Saudi Arabia Medical Aesthetics Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Saudi Arabia Medical Aesthetics Market Overview:

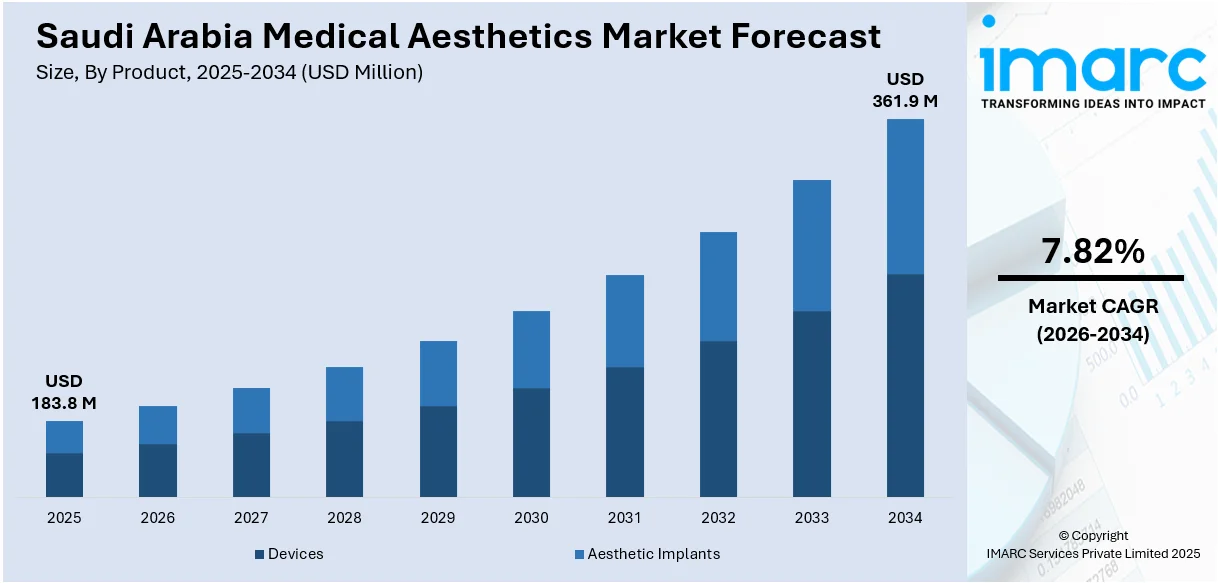

The Saudi Arabia medical aesthetics market size reached USD 183.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 361.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.82% during 2026-2034. The market is witnessing steady growth, driven by growing demand for non-invasive cosmetic procedures, increasing disposable income, and greater awareness about aesthetic treatments. The expanding services in areas like skin rejuvenation, body contouring, and anti-aging solutions, technological advancements and a growing youth population are also contributing to the Saudi Arabia medical aesthetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 183.8 Million |

| Market Forecast in 2034 | USD 361.9 Million |

| Market Growth Rate 2026-2034 | 7.82% |

Saudi Arabia Medical Aesthetics Market Trends:

Expansion of Aesthetic Clinics

Saudi Arabia is experiencing a swift growth of specialized aesthetic clinics and med-spas, fueled by increasing demand for cosmetic treatments and a move toward sophisticated, minimally invasive therapies. These clinics are increasingly opening in urban areas like Riyadh, Jeddah, and Dammam, providing services from injectables and laser treatments to skin rejuvenation and body contouring. For instance, In February 2025, Magrabi Health launched Mayam Aesthetics in Jeddah, a premier dermatology and aesthetic solutions facility. Featuring advanced technology and expert care, it offers a range of treatments, including injectables, skincare, and body contouring. The clinic prioritizes personalized, ethical care in a serene environment, marking Magrabi's entry into aesthetic medicine. This growth is fueled by increasing disposable incomes, societal acceptance of cosmetic makeover, and a younger age group that is proactive towards looks. Many clinics now feature state-of-the-art technologies and internationally trained practitioners, enhancing their appeal to both local and regional clients. The competitive market landscape has also led to service diversification, loyalty programs, and partnerships with skincare brands. This surge in specialized facilities is significantly improving access and driving Saudi Arabia medical aesthetics market growth by making cosmetic services more mainstream and accessible.

