Saudi Arabia Multi-Factor Authentication Market Size, Share, Trends and Forecast by Model, Deployment Type, Application, Vertical, and Region, 2026-2034

Saudi Arabia Multi-Factor Authentication Market Overview:

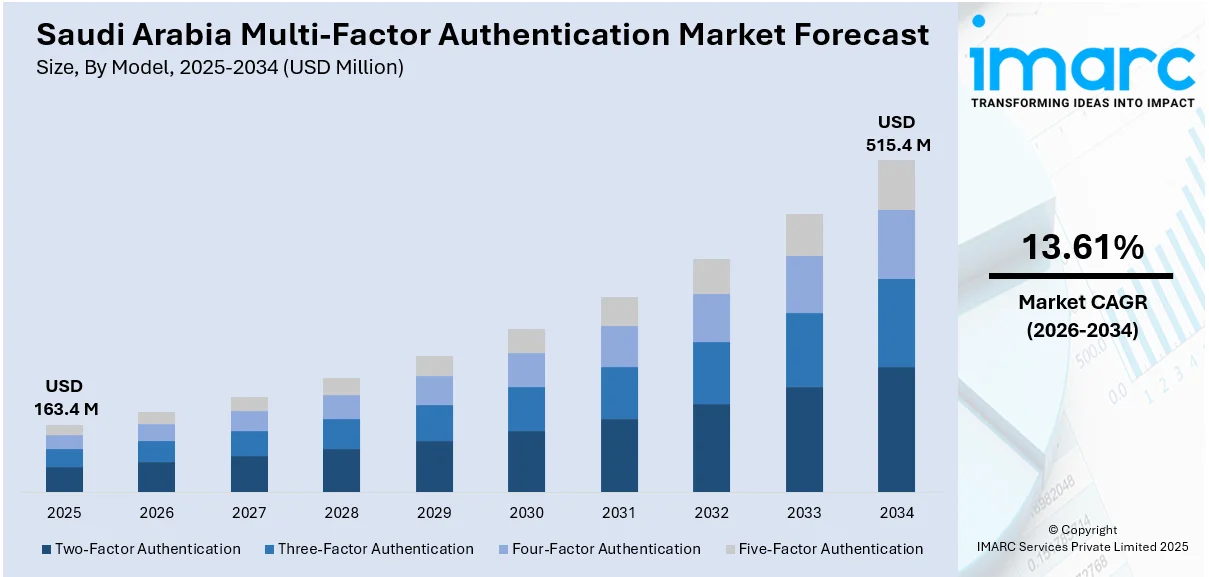

The Saudi Arabia multi-factor authentication market size reached USD 163.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 515.4 Million by 2034, exhibiting a growth rate (CAGR) of 13.61% during 2026-2034. The market is witnessing significant growth due to rising cybersecurity concerns, digital transformation, and regulatory compliance across sectors like banking, government, and telecom. The increasing adoption of multi-factor authentication solutions by organizations to protect sensitive information and prevent unauthorized access is further contributing to the Saudi Arabia multi-factor authentication market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 163.4 Million |

| Market Forecast in 2034 | USD 515.4 Million |

| Market Growth Rate 2026-2034 | 13.61% |

Saudi Arabia Multi-Factor Authentication Market Trends:

Government-led Digital Initiatives

Saudi Arabia’s Vision 2030 and its National Cybersecurity Strategy are accelerating the shift toward secure digital services placing multi-factor authentication (MFA) at the center of identity protection efforts. As the country modernizes public infrastructure and expands e-government platforms like Absher robust authentication systems are becoming standard. These initiatives require secure access to citizen services, digital payments, and sensitive data making MFA adoption critical across ministries and service providers. Additionally, the government is pushing private sector alignment with cybersecurity frameworks set by the National Cybersecurity Authority (NCA), compelling banks, telecoms and enterprises to integrate MFA into their platforms. This top-down push is fostering a unified security ecosystem and encouraging innovation among local authentication and identity tech firms. The result is a steadily growing demand for MFA solutions reinforcing the foundation of the Saudi Arabia multi-factor authentication market.

To get more information on this market Request Sample

Rising Demand in Banking and Finance

Banks and financial institutions in Saudi Arabia are rapidly adopting multi-factor authentication (MFA) to safeguard digital transactions and ensure compliance with evolving regulatory frameworks. With the surge in mobile banking, online payments, and fintech usage, the risk of fraud and identity theft has intensified, prompting institutions to strengthen user verification protocols. MFA methods such as biometric scans, OTPs, and authentication apps are being integrated into core banking platforms to verify identities more securely. The Saudi Central Bank (SAMA) has also issued guidelines emphasizing robust cybersecurity measures, further driving MFA adoption. Additionally, customer expectations for secure and seamless digital experiences are motivating banks to invest in advanced authentication technologies. This shift is not only enhancing security but also building trust in digital financial services, playing a significant role in supporting overall Saudi Arabia multi-factor authentication market growth.

Enterprise Focus on IAM Integration

Large organizations in Saudi Arabia are increasingly positioning multi-factor authentication as a core component of identity and access management systems. Rather than deploying MFA separately, IT architects are integrating additional verification layers such as one-time codes, biometric scans or push approvals directly into single-sign-on workflows. This integration ensures consistent security policies across cloud and on-premises applications, enforcing adaptive controls based on user behavior and risk signals. By embedding MFA within IAM platforms, companies gain centralized oversight of access events, streamline user onboarding and offboarding, and simplify compliance reporting. The unified approach reduces password fatigue for end users and lowers support costs by minimizing password reset requests. As cyber threats remain persistent, anchoring authentication in solid IAM strategies strengthens resilience against credential theft and unauthorized access while enhancing operational efficiency. This model also supports scalable growth as organizations expand cloud services and third-party integrations.

