Saudi Arabia Material Testing Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2026-2034

Saudi Arabia Material Testing Market Overview:

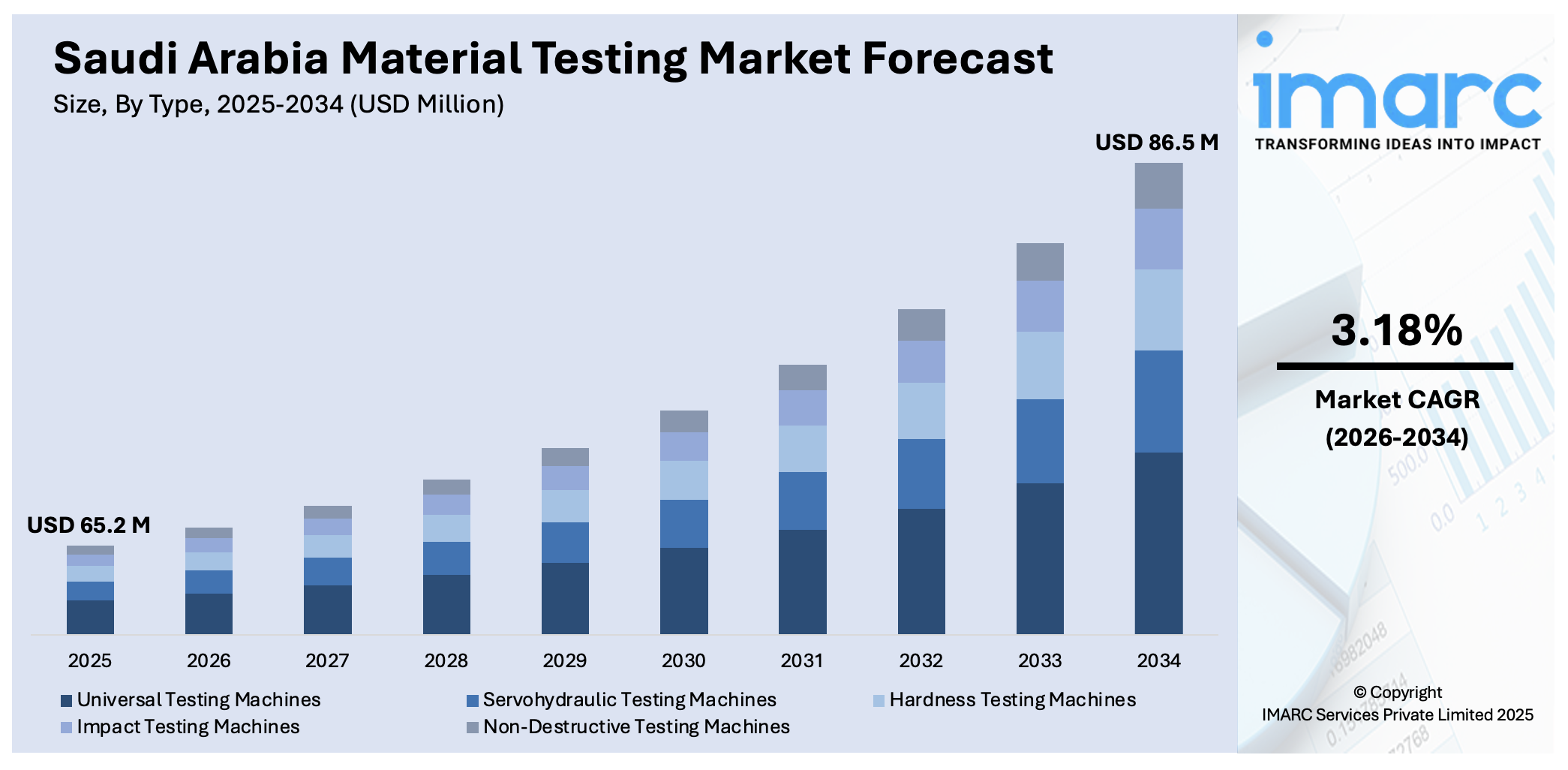

The Saudi Arabia material testing market size reached USD 65.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 86.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.18% during 2026-2034. The market is driven by rapid infrastructure development, stringent regulatory standards in construction and manufacturing, rising demand for quality assurance across industrial sectors, and technological advancements in non-destructive testing. Increased investments in oil, gas, and renewable energy further bolster the need for precise material evaluations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 65.2 Million |

| Market Forecast in 2034 | USD 86.5 Million |

| Market Growth Rate 2026-2034 | 3.18% |

Saudi Arabia Material Testing Market Trends:

Integration of Material Testing in Vision 2030 Megaprojects

Saudi Arabia’s Vision 2030 initiative has catalyzed demand for advanced material testing through its portfolio of megaprojects, including NEOM, the Red Sea Project, and Qiddiya. For instance, in 2023, ACES Jeddah secured a contract for materials testing, environmental testing, and quality control for Phase One of The Red Sea Project in Saudi Arabia. The three-year scope includes establishing on-site labs to conduct 300+ types of tests with a team of over 40 engineers and technicians. The project, led by the Red Sea Development Company, aims to transform the Umluj and Al Wajh region into a luxury eco-tourism destination. These large-scale developments mandate strict compliance with international building codes, requiring extensive verification of material strength, durability, and composition. As a result, engineering firms are embedding sophisticated testing protocols during both design and execution phases to ensure long-term safety and performance. Independent testing laboratories are also witnessing increased contracts from government and private developers to support these compliance requirements. This trend is fostering the establishment of new testing facilities near strategic construction zones and is encouraging the adoption of automated testing equipment and data analytics to expedite result accuracy and meet tight project timelines.

