Saudi Arabia Olive Oil Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Olive Oil Market Overview:

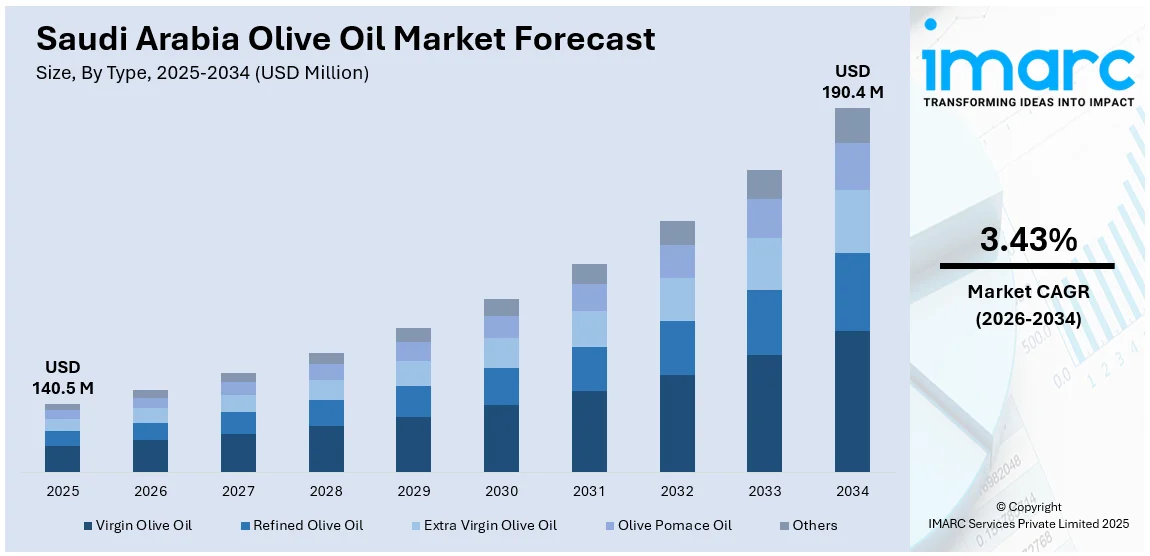

The Saudi Arabia olive oil market size reached USD 140.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 190.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.43% during 2026-2034. The market is expanding with increased cultivation in Tabuk and Al-Jouf, government-backed processing support, and the growing use of solar energy. Regional festivals and heritage branding are also strengthening market visibility, sustainability, and export readiness across the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 140.5 Million |

| Market Forecast in 2034 | USD 190.4 Million |

| Market Growth Rate 2026-2034 | 3.43% |

Saudi Arabia Olive Oil Market Trends:

Government Support and Local Processing Expansion

Saudi Arabia’s market is growing due to strong institutional backing and improvements in regional processing capabilities. The government has prioritized agricultural self-reliance through structured financial aid, equipment supply, and expert guidance to farmers. These measures have increased olive cultivation and strengthen the post-harvest value chain. Local oil extraction and packaging have reduced dependency on imported edible oils, encouraged small-scale entrepreneurship, and built confidence in homegrown produce. In November 2024, Tabuk’s olive presses handled over 94,000 Tons of olives from 1.8 Million trees, producing 12,250 tons of olive oil. This output was backed by seasonal support schemes and events like agricultural festivals that connected farmers to markets and encouraged the adoption of modern techniques. With better access to facilities and a reliable supply chain, more producers are entering the market with quality-compliant products. This development reflects a broader shift toward scaling production without compromising on standards. The government’s role in simplifying access to resources and strengthening rural production zones has improved consistency and traceability in olive oil output. In effect, regional investments and focused policy support are becoming the foundation of the sector’s long-term resilience. They are helping create a more competitive and self-sustaining olive oil market within the Kingdom.

