Saudi Arabia Oleochemicals Market Size, Share, Trends and Forecast by Type, Form, Application, Feedstock, and Region, 2026-2034

Saudi Arabia Oleochemicals Market Overview:

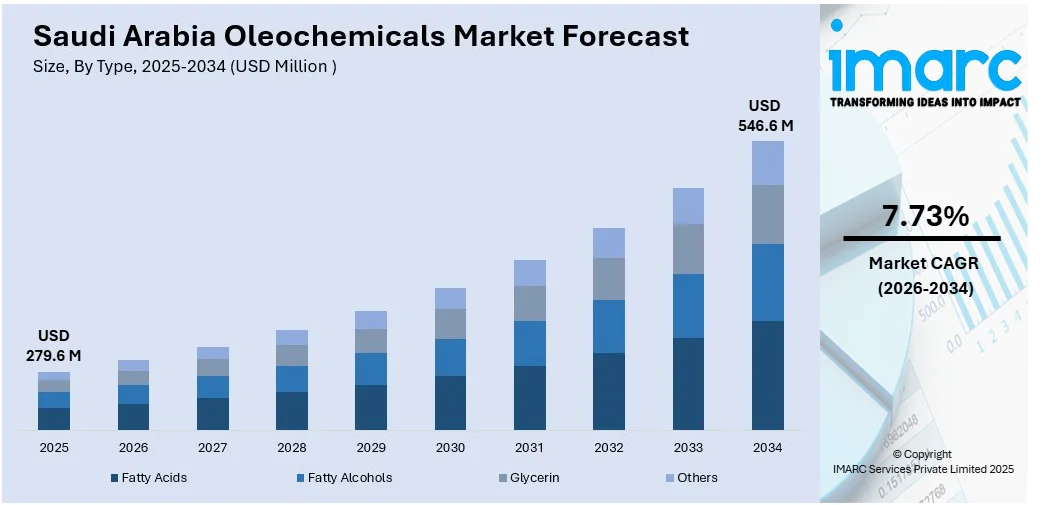

The Saudi Arabia oleochemicals market size reached USD 279.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 546.6 Million by 2034, exhibiting a growth rate (CAGR) of 7.73% during 2026-2034. The market is expanding, driven by the heightened production of soaps, detergents, skincare products, and cosmetics, rising focus on sustainability and carbon footprint reduction, and strategic emphasis of governing agencies on diversifying the petrochemical and industrial base of the economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 279.6 Million |

| Market Forecast in 2034 | USD 546.6 Million |

| Market Growth Rate 2026-2034 | 7.73% |

Saudi Arabia Oleochemicals Market Trends:

Rising Demand from Personal Care and Household Products Industry

Oleochemicals are crucial components used in the personal care and household product manufacturing sectors. They are specifically important in the production of soaps, detergents, skincare products, and cosmetics due to their emulsifying, moisturizing, and surfactant properties. Moreover, as awareness about hygiene and skincare is growing the usage of these products are increasing in Saudi Arabia. This trend is specifically evident among the young individuals, following improvised beauty standards and adopting premium personal care routines. In addition, domestic production of these products has been supported by efforts under Saudi Vision 2030 to increase local manufacturing and decrease reliance on imports. This is resulting in the creation of new processing units based on oleochemicals as main inputs. As a result, the rising personal care and home hygiene market is assuming strong, sustained demand for oleochemical inputs. The IMARC Group predicts that the Saudi Arabia beauty and personal care market size is expected to reach USD 6.4 Billion by 2033. This will further drive the need for oleochemicals for the production of various products in the sector.

To get more information on this market, Request Sample

Shift Toward Sustainable and Bio-Based Alternatives

As the focus increases on sustainability and carbon footprint reduction, Saudi Arabia's oleochemicals industry is experiencing increased demand for bio-based substitutes for petrochemical products. Natural fats and oils (mainly palm, soybean, and vegetable oils) are the primary source of oleochemicals, which are regarded as sustainable alternatives for fossil-based chemicals. This development is in line with the environmental commitments and the wider aspiration of the Kingdom to enhance its sustainability performance under the Saudi Green Initiative and Vision 2030 objectives. Plastics, lubricants, surfactants, and coatings industries are adopting oleochemical inputs to fulfill changing regulatory requirements and consumer preferences. Adoption of biodegradable and renewable raw materials also reduces the environmental footprint of chemical production and adheres to circular economy principles. The IMARC Group states that the Saudi paints Government Initiatives to Diversify Petrochemical Sector and coatings market size will reach USD 2,106.0 Million by 2033.

