Saudi Arabia Online Furniture Market Size, Share, Trends and Forecast by Raw Material, Products, Applications, and Regions, 2026-2034

Saudi Arabia Online Furniture Market Summary:

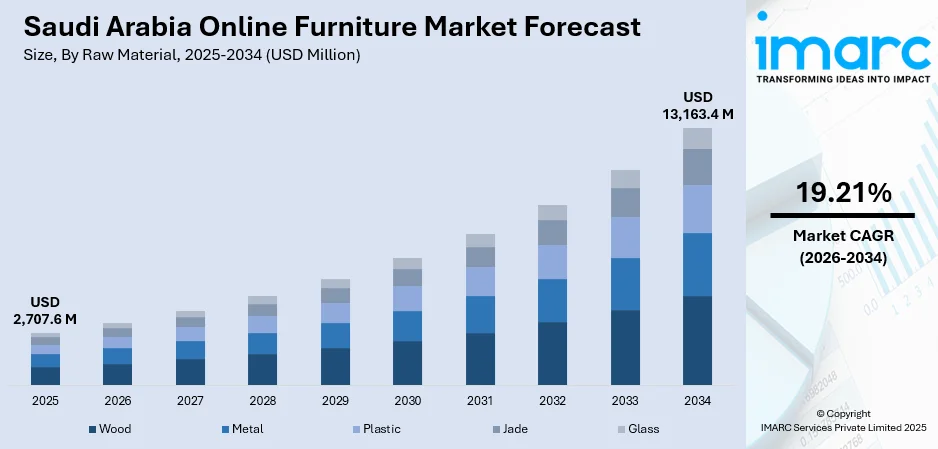

The Saudi Arabia online furniture market size was valued at USD 2,707.6 Million in 2025 and is projected to reach USD 13,163.4 Million by 2034, growing at a compound annual growth rate of 19.21% from 2026-2034.

The market is experiencing transformative growth driven by Saudi Arabia's Vision 2030 infrastructure expansion, heightened e-commerce penetration, and a young digitally native population seeking convenient shopping experiences. Nationwide deployment of advanced payment systems, augmented reality (AR) visualization tools, and buy-now-pay-later services are lowering barriers to online furniture purchases. Smartphone dominance in buyer behavior, combined with improving last-mile logistics infrastructure, positions digital channels as the primary growth factor, thereby expanding Saudi Arabia online furniture market share.

Key Takeaways and Insights:

-

By Raw Material: Wood dominates the market with a share of 46% in 2025, benefiting from cultural preferences for traditional aesthetics and government support for domestic wooden furniture manufacturing.

-

By Product: Living room furniture leads the market with a share of 33% in 2025, driven by extended family gathering traditions and rising demand for premium sectional seating.

-

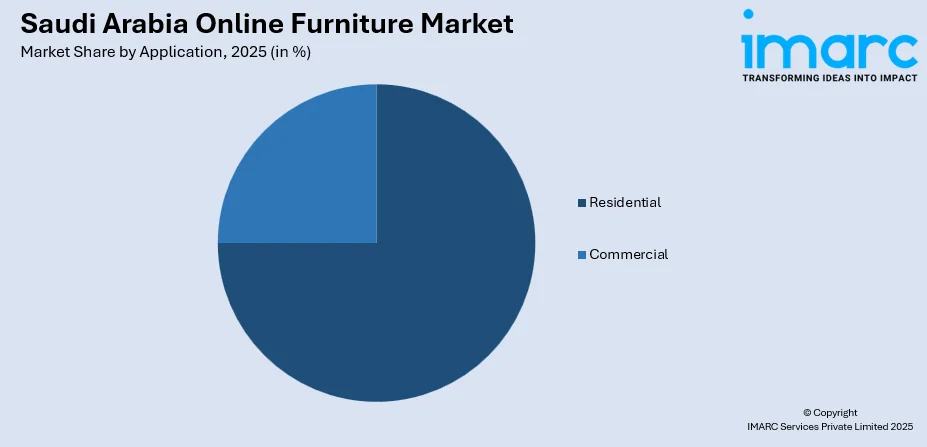

By Application: Residential represents the largest segment with a market share of 75% in 2025, supported by the implementation of massive housing development programs under Vision 2030.

