Saudi Arabia Mining Truck Market Size, Share, Trends and Forecast by Type, Payload Capacity, Application, Drive, and Region, 2026-2034

Saudi Arabia Mining Truck Market Overview:

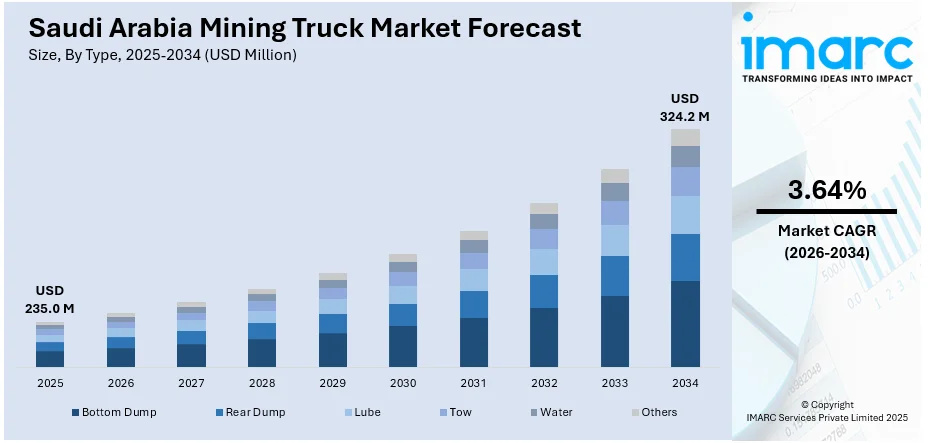

The Saudi Arabia mining truck market size reached USD 235.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 324.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.64% during 2026-2034. The Saudi Arabia mining truck market is driven by expanding mining operations under Vision 2030, technological advancements in automation and fuel efficiency, escalating demand for robust trucks capable of operating in harsh desert environments, and the elevating number of infrastructure projects, such as railways and industrial cities, that support mining activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 235.0 Million |

| Market Forecast in 2034 | USD 324.2 Million |

| Market Growth Rate 2026-2034 | 3.64% |

Saudi Arabia Mining Truck Market Trends:

Expansion of Mining Activities Under Vision 2030

One of the key drivers of the Saudi Arabian mining truck market is the country’s aim to diversify the economy away from oil under Vision 2030, which has placed mining at the forefront of national economic policy. The government wants to make the mining industry the third pillar of the national industry, after oil and petrochemicals. In order to achieve this objective, massive exploration and extraction initiatives have been initiated throughout the nation, opening up resources like phosphates, bauxite, gold, copper, and rare earth elements. The establishment of major mining areas such as the Wa'ad Al Shamal Industrial City and the development of Ma'aden (Saudi Arabian Mining Company) operations require heavy-duty mining trucks for hauling ore and overburden over expansive, in many cases remote, areas. These trucks have to perform in harsh climatic and terrain environments with high-performance and durability requirements. With the additional mining licenses being offered and foreign investment on the rise because of better regulatory systems, the market demand for technologically capable, efficient, and reliable mining trucks is ever rising.

To get more information on this market Request Sample

Technological Advancements and Automation in Heavy Equipment

Another force behind the Saudi Arabian mining truck market is the adoption of advanced technology and automation in mining operations. With the advent of modern mining techniques, there is a growing demand for trucks fitted with smart features like autonomous drive technology, real-time GPS positioning, fuel-efficient algorithms, and predictive maintenance capabilities. Saudi Arabian mining companies are heavily investing in digital transformation in order to maximize productivity, keep workers safe, and minimize operation costs. The extreme desert climate and distant mining locations render conventional manpower-driven operations unsustainable. To counter this, the industry is embracing intelligent mining trucks with minimal human involvement, which can execute sophisticated operations with greater efficiency. The trucks help ensure better load cycles, optimized routes, and reduced downtime through proactive servicing notifications provided by onboard diagnostics. Furthermore, international mining truck producers like Caterpillar, Komatsu, and Volvo are associating with domestic operators to launch their newest models integrated with telematics and automation technologies. This synergy between technological advancement and domestic industry requirement is driving next-gen mining truck demand.

Saudi Arabia Mining Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, payload capacity, application, and drive.

Type Insights:

- Bottom Dump

- Rear Dump

- Lube

- Tow

- Water

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bottom dump, rear dump, lube, tow, water, and others.

Payload Capacity Insights:

- <90 Metric Tons

- 90≤149 Metric Tons

- 150≤290 Metric Tons

- >290 Metric Tons

A detailed breakup and analysis of the market based on the payload capacity have also been provided in the report. This includes <90 metric tons, 90≤149 metric tons, 150≤290 metric tons, and >290 metric tons.

