Saudi Arabia Organic Dairy Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Organic Dairy Market Summary:

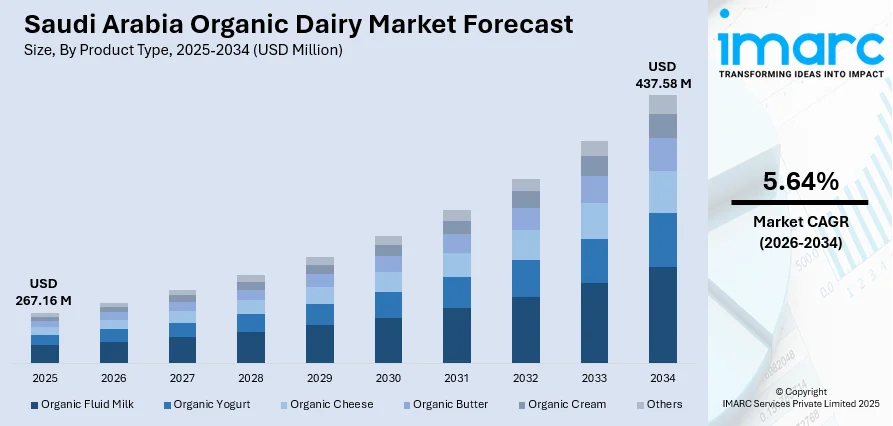

The Saudi Arabia organic dairy market size was valued at USD 267.16 Million in 2025 and is projected to reach USD 437.58 Million by 2034, growing at a compound annual growth rate of 5.64% from 2026-2034.

The Saudi Arabia organic dairy market is experiencing robust expansion fueled by increasing health consciousness among consumers who are seeking hormone-free, antibiotic-free, and pesticide-free dairy alternatives. The Kingdom's Vision 2030 initiative is providing significant impetus through subsidies, research funding, and certification programs aimed at bolstering organic production and sustainable agriculture practices. Rising urbanization, particularly in major metropolitan centers, such as Riyadh, Jeddah, and Dammam, combined with the growing disposable incomes, is accelerating the demand for premium organic dairy products.

Key Takeaways and Insights:

- By Product Type: Organic fluid milk dominates the market with a share of 42% in 2025, driven by the essential role of milk in the Saudi diet, strong consumer preference for natural and hormone-free options, and widespread availability across retail and foodservice channels.

- By Packaging Type: Pouches lead the market with a share of 38.74% in 2025, attributed to their cost-effectiveness, convenience for transportation and storage, and widespread consumer preference for flexible packaging solutions.

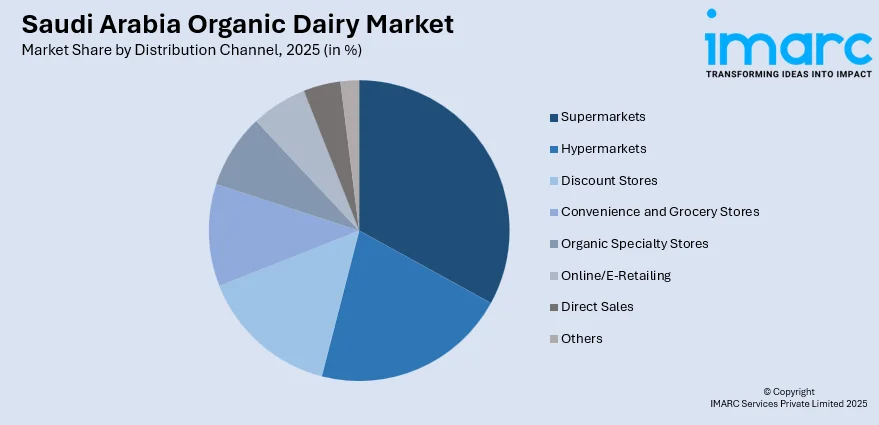

- By Distribution Channel: Supermarkets represent the largest segment with a market share of 33.85% in 2025, benefiting from extensive retail network expansion by major chains, superior product assortment, and enhanced consumer accessibility in urban centers.

- Key Players: The Saudi Arabia organic dairy market exhibits a moderately consolidated competitive landscape, with vertically integrated domestic dairy corporations competing alongside international organic food producers across diverse product categories.

