Saudi Arabia Milk Alternatives Market Size, Share, Trends and Forecast by Source, Flavor, Packaging, Distribution Channel, and Region, 2026-2034

Saudi Arabia Milk Alternatives Market Summary:

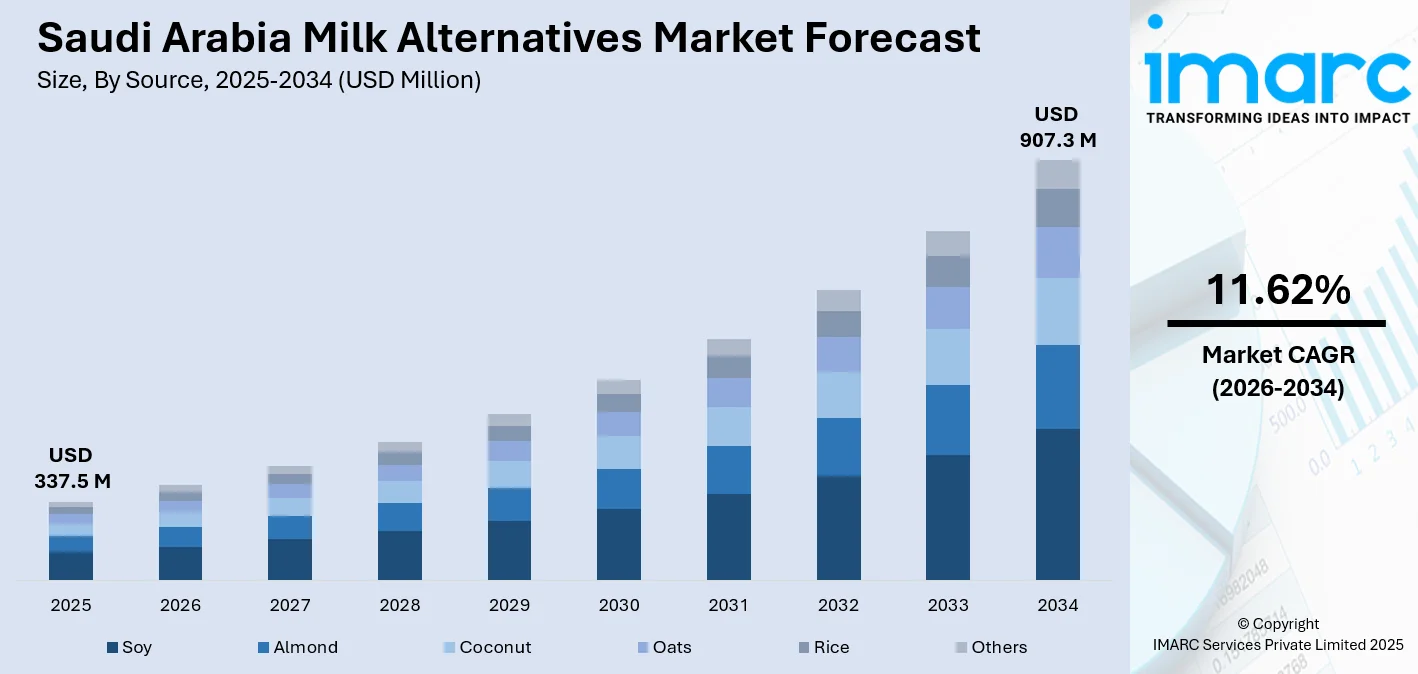

The Saudi Arabia milk alternatives market size was valued at USD 337.5 Million in 2025 and is projected to reach USD 907.3 Million by 2034, growing at a compound annual growth rate of 11.62% from 2026-2034.

The Saudi Arabia milk alternatives market is experiencing robust expansion, driven by escalating health consciousness among consumers and growing preference for plant-based dietary options. Rising awareness about lactose intolerance, increasing vegan and flexitarian lifestyle adoption, and retail modernization across urban centers are reshaping consumption patterns. Strategic alignment with halal and ethical consumer values, coupled with expanded product accessibility through hypermarkets and e-commerce channels, continues to strengthen market presence nationwide.

Key Takeaways and Insights:

- By Source: Soy dominates the market with a share of 38% in 2025, owing to its established nutritional profile, widespread availability, and consumer familiarity with soy-based beverages. The segment benefits from strong protein content recognition and compatibility with local taste preferences, positioning it as the preferred plant-based milk choice.

