Saudi Arabia Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Mobile Phone Insurance Market Overview:

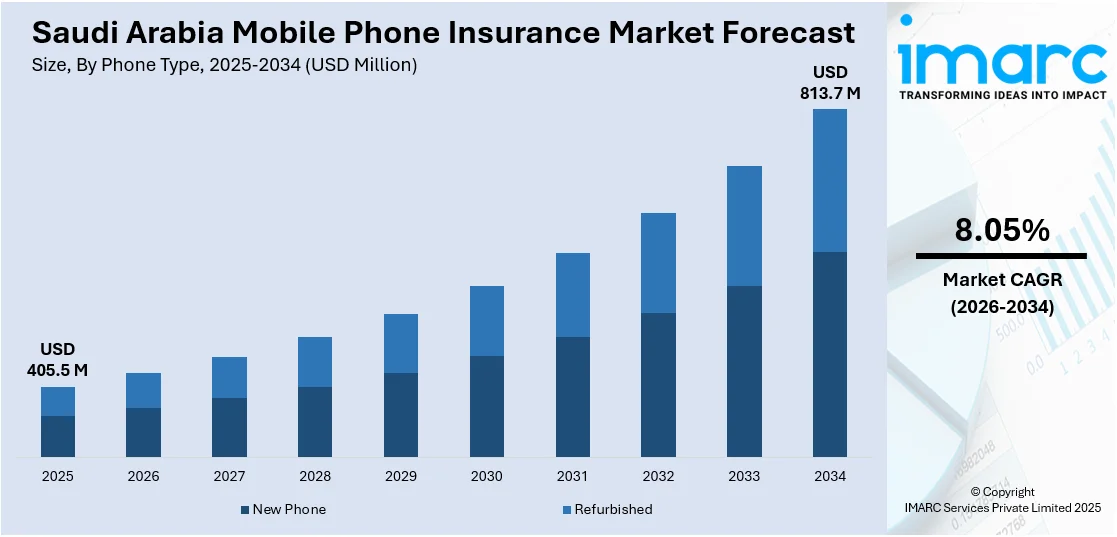

The Saudi Arabia mobile phone insurance market size reached USD 405.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 813.7 Million by 2034, exhibiting a growth rate (CAGR) of 8.05% during 2026-2034. Rising smartphone penetration, higher repair costs, expanding digital financial services, and partnerships between telecom operators and insurtech firms are collectively driving the Saudi Arabia mobile phone insurance market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 405.5 Million |

| Market Forecast in 2034 | USD 813.7 Million |

| Market Growth Rate 2026-2034 | 8.05% |

Saudi Arabia Mobile Phone Insurance Market Trends:

Surge in High-Value Smartphone Penetration

One of the key driving forces behind the expansion of Saudi Arabia's mobile phone insurance market is the rising penetration of high-end smartphones. Due to the elevating demand among consumers for sophisticated technology, top models from premium brands such as Apple, Samsung, and Huawei are increasingly sought after. These high-end phones have exorbitant prices, usually above SAR 4,000, which makes their insurance a cost imperative rather than a choice. This is particularly notable in cities like Riyadh, Jeddah, and Dammam, where consumers frequently request the latest models packed with high-end features like AI-powered cameras, biometric security systems, and super-fast processors. With the price of smartphones increasing over time, that of repair and replacement keeps climbing too. Cracked screens, water damage, and hardware failure lead to costs that almost equal that of mid-range phones. Consequently, consumers of mobile phones are widely turning to insurance plans for accidental damage, theft, and even software failure. Insurers and carriers are taking advantage of this situation by selling bundled insurance offers at the point of purchase or as post-purchase services.

To get more information on this market Request Sample

Growing Awareness and Digital Financial Inclusion

Another driver of Saudi Arabian mobile phone insurance expansion is the higher rate of consumer consciousness and overall agenda of digital financial inclusion fostered by the government. Through Saudi Vision 2030, the Kingdom is driving toward a digitally empowered economy with increased consumer access to financial services and products, such as insurance. This initiative is hugely broadening awareness and adoption of mobile insurance within a previously uninformed or dubious demographic about such services. Government-backed schemes and financial awareness initiatives have also helped to influence consumers' thinking, especially that of the more technologically attuned and young segment. The youth are also more inclined towards seeking out mobile apps and digital channels providing bespoke insurance products with intuitive interfaces and prompt claim processing. Moreover, the progress of fintech products has made it possible for insurers to offer micro-insurance and usage-based policies. These adaptable products enable consumers to manage coverage according to phone use patterns or usage duration, making insurance more accessible and attractive to a larger segment, including low-income or otherwise underpenetrated segments.

