Saudi Arabia Oral Hygiene Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Oral Hygiene Market Overview:

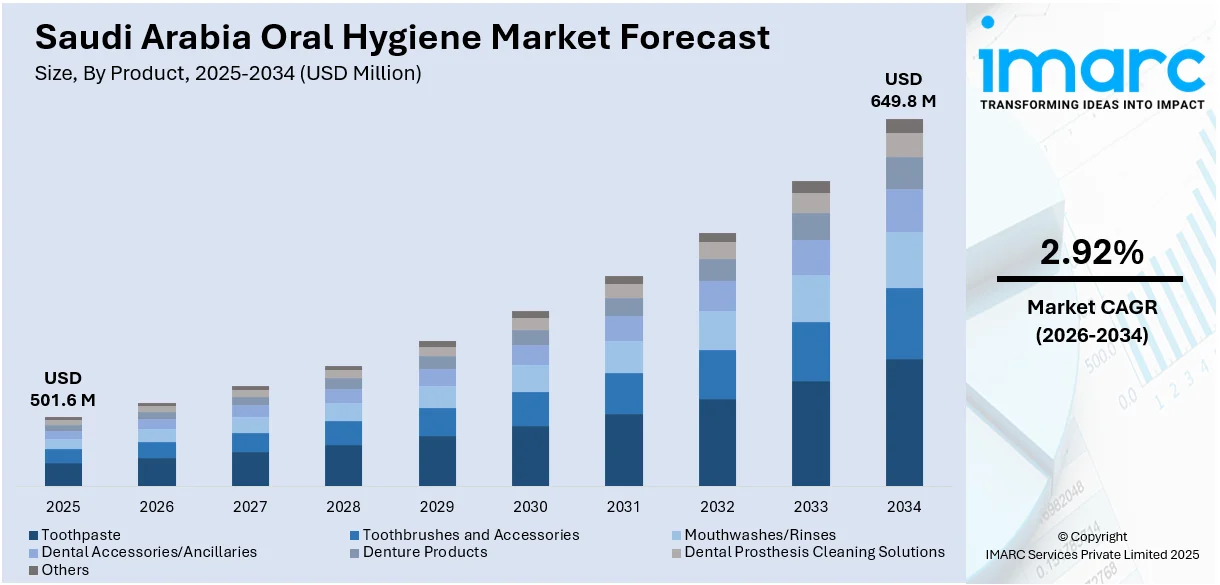

The Saudi Arabia oral hygiene market size reached USD 501.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 649.8 Million by 2034, exhibiting a growth rate (CAGR) of 2.92% during 2026-2034. The rising awareness regarding dental health, growing disposable incomes, expanding urban population, increasing availability of innovative oral care products, government health campaigns, and the influence of Western lifestyle habits are driving the demand for oral hygiene products in Saudi Arabia and encouraging consumers to adopt regular oral care routines and premium dental solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 501.6 Million |

| Market Forecast in 2034 | USD 649.8 Million |

| Market Growth Rate 2026-2034 | 2.92% |

Saudi Arabia Oral Hygiene Market Trends:

E-commerce Growth and Digitalization of the Oral Care

The rapid digital transformation of retail in Saudi Arabia is significantly influencing the oral hygiene market growth. According to an industry report, the country’s e-commerce market is projected to reach USD 708.7 Billion by 2033, registering a compound annual growth rate (CAGR) of 12.8% during 2025–2033. This expansion is reshaping consumer purchasing behavior across multiple sectors, including personal care. The increasing adoption of e-commerce platforms is making oral care products more accessible, with consumers appreciating the convenience, broader product selections, and frequent online promotional deals. The trend is further reinforced by the post-pandemic acceleration in online shopping behavior, especially for health and personal care items. In addition to this, global and local brands are adapting by enhancing their digital storefronts, offering subscription models for oral hygiene essentials, and using data analytics to personalize product recommendations. Online customer reviews, influencer endorsements, and digital health blogs are some of the factors shaping purchasing decisions. Moreover, interactive features like virtual dental consultations, oral health quizzes, and AI-based product selectors are further enriching the consumer journey. Retailers are also focusing on fast delivery logistics and bundling offers, such as family oral care packs or travel kits, to attract diverse consumer segments. Additionally, the integration of digital touchpoints is changing how consumers engage with oral care, thereby creating new expectations around availability, product transparency, and convenience in Saudi Arabia.

To get more information on this market Request Sample

Shift Towards Premium and Specialized Oral Care Products

In Saudi Arabia, consumers are increasingly gravitating towards premium oral care products that offer advanced formulations and targeted benefits, which is creating a positive Saudi Arabia oral hygiene market outlook. According to an industry report, in 2023, average monthly disposable income across households in the Kingdom stood at SAR 11,839 (about USD 3,196.53). This includes an average of SAR 18,056 for Saudi households and SAR 5,428 (about USD 1,465.56) for non-Saudi households. This rising disposable incomes, along with growing health awareness and greater exposure to international brands through both online and offline retail platforms, are key factors driving this shift to premium products. Also, products such as electric toothbrushes, whitening toothpaste, sensitivity-relief formulations, and natural ingredient-based mouthwashes are gaining significant traction. Consumers are not only seeking basic oral hygiene but also products that enhance aesthetics and provide specialized functions, such as anti-cavity, gum protection, or enamel strengthening. Moreover, brands are responding by expanding their portfolios to include fluoride-free variants, charcoal-based pastes, probiotic mouth rinses, and herbal formulations tailored to consumer preferences. The availability of these products through pharmacies, hypermarkets, and e-commerce channels is further accelerating their uptake. Additionally, promotional strategies, influencer marketing, and awareness campaigns about long-term oral health outcomes are encouraging trial and sustained use of premium options. These factors are collectively augmenting Saudi Arabia oral hygiene market share.

