Saudi Arabia Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Saudi Arabia Meat Market Summary:

The Saudi Arabia meat market size was valued at USD 13.99 Billion in 2025 and is projected to reach USD 21.52 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The market is experiencing robust growth as meat represents an important component of the country's food security strategy, influenced by evolving dietary patterns, urban developments, and governmental initiatives aimed at improving domestic production capabilities while lowering import dependency across protein categories. Apart from this, the modernization of retail infrastructures owing to international format adoption and demographic pressures from population growth in urban centers is expanding the Saudi Arabia meat market share.

Key Takeaways and Insights:

- By Type: Raw dominates the market with a share of 70% in 2025, reflecting traditional consumer preferences for fresh, unprocessed protein products prepared at home according to cultural culinary practices and religious dietary requirements.

- By Product: Chicken leads the market with a share of 40.01% in 2025, owing to the widespread consumption behavior, established supply chains, and its positioning as an affordable protein source accessible across diverse income segments.

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 55.1% in 2025, benefiting from extensive geographic coverage, competitive pricing strategies, and comprehensive product assortments catering to bulk purchasing behaviors.

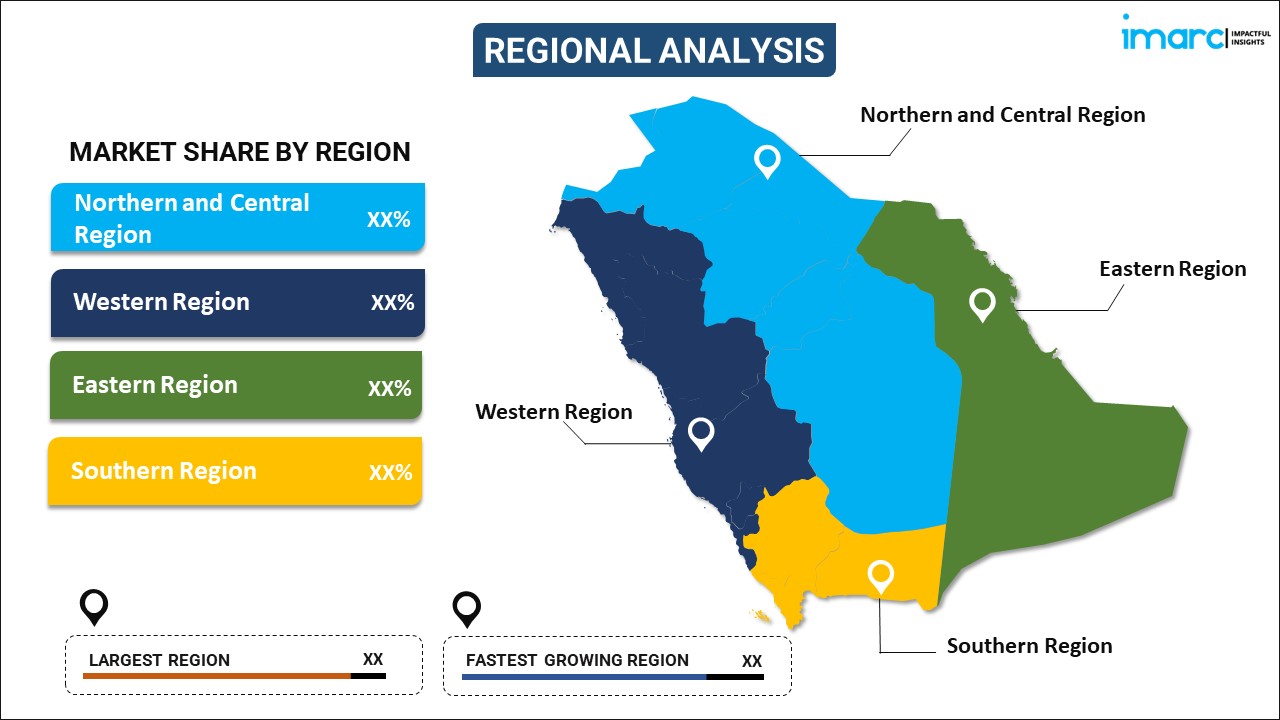

- By Region: Northern and central region accounts for the largest share at 29% in 2025, supported by the high concentration of population in various cities, higher per capita consumption rates, and superior retail infrastructure development.