To get more information on this market Request Sample

Expansion of Material Testing Services in Petrochemical and Energy Sectors

Saudi Arabia’s material testing market is evolving with increased activity in petrochemical and energy production sectors. As the Kingdom diversifies its industrial base while continuing to expand oil and gas capabilities, critical infrastructure, such as pipelines, refineries, and processing plants, requires rigorous evaluation of metal fatigue, corrosion resistance, and structural integrity. For instance, in December 2024, TCR Engineering Services was approved by Saudi Aramco to conduct Engineering Critical Analysis (ECA) for pipeline welds on the Jafurah Gas Compression Plants and PWIS (Package-1) project. The ECA process, compliant with API 1104 – Option 2, includes fracture toughness (CTOD), impact, and tensile testing, as well as finite element analysis (FEA) to assess weld integrity. Specimens from various pipe positions are tested to determine tolerable defect sizes and ensure structural reliability of critical pipeline systems. The growing emphasis on predictive maintenance has led to the deployment of ultrasonic and eddy current testing methods to detect subsurface flaws before failures occur. Moreover, with the rise in renewable energy projects like solar parks, composite materials and high-performance polymers are subject to enhanced lifecycle testing. The specialized demands of these industries are prompting service providers to develop niche testing capabilities tailored to sector-specific environmental and operational conditions.

Localization of Testing Capabilities through Strategic Partnerships

Driven by national policy incentives and a focus on economic localization, material testing services in Saudi Arabia are increasingly being developed through partnerships between local firms and global technology providers. This trend reflects a broader effort to reduce dependence on imported services and equipment while building domestic expertise. Joint ventures are enabling the transfer of proprietary testing methodologies, staff training, and laboratory infrastructure upgrades. As these collaborations mature, localized testing labs are better positioned to offer fast turnaround times, sector-specific certifications, and compliance with Saudi Standards, Metrology and Quality Organization (SASO) guidelines. This strategic realignment is improving regional accessibility to advanced testing services and aligning with the broader industrialization goals outlined in the Kingdom’s National Industrial Development and Logistics Program (NIDLP). For instance, in February 2025, Intertek introduced Saudi Arabia’s first domestic fire testing and certification facility for building materials, located in Al Khobar. Accredited to ISO 17025 and approved by the Saudi Civil Defence, the lab evaluates fire performance for doors, walls, ceilings, glazed partitions, and structural components. By providing these services locally, it eliminates the need for exporting samples, significantly reducing processing times for Saudi-based companies. The facility ensures compliance with Saudi Building Codes and international standards such as ISO, ASTM, UL, and NFPA, reinforcing the country's drive to localize advanced testing capabilities.

Saudi Arabia Material Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on type, material, and end use industry.

Type Insights:

- Universal Testing Machines

- Servohydraulic Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Non-Destructive Testing Machines

The report has provided a detailed breakup and analysis of the market based on the type. This includes universal testing machines, servohydraulic testing machines, hardness testing machines, impact testing machines, and non-destructive testing machines.

Material Insights:

- Metals and Alloys

- Plastics

- Rubber and Elastomers

- Ceramics and Composites

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals and alloys, plastics, rubber and elastomers, ceramics and composites, and others.

