Saudi Arabia Mobile Device Management (MDM) Market Size, Share, Trends and Forecast by Type, Deployment Type, Organization Size, Vertical, and Region, 2026-2034

Saudi Arabia Mobile Device Management (MDM) Market Overview:

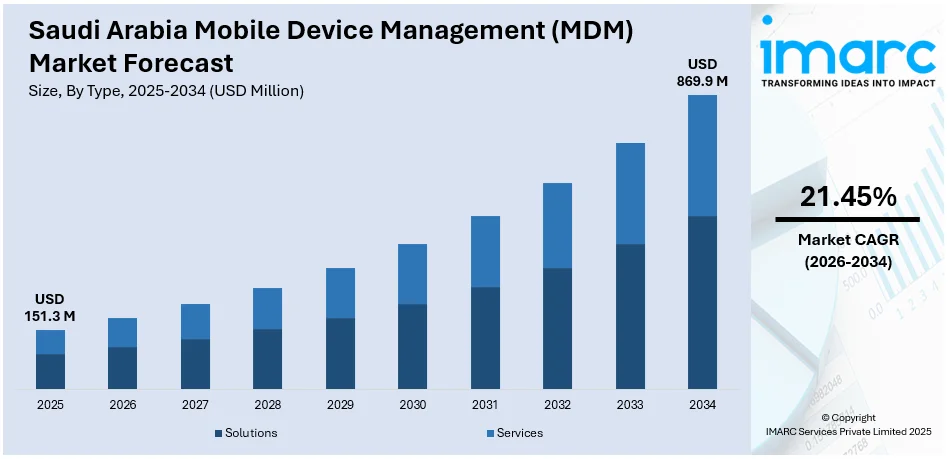

The Saudi Arabia mobile device management (MDM) market size reached USD 151.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 869.9 Million by 2034, exhibiting a growth rate (CAGR) of 21.45% during 2026-2034. The rapid growth of digital payments, e-commerce, and 5G infrastructure in Saudi Arabia is significantly catalyzing the demand for mobile device management (MDM) solutions, as businesses seek to secure mobile operations, ensure regulatory compliance, and protect sensitive data in an increasingly connected, digital-first economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 151.3 Million |

| Market Forecast in 2034 | USD 869.9 Million |

| Market Growth Rate 2026-2034 | 21.45% |

Saudi Arabia Mobile Device Management (MDM) Market Trends:

Expanding Telecom Infrastructure and 5G Deployment

The rapid growth of telecom infrastructure and the continued rollout of 5G networks is a crucial factor impelling the market growth. With the introduction of 5G, companies are obtaining quicker, more dependable, and greater-capacity mobile connectivity, facilitating enhanced mobile operations and effortless real-time collaboration. As businesses progressively rely on mobile devices for data transmission, cloud access, and communication, the demand for secure and centralized management of these devices intensifies. MDM solutions equip organizations with the resources to oversee device health, implement security measures, and guarantee that only compliant devices can access critical networks and assets. The capability to support bandwidth-intensive applications and connect numerous devices at once positions 5G as a catalyst for mobile growth, but it also increases concerns regarding security and control. In 2025, Saudi Telecom Company (STC) signed a $9 billion deal with a government entity to build and operate telecom infrastructure over an 18-month setup and 15-year operational period. The project supports Saudi Arabia’s Vision 2030 digital transformation goals. STC expects a positive financial impact starting Q4 2025. With the implementation of large-scale infrastructure projects, the adoption of MDM solutions will speed up safeguarding and overseeing the increase of connected devices in both public and private sectors. In this advanced telecom landscape, MDM is essential for preserving operational integrity and protecting digital assets.