- By Flavor: Flavored leads the market with a share of 60% in 2025. This dominance is driven by consumer preference for enhanced taste experiences, particularly chocolate, vanilla, and regional flavor profiles that mask the inherent taste of plant sources while appealing to diverse demographic groups, including children and first-time consumers.

- By Packaging: Cartons exhibit a clear dominance in the market with 49% share in 2025, reflecting strong consumer preference for convenient, lightweight, and recyclable packaging solutions that ensure extended shelf life. The format supports efficient distribution across modern retail channels while meeting sustainability expectations.

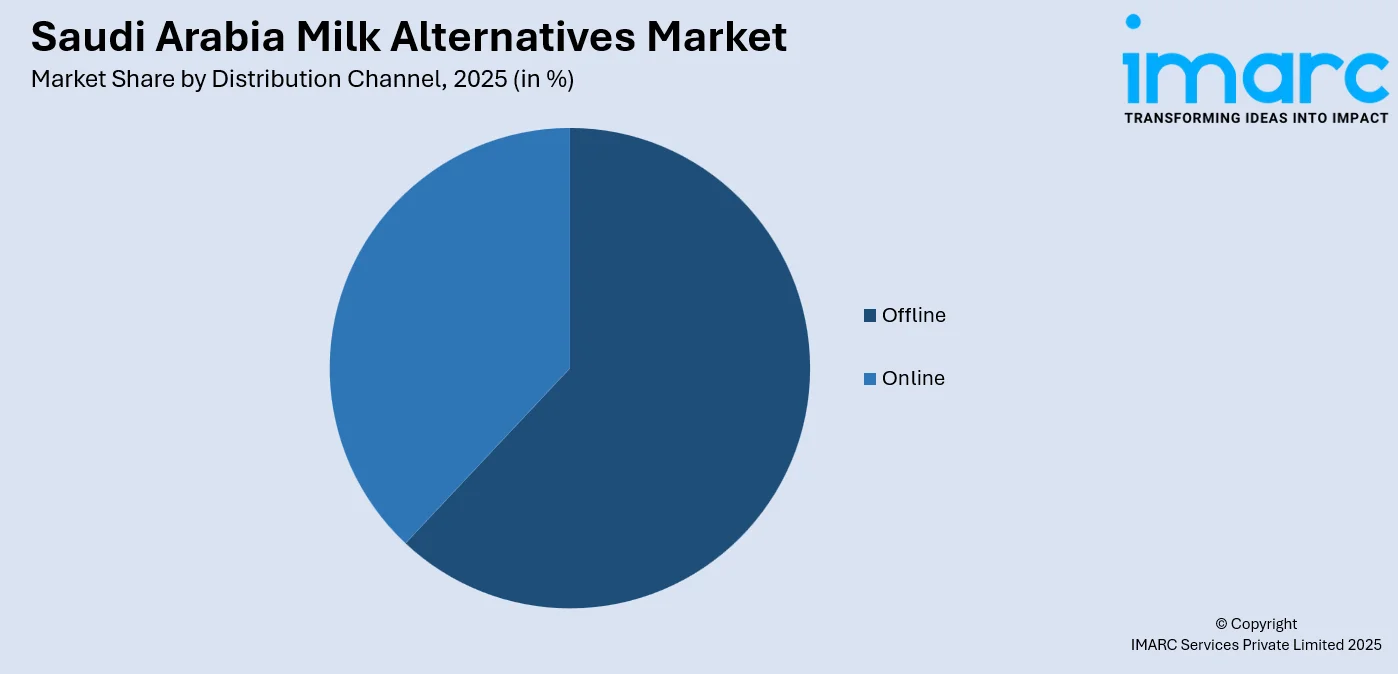

- By Distribution Channel: Offline comprises the leading segment with a 62% share in 2025, driven by the dominance of hypermarkets and supermarkets in Saudi Arabia's retail landscape. Physical stores enable product discovery, promotional sampling, and immediate purchase convenience that continues to attract mainstream consumers.

- By Region: Northern and Central Region represents the largest region with 35% share in 2025, fueled by the concentration of Saudi Arabia's population in Riyadh metropolitan area, higher urbanization rates, greater health awareness among consumers, and superior retail infrastructure supporting diverse product availability.