- Key Players: The Saudi Arabia meat market features a competitive landscape characterized by established domestic producers alongside international suppliers, with companies competing across quality tiers, product innovation, distribution efficiency, and compliance with halal certification standards to capture market share. Some of the key players includes Al-Watania Poultry, Almarai Food Company, Halwani Bros Company, Sunbulah Group, and Tanmiah Food Company.

The Saudi Arabian market is experiencing significant growth, underpinned by demographic expansion, improving disposable incomes, and changing consumption patterns towards protein-intensive diets. Food security is one of the key items in the Kingdom's Vision 2030 economic diversification program through enhanced domestic production, thus creating opportunities for investment in state-of-the-art livestock facilities, cold chain infrastructure, and processing capabilities. Government support manifests itself through subsidized feed programs, veterinary service provision, and favorable financing of agricultural ventures, while regulatory frameworks ensure halal and food safety standards are maintained. For example, in 2025, Al Watania Poultry, one of the world's leading poultry manufacturers, announced the launch of the region's largest cooling facility, a 17,700 kW-capacity cooler. The project is an indication of Al Watania's determination to pursue the realization of food security and the development of Saudi Arabia's economy using advanced technology and increasing the efficiency of the company's facilities and staff. Furthermore, major retailers have expanded temperature-controlled distribution networks across provinces, allowing consistent product availability and assurance of quality from farm to consumer, thereby emboldening confidence in locally sourced meat produce while reducing logistical costs associated with import reliance and creating jobs along the value chain of agriculture.

Saudi Arabia Meat Market Trends:

Premiumization and Quality-Conscious Purchasing

Saudi consumers increasingly focus into quality, traceability, and ethical sourcing when making their meat purchases, moving away from purely price-based decision-making and embracing value-based buying. This is evidenced by increasing demand for organic certifications, antibiotic-free labeling, and transparently documented supply chains. Retailers respond by allocating shelf space to premium product lines, forging direct links with certified farms, and introducing blockchain-enabled monitoring systems that enable end-customers to verify the origin of purchases via smartphone apps, commanding higher margins while fostering brand loyalty among more affluent consumer groups. In 2025, Brazilian meat company BRF launched its first line of chilled chicken products produced in Saudi Arabia. The launch is just the latest attempt by BRF to improve its position in Saudi Arabia, reducing its reliance on export sales to the country by improving local supplies in a key market for the group.

Expansion of Modern Retail Formats

Traditional butcher shops face competitive pressure from expanding supermarket chains and hypermarket formats that offer comprehensive meat departments with professional cutting services, extended operating hours, and integrated loyalty programs. These modern outlets leverage economies of scale to provide competitive pricing while maintaining strict temperature controls, regular quality inspections, and attractive product presentation. The format shift particularly resonates with younger, urban consumers who value convenience, hygiene standards, and one-stop shopping experiences, fundamentally altering distribution dynamics and forcing traditional vendors to upgrade facilities or risk market share erosion. In 2025, Tanmiah Food Company, based in Saudi Arabia, enhanced its collaboration with McDonald’s Saudi Arabia to provide locally sourced poultry for the fast-food chain, signifying a significant advancement in the Kingdom's initiative for food self-sufficiency. The partnership allows McDonald’s to satisfy the increasing demand for high-quality, locally sourced chicken, while also contributing to Saudi Arabia's Vision 2030 goals for local content and agricultural advancement.