-

By Region: Northern and central region leads the market with a share of 38% in 2025, anchored by Riyadh's concentration of mega-infrastructure projects and high-income urban population.

-

Key Players: The Saudi Arabia online furniture market exhibits moderate competitive intensity, with international retailers competing alongside regional players through omnichannel strategies. Moreover, the online launch of various new furniture models is supporting the market growth.

To get more information on this market Request Sample

The online furniture retail landscape is being reshaped by convergence of multiple catalysts. Digital payment infrastructure matured substantially during 2024, with the e-commerce sales employing Mada cards attained USD 52.64 billion. This surge reflects growing buyer confidence in digital commerce security and convenience. Major retailers are deploying sophisticated augmented reality room planners that enable customers to visualize furniture dimensions and colors within their actual living spaces before purchase, dramatically reducing return rates while increasing basket sizes. The government's housing investment through ROSHN and other developers creates sustained demand for complete furniture packages, with online platforms offering integrated room sets tailored to new homeowners. Furthermore, international furniture sellers reported a rise in online sales directly attributable to immersive 3D visualization tools, demonstrating how technology integration drives conversion in this market segment.

Saudi Arabia Online Furniture Market Trends:

Accelerated Digital Transformation Through AR and Virtual Showroom Technologies

Saudi Arabia's online furniture sector is witnessing rapid integration of AR and virtual reality (VR) technologies that fundamentally alter the purchasing journey. Advanced visualization platforms allow people to preview furniture placement, scale, and color coordination within their actual homes using smartphone cameras or desktop interfaces. These tools address traditional online furniture shopping friction points such as size uncertainty and style compatibility concerns. Major retailers report that AR-enabled product pages generate conversion rates substantially higher than conventional static images, while reducing post-purchase returns through improved purchase confidence. In 2024, major Egypt-based e-commerce for furniture, Kemitt expanded into Saudi Arabia, following an undisclosed funding round. Kemitt has launched a specialized website for Saudi Arabia, featuring more than 25,000 SKUs. This comprehensive catalogue offers Saudi customers a wide selection of options, guaranteeing that there is something to match every preference and requirement.

Proliferation of Smart and IoT-Enabled Multifunctional Furniture Solutions

Urban densification and evolving lifestyle preferences are driving demand for intelligent furniture that integrates connectivity features and serves multiple purposes. Space-saving designs that transform between different functions, such as sofas converting to beds or desks with built-in wireless charging, appeal to younger demographics living in compact apartments. Internet of Things (IoT) integration enables furniture pieces to connect with smart home ecosystems, offering features like voice-controlled adjustments, automated lighting, and app-based customization. Government smart city initiatives provide supportive infrastructure, while rising tech literacy among Saudi consumers accelerates adoption. In 2025, The Saudi Smart Home & Furnishings Expo took place from 11 to 13 June 2024 at the Riyadh International Convention and Exhibition Center in Riyadh showcasing cutting-edge and sophisticated products and technologies from all around the world.

Sustainability and Eco-Conscious Material Selection Gaining Market Traction

Environmental awareness is reshaping buyer purchasing criteria in Saudi Arabia's online furniture market, with growing preference for sustainably sourced materials and eco-friendly production processes. Government environmental initiatives including the National Strategy for Environment provide regulatory framework and financial incentives for manufacturers adopting green practices. Furniture made from recycled wood, low-VOC finishes, and biodegradable textiles increasingly features in product catalogs as retailers respond to evolving consumer values. Online platforms leverage transparency around sourcing and manufacturing processes as competitive differentiators, with detailed sustainability certifications prominently displayed on product pages. In 2025, the second Saudi Wood Expo took place to support the country’s ambitions for sustainable and modern development aligned with worldclass wood and woodworking sector standards.

Market Outlook 2026-2034:

The Saudi Arabia online furniture market is poised for exceptional expansion driven by structural economic transformation and digital infrastructure maturation. The market generated a revenue of USD 13,163.4 Million in 2025 and is projected to reach a revenue of USD 2,707.6 Million by 2034, growing at a compound annual growth rate of 19.21% from 2026-2034. The convergence of 5G network expansion, enhanced mobile payment infrastructure, and sophisticated logistics capabilities will eliminate remaining friction points in online furniture transactions.

