Saudi Arabia Offshore Wind Power Market Size, Share, Trends and Forecast by Installation, Water Depth, Capacity, and Region, 2026-2034

Saudi Arabia Offshore Wind Power Market Overview:

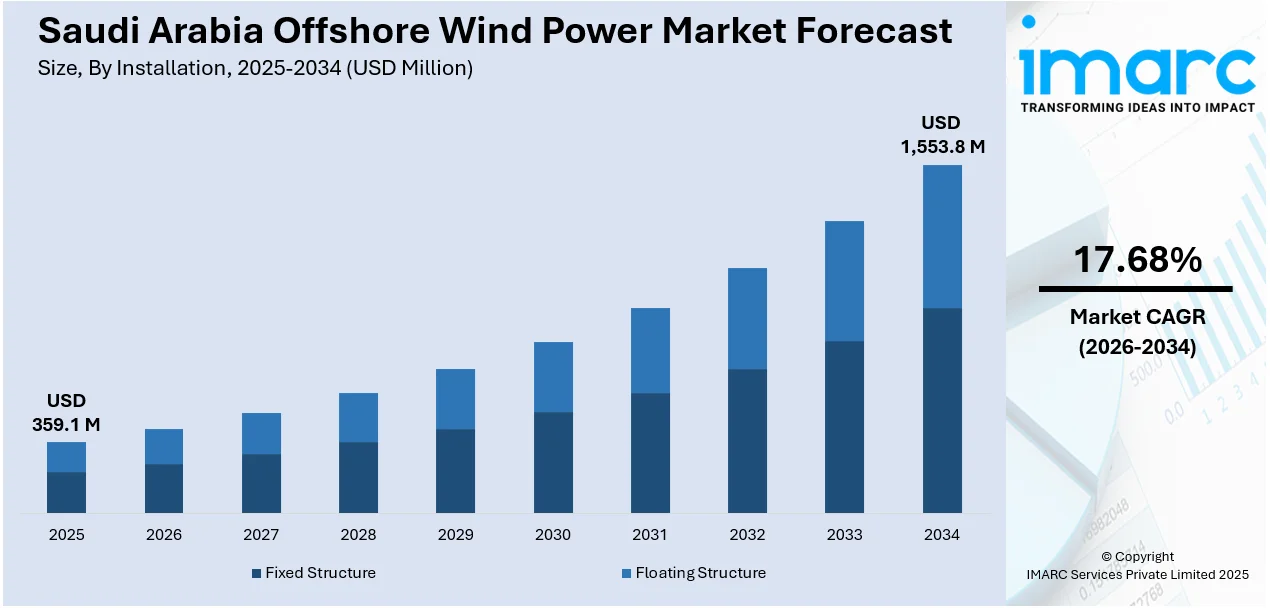

The Saudi Arabia offshore wind power market size reached USD 359.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,553.8 Million by 2034, exhibiting a growth rate (CAGR) of 17.68% during 2026-2034. Vision 2030’s renewable energy goals, strong coastal wind resources, government incentives, diversification from oil, foreign investment interest, and advancements in wind technology, reducing costs and enhancing project feasibility in the Red Sea and Arabian Gulf regions, are some of the factors contributing to Saudi Arabia offshore wind power market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 359.1 Million |

| Market Forecast in 2034 | USD 1,553.8 Million |

| Market Growth Rate 2026-2034 | 17.68% |

Saudi Arabia Offshore Wind Power Market Trends:

Momentum in Renewable Energy Development

Saudi Arabia is evaluating large-scale offshore wind deployment, backed by over 100 GW of estimated capacity along its coastlines. The country’s Vision 2030 initiative is driving increased focus on clean energy expansion, with offshore wind emerging as a potential pillar. Favorable maritime geography and consistent wind speeds create strong foundations for utility-scale projects. Additionally, future connectivity via subsea interconnectors could position Saudi Arabia as a regional supplier of green electricity to high-demand areas in Europe. These developments signal growing interest in diversifying energy exports and building a low-carbon economy. The alignment of government policy, natural resources, and global market opportunities is setting the stage for long-term investments in this sector. These factors are intensifying the Saudi Arabia offshore wind power market growth. For example, as of June 2024, Saudi Arabia holds an estimated 106 GW of offshore wind potential along its coastlines, according to the Global Wind Energy Council. The Kingdom is actively exploring offshore wind as part of its Vision 2030 strategy to expand renewable energy capacity. With favorable coastal conditions and strategic positioning, Saudi Arabia could also become a key exporter of green energy via future subsea interconnectors linking to markets such as Europe.

