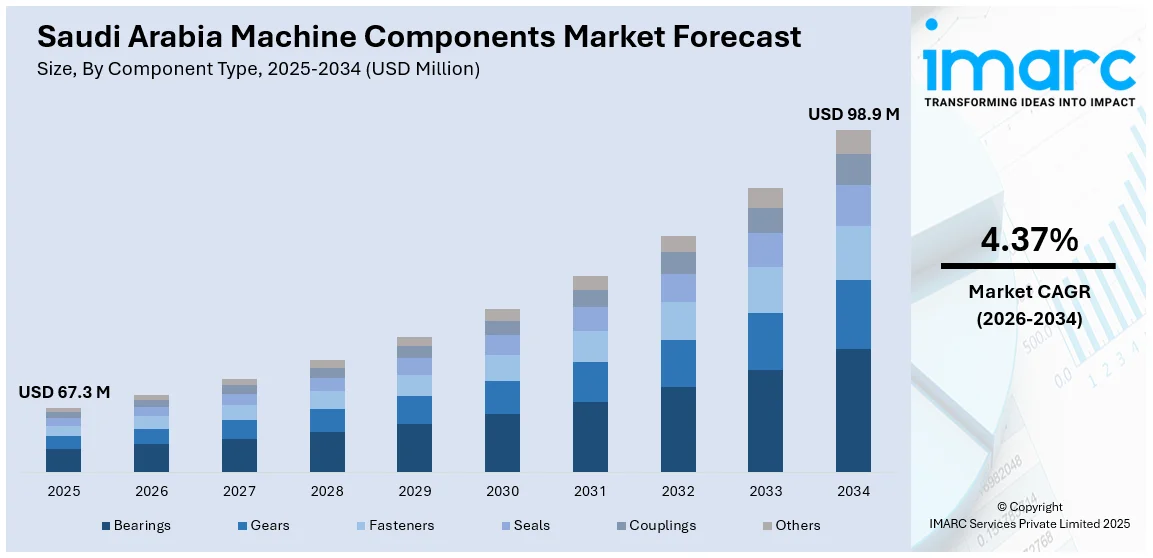

Saudi Arabia Machine Components Market Size, Share, Trends and Forecast by Component Type, Material, End Use Industry, and Region, 2026-2034

Saudi Arabia Machine Components Market Overview:

The Saudi Arabia machine components market size reached USD 67.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 98.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.37% during 2026-2034. At present, with the advancement of large-scale projects under Vision 2030, contractors and developers continue to depend on effective and reliable machinery to adhere to deadlines and sustain productivity. This dependency is creating the need for high-performance machine components, such as gears, bearings, hydraulic systems, and engines. Besides this, increasing vehicle production is contributing to the expansion of the Saudi Arabia machine components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 67.3 Million |

| Market Forecast in 2034 | USD 98.9 Million |

| Market Growth Rate 2026-2034 | 4.37% |

Saudi Arabia Machine Components Market Trends:

Rising construction activities

Rising construction activities are positively influencing the market in Saudi Arabia. As per the IMARC Group, the Saudi Arabia construction market size was valued at USD 97.8 Billion in 2024. The government's focus on expanding cities, transportation networks, commercial spaces, and residential buildings is driving consistent demand for construction machinery and related components. As large-scale projects under Vision 2030 are moving forward, contractors and developers continue to rely heavily on efficient machinery to meet deadlines and maintain productivity. This dependency is creating the need for high-performance machine components, such as gears, bearings, hydraulic systems, and engines. These components play a key role in maintaining equipment durability and performance under challenging conditions. Additionally, local manufacturing units and repair services are experiencing growth as construction firms are seeking timely replacements and upgrades for machinery. The increasing complexity of construction tasks is further catalyzing the demand for specialized machine components tailored to meet specific performance and safety standards. Moreover, the growth of associated sectors like cement, steel, and logistics is contributing to the demand for various industrial machines.

To get more information on this market Request Sample

Growing vehicle production

Increasing vehicle production is impelling the Saudi Arabia machine components market growth. According to industry reports, in 2024, 827,857 new light vehicles made their way onto Saudi roads, marking a strong 6.6% rise compared to 2023. As local manufacturing and assembly plants are expanding, there is an increasing need for engine components, transmission parts, braking systems, and suspension units. The rise in vehicle production is also encouraging investments in advanced machinery, which depends on reliable components to ensure efficiency and precision. Local sourcing of components is becoming essential to reduce costs and lead times, boosting domestic manufacturing of machine parts. Additionally, as vehicle models are becoming more technologically advanced, the need for specialized and high-performance components is high. This trend is supporting innovations and capacity building within the machine components sector. The growing automotive supply chain, including aftermarket services and exports, is further contributing to the steady demand, positioning the market as a critical element in Saudi Arabia’s industrial and transportation ecosystem.

