Saudi Arabia Office Supplies Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Saudi Arabia Office Supplies Market Overview:

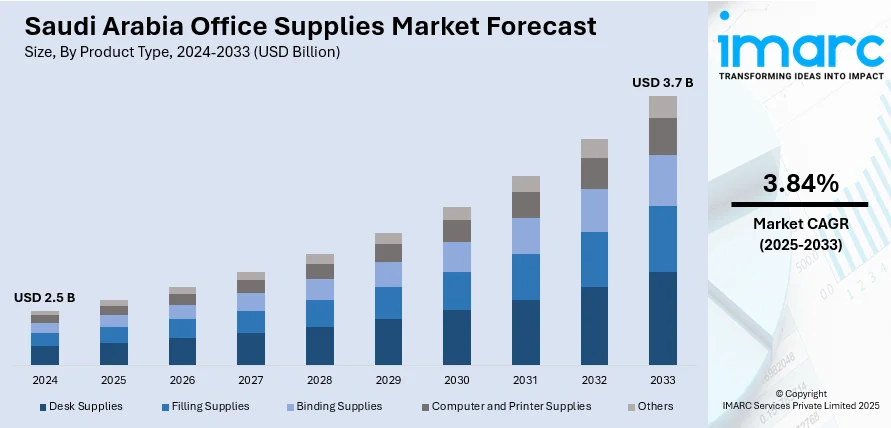

The Saudi Arabia office supplies market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.84% during 2025-2033. The market is expanding, driven by the strong expansion in Saudi Arabia's business ecosystem, driven by Vision 2030 economic diversification efforts, heightened speed of digital transformation supported by strategic national policy, and ambitious drive towards infrastructure development and education reform.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 3.84% |

Saudi Arabia Office Supplies Market Trends:

Expansion of Corporate and Commercial Establishments

The strong expansion in Saudi Arabia's business ecosystem, driven by Vision 2030 economic diversification efforts is increasing demand for office supplies. As the government actively promotes entrepreneurship, foreign direct investment, and new business setup outside the energy industry, there is an expected increase in the demand for conventional and digital office hardware. The financial services, information technology (IT), real estate, and professional services sectors are also focusing on development, each necessitating extensive administrative infrastructure. Additionally, the rise of coworking facilities and business incubators, especially in urban centers like Riyadh and Jeddah, drives the demand for a broad range of office supplies. In 2024, the Executive Centre, the global flexible workspace provider, opened in Saudi Arabia its first and largest center to date, in Riyadh, at the King Abdullah Financial District (KAFD). It boasts an extensive portfolio of more than 220 centers located at business addresses across 36 cities and 16 markets, and an expanding worldwide network of more than 50,000 members. TEC's partnership with JLL and KAFD reflects its drive to increase its presence in primary growth areas.

Digital Transformation and Hybrid Work Models

The speed of digital transformation in Saudi Arabia, supported by strategic national policy, has reconfigured office supply needs. Companies are increasingly embracing hybrid work patterns that blend remote and in-office work. This trend has spawned dual streams of demand: traditional office supplies for physical offices and technology-enabled tools for remote collaboration. Items like webcams, headsets, ergonomic seats, and cloud-compatible devices are gaining popularity. At the same time, use of paper is decreasing in light of digital documentation and cloud-enabled workflow management products, leading to diversification on the part of suppliers. Also, businesses are spending on IT infrastructure to meet cybersecurity, digital communication, and cloud storage demands, shaping the procurement patterns on the office supplies value chain. In 2024, Minister of Human Resources and Social Development Ahmed Al-Rajhi indicated that the percentage of Saudi workers in the private sector achieved a significant rise of 35 percent over the last five years. This further catalyzed the requirement for office spaces and office furniture to accommodate employees.

Government-led Infrastructure and Educational Reforms

The Saudi government's ambitious drive towards infrastructure development and education reform is a major force behind the office supplies market. With programs like the National Transformation Program and the Human Capability Development Program under Vision 2030, significant investments are being directed into the education sector, which directly boosts demand for academic and administrative office supplies. New school campuses, universities, training institutes, and government offices are being built throughout the Kingdom, all of which demand thorough furnishing and equipping with office essentials. Concurrently, civil service and public sector institution reforms demand equipment and administrative tool upgrades to enhance operational efficiency. Moreover, the drive towards digital literacy and STEM education contributes to increased utilization of IT-facilitated office products like printers, tablets, and interactive learning systems.

Saudi Arabia Office Supplies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Desk Supplies

- Filling Supplies

- Binding Supplies

- Computer and Printer Supplies

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes desk supplies, filing supplies, binding supplies, computer and printer supplies, and others.

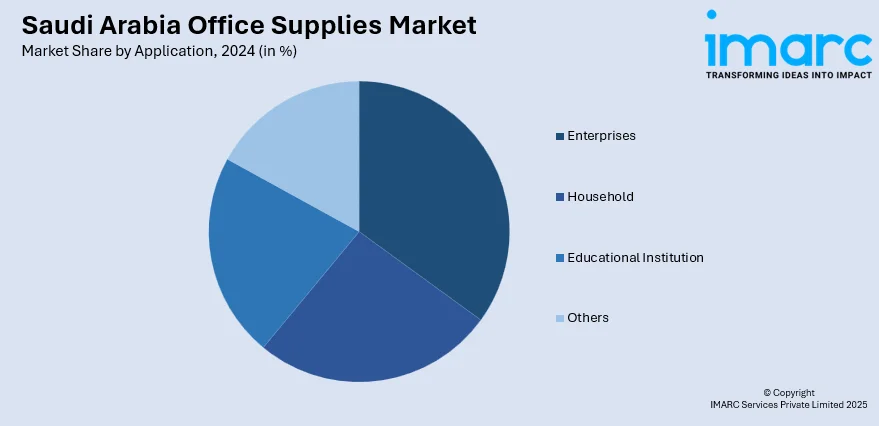

Application Insights:

- Enterprises

- Household

- Educational Institution

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes enterprises, household, educational institutions, and others.

Distribution Channel Insights:

- Supermarket and Hypermarket

- Stationery Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes supermarket and hypermarket, stationery stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Office Supplies Market News:

- January 2024: First Furniture (FFC), the most popular name in office and hospitality furniture, and a United Technology for Construction (UTC) subsidiary under Naif Alrajhi Investment group, inaugurated its luxury Italian office furniture showroom in Saudi Arabia.

- February 2024: Sedus, major office furniture manufacturing company, became the Gold Sponsor of Design Middle East Awards KSA 2024.

Saudi Arabia Office Supplies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Desk Supplies, Filing Supplies, Binding Supplies, Computer and Printer Supplies, Others |

| Applications Covered | Enterprises, Household, Educational Institutions, Others |

| Distribution Channels Covered | Supermarket And Hypermarket, Stationery Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia office supplies market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia office supplies market on the basis of product type?

- What is the breakup of the Saudi Arabia office supplies market on the basis of application?

- What is the breakup of the Saudi Arabia office supplies market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia office supplies market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia office supplies market?

- What are the key driving factors and challenges in the Saudi Arabia office supplies?

- What is the structure of the Saudi Arabia office supplies market and who are the key players?

- What is the degree of competition in the Saudi Arabia office supplies market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia office supplies market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia office supplies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia office supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)