Processed and Ready-to-Cook Product Innovation

Changing lifestyle patterns among working professionals and dual-income households drive substantial growth in processed meat segments including marinated cuts, pre-seasoned products, and ready-to-cook meal solutions. Manufacturers respond with product innovation addressing time constraints while accommodating local flavor preferences through traditional spice blends and recipe formulations. This category expansion enables producers to capture higher value addition, extend shelf life through advanced preservation techniques, and differentiate offerings in increasingly competitive markets, while simultaneously addressing consumer demands for convenient meal preparation without compromising taste expectations or cultural authenticity. IMARC Group predicts that the Saudi Arabia meat processing market is projected to attain USD 334.13 Million by 2033.

How Vision 2030 is Transforming the Saudi Arabia Meat Market:

Saudi Arabia’s Vision 2030 is reshaping the meat market by pushing the country toward higher self-reliance, better quality, and stronger food security. Large investments are flowing into local livestock farming, poultry production, and modern slaughterhouses to cut dependence on imports. Programs supporting agri-tech, climate-controlled farms, and efficient feed management are lifting domestic output, especially in poultry and processed meat. The policy focus on halal integrity and food safety has tightened standards across the supply chain, from farms to retail shelves. This has encouraged upgrades in cold storage, traceability systems, and packaging. Vision 2030 is also opening space for private players and foreign partners through incentives, land access, and easier licensing, speeding up capacity expansion. Changing consumer habits are another driver. Urban lifestyles and rising incomes are boosting demand for chilled, frozen, and ready-to-cook meat products. Together, these shifts are turning the Saudi meat market into a more structured, investment-friendly sector with clearer growth paths over the coming decade.

Market Outlook 2026-2034:

The Saudi Arabia meat market demonstrates strong expansion prospects underpinned by population growth, urbanization acceleration, and dietary transition toward increased protein consumption reflecting prosperity gains. Government initiatives supporting domestic livestock production, coupled with private sector investments in processing infrastructure and cold chain logistics, position the market for sustained development. The market generated a revenue of USD 13.99 Billion in 2025 and is projected to reach a revenue of USD 21.52 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034. The increasing penetration of e-commerce platforms offering doorstep delivery of fresh and frozen meat products further expands market accessibility, particularly benefiting consumers in remote areas with limited retail options.

Saudi Arabia Meat Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Raw |

70% |

|

Product |

Chicken |

40.01% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

55.1% |

|

Region |

Northern and Central Region |

29% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Raw

- Processed

Raw dominates with a market share of 70% of the total Saudi Arabia meat market in 2025.

Raw meat maintains its commanding position within the Saudi Arabian market due to deeply embedded cultural preferences for freshly slaughtered products that align with Islamic dietary laws and traditional cooking methodologies. Consumers exhibit strong trust in their ability to assess quality through visual inspection, texture evaluation, and direct interaction with butchers who provide customized cutting services tailored to specific recipe requirements. This preference transcends income levels, with both affluent and budget-conscious households prioritizing raw meat purchases for daily meal preparation.

The segment's dominance reflects infrastructural realities including widespread availability of home refrigeration, established wet market networks, and cultural knowledge transmission regarding meat selection and preparation techniques passed through generations. Religious observances including Eid celebrations and Ramadan significantly amplify raw meat consumption as families prepare traditional dishes requiring specific cuts and fresh ingredients. Retailers respond by maintaining extensive raw meat offerings with visible butchery operations, enabling customers to witness cutting procedures and request particular specifications, thereby reinforcing confidence in product integrity and adherence to halal standards throughout the supply chain.

Product Insights:

- Chicken

- Beef

- Mutton

- Others

Chicken leads with a share of 40.01% of the total Saudi Arabia meat market in 2025.

Chicken holds the largest share in the Saudi Arabia meat market, driven by affordability, wide availability, and strong alignment with local food habits. It is a daily protein choice across households, restaurants, and institutional buyers. Fast food chains, quick service restaurants, and home cooking rely heavily on chicken due to its versatility in traditional and western recipes. Large-scale imports, coupled with growing domestic poultry production, help maintain stable supply and competitive pricing. Government support for poultry farming and investments in cold chain logistics have further strengthened chicken’s dominance across both urban and semi-urban markets.