Government Initiatives to Diversify Petrochemical Sector

The strategic emphasis of the Saudi government on diversifying the petrochemical and industrial base of the economy is one of the key drivers of the market. Under Vision 2030 and accompanying programs, the Kingdom is heavily investing in developing its chemical production capacities beyond the conventional crude oil and gas industries. This involves the establishment of integrated chemical parks and clusters, which promote innovation and the manufacturing of specialty chemicals, such as oleochemicals. These infrastructure projects are intended to entice foreign investment, facilitate public-private partnerships, and increase the value chain through the processing of raw materials into higher-value chemical products. Subsidies, tax breaks, and research grants are also being offered to local manufacturers to persuade them to go into sustainable production procedures. For instance, in 2025, Saudi Arabia launched a new environmental financing proposal worth SR1 billion ($266.6 million), to encourage the participation of private companies in sustainable projects.

Saudi Arabia Oleochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, form, application, and feedstock.

Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Fatty Acids

- Fatty Alcohols

- Glycerin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fatty acids, fatty alcohols, glycerin, and others.

Form Insights:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid (flakes, pellets, beads, and others).

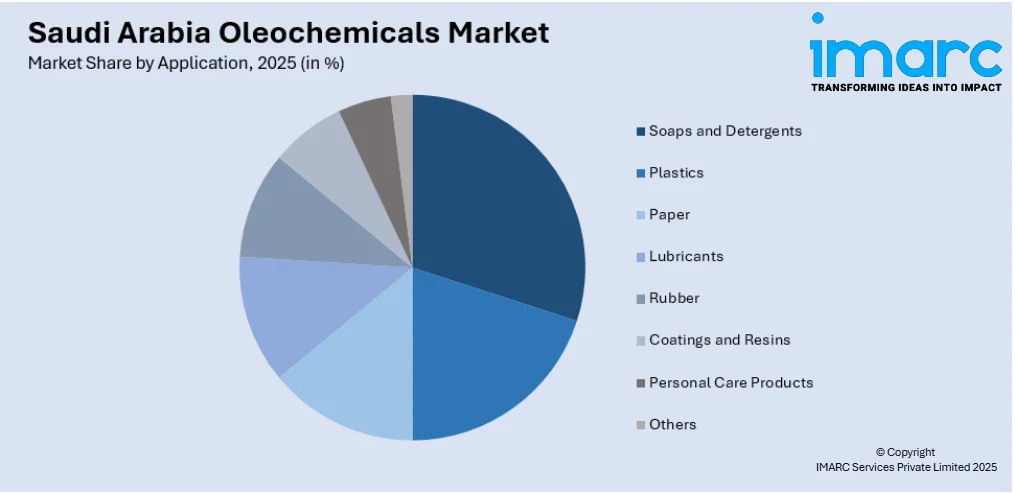

Application Insights:

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes soaps and detergents, plastics, paper, Lubricants, rubber, coatings and resins, personal care products, and others.

Feedstock Insights:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

A detailed breakup and analysis of the market based on the feedstock have also been provided in the report. This includes palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Oleochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fatty Acids, Fatty Alcohols, Glycerine, Others |

| Forms Covered |

|

| Applications Covered | Soaps and Detergents, Plastics, Paper, Lubricants, Rubber, Coatings and Resins, Personal Care Products, Others |

| Feedstocks Covered | Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia oleochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia oleochemicals market on the basis of type?

- What is the breakup of the Saudi Arabia oleochemicals market on the basis of form?

- What is the breakup of the Saudi Arabia oleochemicals market on the basis of application?

- What is the breakup of the Saudi Arabia oleochemicals market on the basis of feedstock?

- What is the breakup of the Saudi Arabia oleochemicals market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia oleochemicals market?

- What are the key driving factors and challenges in the Saudi Arabia oleochemicals?

- What is the structure of the Saudi Arabia oleochemicals market and who are the key players?

- What is the degree of competition in the Saudi Arabia oleochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia oleochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia oleochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia oleochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)