To get more information on this market Request Sample

The Saudi Arabia organic dairy market is witnessing significant transformation, as consumer preferences are evolving towards healthier, more sustainable food options. The Ministry of Environment, Water and Agriculture launched a public awareness campaign for Organic Food Day 2024 in November, highlighting the importance of organic foods as safer, healthier dietary choices and demonstrating government commitment to promoting organic consumption. Health-conscious consumers are gravitating towards organic dairy products that align with their wellness aspirations. The expanding modern retail infrastructure, coupled with the proliferation of e-commerce platforms, is enhancing product accessibility and enabling organic dairy producers to connect with a broader consumer base across urban and rural regions.

Saudi Arabia Organic Dairy Market Trends:

Rising Health Consciousness Driving Organic Dairy Adoption

Saudi consumers are increasingly prioritizing health and wellness in their dietary choices, significantly influencing the organic dairy market trajectory. As per IMARC Group, the Saudi Arabia health and wellness market size reached USD 38,747.7 Million in 2025. The awareness about diet-related health issues, lifestyle diseases, and food safety concerns is propelling the demand for organic dairy products perceived as healthier alternatives. Consumers are seeking organic dairy options that offer hormone-free, antibiotic-free, and preservative-free formulations while delivering superior nutritional benefits.

Government Initiatives Fostering Sustainable Organic Agriculture

The Saudi government is actively promoting organic farming and sustainable agriculture through comprehensive policy frameworks aligned with Vision 2030 objectives. In October 2025, Abdulrahman Alfadley, Minister of Environment, Water, and Agriculture, inaugurated the 42nd Saudi Agriculture Exhibition in Riyadh. Minister Alfadley toured the exhibition, which showcased various agricultural sectors, such as plant production, organic farming, livestock (including poultry and dairy), food processing and packaging, as well as aquaculture. Government-funded research programs are supporting innovations in dairy production, while subsidies for organic fertilizers and agricultural inputs are reducing barriers for farmers transitioning to organic practices.

Expansion of Premium and Functional Organic Dairy Products

The Saudi organic dairy market is witnessing growing diversification with manufacturers introducing premium and functional organic variants to meet evolving consumer expectations. There is rising demand for organic probiotic yogurts, lactose-free organic milk, and protein-enriched organic dairy beverages that combine health benefits with convenience. The working population is increasingly seeking ready-to-consume organic dairy formats that deliver nutritional value without compromising on quality. As per CEIC, in June 2025, the number of employed persons in Saudi Arabia was recorded at 18,179,370.000 individuals.

How Vision 2030 is Transforming the Saudi Arabia Organic Dairy Market:

Vision 2030 is reshaping Saudi Arabia’s organic dairy market by prioritizing food security, local production, and healthy living. The policy focus on agricultural diversification is encouraging investments in modern dairy farms, cold-chain logistics, and certified organic feeding systems, reducing reliance on imports. Government support for agritech, water-efficient farming, and sustainable fodder cultivation is making organic dairy more viable in an arid climate. At the same time, public health campaigns under Vision 2030 are increasing awareness about clean-label, chemical-free foods, leading consumers towards organic milk, yogurt, and cheese. Retail sector modernization and tourism development are also expanding premium food demand through supermarkets, hotels, and wellness-focused outlets. Moreover, entrepreneurship programs and funding incentives are helping local startups enter organic dairy processing and branding.

Market Outlook 2026-2034:

The Saudi Arabia organic dairy market is positioned for sustained revenue growth, supported by favorable demographic trends, expanding retail infrastructure, and strengthening regulatory frameworks. The market generated a revenue of USD 267.16 Million in 2025 and is projected to reach a revenue of USD 437.58 Million by 2034, growing at a compound annual growth rate of 5.64% from 2026-2034. Government initiatives promoting food security and self-sufficiency under Vision 2030 are creating enabling conditions for domestic organic dairy production expansion. The growing penetration of organized retail is enhancing product accessibility, fueling the market expansion.

Saudi Arabia Organic Dairy Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Organic Fluid Milk | 42% |

| Packaging Type | Pouches | 38.74% |

| Distribution Channel | Supermarkets | 33.85% |

Product Type Insights:

- Organic Fluid Milk

- Organic Yogurt

- Organic Cheese

- Organic Butter

- Organic Cream

- Others

Organic fluid milk dominates with a market share of 42% of the total Saudi Arabia organic dairy market in 2025.