To get more information on this market Request Sample

Rising International Collaboration in Clean Energy Expansion

Saudi Arabia’s offshore wind ambitions are drawing attention from global players with expanding renewable energy portfolios. As part of broader efforts to meet net-zero goals, major international developers are scaling their offshore wind activities and identifying strategic markets with long-term potential. With the Kingdom setting targets under its Vision 2030 roadmap, the offshore wind segment presents an opportunity for cooperation that aligns with both national goals and global decarbonization efforts. Growing international participation could bring technical expertise, investment capacity, and project execution experience to support Saudi Arabia’s clean energy infrastructure. This alignment between national energy planning and foreign renewable initiatives is laying the groundwork for the next phase of offshore wind activity in the region. For instance, in December 2024, TotalEnergies, targeting net zero by 2050, expanded its global renewables portfolio, including offshore wind. Though recently awarded a 300 MW solar project in Saudi Arabia, the company’s broader strategy includes offshore wind development. With 22 GW of renewable capacity in 2023 and plans for 35 GW by 2025, its future projects could support Saudi Arabia’s emerging offshore wind ambitions aligned with Vision 2030’s clean energy goals.

Saudi Arabia Offshore Wind Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on installation, water depth, and capacity.

Installation Insights:

- Fixed Structure

- Floating Structure

The report has provided a detailed breakup and analysis of the market based on the installation. This includes fixed structure and floating structure.

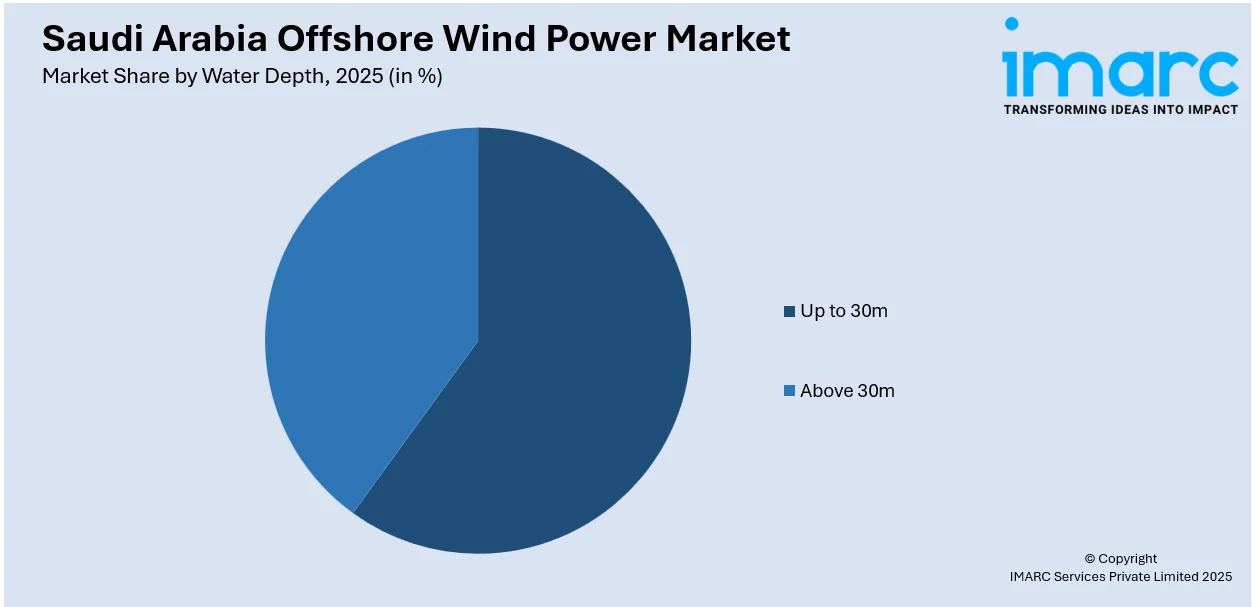

Water Depth Insights:

Access the comprehensive market breakdown Request Sample

- Up to 30m

- Above 30m

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes up to 30m and above 30m.

Capacity Insights:

- Up to 3MW

- 3MW to 5MW

- Above 5MW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 3MW, 3MW to 5MW, and above 5MW.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Offshore Wind Power Market News:

- In December 2024, Saudi Arabia and France agreed to deepen energy cooperation with a strong focus on low-emission hydrogen and renewable electricity. France’s decarbonization strategy, backed by the France 2030 investment plan, targets 100GW of renewable capacity by 2050, including 40GW from offshore wind. This aligns with Saudi Arabia’s export potential in hydrogen, backed by its renewable resources and strategic location near global demand hubs, potentially accelerating offshore wind collaboration.

Saudi Arabia Offshore Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Fixed Structure, Floating Structure |

| Water Depths Covered | Up to 30m, Above 30m |

| Capacities Covered | Up to 3MW, 3MW to 5MW, Above 5MW |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia offshore wind power market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia offshore wind power market on the basis of installation?

- What is the breakup of the Saudi Arabia offshore wind power market on the basis of water depth?

- What is the breakup of the Saudi Arabia offshore wind power market on the basis of capacity?

- What is the breakup of the Saudi Arabia offshore wind power market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia offshore wind power market?

- What are the key driving factors and challenges in the Saudi Arabia offshore wind power market?

- What is the structure of the Saudi Arabia offshore wind power market and who are the key players?

- What is the degree of competition in the Saudi Arabia offshore wind power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia offshore wind power market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia offshore wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia offshore wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)