Beef and mutton follow chicken but serve more specific consumption occasions in Saudi Arabia. Beef is commonly used in processed foods, burgers, and foodservice formats, while mutton holds cultural importance, especially during religious festivals, family gatherings, and traditional cuisine. Mutton is priced higher, which limits its everyday consumption compared to chicken. The “others” category, including camel and processed meats, remains niche but steady. Changing lifestyles, rising tourism, and expanding hospitality sectors continue to shape demand patterns, yet chicken remains the most consistent and volume-driven meat segment in the country.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 55.1% share of the total Saudi Arabia meat market in 2025.

Supermarkets and hypermarkets command the distribution landscape through strategic advantages including extensive geographic footprints, significant purchasing power enabling competitive pricing, and comprehensive product assortments that satisfy diverse consumer preferences within single shopping trips. These formats invest substantially in refrigeration infrastructure, temperature monitoring systems, and trained personnel capable of providing cutting services and product guidance, thereby addressing quality concerns while offering convenience that traditional outlets struggle to match.

The channel's dominance accelerates through aggressive expansion strategies targeting emerging residential developments, implementation of private label meat brands offering value alternatives to national brands, and integration of loyalty programs that incentivize repeat patronage through points accumulation and exclusive promotions. Major chains leverage sophisticated inventory management systems ensuring consistent product availability while minimizing waste through demand forecasting and dynamic pricing adjustments for products approaching sell-by dates. Enhanced shopping experiences featuring modern ambiance, organized displays, and streamlined checkout processes particularly resonate with younger, urban consumers who prioritize hygiene standards and shopping efficiency, fundamentally reshaping meat retail dynamics and capturing market share from fragmented traditional trade channels.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 29% of the total Saudi Arabia meat market in 2025.

The Northern and Central Region establishes market leadership anchored by Riyadh's position as the national capital and largest metropolitan area, concentrating substantial population density, elevated income levels, and advanced retail infrastructure that supports sophisticated meat distribution networks. The region benefits from superior logistics connectivity facilitating efficient product movement from production facilities and import terminals, coupled with higher per capita consumption rates reflecting urban dietary patterns characterized by increased protein intake and dining diversity.

Regional dominance extends through the presence of major retail chains maintaining flagship stores and distribution centers, government institutions and corporate headquarters generating significant food service demand, and affluent residential communities exhibiting premium product preferences. The concentration of expatriate populations introduces diverse consumption patterns and demands for international meat products, prompting retailers to expand offerings beyond traditional categories. Infrastructure investments including modern cold storage facilities, quality testing laboratories, and transportation networks supporting temperature-controlled logistics reinforce the region's competitive advantages, enabling consistent product quality maintenance and rapid market responsiveness to evolving consumer preferences while setting benchmarks for operational standards subsequently adopted across other geographic markets.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Meat Market Growing?

Population Growth and Demographic Expansion

Saudi Arabia experiences steady population growth combining natural increase with expatriate workforce expansion, directly translating into elevated aggregate demand for staple food products including meat across categories. As of mid-2024, Saudi Arabia's population hit 35.3 million, with Saudi citizens making up over 55 percent of the overall figure. The Kingdom's population exhibits a youthful demographic profile with substantial proportions in prime consumption age brackets, generating sustained demand growth trajectories independent of per capita consumption changes. Urban migration patterns concentrate populations in metropolitan centers with established retail infrastructure, facilitating market penetration for modern distribution formats and processed product categories. Additionally, household formation rates among young Saudi nationals supported by government housing initiatives create new consumption units with distinct purchasing patterns emphasizing convenience and quality.

