Saudi Arabia Maintenance Repair and Operations Market Size, Share, Trends and Forecast by Provider, MRO Type, and Region, 2025-2033

Saudi Arabia Maintenance Repair and Operations Market Overview:

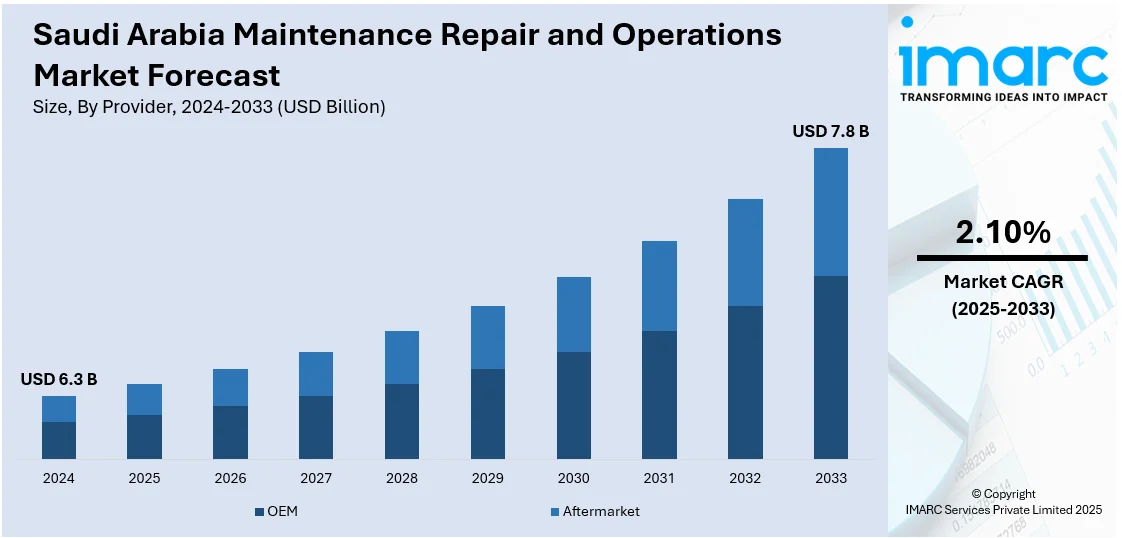

The Saudi Arabia maintenance repair and operations market size reached USD 6.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 2.10% during 2025-2033. The market share is expanding, driven by the rising establishment of advanced healthcare facilities, which is creating the need for repair services, along with the broadening of oil drilling activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.3 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 2.10% |

Saudi Arabia Maintenance Repair and Operations Market Trends:

Increasing emphasis on advanced healthcare infrastructure

The rising focus on advanced healthcare infrastructure is offering a favorable Saudi Arabia maintenance repair and operations market outlook. Government agencies are emphasizing the usage of modern tools to enhance the early detection of diseases, creating the need for regular maintenance. In June 2024, the Health Sector Transformation Program, which was a component of Kingdom Vision 2030, revealed a notable transformational milestones that symbolized the achievements in national health initiatives. The beneficiaries for early diabetes detection exceeded 480,000, and cases of breast cancer detection went beyond 130,000. The early identification of colorectal cancer exceeded 120,000 cases. With increasing investments in healthcare under Vision 2030, more hospitals are being built, and existing ones are upgrading their equipment, driving the demand for systematic maintenance and repair services. Advanced medical devices, electrical networks, and sanitation systems require constant upkeep to ensure smooth operations and compliance with safety standards. As more healthcare facilities integrate smart technology, the need for specialized maintenance teams to manage automated systems, digital record-keeping, and security infrastructure is also rising. Additionally, with the growing patient admissions and medical tourism activities, facilities are focusing on efficient inventory management of medical supplies, pharmaceuticals, and critical spare parts. Maintenance and repair tasks are becoming essential in ensuring uninterrupted services in emergency rooms, surgical centers, and intensive care units (ICUs). The demand for high-quality and cost-effective maintenance services is further increasing, as healthcare providers aim to refine patient care, lower downtime, and extend the lifespan of medical infrastructure.

Expansion of drilling services

The expansion of drilling services is fueling the Saudi Arabia maintenance repair and operations market growth. With an increasing number of drilling rigs and advanced extraction technologies being deployed, the demand for regular maintenance and operational support is rising. Drilling equipment, such as rigs, pumps, and wellheads, requires constant servicing to prevent breakdowns and ensure smooth functioning in challenging environments. Companies are investing in high-quality spare parts, lubrication solutions, and predictive maintenance tools to extend the lifespan of machinery and reduce costly downtimes. Additionally, automation in drilling processes is creating the need for specialized maintenance repair and operation services to handle complex digital monitoring systems and robotics. The expansion of offshore and deep-water drilling projects is further catalyzing the demand for maintenance services due to the harsh operational conditions. As Saudi Arabia continues to focus on energy development, efficient maintenance repair and operation solutions are playing a crucial role in sustaining productivity, ensuring safety, and complying with industry regulations in the rapidly evolving drilling services industry. According to the IMARC Group, the Saudi Arabia drilling services market is set to attain USD 320 Million by 2033, showing a growth rate (CAGR) of 4.44% during 2025-2033.