- Key Players: Key players drive the Saudi Arabia milk alternatives market by expanding product portfolios, introducing locally adapted formulations, and strengthening distribution networks. Their investments in marketing campaigns, premium positioning, and partnerships with specialty coffee chains boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments throughout the Kingdom.

To get more information on this market Request Sample

The Saudi Arabia milk alternatives market is propelled by a convergence of health-oriented consumer behavior, cultural compatibility, and retail infrastructure modernization. Growing awareness about diet-related health conditions, including obesity and diabetes, has prompted consumers to actively explore lighter, plant-based dietary options as alternatives to conventional dairy products. A 2024 report from the General Authority for Statistics (GASTAT) indicated that 23.1% of people aged 15 and older were categorized as obese, while 45.1% were deemed overweight. The Kingdom's health-conscious population increasingly seeks products offering lower calorie content, reduced cholesterol, and enhanced nutritional profiles. Religious and ethical considerations further strengthen market appeal, as plant-based milk alternatives inherently align with halal certification requirements and transparent sourcing expectations valued by Saudi consumers. Additionally, the flourishing specialty coffee culture across urban centers has normalized plant-based milk consumption, encouraging consumer trial and driving sustained category growth.

Saudi Arabia Milk Alternatives Market Trends:

Premiumization and Functional Formulations

The Saudi Arabia milk alternatives market is witnessing a pronounced shift towards premium and functionally enhanced product offerings. Consumers increasingly seek plant-based beverages fortified with essential vitamins, minerals, and additional nutrients that support specific health objectives. This premiumization trend reflects evolving expectations for products delivering tangible wellness benefits beyond basic dairy replacement. Manufacturers are responding by developing specialized formulations targeting digestive health, bone strength, and cardiovascular wellness, positioning milk alternatives as purposeful nutritional choices rather than mere substitutes.

Expansion of Specialty Coffee Channel Integration

The rapidly expanding specialty coffee culture across Saudi Arabia is significantly influencing milk alternatives consumption patterns. Boutique cafes and international coffee chains routinely offer oat, almond, and soy milk as standard menu options, normalizing plant-based choices among mainstream consumers. This foodservice channel integration drives consumer familiarity and encourages household purchasing. As per IMARC Group, the Saudi Arabia foodservice market size was valued at USD 28,669 Million in 2024. The barista-quality segment has gained particular prominence, with formulations specifically designed for optimal foaming and texture performance in espresso-based beverages becoming increasingly sought after.

Local Production and Regional Flavor Adaptation

A growing emphasis on local manufacturing and culturally adapted product development characterizes the evolving Saudi Arabia milk alternatives landscape. Domestic producers are establishing production capabilities to reduce import dependence while developing formulations, incorporating regionally favored ingredients, such as dates and local nuts. This localization approach addresses consumer preferences for familiar flavor profiles while supporting national food security objectives. The strategy enables competitive pricing advantages and ensures freshness standards that resonate with quality-conscious consumers.

How Vision 2030 is Transforming the Saudi Arabia Milk Alternatives Market:

Vision 2030 is transforming the Saudi Arabia milk alternatives market by reshaping consumer lifestyles, health awareness, and domestic food production priorities. The program’s emphasis on preventive healthcare and wellness is encouraging consumers to reduce dairy intake and explore plant-based options, such as almond, oat, and soy milk. Urbanization and changing dietary habits, particularly among younger and expatriate populations, are accelerating adoption of functional and lactose-free beverages. Vision 2030 also supports local food manufacturing and agricultural innovation, enabling domestic production of milk alternatives and reducing reliance on imports. Expansion of modern retail and e-commerce platforms is improving product availability and consumer education. Additionally, sustainability goals under Vision 2030 are aligning with plant-based consumption trends, as milk alternatives appeal to environmentally conscious consumers seeking ethical and resource-efficient food choices.

Market Outlook 2026-2034:

The Saudi Arabia milk alternatives market outlook remains strongly positive, as consumer adoption accelerates across demographic segments and distribution channels continue to expand. Sustained investment in product innovations, including enhanced nutritional profiles and diverse flavor portfolios, positions manufacturers to capture evolving preferences. The market generated a revenue of USD 337.5 Million in 2025 and is projected to reach a revenue of USD 907.3 Million by 2034, growing at a compound annual growth rate of 11.62% from 2026-2034. Government-supported health initiatives promoting balanced nutrition, combined with retail sector modernization under Vision 2030, create favorable conditions for sustained expansion. The integration of plant-based options into mainstream foodservice establishments further normalizes consumption patterns while digital retail channels offer expanded accessibility for health-conscious consumers.