Saudi Arabia Online Furniture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Raw Material | Wood | 46% |

| Product | Living Room Furniture | 33% |

| Application | Residential | 75% |

| Regions | Northern and Central Region | 38% |

Raw Material Insights:

- Wood

- Metal

- Plastic

- Jade

- Glass

Wood dominates with a market share of 46% of the total Saudi Arabia online furniture market in 2025.

Wood furniture commands the largest share in Saudi Arabia's online furniture market, reflecting deep-rooted consumer preferences for natural materials that convey warmth, elegance, and traditional craftsmanship. The material's versatility enables diverse design applications from classic carved pieces to contemporary minimalist styles, satisfying varied aesthetic requirements across demographic segments. Online retailers emphasize wood's inherent qualities including durability, easy maintenance, and non-toxic nature through detailed product descriptions and high-resolution imagery.

Sustainable wood sourcing and reclaimed timber are also gaining traction, driven by growing environmental awareness. As online platforms expand, they make it easier for people to access a wide range of wooden furniture, from handcrafted items to imported collections. With the Kingdom’s ongoing urbanization and investment in home development, wood remains a material of choice for its visual warmth, versatility, and enduring value. Whether for formal living spaces or everyday use, wooden furniture offers a perfect balance of tradition, style, and function. Its adaptability across styles, from rustic to minimalist, ensures that wood retains a leading position in the evolving digital furniture landscape in Saudi Arabia.

Product Insights:

- Living Room Furniture

- Bedroom Furniture

- Office Furniture

- Kitchen Furniture

- Others

Living room furniture leads with a share of 33% of the total Saudi Arabia online furniture market in 2025.

Living room furniture represents the cornerstone of Saudi Arabia's online furniture market, driven by cultural emphasis on hospitality and extended family gatherings that necessitate spacious, comfortable seating arrangements capable of accommodating multi-generational interactions. Premium sofas, sectional configurations, and carved wood tables feature prominently in consumer wish lists as these pieces serve as visual centerpieces while facilitating social connectivity during frequent family visits and guest entertainment. Online platforms cater to this demand through sophisticated 3D configurators that enable customization of upholstery fabrics, sectional arrangements, cushion firmness, and finishing details before purchase commitment.

The segment's dominance reflects both replacement cycles as households upgrade existing pieces to align with contemporary design trends and new home furnishing requirements from Vision 2030's residential construction boom delivering thousands of units annually. Living room and dining room furniture collectively retained a major portion of the home furniture market share in 2024, with villa purchases favoring premium materials and artisanal craftsmanship while compact apartment layouts in cities like Jeddah drive interest in modular designs that optimize space utilization without sacrificing comfort or style, perfectly suited to online visualization tools.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential exhibits a clear dominance with a 75% share of the total Saudi Arabia online furniture market in 2025.

Residential applications overwhelmingly dominate Saudi Arabia's online furniture market as Vision 2030's transformative housing programs generate sustained demand for complete home furnishing solutions spanning bedrooms, living areas, kitchens, and outdoor spaces. ROSHN's ambitious target of 400,000 housing units complemented by new residential deliveries in Riyadh alone creates massive baseline requirements for beds, seating, storage, and dining furniture across diverse price segments and style preferences. Online platforms capitalize on this opportunity by offering curated room packages that simplify purchasing decisions for first-time homeowners while providing value through bundled pricing and coordinated design aesthetics that eliminate uncertainty around furniture compatibility.

The government's push toward 70% homeownership by 2030 ensures continued momentum as demographic expansion and urbanization drive household formation rates requiring furnishing of newly constructed units. IMARC Group predicts that the Saudi Arabia home furniture market is projected to attain USD 9,821.0 Million by 2034. This reflects both new construction absorption and renovation activities among existing homeowners seeking to refresh interiors in alignment with contemporary design trends showcased through social media and online inspiration galleries that influence purchasing decisions.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 38% of the total Saudi Arabia online furniture market in 2025.