Organic fluid milk holds prominence, reflecting the fundamental importance of milk in the Saudi diet and the growing consumer preference for natural, hormone-free options. The segment benefits from strong cultural traditions that prioritize milk consumption across all age groups, from children to the elderly, as a primary source of calcium and essential nutrients. According to data from the General Authority for Statistics (GASTAT), the senior demographic, those 65 years and older, represented 2.8%, or 988,000 individuals, in 2024.

Saudi consumers are increasingly recognizing the health benefits of organic fluid milk, including the absence of synthetic hormones, antibiotics, and pesticides that are commonly associated with conventional dairy production. This awareness is particularly pronounced among young families and health-conscious professionals who are willing to pay higher prices for items that align with their wellness aspirations. Major dairy producers are responding to this demand by expanding their organic fluid milk offerings with various fat content options and fortified variants.

Packaging Type Insights:

- Pouches

- Tetra-packs

- Bottles

- Cans

- Others

Pouches lead with a share of 38.74% of the total Saudi Arabia organic dairy market in 2025.

Pouches are widely adopted due to their cost-effectiveness, convenience, and practical advantages. The flexible packaging format offers significant benefits in terms of transportation efficiency, storage optimization, and reduced environmental footprint compared to rigid packaging alternatives. Saudi consumers appreciate the convenience of pouch packaging, which allows easy handling, portion control, and minimal storage space requirements in household refrigerators.

The lightweight nature of pouches also reduces shipping costs and carbon emissions, aligning with growing sustainability consciousness among consumers and manufacturers alike. Major dairy producers have invested significantly in advanced pouch filling technologies to ensure product freshness, extended shelf life, and contamination prevention. The pouch segment's growth trajectory is being reinforced by technological innovations in flexible packaging materials and manufacturing processes. The Saudi market is witnessing growing adoption of stand-up pouches with convenient spouts and resealable features that enhance consumer experience while maintaining product integrity. The cost advantages of pouch packaging enable manufacturers to offer competitively priced organic dairy products, supporting market penetration among price-sensitive consumer segments.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets

- Hypermarkets

- Discount Stores

- Convenience and Grocery Stores

- Organic Specialty Stores

- Online/E-Retailing

- Direct Sales

- Others

Supermarkets exhibit a clear dominance with a 33.85% share of the total Saudi Arabia organic dairy market in 2025.

Supermarkets have become the leading distribution channel for organic dairy in Saudi Arabia, leveraging their extensive retail networks, superior product assortment, and strong consumer trust. Major supermarket chains, including Panda, Danube, and Al Othaim, have significantly expanded their organic and health-focused product sections to capture the growing demand for premium dairy alternatives. These retail formats offer consumers the advantage of one-stop shopping, competitive pricing through economies of scale, and convenient locations in residential areas across major cities. Supermarkets have also invested in dedicated refrigeration infrastructure and trained staff to ensure proper handling and storage of organic dairy products, maintaining quality from shelf to home.

The supermarket channel's leadership position is further reinforced by strategic initiatives to enhance the organic shopping experience and build consumer loyalty. Retail chains are increasing their partnerships with local organic producers and implementing private label organic dairy lines to offer attractive price points while maintaining quality standards. The integration of loyalty programs, promotional activities, and consumer education initiatives within supermarkets is driving repeat purchases and supporting market growth. As organized retail continues its expansion across secondary cities and emerging urban centers, the supermarket channel is expected to maintain its dominant position in organic dairy distribution.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region, anchored by Riyadh, holds prominence due to its substantial population concentration, high purchasing power, and advanced retail infrastructure. The region benefits from proximity to major dairy production facilities and robust cold chain logistics networks that ensure product freshness and availability across diverse retail channels.

The Western Region, encompassing Jeddah, Makkah, and Medina, represents a significant market for organic dairy products influenced by tourism, cultural diversity, and international consumer preferences. The region's commercial hub status and growing expatriate population are driving the demand for premium organic dairy options across retail and foodservice channels.

The Eastern Region, including Dammam, Al Khobar, and Jubail, accounts for substantial organic dairy consumption supported by economic prosperity, industrial development, and diverse population demographics. The region's strategic port access facilitates the import of specialized organic ingredients while its industrial base supports efficient distribution across neighboring provinces.

The Southern Region, including Abha, Jizan, and Najran, represents an emerging market for organic dairy products with growth opportunities driven by improving retail infrastructure and rising health awareness. The region's agricultural heritage and rising urbanization are creating favorable conditions for organic dairy market expansion.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Organic Dairy Market Growing?

