Saudi Arabia Machine Tools Market Size, Share, Trends and Forecast by Tool Type, Technology Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Machine Tools Market Overview:

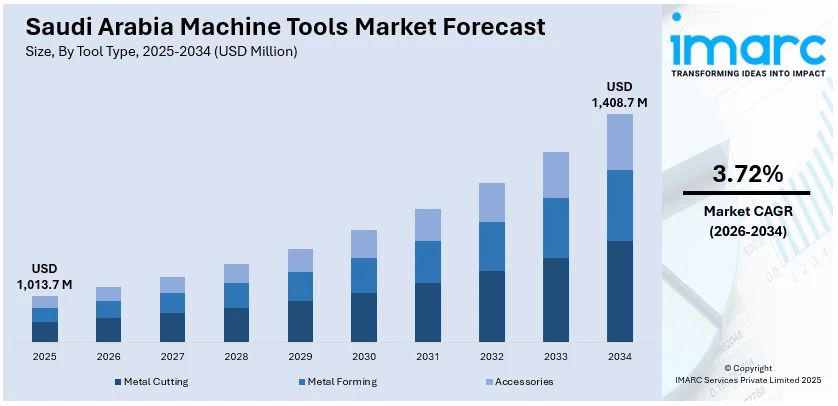

The Saudi Arabia machine tools market size reached USD 1,013.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,408.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.72% during 2026-2034. The increasing investments in industrial automation, augmenting demand from the automobile and aerospace industries, fast growth of metal manufacturing and fabrication industries, encouragement by the government policies under Vision 2030, and the rising demand for precision engineering are some of the key drivers contributing to the Saudi Arabia machine tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,013.7 Million |

| Market Forecast in 2034 | USD 1,408.7 Million |

| Market Growth Rate 2026-2034 | 3.72% |

Saudi Arabia Machine Tools Market Trends:

Adoption of CNC and Automation-Integrated Machine Tools

The widespread adoption of computer numerical control (CNC) and automation-integrated systems is positively impacting the Saudi Arabia machine tools market outlook. Conventional, manually operated machines are increasingly supplanted by precision-driven, software-enabled alternatives that offer enhanced operational efficiency, greater accuracy, and reduced human error. This transition is particularly evident in sectors such as automotive, aerospace, and precision engineering, where the complexity and tolerance requirements of manufactured components necessitate advanced tooling solutions. CNC machines integrated with CAD/CAM software and real-time monitoring systems are gaining prominence due to their compatibility with Industry 4.0 standards. Apart from this, with 63% of people in the Kingdom being under 30, Saudi Arabia is leveraging its youthful demographic to build a future-ready industrial workforce. A strong partnership between the government and the private sector is central to this effort, aiming to prepare young nationals for roles in high-technology sectors. Notably, 76 percent of young Saudis regard the government as a positive force for change, reflecting widespread public support for modernization initiatives. This leads to targeted investment in industrial training and technical education programs designed to cultivate a skilled talent pool. These initiatives are equipping the next generation with the capabilities to operate, manage, and maintain advanced CNC systems, automation-driven machinery, and precision engineering tools.

To get more information on this market, Request Sample

Localization of Manufacturing and Industrial Supply Chains

The localization of manufacturing capabilities is providing a boost to Saudi Arabia machine tools market growth. The Kingdom is actively working to reduce its dependence on imports by fostering domestic production across key sectors, including oil and gas, defense, construction, and automotive. This shift is significantly increasing the demand for a broad range of machine tools required to support machining, metalworking, and component manufacturing processes. Furthermore, the In-Kingdom Total Value Add (IKTVA) program, initiated by Saudi Aramco, underscores the Kingdom’s strategic push to build domestic industrial capacity by promoting local sourcing and encouraging international companies to establish production facilities within Saudi Arabia. According to an industry report, the program has led to the establishment of 350 local manufacturing facilities, with the IKTVA rating reaching 67 percent in 2024, which is a rise from 35 percent in 2015, bringing the initiative close to Aramco’s 70 percent localization target. This expansion of local manufacturing capabilities has significantly increased demand for machine tools, particularly precision machining and fabrication equipment required to support production across energy, petrochemicals, and heavy industries. In addition to this, the development of industrial zones and the expansion of cities under the Saudi Authority for Industrial Cities and Technology Zones (MODON) further contribute to the increasing reliance on machine tools.

Saudi Arabia Machine Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on tool type, technology type, and, end use industry.

Tool Type Insights:

- Metal Cutting

- Metal Forming

- Accessories

The report has provided a detailed breakup and analysis of the market based on the tool type. This includes metal cutting, metal forming, and accessories.

Technology Type Insights:

- Conventional

- CNC (Computerized Numerical Control)

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes conventional and CNC (computerized numerical nontrol).

End Use Industry Insights:

.jpeg)

Access the Comprehensive Market Breakdown, Request Sample

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Consumer Goods

- Precision Engineering

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace and defense, electrical and electronics, consumer goods, precision engineering, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Easter Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Machine Tools Market News:

- On February 3, 2025, Simplex, a startup company based in Egypt, specializing in computer numerical control (CNC) machine production, secured USD 13 Million to establish a 20,000-square-meter CNC factory in Riyadh, Saudi Arabia. This initiative follows a MoU with Saudi Arabia's National Industrial Development Centre, aiming to enhance the Kingdom's industrial sector and align with its Vision 2030 objectives. Operations are scheduled to commence in the first quarter of 2026.

Saudi Arabia Machine Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tool Types Covered | Metal Cutting, Metal Forming, Accessories |

| Technology Types Covered | Conventional, CNC (Computerized Numerical Control) |

| End Use Industries Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Consumer Goods, Precision Engineering, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia machine tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia machine tools market on the basis of tool type?

- What is the breakup of the Saudi Arabia machine tools market on the basis of technology type?

- What is the breakup of the Saudi Arabia machine tools market on the basis of end use industry?

- What is the breakup of the Saudi Arabia machine tools market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia machine tools market?

- What are the key driving factors and challenges in the Saudi Arabia machine tools market?

- What is the structure of the Saudi Arabia machine tools market and who are the key players?

- What is the degree of competition in the Saudi Arabia machine tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia machine tools market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia machine tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia machine tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)