Saudi Arabia Minimally Invasive Surgery Market Size, Share, Trends and Forecast by Product Type, Application, End-User, and Region, 2026-2034

Saudi Arabia Minimally Invasive Surgery Market Overview:

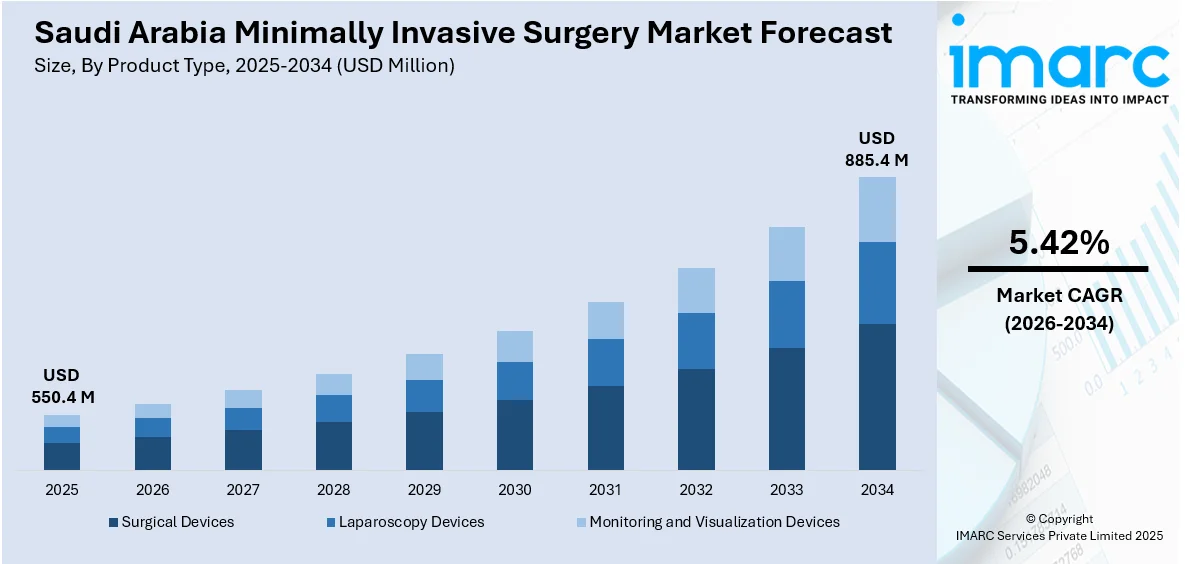

The Saudi Arabia minimally invasive surgery market size reached USD 550.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 885.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.42% during 2026-2034. Increasing chronic disease cases, rising patient preference for faster recovery, technological innovation, burgeoning aging population, robotic surgery adoption, government healthcare investment, medical tourism growth, enhanced hospital infrastructure, development of surgeon training programs, escalating demand for cosmetic procedures, and improved surgical precision through advanced imaging are factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 550.4 Million |

| Market Forecast in 2034 | USD 885.4 Million |

| Market Growth Rate 2026-2034 | 5.42% |

Saudi Arabia Minimally Invasive Surgery Market Trends:

Technological Advancements in Surgical Instruments and Imaging

The continuous improvements in surgical tools and visualization technologies are among the key factors boosting the Saudi Arabia minimally invasive surgery market share. The introduction of high-definition endoscopes, advanced laparoscopic instruments, and real-time imaging systems has enhanced the accuracy and safety of these procedures. Innovations such as three-dimensional (3D) visualization, fluorescence-guided surgery, and integrated surgical platforms now enable surgeons to operate with greater precision and control, reducing the likelihood of complications. Moreover, the growing availability of these technologies across leading hospitals in Riyadh, Jeddah, and Dammam indicates a shift toward more technologically enabled operating rooms, which is propelling the market growth. Furthermore, Saudi Arabia's strategic focus on digital transformation in healthcare, backed by Vision 2030, is fostering the adoption of cutting-edge surgical systems.

To get more information on this market Request Sample

Shifting Preference for Less Invasive Treatments

The rising inclination of the patients towards minimally invasive (MI) procedure is contributing to the expansion of Saudi Arabia minimally invasive surgery market growth. This change in demand is driven by the increasing awareness regarding the advantages of MIS, such as less pain, smaller scars, lower chances of infection, and shorter recovery time. These advantages are especially attractive to working professionals and younger demographic groups, who want to get back to normal activities, faster. The availability of online health information and social media discussions around modern surgical options has empowered patients to actively seek out less invasive alternatives. In line with this, hospitals and clinics are laying out exclusive MIS services to their patients that focus on patient-centric results, which is driving the market growth. Additionally, the aesthetic connotation associated with MIS, as well as cultural factors in the Kingdom, including stigma against visible scars and prolonged hospitalization, is favoring the market growth.

Aging Population and Rising Surgical Demand

As per the Saudi Arabia minimally invasive surgery market forecast, the country is experiencing a demographic shift marked by a steadily increasing proportion of elderly citizens. In 2025, a study of 5,874 individuals aged 65 and older found that 58.1% had hypertension, 48.6% had diabetes, and 27.5% had cardiac diseases in the country. This demographic trend is directly influencing the demand for surgical procedures, particularly those targeting chronic and degenerative conditions such as hernias, gallbladder disorders, joint diseases, and cardiovascular issues. Minimally invasive surgery (MIS) presents a safer and more efficient alternative for this demographic, who are often at greater risk from traditional open surgeries due to comorbidities. MIS reduces physical trauma and recovery time, which is essential for elderly patients who may face complications during prolonged hospitalization. In line with this, the government’s expansion of geriatric care services and specialty hospitals under the Health Sector Transformation Program has created infrastructure to support age-specific surgical care, which is creating a positive Saudi Arabia minimally invasive surgery market outlook. Additionally, training initiatives for surgeons in MIS techniques related to geriatrics is another factor contributing to the market growth.