To get more information on this market Request Sample

Adoption of Digital Payment Systems and E-Commerce Growth

The increase in digital payment platforms and swift expansion of e-commerce in Saudi Arabia is catalyzing the demand for MDM services. As Saudi Arabia experiences extensive digital transformation, mobile devices are becoming pivotal in how individuals perform financial transactions, shop online, and interact with digital banking services. The rise in mobile commerce is driving the need for secure device management solutions to safeguard sensitive information. MDM tools are becoming crucial for companies to guarantee that devices used by employees and customers in digital transactions are protected from fraud, data breaches, and cyber risks. These solutions also assist organizations in adhering to local and industry-specific regulations related to data protection and payment processing. A significant case is Mastercard’s introduction of a localized e-commerce payment processing framework in Saudi Arabia for 2024, backed by the Saudi Central Bank (SAMA). This project launched the Mastercard Gateway, which enabled more than 30 payment options and featured enhanced fraud prevention functionalities, emphasizing the importance of strong mobile security. The platform's alignment with Saudi Vision 2030 highlights the Kingdom's dedication to a safe digital economy. With initiatives like this ongoing, the need for MDM solutions that can protect mobile endpoints engaged in digital payments is increasing. MDM is not just a technological upgrade but a strategic necessity for businesses operating in an increasingly digital, mobile-first economy.

Saudi Arabia Mobile Device Management (MDM) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, deployment type, organization size, and vertical.

Type Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solutions and services.

Deployment Type Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

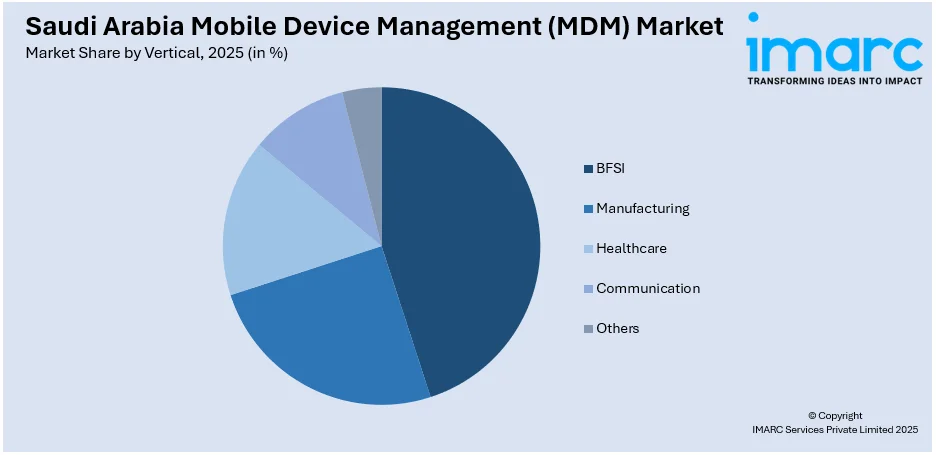

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- Healthcare

- Communication

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, manufacturing, healthcare, communication, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Mobile Device Management (MDM) Market News:

- In March 2025, MECS, a top cybersecurity firm in Saudi Arabia, offers advanced Mobile Device Management (MDM) services to secure mobile devices and ensure regulatory compliance. With features like encryption, remote wiping, and 24/7 monitoring, MECS helps businesses protect sensitive data. Their tailored solutions support Saudi Arabia’s Vision 2030 digital transformation goals.

Saudi Arabia Mobile Device Management (MDM) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Types Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Verticals Covered | BFSI, Manufacturing, Healthcare, Communication, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia mobile device management (MDM) market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia mobile device management (MDM) market on the basis of type?

- What is the breakup of the Saudi Arabia mobile device management (MDM) market on the basis of deployment type?

- What is the breakup of the Saudi Arabia mobile device management (MDM) market on the basis of organization size?

- What is the breakup of the Saudi Arabia mobile device management (MDM) market on the basis of vertical?

- What is the breakup of the Saudi Arabia mobile device management (MDM) market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia mobile device management (MDM) market?

- What are the key driving factors and challenges in the Saudi Arabia mobile device management (MDM) market?

- What is the structure of the Saudi Arabia mobile device management (MDM) market and who are the key players?

- What is the degree of competition in the Saudi Arabia mobile device management (MDM) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia mobile device management (MDM) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia mobile device management (MDM) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia mobile device management (MDM) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)