The Northern and Central Region, centered around Riyadh, commands the largest share of Saudi Arabia's online furniture market through a combination of demographic concentration, high disposable incomes, and unprecedented infrastructure development activity driving both residential and commercial furniture demand. Riyadh's status as the Kingdom's capital and commercial hub concentrates government procurement, corporate headquarters, and high-earning professionals who represent premium target demographics for online furniture retailers seeking customers with strong purchasing power and digital shopping fluency.

The region's share reflects both volume advantages from population density exceeding other regions and value premiums from affluent consumer segments willing to invest in quality furnishings that reflect their elevated lifestyle aspirations and social status. The Central Region encompassing Riyadh accounted for a major share of the broader furniture market in 2024, with the city issuing funds in contracts during 2025 across public-sector ministries, hospitals, and universities that subsequently drive residential furniture demand through employment growth and income appreciation. Mega-developments including New Murabba spanning 19 square kilometers, Avenues Riyadh, and King Salman Park create concentrated demand pulses as thousands of residential units reach completion simultaneously.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Online Furniture Market Growing?

Vision 2030 Megaproject Infrastructure Creating Sustained Residential and Commercial Demand

Saudi Arabia's Vision 2030 economic transformation agenda represents the fundamental growth driver for online furniture demand through its unprecedented scale of infrastructure investment and residential construction. The Kingdom's USD 150 billion construction spending allocation for 2025, generates systematic furniture requirements across residential developments, hospitality projects, and commercial facilities. Mega-initiatives including NEOM, Qiddiya, and Red Sea Development require comprehensive furniture procurement spanning luxury hotels, residential communities, and commercial spaces. The government's USD 40 billion commitment toward housing investments materializes through ROSHN's target of 400,000 residential units and continuous delivery of villa and apartment complexes. Riyadh alone witnesses over 70,000 new housing units under construction, each representing complete furniture package opportunities. These developments concentrate in master-planned communities that attract young professionals and families seeking modern lifestyles, demographics particularly receptive to online purchasing channels. The systematic nature of Vision 2030 delivery timelines provides predictable demand visibility that enables online retailers to optimize inventory management and logistics infrastructure investments.

Maturation of E-Commerce Infrastructure and Digital Payment Ecosystem

Saudi Arabia's digital commerce infrastructure has evolved dramatically, removing traditional barriers to online furniture purchasing through payment innovation, logistics enhancement, and technology platform sophistication. Buy-now-pay-later services through platforms fundamentally altered purchase dynamics by eliminating upfront payment barriers for high-ticket furniture items, enabling consumers to spread costs across installments while retailers capture sales that might otherwise be delayed or forgone. Contactless Mada debit cards interoperate with Apple Pay and Mada Pay for seamless checkout experiences, while merchant fee caps incentivize ubiquitous payment acceptance. Logistics infrastructure investments enhanced port capabilities support reliable delivery of bulky furniture items across the Kingdom. Together, these elements create a conducive ecosystem where online furniture purchasing becomes practical, convenient, and financially accessible. IMARC Group predicts that the Saudi Arabia e-commerce market is projected to attain USD 708.7 Billion by 2033.

Young, Urbanized Population with Digital-Native Behaviors and Evolving Lifestyle Preferences

Demographic dynamics position Saudi Arabia's population as ideally suited for online furniture market expansion through age composition, urbanization patterns, and technology fluency. Moreover, 71% of the Kingdom's population remains under 35 years old, representing cohorts raised with smartphone ubiquity and digital service expectations. This demographic naturally gravitates toward online shopping channels offering convenience, product variety, and price transparency advantages over traditional retail formats. Smartphone penetration approaching universal levels among younger demographics enables mobile-first shopping behaviors. This convergence of youth, urbanization, income growth, and technology fluency creates ideal conditions for online furniture retail expansion.

Market Restraints:

What Challenges the Saudi Arabia Online Furniture Market is Facing?

Heavy Import Dependency Exposing Market to Global Supply Chain Disruptions and Cost Volatility

Saudi Arabia's online furniture market faces structural vulnerability through limited domestic manufacturing capacity that necessitates reliance on international suppliers for both finished products and raw materials. Port congestion, Red Sea shipping route disruptions, and elevated import duties combine inflating landed costs, compressing retailer margins and elevating consumer prices. Three-week delays in customs clearance at congested ports complicate project timelines for hospitality and residential developments requiring coordinated furniture deliveries. While government initiatives through the Saudi Industrial Development Fund aim to scale domestic production capacity, meaningful impact requires years to materialize as factories establish operations and develop quality standards matching international competition.