To get more information on this market Request Sample

Rise in Sustainability-Focused Production Practices

Saudi Arabia’s olive oil market is gradually shifting toward more sustainable and energy-efficient production methods. Growing awareness of environmental concerns and a national push for cleaner technologies are influencing the way olive oil is processed and marketed. Producers are beginning to adopt renewable energy and low-emission alternatives as part of their operations. This shift is not only driven by regulatory alignment but also by economic factors such as reducing fuel costs and meeting the standards of international buyers. In October 2024, ENGIE signed a Power Purchase Agreement with Al-Jouf Agricultural Development Company (JADCO) to build an 8MWp onsite solar PV project at the Busaita industrial complex. The clean energy generated will power JADCO’s olive oil, pickles, and French fries units, cutting 13,000 tons of carbon emissions annually by reducing diesel use. This initiative supported both national sustainability goals under Vision 2030 and ENGIE’s net-zero commitments. For the olive oil sector, such moves increase operational stability, lower long-term costs, and improve the environmental profile of exports. These production upgrades also enhance compliance with eco-certifications demanded in global markets. As more companies take this route, sustainable infrastructure is likely to become a defining factor in shaping competitiveness and long-term growth in Saudi Arabia’s olive oil industry.

Saudi Arabia Olive Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, distribution channel, and application.

Type Insights:

- Virgin Olive Oil

- Refined Olive Oil

- Extra Virgin Olive Oil

- Olive Pomace Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes virgin olive oil, refined olive oil, extra virgin olive oil, olive pomace oil, and others.

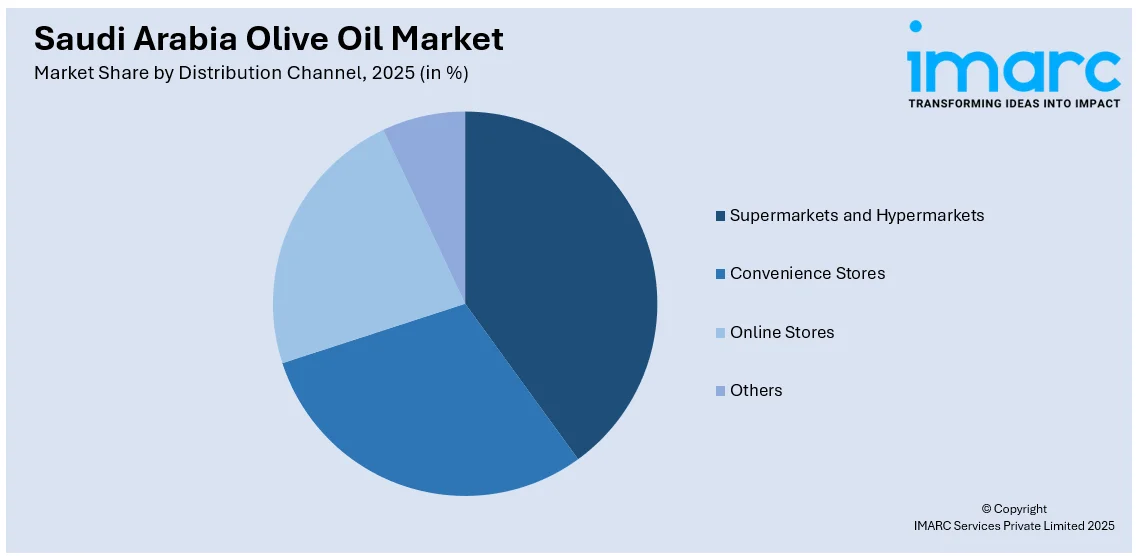

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Application Insights:

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverage, pharmaceuticals, cosmetics, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Olive Oil Market News:

- March 2025: Syria produced 122,000 Tons of olive oil, with 22,000 Tons available for export after meeting local demand. Exports to key markets like Saudi Arabia supported regional supply, strengthening trade ties and positively impacting the Saudi olive oil market’s import stability and diversity.

- October 2024: ENGIE signed a Power Purchase Agreement with JADCO for an 8MWp onsite solar PV project at Busaita, powering olive oil operations. This reduced diesel use, cut 13,000 tons of emissions yearly, and boosted sustainability in Saudi Arabia’s olive oil production and energy efficiency.

Saudi Arabia Olive Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Virgin Olive Oil, Refined Olive Oil, Extra Virgin Olive Oil, Olive Pomace Oil, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Food and Beverage, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia olive oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia olive oil market on the basis of the type?

- What is the breakup of the Saudi Arabia olive oil market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia olive oil market on the basis of application?

- What is the breakup of the Saudi Arabia olive oil market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia olive oil market?

- What are the key driving factors and challenges in the Saudi Arabia olive oil?

- What is the structure of the Saudi Arabia olive oil market and who are the key players?

- What is the degree of competition in the Saudi Arabia olive oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia olive oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia olive oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia olive oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)