Saudi Arabia Medical Wearables Market Size, Share, Trends and Forecast by Product, Device Type, End User, and Region, 2026-2034

Saudi Arabia Medical Wearables Market Overview:

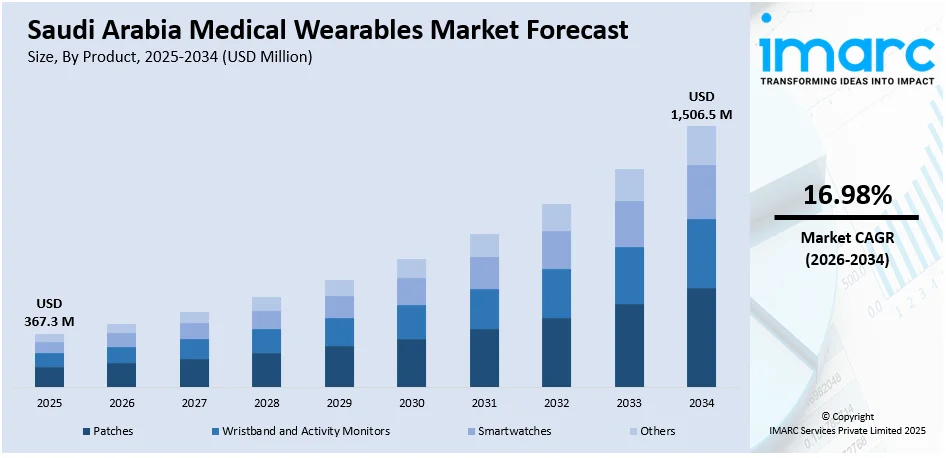

The Saudi Arabia medical wearables market size reached USD 367.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,506.5 Million by 2034, exhibiting a growth rate (CAGR) of 16.98% during 2026-2034. Rising health awareness and a shift towards preventive healthcare are driving the demand for wearable devices in Saudi Arabia. The increased availability, affordability, and accessibility of various wearables through online and retail channels are allowing more individuals to adopt health-tracking technologies for proactive wellness management, contributing to the expansion of the Saudi Arabia medical wearables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 367.3 Million |

| Market Forecast in 2034 | USD 1,506.5 Million |

| Market Growth Rate 2026-2034 | 16.98% |

Saudi Arabia Medical Wearables Market Trends:

Growing Health Awareness and Preventive Healthcare Focus

A notable rise in health awareness in Saudi Arabia is driving a shift toward preventive healthcare as people take a more proactive role in managing their well-being. As lifestyle-related health concerns rise, many individuals are seeking ways to monitor their wellness beyond traditional healthcare settings. This shift in culture is catalyzing the demand for wearable devices that provide continuous, real-time information on key health indicators, including heart rate, sleep patterns, and activity intensity. In 2024, Huawei released the HUAWEI WATCH GT 5 Series in Saudi Arabia, available for pre-order for 999 SAR. This smartwatch featured the innovative TruSense system, which monitored advanced health metrics and emotional wellness, in addition to offering extended battery life and enhanced sports modes. The device was compatible with both Android and iOS, ensuring it was accessible to a broad audience. Such advancements enable individuals to monitor their health condition, identify early signs of potential health problems, and assess their progress, thereby minimizing the need for more extensive interventions. With the growing importance of preventive healthcare, wearable devices are becoming an effective means for individuals in Saudi Arabia to manage their health, promoting sustained well-being and an enhanced quality of life. This trend highlights how wearable devices are empowering individuals to take a more proactive role in managing their health beyond conventional healthcare settings.

To get more information on this market Request Sample

Increased Availability and Accessibility of Wearable Devices

The increasing availability of wearables is a key factor contributing to the Saudi Arabia medical wearables market growth. The presence of various devices, ranging from basic fitness trackers to sophisticated medical-grade wearables, allows users to select products that suit their health objectives and financial considerations. The enhanced accessibility is also supported by local and global brands that offer competitive prices, making health-tracking technology more affordable. Online shopping sites and physical stores are also improving access to these devices, allowing buyers to purchase them conveniently from the comfort of their own homes. The e-commerce market in Saudi Arabia, estimated to be worth USD 222.9 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 12.8%, reaching USD 708.7 billion by 2033. This expansion highlights the growing reliance on online shopping, where health-related devices are now readily accessible to a broader audience. The combination of cost-effectiveness, diverse options, and improved distribution methods via both physical shops and online platforms is boosting the adoption rates of wearable technology. As a result, Saudi Arabia is experiencing a notable increase in individuals integrating wearables into their everyday lives, which is enhancing the market demand. This trend is expected to persist as more people recognize the convenience and health benefits that these wearable devices offer.