To get more information on this market Request Sample

Rising Demand for Non-Invasive Procedures

Non-invasive aesthetic treatments are gaining widespread popularity in Saudi Arabia, reflecting a shift in consumer preference toward procedures that offer visible results with minimal recovery time. Treatments such as Botox, dermal fillers, chemical peels, and laser therapies are increasingly favored for addressing concerns like wrinkles, pigmentation, and skin tightening without the risks associated with surgery. For instance, in March 2025, Cytrellis Biosystems received approval from Health Canada and the Saudi Food and Drug Authority to commercialize its ellacor® with Micro-Coring® technology. This milestone expands the company's global presence, offering a non-surgical solution for skin rejuvenation in growing markets, including Canada and Saudi Arabia. The appeal lies in the convenience, shorter treatment sessions, and reduced post-procedure downtime, making them suitable for working professionals and younger demographics seeking subtle enhancements. Clinics are rapidly expanding their offerings to meet this growing demand, often investing in advanced devices and certified practitioners. Social media and celebrity influence further amplify interest, encouraging more people to explore cosmetic enhancements. This rising preference for low-risk, high-reward treatments is a major contributor to Saudi Arabia medical aesthetics market growth, making non-invasive procedures central to the industry’s expansion.

Saudi Arabia Medical Aesthetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Devices

- Aesthetic Implants

The report has provided a detailed breakup and analysis of the market based on the product. This includes devices and aesthetic implants.

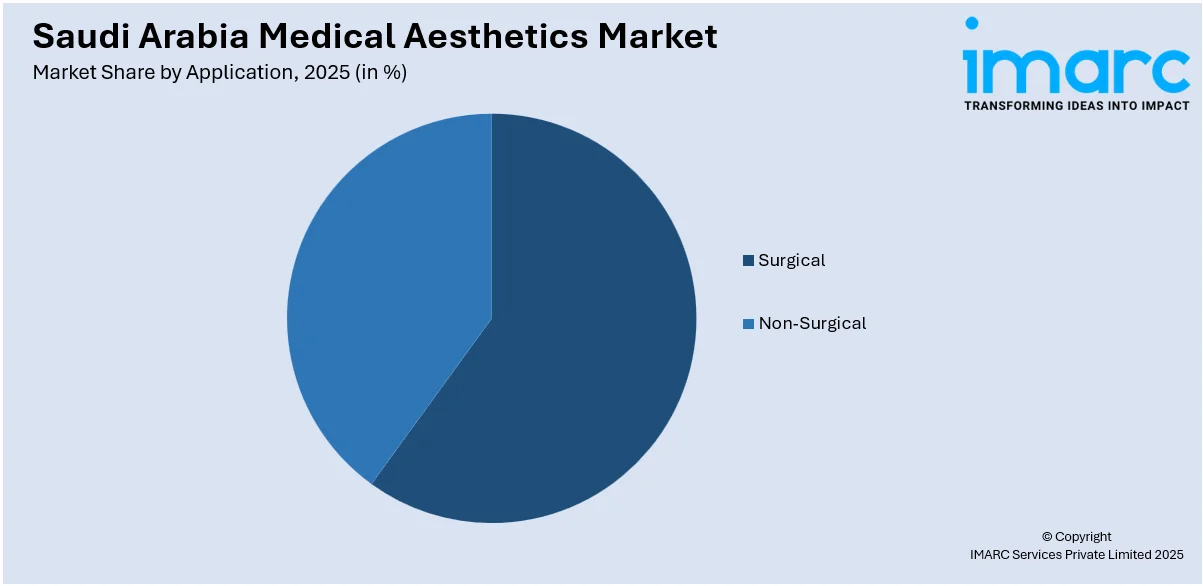

Application Insights:

Access the comprehensive market breakdown Request Sample

- Surgical

- Non-Surgical

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes surgical and non-surgical.

End User Insights:

- Hospitals and Clinics

- Medical Spas and Beauty Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics and medical spas and beauty centers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Medical Aesthetics Market News:

- In February 2025, Cynosure Lutronic signed a strategic distribution agreement with Amico Aesthetics, naming them the sole distributor for its products across the Middle East, including KSA. This partnership aims to enhance aesthetic practice standards and customer support in the region through innovative technologies and training initiatives.

- In February 2025, YA-MAN launched its products in Saudi Arabia, marking its debut in the Middle East. With an Arabic e-commerce site and partnerships with local aesthetic clinics, the brand aims to cater to the region’s youth and address rising beauty awareness under Saudi Arabia's "Vision 2030" initiative.

Saudi Arabia Medical Aesthetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Devices, Aesthetic Implants |

| Applications Covered | Surgical, Non-Surgical |

| End Users Covered | Hospitals and Clinics, Medical Spas and Beauty Centers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia medical aesthetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia medical aesthetics market on the basis of product?

- What is the breakup of the Saudi Arabia medical aesthetics market on the basis of application?

- What is the breakup of the Saudi Arabia medical aesthetics market on the basis of end user?

- What is the breakup of the Saudi Arabia medical aesthetics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia medical aesthetics market?

- What are the key driving factors and challenges in the Saudi Arabia medical aesthetics market?

- What is the structure of the Saudi Arabia medical aesthetics market and who are the key players?

- What is the degree of competition in the Saudi Arabia medical aesthetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia medical aesthetics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia medical aesthetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia medical aesthetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)