Saudi Arabia Oral Hygiene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, distribution channel, and application.

Product Insights:

- Toothpaste

- Toothbrushes and Accessories

- Mouthwashes/Rinses

- Dental Accessories/Ancillaries

- Denture Products

- Dental Prosthesis Cleaning Solutions

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes toothpaste, toothbrushes and accessories, mouthwashes/rinses, dental accessories/ancillaries, denture products, dental prosthesis cleaning solutions, and others.

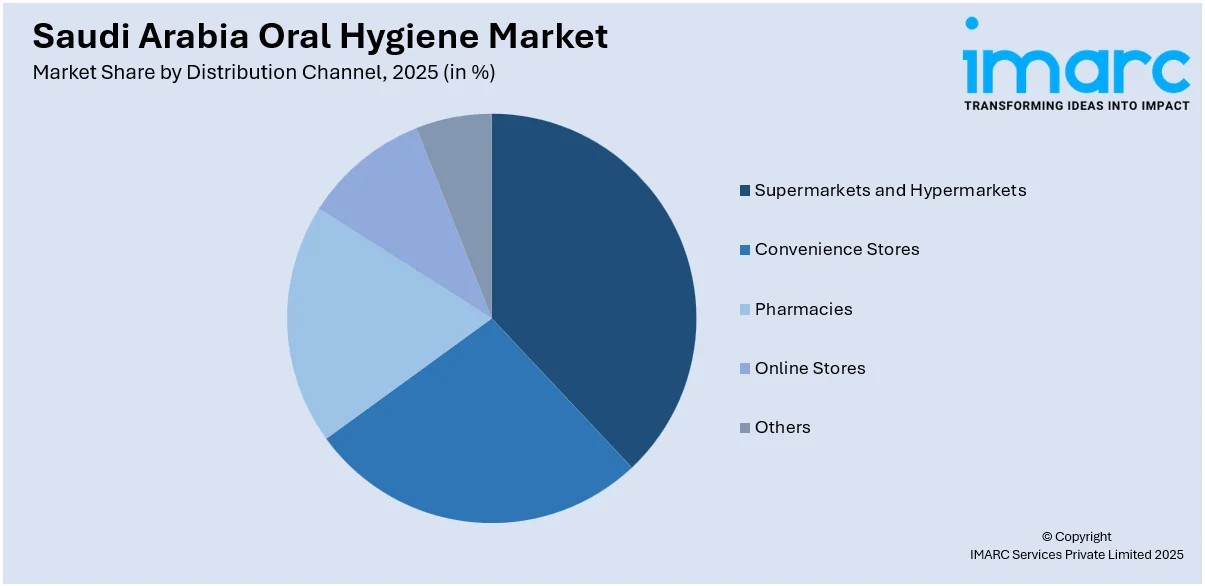

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies, online stores, and others.

Application Insights:

- Adults

- Kids

- Infants

The report has provided a detailed breakup and analysis of the market based on the application. This includes adults, kids, and infants.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Oral Hygiene Market News:

- On June 24, 2023, the Kingdom of Saudi Arabia inaugurated a mobile dental clinic near the Grand Mosque in Makkah to provide free dental services to Haj pilgrims. Operated by the Makkah Healthcare Cluster under the Ministry of Health, the clinic is staffed by 32 medical and operational personnel and offers 24-hour services throughout the Haj season. This initiative aims to address the lack of dental care facilities in the area, ensuring pilgrims receive necessary treatments without leaving the vicinity of the Grand Mosque.

- On February 12, 2024, Dentakay, a leading Turkish dental healthcare provider, inaugurated its first clinic in the GCC region, located in Riyadh, Saudi Arabia. This expansion aligns with Dentakay's global growth strategy and addresses the rising demand for advanced dental services in the Kingdom. The Riyadh clinic offers comprehensive dental care, including emergency procedures, routine check-ups, surgeries, and cosmetic treatments, staffed by a team of experienced dental professionals.

Saudi Arabia Oral Hygiene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toothpaste, Toothbrushes and Accessories, Mouthwashes/Rinses, Dental Accessories/Ancillaries, Denture Products, Dental Prosthesis Cleaning Solutions, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, Others |

| Applications Covered | Adults, Kids, Infants |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia oral hygiene market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia oral hygiene market on the basis of product?

- What is the breakup of the Saudi Arabia oral hygiene market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia oral hygiene market on the basis of application?

- What is the breakup of the Saudi Arabia oral hygiene market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia oral hygiene market?

- What are the key driving factors and challenges in the Saudi Arabia oral hygiene market?

- What is the structure of the Saudi Arabia oral hygiene market and who are the key players?

- What is the degree of competition in the Saudi Arabia oral hygiene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia oral hygiene market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia oral hygiene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia oral hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)