Saudi Arabia Minimally Invasive Surgery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, application, and end-user.

Product Type Insights:

- Surgical Devices

- Laparoscopy Devices

- Monitoring and Visualization Devices

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surgical devices, laparoscopy devices, and monitoring and visualization devices.

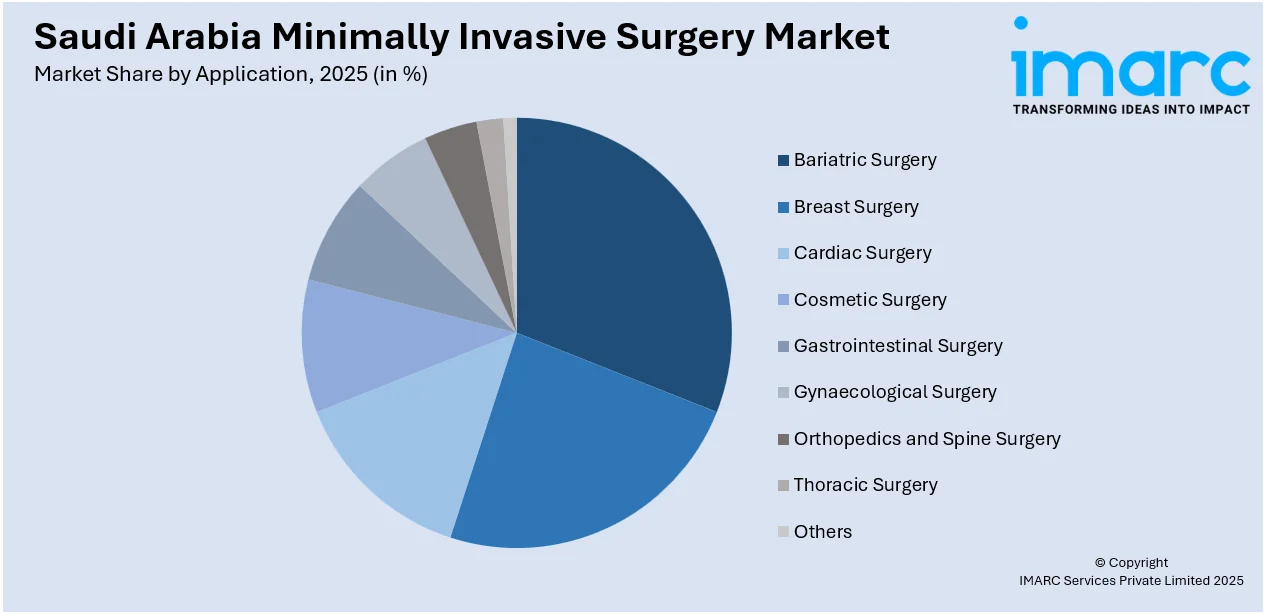

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bariatric Surgery

- Breast Surgery

- Cardiac Surgery

- Cosmetic Surgery

- Gastrointestinal Surgery

- Gynaecological Surgery

- Orthopedics and Spine Surgery

- Thoracic Surgery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bariatric surgery, breast surgery, cardiac surgery, cosmetic surgery, gastrointestinal surgery, gynaecological surgery, orthopedics and spine surgery, thoracic surgery, and others.

End-User Insights:

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, clinics, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Minimally Invasive Surgery Market News:

- In 2025, Johns Hopkins Aramco Healthcare (JHAH) in Dhahran achieved a significant milestone by performing Saudi Arabia’s first robotic-assisted colon cancer surgery. This advanced procedure utilized robotic technology to enhance surgical precision, reduce recovery time, and minimize patient discomfort, marking a pivotal moment in the country's medical advancements.

- In 2024, Saudi Arabia performed the world’s first fully robotic heart transplant at King Faisal Specialist Hospital and Research Center. This groundbreaking procedure utilized advanced robotic technology to ensure greater precision, reduced recovery time, and minimized surgical risks, marking a major milestone in Saudi Arabia's healthcare innovation.

Saudi Arabia Minimally Invasive Surgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surgical Devices, Laparoscopy Devices, Monitoring and Visualization Devices |

| Applications Covered | Bariatric Surgery, Breast Surgery, Cardiac Surgery, Cosmetic Surgery, Gastrointestinal Surgery, Gynaecological Surgery, Orthopedics and Spine Surgery, Thoracic Surgery, Others |

| End-Users Covered | Hospitals, Clinics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia minimally invasive surgery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia minimally invasive surgery market on the basis of product type?

- What is the breakup of the Saudi Arabia minimally invasive surgery market on the basis of application?

- What is the breakup of the Saudi Arabia minimally invasive surgery market on the basis of end-user?

- What is the breakup of the Saudi Arabia minimally invasive surgery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia minimally invasive surgery market?

- What are the key driving factors and challenges in the Saudi Arabia minimally invasive surgery market?

- What is the structure of the Saudi Arabia minimally invasive surgery market and who are the key players?

- What is the degree of competition in the Saudi Arabia minimally invasive surgery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia minimally invasive surgery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia minimally invasive surgery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia minimally invasive surgery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)