Saudi Arabia Meal Replacements Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Saudi Arabia Meal Replacements Market Overview:

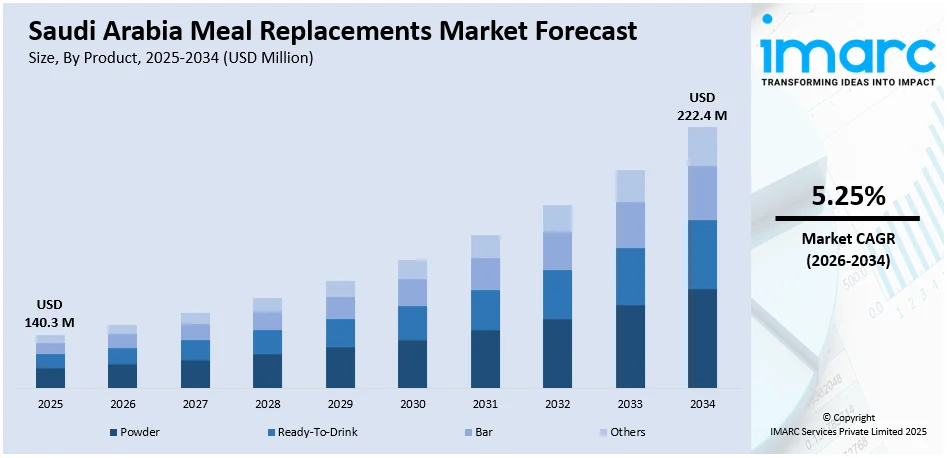

The Saudi Arabia meal replacements market size reached USD 140.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 222.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.25% during 2026-2034. At present, online platforms are becoming more popular among consumers who need easy access, assortment, and competitive pricing for meal replacement items. Apart from this, the rising wave of health-conscious lifestyles in Saudi Arabia is supporting the market growth. Moreover, the growing demand for convenience and on-the-go foods is expanding the Saudi Arabia meal replacements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 140.3 Million |

| Market Forecast in 2034 | USD 222.4 Million |

| Market Growth Rate 2026-2034 | 5.25% |

Saudi Arabia Meal Replacements Market Trends:

Rising Health Awareness Amongst Consumers

There is a rising wave of health-conscious lifestyle in Saudi Arabia, driving the demand for meal replacements. Consumers increasingly recognize the value of balanced nutrition and actively look for easy-to-consume yet healthy food options. This is being driven by increased awareness about lifestyle diseases like obesity, diabetes, and cardiovascular diseases, which are rising in the country. Consequently, individuals are now resorting to meal replacement foods that provide a well-balanced mix of proteins, vitamins, and minerals, sometimes less than a normal meal. The increased exposure to meal replacement foods, sold as being healthy and convenient at the same time, is contributing to the growth of the market. Healthy consumer individuals are also taking up fitness regimens, which is making them more willing to buy meal replacement products that enhance their nutrition requirements. The IMARC Group predicts that the Saudi Arabia health and fitness club market size is projected to attain USD 2,673.5 Million by 2033.

To get more information on this market Request Sample

Growing Demand for Convenience and On-the-Go Foods

The high-speed life in Saudi Arabia is generating more demand for convenient ready-to-eat foods. Working professionals, students, and urban dwellers are looking for meal replacement products that match their time limitations without compromising on the nutritional aspect. With traffic jams and long working hours still prevalent, individuals are turning towards meal replacement shakes, bars, and snacks that can be eaten on the go during hectic periods throughout the day. Heightened requirement for convenience is facilitating the development and the offering of convenient meal solutions which need little preparation and can easily be consumed on-the-go while working or traveling. The increased availability of these items at convenience stores, supermarkets, and through online channels is increasing access to meal replacements and boosting demand. Customers are always seeking convenient means of having a healthy diet without the time it takes for preparing meals in the conventional manner.

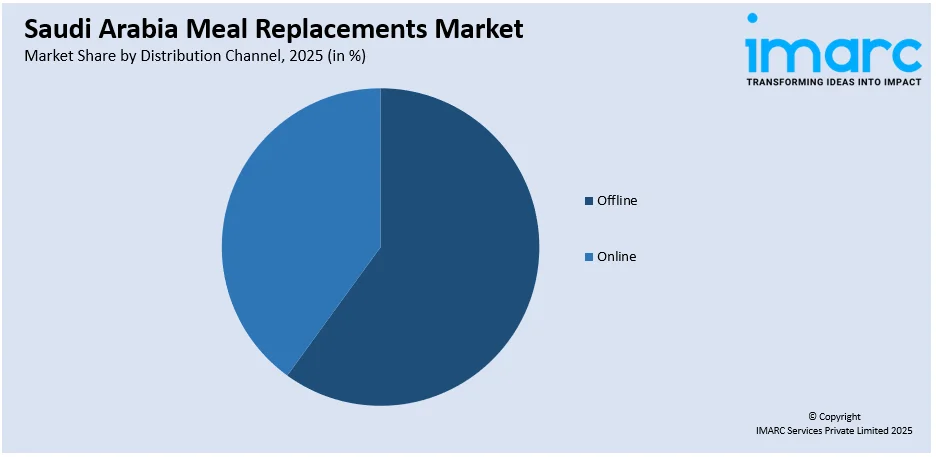

Increasing E-commerce and Retail Channels

The quick e-commerce development and Saudi retail channel expansion are supporting the Saudi Arabia meal replacements market growth. Online platforms are becoming more popular among consumers who need easy access, assortment, and competitive pricing. Online retailers offer a hassle-free shopping experience, enabling customers to compare various brands and types of products and enjoy doorstep delivery services. Retailers are also introducing meal replacement products in their brick-and-mortar stores like pharmacies, supermarkets, and health food shops, to meet the increasing demand. This availability of retail platforms, both online and offline, is facilitating greater accessibility for consumers to a variety of meal replacement products. With more brands and retailers entering the marketplace, the visibility and availability of these products are growing, further fueling their consumption among health-focused and time-poor individuals throughout the region. In 2024, Agthia Group PJSC, a major food and beverage brand in the region, officially launched its new protein manufacturing plant in Industrial City 1, Jeddah, KSA. This strategic investment represents a crucial advancement in Agthia’s dedication to Saudi Vision 2030, aimed at enhancing the Kingdom’s F&B market, and aligns with the Group’s long-term plan to position itself as a leading force in the sector across the MENA region and beyond by 2025.

Saudi Arabia Meal Replacements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Powder

- Ready-To-Drink

- Bar

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes powder, ready-to-drink, bar, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Others

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline (hypermarkets and supermarkets, convenience stores, specialty stores, and others) and online.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Meal Replacements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Powder, Ready-To-Drink, Bar, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia meal replacements market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia meal replacements market on the basis of product?

- What is the breakup of the Saudi Arabia meal replacements market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia meal replacements market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia meal replacements market?

- What are the key driving factors and challenges in the Saudi Arabia meal replacements market?

- What is the structure of the Saudi Arabia meal replacements market and who are the key players?

- What is the degree of competition in the Saudi Arabia meal replacements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia meal replacements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia meal replacements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia meal replacements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)