Saudi Arabia Milk Alternatives Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Soy |

38% |

|

Flavor |

Flavored |

60% |

|

Packaging |

Cartons |

49% |

|

Distribution Channel |

Offline |

62% |

|

Region |

Northern and Central Region |

35% |

Source Insights:

- Soy

- Almond

- Coconut

- Oats

- Rice

- Others

Soy dominates with a market share of 38% of the total Saudi Arabia milk alternatives market in 2025.

Soy maintains market leadership owing to its established nutritional credentials and widespread consumer recognition. The segment benefits from soy's reputation as a complete protein source containing essential amino acids, making it particularly attractive for health-conscious consumers seeking nutritional parity with conventional dairy. Saudi consumers demonstrate strong familiarity with soy products, supported by decades of market presence and consistent quality standards. Additionally, ongoing consumer education campaigns highlighting soy’s health benefits, including heart health and cholesterol management, reinforce its trusted status and sustain long-term market leadership.

The soy segment's dominance reflects effective distribution across both traditional retail channels and modern hypermarket formats, ensuring accessibility for diverse consumer segments. Product versatility enables soy milk incorporation across multiple consumption occasions, including breakfast beverages, cooking applications, and coffee accompaniment. Continuous formulation improvements addressing taste preferences, including flavored variants and fortified options, sustain consumer interest. The segment's cost-effectiveness relative to premium alternatives such as almond and oat milk further strengthens its position among price-sensitive consumers while maintaining quality expectations.

Flavor Insights:

- Flavored

- Unflavored

Flavored leads with a share of 60% of the total Saudi Arabia milk alternatives market in 2025.

Flavored commands significant market share by effectively addressing consumer taste expectations and overcoming adoption barriers associated with unfamiliar plant-based profiles. Enhanced flavors, including chocolate, vanilla, and strawberry variants, appeal particularly to younger consumers and families introducing children to dairy alternatives. These formulations mask inherent plant source tastes while delivering enjoyable drinking experiences that encourage repeat purchase behavior. The Saudi Arabia instant coffee market, projected to reach USD 199.6 Million by 2033, has further boosted flavored options designed for specialty beverage applications.

The flavored segment's success reflects strategic manufacturer investment in taste optimization and sensory research targeting regional preferences. Product development increasingly incorporates regionally relevant flavor profiles appealing to Saudi consumers while maintaining international quality standards. Flavored varieties facilitate consumer transition from conventional dairy by delivering familiar sweetness and taste satisfaction. The segment benefits from prominent shelf positioning in retail environments and active marketing campaigns emphasizing taste enjoyment alongside health benefits, creating compelling value propositions for mainstream adoption.

Packaging Insights:

- Cartons

- Glass Bottles

- Others

Cartons exhibit a clear dominance with a 49% share of the total Saudi Arabia milk alternatives market in 2025.

Cartons maintain market leadership through their practical advantages, addressing consumer convenience and product preservation requirements. The format provides excellent barrier protection extending shelf life without refrigeration until opening, making it ideal for Saudi Arabia's warm climate conditions. Lightweight construction facilitates easy handling and storage while reducing transportation costs throughout the supply chain. Aseptic carton technology ensures product safety and quality maintenance, building consumer confidence. Major carton packaging developments continue to advance, with leading suppliers investing in production modernization across the region.

Sustainability considerations increasingly influence carton packaging preference among environmentally conscious consumers. The recyclable nature of carton materials aligns with growing awareness about packaging waste reduction and circular economy principles. Cartons offer efficient space utilization in retail displays and household storage compared to alternative formats. Single-serve and multi-pack carton options provide consumption flexibility addressing diverse usage occasions from individual portions to family sizes. The format's compatibility with both ambient and chilled distribution channels further supports its widespread retail presence across hypermarkets, supermarkets, and convenience outlets.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline comprises the leading segment with a 62% share of the total Saudi Arabia milk alternatives market in 2025.

