Saudi Arabia Motor Insurance Market Expected to Reach USD 9,280.3 Million by 2033 - IMARC Group

Saudi Arabia Motor Insurance Market Statistics, Outlook and Regional Analysis 2025-2033

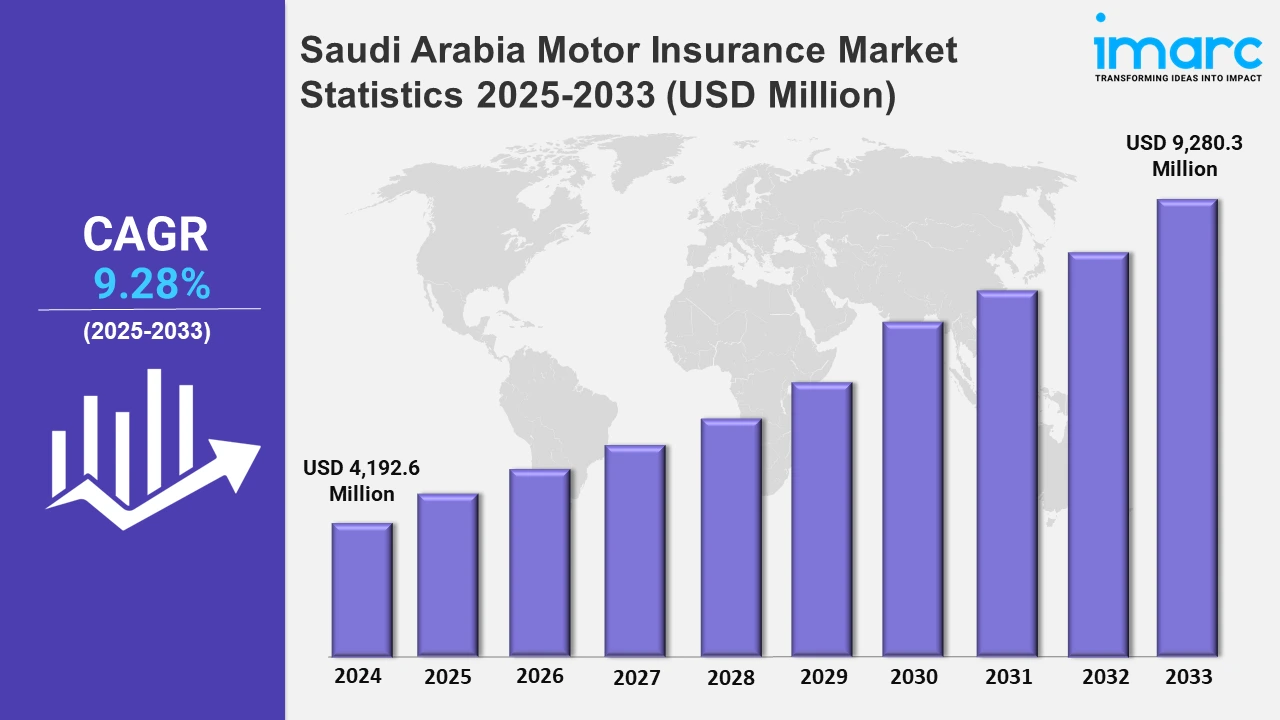

The Saudi Arabia motor insurance market size was valued at USD 4,192.6 Million in 2024, and it is expected to reach USD 9,280.3 Million by 2033, exhibiting a growth rate (CAGR) of 9.28% from 2025 to 2033.

To get more information on this market, Request Sample

The market is primarily driven by the Saudi government enforcing mandatory insurance policies. In addition to this, the government's emphasis on improving road safety and reducing accident-related costs has led to a rise in compliance with insurance policies. The introduction of new laws and regulations aimed at enhancing consumer protection and transparency in the insurance sector has further bolstered the growth of the motor insurance market. For instance, in September 2023, The Saudi General Traffic Department announced the automatic electronic monitoring of violations related to vehicle insurance validity from October 1, 2023. The initiative aims to identify and address vehicles operating without valid insurance across all regions of the Kingdom, with electronic checks conducted once every 15 days.