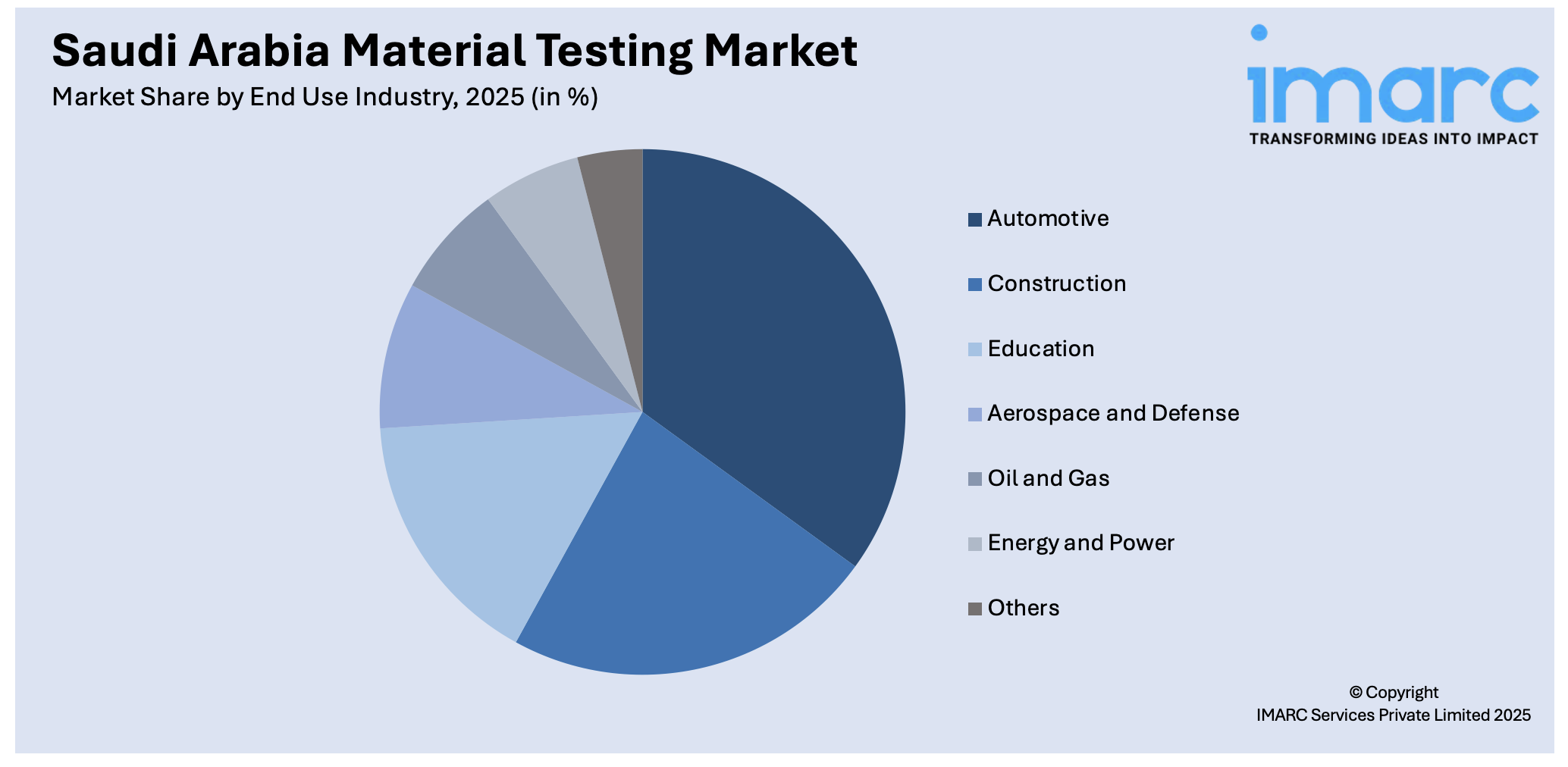

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Construction

- Education

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, construction, education, aerospace and defense, oil and gas, energy and power, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Material Testing Market News:

- In March 2025, TCR Arabia, a joint venture between India’s TCR Engineering and Saudi Arabia’s Future Prospects, expanded its regional footprint with the launch of a new branch in Yanbu, strengthening its position in Saudi Arabia’s materials testing and engineering services sector. Headquartered in Dammam with operations in Jubail, the company specializes in materials testing, NDT, asset integrity, and engineering consulting. The Yanbu facility enhances TCR Arabia’s capacity to serve major initiatives like the Red Sea Project, NEOM, and the Master Gas Pipeline, in alignment with Vision 2030 and the IKTVA program.

- In March 2025, Aramco launched Saudi Arabia’s first CO₂ Direct Air Capture (DAC) test unit in Dhahran, developed with Siemens Energy. The pilot facility removes 12 tons of CO₂ annually and serves as a platform to test next-generation capture materials in local conditions. It aims to lower costs and support future large-scale DAC deployment. This initiative aligns with Aramco’s goal of achieving net-zero emissions by 2050 and follows plans for a major Carbon Capture and Storage (CCS) hub in Jubail.

- In February 2025, Arab Center for Engineering Studies (ACES) launched a new laboratory in Gayal, NEOM, approximately 150 km from Tabuk City, within Module 43 of The Line Project. This state-of-the-art facility is one of ACES’ largest in western Saudi Arabia and offers a comprehensive suite of services, including geotechnical investigations, construction material testing, chemical and environmental analysis, pile testing, instrumentation, and non-destructive testing. This marks ACES’ 14th lab in Saudi Arabia, reinforcing its strategy to expand regional coverage and better serve its growing client base across the Kingdom.

Saudi Arabia Material Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines |

| Materials Covered | Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, Others |

| End Use Industries Covered | Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia material testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia material testing market on the basis of type?

- What is the breakup of the Saudi Arabia material testing market on the basis of material?

- What is the breakup of the Saudi Arabia material testing market on the basis of end use industry?

- What is the breakup of the Saudi Arabia material testing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia material testing market?

- What are the key driving factors and challenges in the Saudi Arabia material testing?

- What is the structure of the Saudi Arabia material testing market and who are the key players?

- What is the degree of competition in the Saudi Arabia material testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia material testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia material testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia material testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)