Saudi Arabia Maritime Logistics Market Size, Share, Trends and Forecast by Service Type, Application, Mode of Transport, End-User, and Region, 2026-2034

Saudi Arabia Maritime Logistics Market Overview:

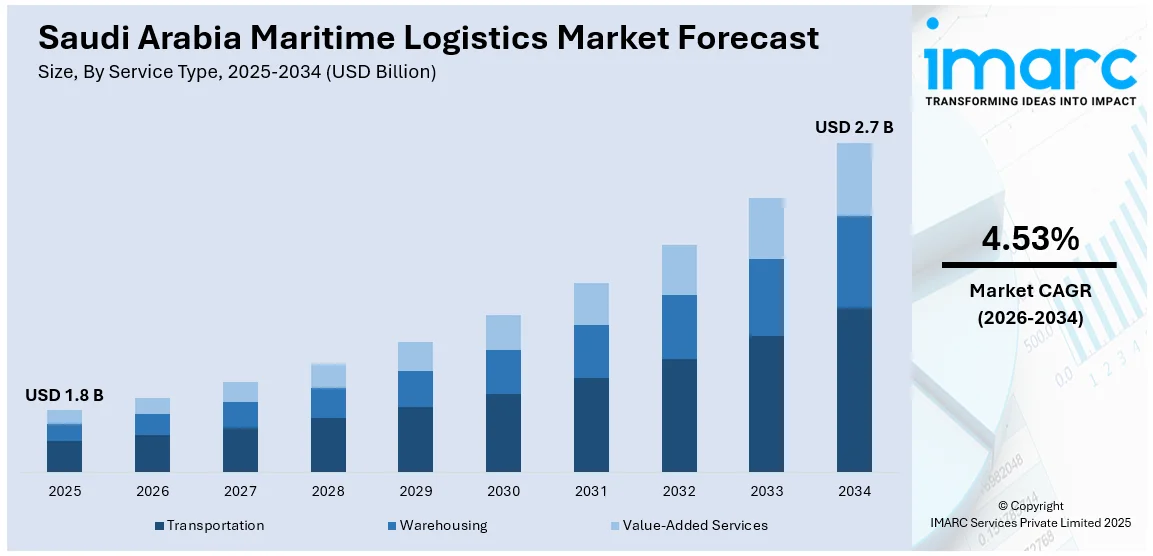

The Saudi Arabia maritime logistics market size reached USD 1.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.53% during 2026-2034. The Kingdom’s strategic location as a global transit hub boosts trade, while initiatives like enhanced connectivity and partnerships align with Vision 2030 to strengthen its position in international logistics. In addition, government investments in port infrastructure, digital transformation, and sustainability efforts are contributing to the expansion of the Saudi Arabia maritime logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2034 | USD 2.7 Billion |

| Market Growth Rate 2026-2034 | 4.53% |

Saudi Arabia Maritime Logistics Market Trends:

Increased Government Investment in Infrastructure Development

Saudi Arabia's maritime logistics industry is witnessing notable expansion, driven by enhanced government investment in port facilities as part of the comprehensive Vision 2030 plan. This effort aims to broaden the economy and decrease dependence on oil revenue by improving key sectors, such as maritime logistics. A crucial element of this strategy involves enhancing port facilities, including the establishment of King Abdullah Port and the current expansion of Jeddah Islamic Port, both of which are essential for boosting the Kingdom's maritime capacity. These efforts extend beyond physical infrastructure and emphasize the incorporation of cutting-edge technologies, such as automation, digital logistics, and sustainable methods, to enhance efficiency and reduce expenses. The forthcoming 2nd International Port & Marine Development Conference (IPMDC 2025) in Jeddah emphasizes these goals by uniting international specialists to explore sustainable port infrastructure, automation, and environment-friendly logistics solutions. The initiative aims to promote creativity, attract funding, and align regional maritime growth with Saudi Arabia’s Vision 2030. This focus on digital transformation and sustainable practices is closely connected to the Kingdom's initiatives to upgrade its ports, optimize supply chain processes, and improve global connectivity. By investing in extensive infrastructure initiatives, Saudi Arabia is establishing itself as a significant contender in global trade and shipping, thereby improving its logistics capabilities on both regional and international levels. These strategic investments are supporting the Saudi Arabia maritime logistics market growth and enhancing its global competitiveness.

To get more information on this market Request Sample

Strategic Location and Growth of Regional Trade

The strategic location of Saudi Arabia at the intersection of Europe, Asia, and Africa is positively influencing its maritime logistics sector. Located along key international shipping lanes, Saudi Arabia acts as an important transit hub for merchandise traveling via the Red Sea and the Arabian Gulf, making its ports vital centers for both regional and global commerce. This geographic advantage is driving the need for effective and dependable logistics services, which are increasing in tandem with growing trade volumes. The government's dedication to enhancing trade relations and cultivating global partnerships further propels the sector's growth. A notable instance of this is the 2025 introduction of MSC's "Clanga" shipping service at Jubail Commercial Port. This innovative service connects Saudi Arabia to major East Asian markets, including Singapore, Shanghai, and Colombo, significantly enhancing the Kingdom's logistics infrastructure and export competitiveness. This service enhancement aligns with Saudi Arabia's National Transport and Logistics Strategy, which aims to establish the nation as a global logistics hub by enhancing connectivity and increasing trade volumes. With a rising number of global shipping companies and partners utilizing Saudi Arabia’s ports, the Kingdom enhances its role as a vital participant in the worldwide supply chain, capitalizing on its strategic location to foster the growth of the maritime logistics sector.