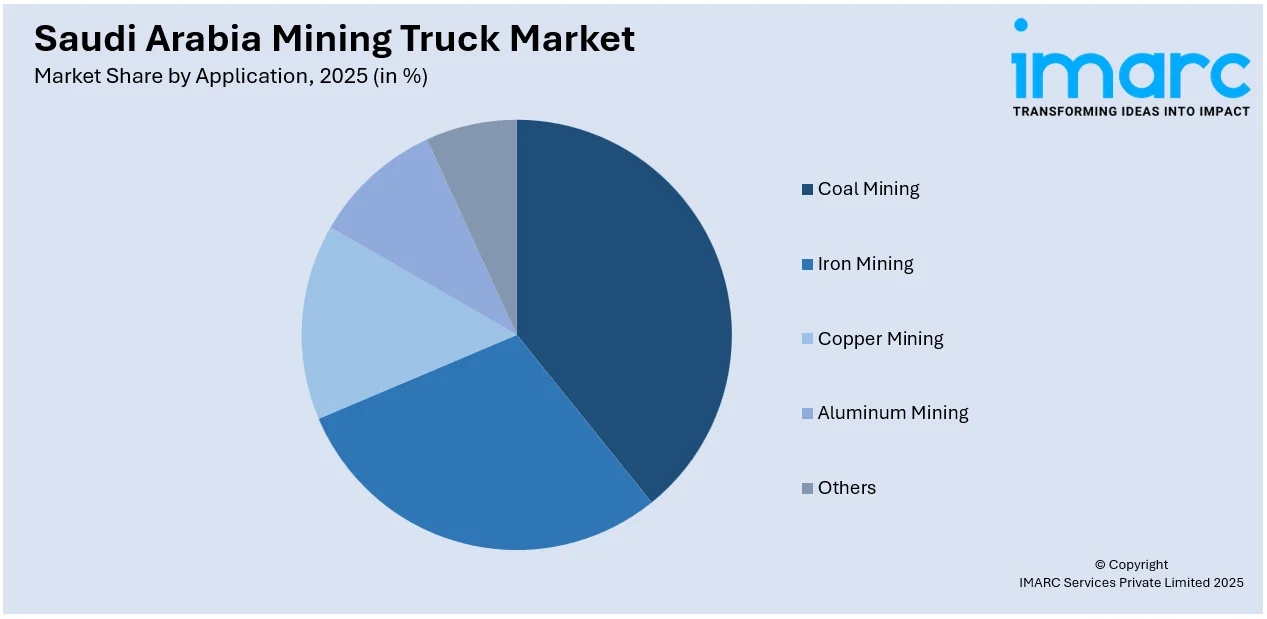

Application Insights:

Access the comprehensive market breakdown Request Sample

- Coal Mining

- Iron Mining

- Copper Mining

- Aluminum Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes coal mining, iron mining, copper mining, aluminum mining, and others.

Drive Insights:

- Mechanical Drive

- Electrical Drive

A detailed breakup and analysis of the market based on the drive have also been provided in the report. This includes mechanical drive and electrical drive.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Mining Truck Market News:

- November 2024: Tata Motors introduced the Prima 4440.S AMT, its first Automated Manual Transmission truck, at the HEAT Show in Dammam, Saudi Arabia. This model featured advanced systems like Load-Based Speed Control and Auto Start-Stop to enhance fuel efficiency. With a 400 hp engine and pneumatic suspension, it was tailored for heavy-duty applications, such as transporting large machinery and containers.

- June 2024: JAC launched its medium and heavy-duty trucks in Dammam, showcasing models for cargo transport, towing, and dump operations. These trucks featured powertrain combinations like Cummins+ZF and Weichai+FAST, catering to diverse industrial needs.

Saudi Arabia Mining Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bottom Dump, Rear Dump, Lube, Tow, Water, Others |

| Payload Capacities Covered | <90 Metric Tons, 90≤149 Metric Tons, 150≤290 Metric Tons, >290 Metric Tons |

| Applications Covered | Coal Mining, Iron Mining, Copper Mining, Aluminum Mining, Others |

| Drives Covered | Mechanical Drive, Electrical Drive |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia mining truck market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia mining truck market on the basis of type?

- What is the breakup of the Saudi Arabia mining truck market on the basis of payload capacity?

- What is the breakup of the Saudi Arabia mining truck market on the basis of application?

- What is the breakup of the Saudi Arabia mining truck market on the basis of drive?

- What are the various stages in the value chain of the Saudi Arabia mining truck market?

- What are the key driving factors and challenges in the Saudi Arabia mining truck market?

- What is the structure of the Saudi Arabia mining truck market and who are the key players?

- What is the degree of competition in the Saudi Arabia mining truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia mining truck market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia mining truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia mining truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)