Saudi Arabia Multi-Factor Authentication Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on model, deployment type, application, and vertical.

Model Insights:

- Two-Factor Authentication

- Three-Factor Authentication

- Four-Factor Authentication

- Five-Factor Authentication

The report has provided a detailed breakup and analysis of the market based on the model. This includes two-factor authentication, three-factor authentication, four-factor authentication, and five-factor authentication.

Deployment Type Insights

- On-Premises

- On-Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and on-cloud.

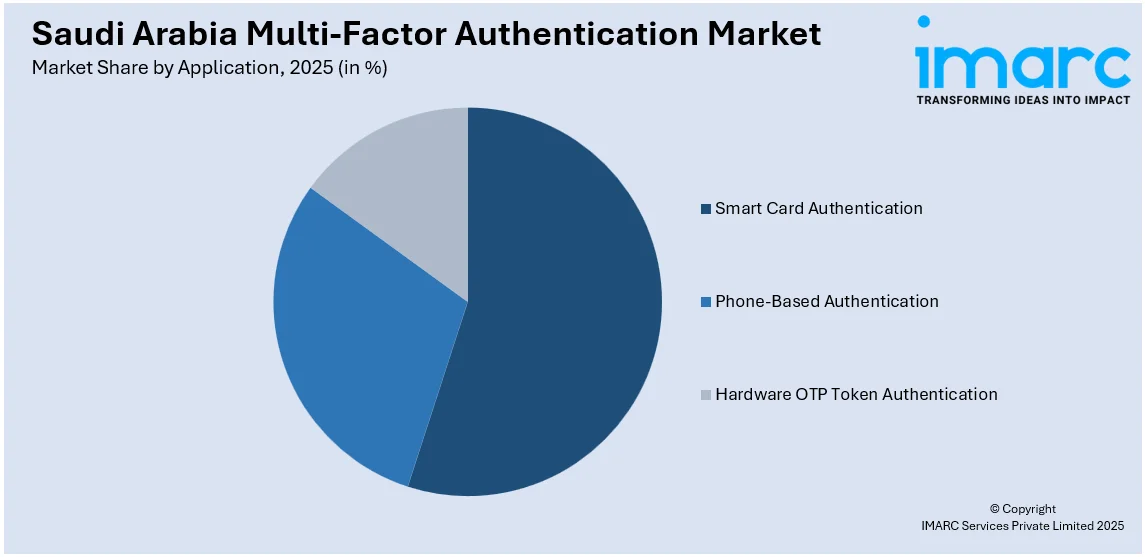

Application Insights:

Access the comprehensive market breakdown Request Sample

- Smart Card Authentication

- Phone-Based Authentication

- Hardware OTP Token Authentication

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart card authentication, phone-based authentication, and hardware OTP token authentication.

Vertical Insights:

- Banking and Finance

- Government

- Travel and Immigration

- Military and Defense

- IT and Telecom

- Healthcare

- Retail and Ecommerce

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes banking and finance, government, travel and immigration, military and defense, IT and telecom, healthcare, retail and ecommerce, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Multi-Factor Authentication Market News:

- In April 2025, Saudi startup Sadq raised USD 1.46 million in pre-Series A funding led by X by Unifonic Fund. The investment will enhance their digital authentication services, including MFA solutions, focusing on technology improvement and talent acquisition, as they strengthen their position in the rapidly growing digital trust sector in Saudi Arabia.

- In February 2025, Saudi Arabia's Absher platform introduced new digital identity services for citizens and expatriates, achieving 28 million digital identities. Features include digital ID verification for expatriates and enhanced management of national IDs. The upgrades aim to streamline government procedures and enhance service quality, supporting the country's digital transformation efforts.

Saudi Arabia Multi-Factor Authentication Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Models Covered | Two-Factor Authentication, Three-Factor Authentication, Four-Factor Authentication, Five-Factor Authentication |

| Deployment Types Covered | On-Premises, On-Cloud |

| Applications Covered | Smart Card Authentication, Phone-Based Authentication, Hardware OTP Token Authentication |

| Verticals Covered | Banking and Finance, Government, Travel and Immigration, Military and Defense, IT and Telecom, Healthcare, Retail and Ecommerce, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia multi-factor authentication market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia multi-factor authentication market on the basis of model?

- What is the breakup of the Saudi Arabia multi-factor authentication market on the basis of deployment type?

- What is the breakup of the Saudi Arabia multi-factor authentication market on the basis of application?

- What is the breakup of the Saudi Arabia multi-factor authentication market on the basis of vertical?

- What is the breakup of the Saudi Arabia multi-factor authentication market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia multi-factor authentication market?

- What are the key driving factors and challenges in the Saudi Arabia multi-factor authentication?

- What is the structure of the Saudi Arabia multi-factor authentication market and who are the key players?

- What is the degree of competition in the Saudi Arabia multi-factor authentication market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia multi-factor authentication market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia multi-factor authentication market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia multi-factor authentication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)