Offline leads the market in Saudi Arabia, owing to the extensive presence of hypermarkets and supermarkets across Saudi Arabia's urban landscape. Physical stores enable consumers to examine products, compare options, and benefit from promotional activities, including in-store sampling that drives trial and adoption. Major retail chains provide comprehensive product assortments featuring both international and local milk alternative brands. These outlets also ensure reliable cold-chain storage and inventory availability, reinforcing consumer trust in product freshness and quality at the point of purchase.

The offline segment benefits from established consumer shopping habits and the immediate gratification of in-store purchases. Hypermarkets and supermarkets offer competitive pricing, frequent promotional discounts, and loyalty programs encouraging repeat purchases. Strategic shelf positioning within health food and dairy alternative sections improves product visibility and consumer discovery. Staff recommendations and point-of-sale (POS) materials support consumer education regarding product benefits and usage applications. The physical retail experience remains particularly important for first-time purchasers exploring milk alternatives, enabling confident purchase decisions through direct product assessment.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the largest region with a 35% share of the total Saudi Arabia milk alternatives market in 2025.

Northern and Central Region leads the Saudi Arabia milk alternatives market, driven by population concentration in Riyadh, the Kingdom's capital and largest metropolitan area. The population of the Riyadh metro area in 2025 was 7,953,000, reflecting a 1.69% rise from 2024. This region demonstrates heightened health consciousness among its urbanized population, with consumers actively seeking nutritious alternatives to conventional dairy products. Superior retail infrastructure, featuring major hypermarket chains, specialty health stores, and premium supermarkets, ensures comprehensive product availability across diverse price points. The region's economic significance and higher average disposable incomes support premium product consumption and willingness to experiment with innovative health-oriented offerings.

The flourishing specialty coffee culture in Riyadh significantly influences milk alternatives adoption, with numerous cafes routinely offering plant-based options. Café licensing activity has accelerated substantially across the Kingdom's major cities, creating additional consumer touchpoints for milk alternatives exposure. The region's expatriate population, familiar with international plant-based consumption trends, further supports market growth. Educational institutions and corporate workplaces increasingly incorporate health-focused beverage options, normalizing milk alternatives consumption among working professionals.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Milk Alternatives Market Growing?

Rising Health Consciousness and Lifestyle Disease Awareness

The Saudi Arabia milk alternatives market is experiencing substantial growth, driven by heightened awareness about health and wellness among consumers nationwide. As per IMARC Group, the Saudi Arabia health and wellness market size reached USD 38,747.7 Million in 2025. Increasing prevalence of lifestyle-related conditions, including obesity, diabetes, and cardiovascular diseases, has prompted individuals to actively reconsider dietary choices and seek healthier alternatives to conventional food products. Plant-based milk alternatives are perceived as beneficial dietary substitutes offering lower calorie content, reduced saturated fat, and absence of cholesterol compared to traditional dairy. Government-initiated health campaigns emphasizing balanced nutrition and calorie awareness have reinforced consumer motivation to explore plant-based options. The younger generation demonstrates particular receptiveness to health messaging, actively researching nutritional information and prioritizing products aligned with wellness objectives. Fitness culture expansion across Saudi Arabia's urban centers further amplifies demand for plant-based beverages perceived as supporting active lifestyle maintenance. This fundamental shift in consumer health orientation creates sustained growth momentum for milk alternatives, positioning them as purposeful nutritional choices.

Lactose Intolerance Prevalence and Digestive Health Concerns

Widespread lactose intolerance among the Saudi Arabian population represents a significant driver for milk alternatives market expansion. A considerable proportion of adults experience discomfort following dairy consumption, including symptoms such as bloating, digestive distress, and gastrointestinal complications. Growing awareness about lactose intolerance as a diagnosable condition has encouraged affected individuals to actively seek comfortable dietary alternatives. Plant-based milk products offer naturally lactose-free compositions providing digestive comfort without sacrificing beverage enjoyment. Healthcare professional recommendations increasingly suggest plant-based alternatives for patients managing lactose-related digestive issues, further validating product adoption. Consumer education regarding lactose intolerance symptoms and management options has improved significantly, enabling informed purchasing decisions. The availability of diverse plant-based sources, including soy, almond, oat, and coconut, provides options addressing individual tolerance levels and taste preferences. This health-driven necessity creates a reliable consumer base seeking permanent dietary substitutions rather than occasional alternatives.