Saudi Arabia Maintenance Repair and Operations Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on provider and MRO type.

Provider Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the provider. This includes OEM and aftermarket.

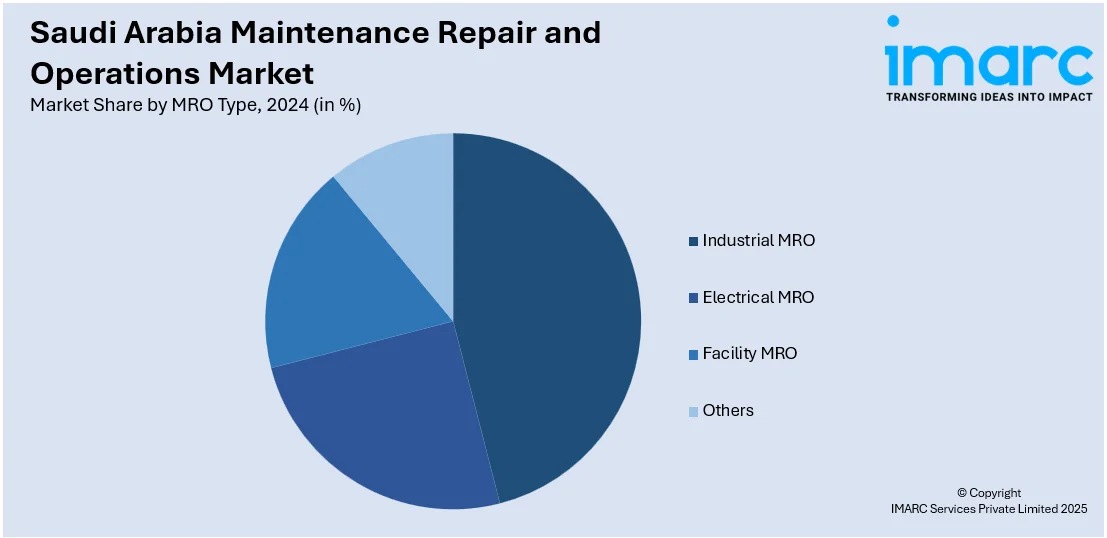

MRO Type Insights:

- Industrial MRO

- Electrical MRO

- Facility MRO

- Others

A detailed breakup and analysis of the market based on the MRO type have also been provided in the report. This includes industrial MRO, electrical MRO, facility MRO, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Maintenance Repair and Operations Market News:

- In February 2025, Panasonic Avionics Corporation entered into a significant ten-year contract with Riyadh Air, Saudi Arabia's leading airline, to deliver in-flight entertainment maintenance services for its 32 Boeing 787 Dreamliners. In conjunction with the agreement, Panasonic Technical Services (PTS) would set up a specialized line maintenance station in Riyadh. Expert technical teams specialized in the Dreamliner's sophisticated systems would provide superior maintenance, repair, and overhaul services.

- In December 2024, Air France KLM Engineering & Maintenance (AFI KLM E&M) along with the MRO division of Saudi Arabian Airlines revealed the establishment of a joint venture (JV) for GE Aerospace GEnx engine maintenance in Riyadh. The MOU included maintenance collaborations and enhanced passenger connectivity among Saudi Arabia, France, and the Netherlands, potentially resulting in more travel choices between these destinations. The contract aimed to enhance and localize Saudia Technic’s maintenance repair and operation capabilities, as it sought to develop skills at its facility in Jeddah.

Saudi Arabia Maintenance Repair and Operations Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | OEM, Aftermarket |

| MRO Type Covered | Industrial MRO, Electrical MRO, Facility MRO, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia maintenance repair and operations market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia maintenance repair and operations market on the basis of provider?

- What is the breakup of the Saudi Arabia maintenance repair and operations market on the basis of MRO type?

- What is the breakup of the Saudi Arabia maintenance repair and operations market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia maintenance repair and operations market?

- What are the key driving factors and challenges in the Saudi Arabia maintenance repair and operations market?

- What is the structure of the Saudi Arabia maintenance repair and operations market and who are the key players?

- What is the degree of competition in the Saudi Arabia maintenance repair and operations market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia maintenance repair and operations market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia maintenance repair and operations market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia maintenance repair and operations industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)