Increasing demand from oil and gas industry

The oil and gas sector relies on machines like pumps, compressors, drilling rigs, and turbines, which require precision components for efficient operation. As exploration and production activities are growing, the need for reliable machine parts is increasing to ensure safety, uptime, and operational efficiency. As per the ITA, by March 2024, Saudi Arabia possessed approximately 17% of the world’s proven petroleum reserves and ranked as one of the largest net exporters of petroleum. Saudi Arabia had the second-largest proven oil reserves in the world. Components used in harsh environments must withstand high pressure, temperature, and corrosion, encouraging manufacturers to innovate and supply advanced materials and designs. This growing demand leads to greater investments in local manufacturing and customization of machine components. It also supports the development of a robust supply chain for maintenance and replacements.

Saudi Arabia Machine Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, material, and end use industry.

Component Type Insights:

- Bearings

- Gears

- Fasteners

- Seals

- Couplings

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes bearings, gears, fasteners, seals, couplings, and others.

Material Insights:

- Metals

- Plastics

- Composites

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals, plastics, and composites.

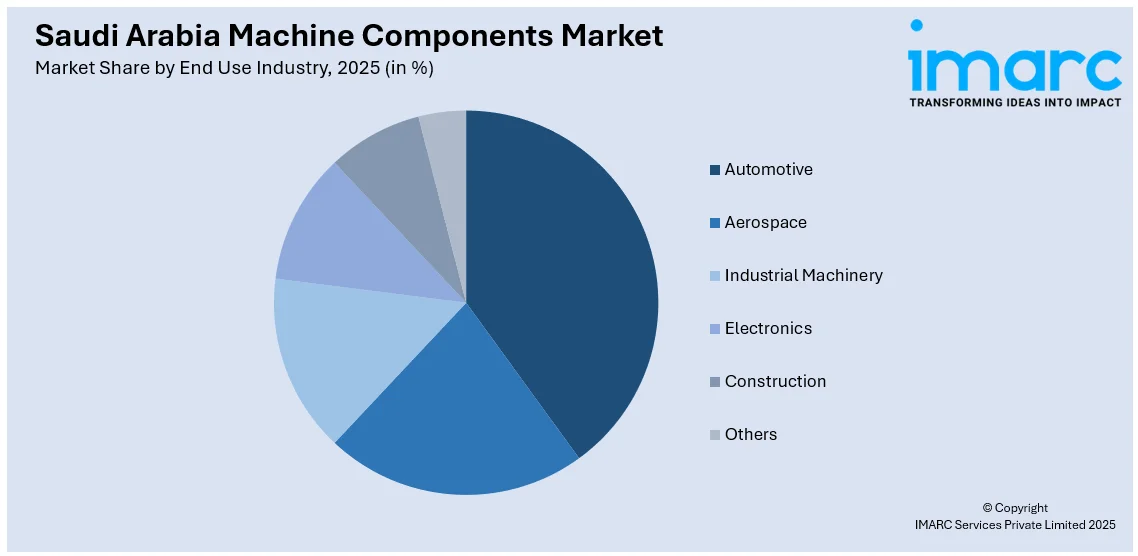

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace

- Industrial Machinery

- Electronics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, industrial machinery, electronics, construction, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Machine Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Bearings, Gears, Fasteners, Seals, Couplings, Others |

| Materials Covered | Metals, Plastics, Composites |

| End Use Industries Covered | Automotive, Aerospace, Industrial Machinery, Electronics, Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia machine components market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia machine components market on the basis of component type?

- What is the breakup of the Saudi Arabia machine components market on the basis of material?

- What is the breakup of the Saudi Arabia machine components market on the basis of end use industry?

- What is the breakup of the Saudi Arabia machine components market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia machine components market?

- What are the key driving factors and challenges in the Saudi Arabia machine components market?

- What is the structure of the Saudi Arabia machine components market and who are the key players?

- What is the degree of competition in the Saudi Arabia machine components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia machine components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia machine components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia machine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)