Raw Material Price Volatility Creating Margin Pressure and Planning Uncertainty

Global commodity markets' inherent volatility in wood, metal, and polymer pricing directly impacts Saudi Arabia's furniture sector through the Kingdom's dependency on imported raw materials. Geopolitical tensions including the Russia-Ukraine conflict disrupted timber supply chains, triggering price spikes that manufacturers struggle to absorb without passing costs to consumers. Limited domestic forestry resources and metal production capacity leave the industry exposed to international price movements beyond local control. Currency exchange rate fluctuations against the US dollar further complicate cost management as many supplier contracts denominate in foreign currencies. Manufacturers holding minimal inventory face stock-out risks when container availability contracts, forcing emergency airfreight arrangements that erode profitability through premium transportation costs.

Last-Mile Delivery Infrastructure Gaps Constraining Geographic Market Penetration

Despite significant progress in e-commerce logistics, Saudi Arabia's online furniture market continues grappling with last-mile delivery challenges particularly pronounced in remote and secondary urban areas. Delivery failure rates approaching 40% in remote zones reflect inadequate transportation networks, limited warehousing density outside major cities, and coordination complexities for bulky furniture items requiring specialized handling. While pilot programs testing drone delivery and expansion of parcel locker networks show promise, these solutions remain nascent and geographically limited in deployment. Temperature-controlled warehousing essential for preserving furniture quality during extreme summer heat requires substantial capital investment that has yet to achieve comprehensive geographic coverage. AI route optimization and automated logistics systems are still developing, meaning many deliveries rely on manual coordination prone to delays and errors. Port congestion adding three weeks to customs clearance compounds timing unpredictability that frustrates consumers expecting prompt delivery after online purchases, potentially driving preference back toward physical retail where immediate product availability provides certainty.

Competitive Landscape:

Key players in Saudi Arabia’s online furniture market are adopting several strategies to stay competitive and meet evolving demands. A primary focus is enhancing digital experiences through improved website interfaces, mobile optimization, and AI-powered product recommendations that offer a more personalized shopping journey. Many businesses are integrating augmented reality (AR) tools, allowing customers to virtually place furniture in their homes before buying, which improves decision-making and reduces return rates. Logistics and last-mile delivery services are also being upgraded to ensure faster and more reliable shipping across the Kingdom. Companies are increasing their warehousing capacity and streamlining supply chains to manage inventory efficiently. Additionally, there is a heightened emphasis on sustainable practices, with more brands offering eco-friendly materials and modular furniture suited for smaller, modern living spaces. Customization options and locally inspired designs are gaining popularity, aligning with buyers’ desire for unique, functional, and culturally relevant furniture in line with modern Saudi lifestyles.

Saudi Arabia Online Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Plastic, Jade, Glass |

| Products Covered | Living Room Furniture, Bedroom Furniture, Office Furniture, Kitchen Furniture, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia online furniture market size was valued at USD 2,707.6 Million in 2025.

The Saudi Arabia online furniture market is expected to grow at a compound annual growth rate of 19.21% from 2026-2034 to reach USD 13,163.4 Million by 2034.

Wood dominated the market with a 46% share in 2025, driven by traditional aesthetic preferences, versatile design applications, and government support for domestic wooden furniture manufacturing through government funds.

Key factors driving the Saudi Arabia online furniture market include Vision construction spending and infrastructure pipeline creating sustained residential demand, e-commerce infrastructure maturation in digital transactions processed, and a young urbanized population with 71% under 35 years old exhibiting strong digital-native purchasing behaviors combined with urban developments and household formation requiring new homes annually.

Major challenges include heavy import dependency exposing the market to supply chain disruptions with landed costs inflation due to port congestion and elevated duties, raw material cost volatility particularly in wood and metal pricing creating margin pressure and planning uncertainty, and last-mile delivery infrastructure gaps resulting in delivery failure rates in remote zones despite drone pilots and parcel locker expansion efforts still developing comprehensive geographic coverage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)