Retail Modernization and Enhanced Product Accessibility

The rapid modernization of Saudi Arabia's retail sector under Vision initiative frameworks has substantially improved milk alternatives market accessibility and consumer reach. Expansion of hypermarket and supermarket networks across urban and suburban areas ensures diverse product availability, reaching broader consumer demographics. International retail partnerships have introduced global plant-based brands previously unavailable in the Saudi market, expanding consumer choice and category awareness. Dedicated health food sections within major retail outlets provide focused product visibility, encouraging discovery and trial. E-commerce platform growth offers additional purchasing convenience, enabling consumers to access specialized products regardless of geographic location. As per CEIC, e-commerce and shopping data was noted at 91.356 USD on 03 Dec 2025. Retail promotional activities, including sampling programs, discount campaigns, and loyalty rewards, stimulate consumer trial and repeat purchasing. Cold chain infrastructure improvements ensure product quality maintenance throughout distribution networks, building consumer confidence. The proliferation of specialty coffee chains routinely offering plant-based milk options has normalized these products as mainstream beverage choices rather than niche alternatives.

Market Restraints:

What Challenges is the Saudi Arabia Milk Alternatives Market Facing?

Premium Pricing Compared to Conventional Dairy Products

The Saudi Arabia milk alternatives market faces challenges related to premium pricing positioning that limits accessibility for price-sensitive consumer segments. Plant-based milk products typically command higher retail prices compared to conventional dairy options, creating adoption barriers among budget-conscious households. Import dependence for many specialty ingredients, including almonds and oats, contributes to elevated production costs reflected in consumer pricing. This price differential restricts market penetration beyond health-focused and affluent consumer segments willing to pay premiums for perceived benefits.

Strong Cultural Preference for Traditional Dairy Consumption

Deep-rooted cultural traditions favoring conventional dairy consumption present persistent challenges for milk alternatives market expansion in Saudi Arabia. Dairy products hold established positions within traditional cuisine and daily dietary habits, creating psychological resistance to substitution. Generational preferences and family consumption patterns reinforce conventional dairy usage across cooking applications and beverage occasions. Consumer perception challenges regarding plant-based product taste profiles and nutritional equivalency require ongoing education and marketing investment to overcome.

Limited Consumer Awareness in Non-Urban Markets

Geographic disparities in consumer awareness and product availability create market development challenges beyond major metropolitan centers. Rural and semi-urban areas demonstrate lower familiarity with milk alternatives benefits and usage applications compared to urban populations. Retail infrastructure limitations in smaller towns restrict product accessibility and consumer exposure opportunities. Marketing and promotional activities concentrate predominantly in major cities, leaving significant population segments underserved regarding product education and availability.

Competitive Landscape:

The Saudi Arabia milk alternatives market exhibits a competitive structure, comprising established international corporations and emerging regional producers. Global dairy conglomerates leverage extensive research capabilities, established brand recognition, and diversified product portfolios to maintain market leadership positions. Regional manufacturers capitalize on localized production advantages, market understanding, and distribution network familiarity to compete effectively. The competitive landscape demonstrates moderate consolidation with leading players commanding significant market share while accommodating specialized manufacturers targeting specific consumer segments. Strategic partnerships between international brands and local distributors facilitate market entry and ensure product accessibility across retail channels. Innovation focus emphasizes product development, addressing taste optimization, nutritional enhancement, and packaging sustainability.

Saudi Arabia Milk Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Soy, Almond, Coconut, Oats, Rice, Others |

| Flavors Covered | Flavored, Unflavored |

| Packagings Covered | Cartons, Glass bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia milk alternatives market size was valued at USD 337.5 Million in 2025.

The Saudi Arabia milk alternatives market is expected to grow at a compound annual growth rate of 11.62% from 2026-2034 to reach USD 907.3 Million by 2034.

Soy dominated the market with a share of 38%, owing to its established nutritional profile, widespread availability, and strong consumer familiarity with soy-based beverages. Soy’s versatility across everyday consumption occasions and consistent taste acceptance further reinforce its leading position among diverse consumer segments.

Key factors driving the Saudi Arabia milk alternatives market include rising health and wellness consciousness among consumers, increasing lactose intolerance prevalence, retail modernization, and specialty coffee culture expansion.

Major challenges include premium pricing compared to conventional dairy, strong cultural preference for traditional dairy consumption, limited awareness in non-urban markets across the country, and import dependence for specialty ingredients.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)