Saudi Arabia Maritime Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service type, application, mode of transport, and end-user.

Service Type Insights:

- Transportation

- Warehousing

- Value-Added Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, warehousing, and value-added services.

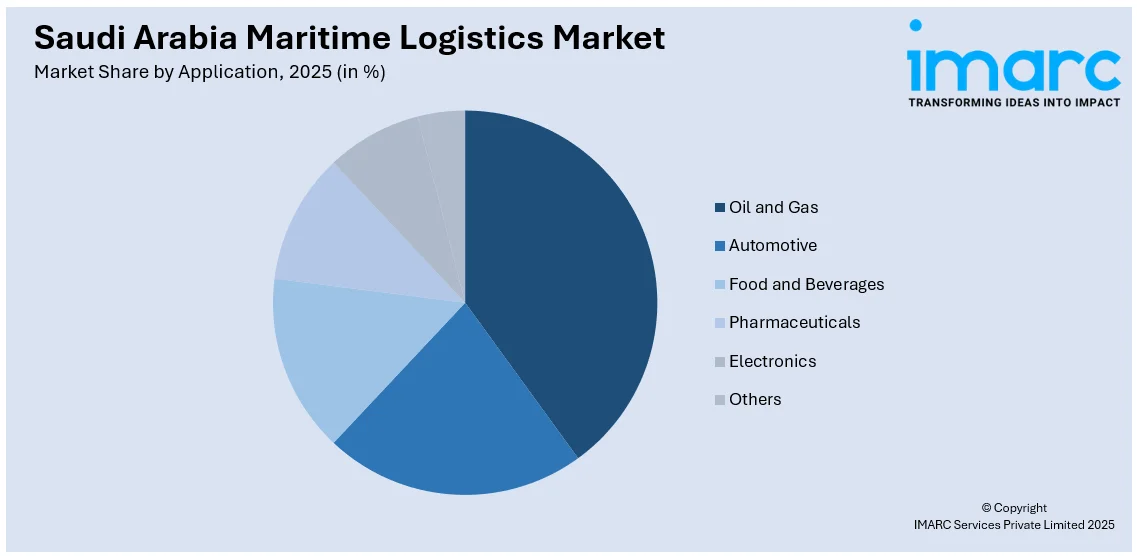

Application Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Automotive

- Food and Beverages

- Pharmaceuticals

- Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, automotive, food and beverages, pharmaceuticals, electronics, and others.

Mode of Transport Insights:

- Sea

- Inland Waterways

The report has provided a detailed breakup and analysis of the market based on the mode of transport. This includes sea and inland waterways.

End-User Insights:

- Commercial

- Industrial

- Government

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial, industrial, and government.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Maritime Logistics Market News:

- In May 2025, the Saudi Ports Authority (Mawani) launched Evergreen Marine’s new “ARPG” shipping service at King Abdulaziz Port in Dammam. This service connects Dammam with key ports across Asia and the Middle East, boosting Saudi Arabia’s maritime logistics network. It supports the Kingdom’s goal to become a global logistics hub under the National Transport and Logistics Strategy.

- In November 2024, Saudi Arabia’s Folk Maritime Services launched the “India-Arabian Gulf Service,” connecting key GCC ports like Dammam with major Indian ports Nhava Sheva and Mundra. The route, starting with a 14-day frequency, aimed to boost trade in consumer goods, petrochemicals, and essential commodities. This initiative supported Vision 2030’s goal of establishing Dammam as a global logistics hub.

Saudi Arabia Maritime Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Warehousing, Value-Added Services |

| Applications Covered | Oil and Gas, Automotive, Food and Beverages, Pharmaceuticals, Electronics, Others |

| Mode of Transports Covered | Sea, Inland Waterways |

| End-Users Covered | Commercial, Industrial, Government |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia maritime logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia maritime logistics market on the basis of service type?

- What is the breakup of the Saudi Arabia maritime logistics market on the basis of application?

- What is the breakup of the Saudi Arabia maritime logistics market on the basis of mode of transport?

- What is the breakup of the Saudi Arabia maritime logistics market on the basis of end-user?

- What is the breakup of the Saudi Arabia maritime logistics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia maritime logistics market?

- What are the key driving factors and challenges in the Saudi Arabia maritime logistics market?

- What is the structure of the Saudi Arabia maritime logistics market and who are the key players?

- What is the degree of competition in the Saudi Arabia maritime logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia maritime logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia maritime logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia maritime logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)