Saudi Arabia Medical Wearables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, device type, and end user.

Product Insights:

- Patches

- Wristband and Activity Monitors

- Smartwatches

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes patches, wristband and activity monitors, smartwatches, and others.

Device Type Insights:

- Diagnostic and Monitoring Medical Devices

- Vital Signs Monitoring Devices

- ECG /Holter Heart Rate Monitors

- Pulse Oximeters

- Blood Pressure Monitors

- Multiparameter Trackers

- Glucose Monitoring Devices

- Sleep Apnea Monitors

- Fetal Monitoring Devices

- Neurological Monitoring Devices

- Vital Signs Monitoring Devices

The report has provided a detailed breakup and analysis of the market based on the device type. This includes diagnostic and monitoring medical devices [vital signs monitoring devices (ECG/Holter heart rate monitors, pulse oximeters, blood pressure monitors, and multiparameter trackers), glucose monitoring devices, sleep apnea monitors, fetal monitoring devices, and neurological monitoring devices].

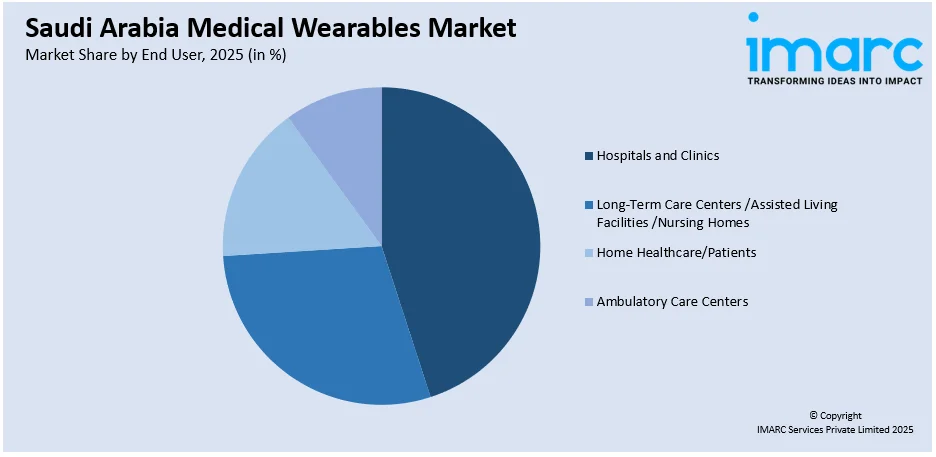

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Long-Term Care Centers /Assisted Living Facilities /Nursing Homes

- Home Healthcare/Patients

- Ambulatory Care Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, long-term care centers /assisted living facilities /nursing homes, home healthcare/patients, and ambulatory care centers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Medical Wearables Market News:

- In February 2025, LEAP 2025 in Riyadh featured medical wearables like XPANCEO’s smart contact lens, which monitors stress, blood sugar, and body temperature. Dutch designer Anouk Wipprecht also showcased wearable tech with health functions, including a heartbeat-monitoring robotic dress.

- In January 2025, Samsung announced the Galaxy Ring expansion to sizes 14 and 15 and its availability in 15 more markets starting February, adding to the existing 38 markets including Saudi Arabia. The Samsung Health app also introduced new features like Sleep environment report, Sleep time guidance, and a Mindfulness tracker. These updates aim to enhance sleep quality and overall wellness.

Saudi Arabia Medical Wearables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Patches, Wristband and Activity Monitors, Smartwatches, Others |

| Device Types Covered |

|

| End Users Covered | Hospitals and Clinics, Long-Term Care Centers /Assisted Living Facilities /Nursing Homes, Home Healthcare/Patients, Ambulatory Care Centers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia medical wearables market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia medical wearables market on the basis of product?

- What is the breakup of the Saudi Arabia medical wearables market on the basis of device type?

- What is the breakup of the Saudi Arabia medical wearables market on the basis of end user?

- What is the breakup of the Saudi Arabia medical wearables market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia medical wearables market?

- What are the key driving factors and challenges in the Saudi Arabia medical wearables market?

- What is the structure of the Saudi Arabia medical wearables market and who are the key players?

- What is the degree of competition in the Saudi Arabia medical wearables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia medical wearables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia medical wearables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia medical wearables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)