Saudi Arabia Mobile Phone Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on phone type, coverage, distribution channel, and end user.

Phone Type Insights:

- New Phone

- Refurbished

The report has provided a detailed breakup and analysis of the market based on the phone type. This includes new phone and refurbished.

Coverage Insights:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes physical damage, electronic damage, virus protection, data protection, and theft protection.

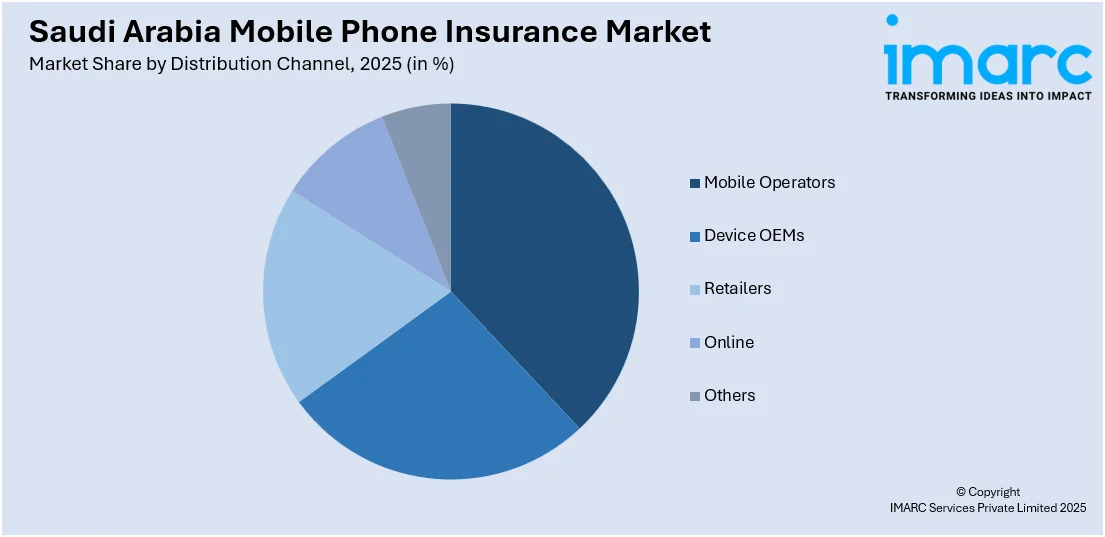

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mobile operators, device OEMs, retailers, online, and others.

End User Insights:

- Corporate

- Personal

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate and personal.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Mobile Phone Insurance Market News:

- January 2025: Nokia and Zain KSA launched a 4G/5G femtocell solution to enhance indoor connectivity for Saudi enterprises. This deployment includes Nokia’s smart nodes and services like IP Security Gateway and Femto Manager, ensuring secure, reliable network access across business locations. Improved coverage supports advanced digital services, indirectly encouraging the adoption of mobile phone insurance by enabling seamless connectivity for mobile devices.

- March 2024: Singapore-based insurtech company bolttech expanded into the Middle East by partnering with Saudi Telecom Company (stc). This collaboration aims to provide stc's customers with embedded device protection offerings through a technology-enabled experience. The partnership also explores expanding protection services beyond mobile devices to include home appliances, health electronics, and cyber assets, aligning with the digital lifestyle of consumers in Saudi Arabia.

Saudi Arabia Mobile Phone Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia mobile phone insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia mobile phone insurance market on the basis of phone type?

- What is the breakup of the Saudi Arabia mobile phone insurance market on the basis of coverage?

- What is the breakup of the Saudi Arabia mobile phone insurance market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia mobile phone insurance market on the basis of end user?

- What is the breakup of the Saudi Arabia mobile phone insurance market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia mobile phone insurance market?

- What are the key driving factors and challenges in the Saudi Arabia mobile phone insurance?

- What is the structure of the Saudi Arabia mobile phone insurance market and who are the key players?

- What is the degree of competition in the Saudi Arabia mobile phone insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia mobile phone insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia mobile phone insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)