Rising Disposable Incomes and Economic Prosperity

Economic development initiatives under Vision 2030 diversification programs generate employment opportunities across non-oil sectors, elevating household incomes and expanding the middle-class consumer segment with enhanced purchasing power for protein products. Income growth enables dietary upgrading from lower-cost protein sources toward premium meat categories including imported cuts, organic products, and specialty items previously considered discretionary purchases. In Saudi Arabia, the GDP is anticipated to expand by 3.7% annually in 2025, surpassing the global GDP growth expected at 3.2%, a slight rise from 3.1% in 2024. At the same time, it is anticipated that consumer spending in the Kingdom will grow by 4.5%, while consumer price inflation is expected to hit 2%. Increased affluence manifests through higher per capita meat consumption rates as households allocate larger budget shares to food categories emphasizing nutritional quality and variety. The prosperity effect extends beyond direct income impacts to encompass improved living standards, expanded credit availability facilitating bulk purchases and appliance investments like large refrigerators supporting storage, and psychological confidence encouraging discretionary spending on premium products. Additionally, government employment stability and private sector wage growth create sustained purchasing power supporting consistent demand patterns rather than volatile consumption cycles, providing market stability that encourages supply chain investments and capacity expansions.

Government Food Security Initiatives and Domestic Production Support

Strategic national priorities emphasizing food security drive substantial government support for domestic meat production through subsidized feed programs, veterinary services provision, and favorable financing terms for livestock farming investments. Saudi Arabia's Vision 2030 represents a transformative initiative designed to redefine the Kingdom's economy, primarily concentrating on improving food security via a thorough US$10 billion strategy to stabilize the international food supply chain and increase local agricultural output. Policy frameworks encourage private sector participation in modern farming facilities incorporating advanced breeding technologies, automated feeding systems, and biosecurity protocols that enhance productivity while ensuring product safety standards. Infrastructure development including specialized industrial zones for food processing, cold storage networks, and livestock transport corridors reduces operational costs and improves supply chain efficiency. Regulatory reforms streamlining import procedures for breeding stock and feed inputs while maintaining stringent quality standards for domestic products create competitive domestic industries capable of substituting imports.

Market Restraints:

What Challenges the Saudi Arabia Meat Market is Facing?

Climate Constraints and Environmental Limitations

The Kingdom's arid climate and limited water resources create fundamental challenges for domestic livestock production, particularly for feed crop cultivation supporting large-scale animal husbandry operations. Extreme summer temperatures necessitate substantial investments in climate-controlled housing, ventilation systems, and cooling infrastructure that elevate production costs relative to regions with temperate climates naturally suited to livestock farming. Water scarcity constrains both direct animal consumption needs and feed production, forcing reliance on imported feed ingredients that expose producers to global commodity price volatility. Environmental considerations including grazing land availability, waste management requirements, and sustainability pressures limit production expansion potential. These structural challenges maintain partial import dependency despite government initiatives supporting domestic production, creating supply vulnerabilities to international market disruptions and exchange rate fluctuations while limiting cost competitiveness against imported alternatives.

Price Sensitivity and Economic Affordability Constraints

Significant portions of the Saudi consumer base, particularly among lower-income expatriate workers and budget-conscious Saudi households, exhibit high price sensitivity that limits premium product adoption and constrains consumption levels during periods of economic uncertainty or price inflation. Meat products represent substantial household budget allocations, rendering consumption patterns vulnerable to income shocks, employment disruptions, or competing financial obligations including remittances and savings priorities. Processed and value-added meat categories command price premiums that exclude price-sensitive segments, limiting market expansion beyond middle and upper-income consumers. Economic cycles affecting construction, hospitality, and retail sectors that employ substantial expatriate populations create demand volatility as affected workers reduce discretionary food spending. Additionally, competition from alternative protein sources including legumes, eggs, and dairy products offering lower cost per gram of protein creates substitution pressures during price increases, forcing meat producers and retailers to carefully balance margin objectives against volume preservation through competitive pricing strategies.

Cold Chain Infrastructure Gaps and Logistical Challenges

Despite improvements, cold chain infrastructure exhibits gaps particularly in remote regions and secondary cities, creating quality maintenance challenges for perishable meat products from production through retail. Temperature control breaks during transportation, storage, and retail display can compromise product safety and reduce shelf life, generating waste and consumer confidence concerns. The geographic dispersion of population centers across vast distances elevates logistics costs and complexity, particularly for fresh product distribution requiring rapid movement and consistent refrigeration. Smaller retailers lack capital for advanced refrigeration equipment and backup power systems, limiting their ability to stock diverse meat assortments and compete effectively with modern chains. Infrastructure inadequacies become more pronounced during peak demand periods including religious holidays when supply chains face maximum stress, potentially leading to quality compromises or availability gaps that disappoint consumers and damage brand reputations, thereby constraining market growth potential and limiting effective competition across distribution formats.