Saudi Arabia is witnessing rapid urbanization, particularly in cities like Riyadh, Jeddah, and Dammam. With growing urban populations, traffic congestion and the risk of accidents have increased. This creates a higher demand for insurance policies, as consumers seek to mitigate financial losses from accidents and damages that are more likely in high-traffic areas. As Saudi Arabia diversifies its economy under Vision 2030, there has been an influx of expatriates, increased domestic tourism, and more investments in infrastructure. This has contributed to the rising number of vehicles on the roads, further driving the need for motor insurance coverage. For instance, in July 2024, Najm for Insurance Services Company, a Saudi-based provider of comprehensive insurance solutions, announced a new telematics initiative aimed at improving road safety across Saudi Arabia. This initiative was launched in partnership with Cambridge Mobile Telematics (CMT), known for their AI-driven DriveWell Fusion® platform, and AiGeNiX, a leader in AI-based analytics with significant regional presence. By collecting and analyzing driving data, the initiative seeks to reduce accidents and enhance overall road safety in line with Saudi Arabia’s Vision 2030 objectives.

Saudi Arabia Motor Insurance Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region. In the northern and central regions, the rising vehicle ownership due to urbanization and economic growth increases the demand for motor insurance. In the Western region, high population density, tourism growth, and heavy traffic lead to increased motor insurance demand. Industrial growth, business activities, and expatriate populations drive the need for motor insurance in the Eastern region. In the Southern region, the growing vehicle ownership and government initiatives boost the demand for motor insurance in urbanized areas.

Northern and Central Region Motor Insurance Market Trends:

The increasing urbanization and economic growth drive vehicle ownership, creating a higher demand for motor insurance in the northern and central regions. The central location also encourages long-distance travel, raising the need for comprehensive coverage and third-party insurance to meet regulatory requirements.

Western Region Motor Insurance Market Trends:

The growth of tourism and many expatriates contribute to higher vehicle usage, boosting insurance demand across the Western region. The region's high population density and heavy traffic also increase the need for protective coverage against accidents and damages.

Eastern Region Motor Insurance Market Trends:

The Eastern region's industrial growth and the presence of major ports drive vehicle ownership, especially among workers and businesses. This leads to an increased demand for motor insurance, especially third-party coverage, to ensure compliance with regulatory standards.

Southern Region Motor Insurance Market Trends:

The Southern region experiences rising vehicle ownership, partly due to economic development and government initiatives. With an increase in road traffic and urbanization, the demand for motor insurance, particularly comprehensive coverage, is growing to manage risks associated with higher accident rates.

Top Companies Leading in the Saudi Arabia Motor Insurance Industry

The market in Saudi Arabia is highly competitive, with both local and international insurance providers vying for market share. Key players like Tawuniya, Bupa, Allianz, and Tadawul-listed Rasan Information Technology Co. dominate the market, offering a range of products, from third-party coverage to comprehensive plans. These companies are focusing on digital transformation, customer-centric services, and competitive pricing to attract consumers. Additionally, new entrants and insurtech startups are disrupting the market by offering innovative, user-friendly platforms and tailored insurance solutions, intensifying the competition.

In September 2024, Tadawul-listed Rasan Information Technology Co. announced that its subsidiary, Tameeni Electronic Insurance Broker, had obtained a no-objection letter from the Saudi Insurance Authority to sell comprehensive motor insurance for leased vehicles.

Saudi Arabia Motor Insurance Market Segmentation Coverage

- On the basis of the insurance type, the market has been categorized into third party liability and comprehensive. Mandatory insurance regulations require all vehicle owners to have third-party liability coverage, driving its large market share. On the other hand, the rising awareness of the need for full protection against accidents, theft, and damage makes comprehensive insurance highly popular among consumers.

- Based on distribution channel, the market is classified into agents, brokers, banks, online, and others. Insurance agents maintain strong customer relationships and offer personalized services, driving their significant market share. Brokers provide customers with a variety of options from different insurers, helping to expand their market presence. Banks offer bundled insurance products alongside auto loans, making motor insurance more accessible to consumers. The growing preference for convenience and digital platforms has led to the rise of online insurance sales, attracting tech-savvy consumers.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4,192.6 Million |

| Market Forecast in 2033 | USD 9,280.3 Million |

| Market Growth Rate (2025-2033) | 9.28% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Third Party Liability, Comprehensive |

| Distribution Channels Covered | Agents, Brokers, Banks, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)