Competitive Landscape:

The Saudi Arabia meat market exhibits moderate competitive intensity characterized by the coexistence of established domestic producers operating large-scale integrated operations alongside international suppliers servicing premium segments and specialty categories. Domestic players leverage advantages including proximity to consumers enabling fresh product delivery, cultural understanding of local preferences, and strong relationships with traditional distribution channels, while maintaining competitive pricing through operational efficiencies and government support programs. International suppliers differentiate through premium positioning emphasizing superior genetics, advanced processing technologies, and certifications appealing to quality-conscious consumers willing to pay price premiums. The competitive dynamic extends across value chain stages from primary production through processing and retail, with vertical integration strategies providing cost control and quality assurance advantages. Retailers exert increasing influence through private label development, supplier consolidation pressures, and shelf space allocation decisions that favor partners offering consistent quality, promotional support, and logistical reliability, intensifying competition among suppliers for strategic retail partnerships. Some of the key players include:

- Al-Watania Poultry

- Almarai Food Company

- Halwani Bros Company

- Sunbulah Group

- Tanmiah Food Company

Recent Developments:

- In December 2025, Waleem Meat Factory, the biggest and most modern meat processing plant in Saudi Arabia, officially declared its grand opening today in Buraidah, Al-Qassim. This cutting-edge facility, boasting a production capacity of 60 tons daily, represents an important achievement in the Kingdom’s pursuit of food security and economic diversification, aligned with Saudi Vision 2030.

- In October 2025, Marfrig Global Foods and RF partner have finalized terms with Halal Products Development Company (HPDC) to expand a joint venture in Saudi Arabia. The two Brazilian meat giants now comprise MBRF after a merger agreement was approved in September. Before that merger, BRF had established a joint venture with HPDC, which is owned by Saudi Arabia’s sovereign wealth fund, the Public Investment Fund. As per an agreement revealed yesterday (27 October), BRF will transfer its distribution operations in Kuwait, Oman, Qatar, Saudi Arabia, and the UAE into the joint venture named BRF Arabia Holding.

- In March 2025, Hilton Foods has formed a long-term partnership with The National Agricultural Development Company (NADEC) in Saudi Arabia, extending the company's presence in the Middle East. Hilton Foods will own a 49% share in the joint venture and invest £6.5 million in an initial total of SAR 60 million (around £13 million) for the facility. The collaboration, planned to continue for a decade, merges Hilton Foods' skills in meat processing and packaging with NADEC's well-established cattle operations in the area.

Saudi Arabia Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Al-Watania Poultry, Almarai Food Company, Halwani Bros Company, Sunbulah Group, Tanmiah Food Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia meat market size was valued at USD 13.99 Billion in 2025.

The Saudi Arabia meat market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 21.52 Billion by 2034.

Raw dominated the type segment with a market share of 70% in 2025, driven by deeply embedded cultural preferences for fresh, unprocessed products aligning with Islamic dietary laws, traditional cooking practices, and consumer trust in quality assessment through direct butcher interactions.

Saudi Arabia’s meat market is shaped by rising demand for premium, traceable products, growth of modern retail and foodservice partnerships, and strong momentum in processed and ready-to-cook offerings, supported by local production, convenience-led consumption, and Vision 2030 food security initiatives.

Major challenges include climate constraints limiting domestic livestock production potential, water scarcity increasing dependence on imported feed ingredients, price sensitivity among budget-conscious consumer segments restricting premium product adoption, cold chain infrastructure gaps affecting quality maintenance particularly in remote regions, and environmental sustainability pressures constraining production expansion possibilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)