Rising Health Consciousness and Wellness-Oriented Consumer Behavior

The Saudi Arabia organic dairy market is experiencing robust growth driven by increasing health consciousness among consumers who are actively seeking safer, healthier, and more nutritious food alternatives. The awareness of diet-related health conditions, including obesity, diabetes, and cardiovascular diseases, has prompted Saudi consumers to reevaluate their dietary choices and gravitate toward organic products that offer freedom from synthetic chemicals and artificial additives. As per the International Diabetes Federation, 23.1% of the total Saudi Arabia population was affected by diabetes in 2024. This health crisis is compelling consumers to prioritize organic dairy products that deliver superior nutritional profiles while minimizing exposure to potentially harmful substances. The perception of organic dairy as a premium, trustworthy option is particularly strong among young families with children, where parents are increasingly willing to invest in healthier food options for their households.

Government Support Through Vision 2030 and Agricultural Development Initiatives

Government support under Vision 2030 and agricultural development initiatives is strongly driving the growth of the organic dairy market in Saudi Arabia by improving both production capacity and market readiness. Authorities are encouraging domestic dairy farming through financial incentives, low-interest loans, and subsidies for adopting sustainable and organic practices. Investments in modern irrigation systems, climate-controlled barns, and advanced feeding technologies are helping organic dairy farms overcome harsh climatic conditions and water scarcity. Support for local fodder cultivation and import facilitation of organic feed is also reducing operational risks for producers. In parallel, regulatory frameworks are being strengthened to improve organic certification, quality control, and product traceability, which builds consumer trust in organic labels. Infrastructure development for cold storage, logistics, and food processing zones further enables smooth distribution of perishable organic dairy products. Overall, these initiatives are lowering entry barriers, reducing costs, and making organic dairy a commercially attractive segment in Saudi Arabia.

Expanding Modern Retail Infrastructure and E-commerce Penetration

The rapid expansion of modern retail formats and digital commerce platforms is significantly enhancing the accessibility and availability of organic dairy products across Saudi Arabia. Major retail chains are investing heavily in store expansion, with Lulu Group planning to launch 100 hypermarkets in Saudi Arabia in 2023. Online grocery platforms and quick-commerce apps are making organic milk, yogurt, and cheese easily available across urban and semi-urban areas, removing geographic limitations. Digital storefronts also allow brands to highlight certifications, sourcing practices, and nutritional benefits, helping consumers make informed choices and build trust. Subscription models and home delivery options are further boosting repeat purchases, especially among busy urban families. Moreover, data-driven marketing and personalized promotions on e-commerce platforms are increasing trial rates.

Market Restraints:

What Challenges is the Saudi Arabia Organic Dairy Market Facing?

High Production Costs and Premium Pricing Constraints

The Saudi Arabia organic dairy market is facing challenges related to the higher production costs associated with organic farming practices, which result in premium pricing that may limit accessibility for price-sensitive consumer segments. Organic dairy production requires specialized feed, stringent animal welfare standards, and certification compliance that significantly increase operational expenses compared to conventional dairy farming.

Limited Domestic Organic Farming Infrastructure

The organic dairy market is constrained by the limited scale of domestic organic farming operations and the Kingdom's reliance on imported organic ingredients and raw materials. Saudi Arabia's arid climate and water scarcity present inherent challenges for expanding organic agricultural production, requiring significant investments in sustainable farming technologies and irrigation systems.

Supply Chain and Cold Storage Challenges

The organic dairy market encounters logistical challenges related to maintaining product integrity throughout the supply chain, particularly in ensuring consistent cold storage conditions from production to consumption. The specialized handling requirements for organic dairy products necessitate investments in dedicated transportation and storage infrastructure that may not be universally available across all regions.

Competitive Landscape:

The Saudi Arabia organic dairy market exhibits a moderately consolidated competitive structure, characterized by the presence of established domestic dairy corporations, vertically integrated food conglomerates, and international organic food specialists. Leading market participants are leveraging their extensive production capabilities, distribution networks, and brand recognition to capture market share in the growing organic segment. Companies are focusing on product innovations, quality certification, and sustainability initiatives to differentiate their offerings and build consumer trust. Strategic investments in organic production facilities, cold chain infrastructure, and digital marketing capabilities are enabling market leaders to strengthen their competitive positions. The market is witnessing increased collaboration between dairy producers, retail partners, and technology providers to develop integrated solutions that enhance product quality, supply chain efficiency, and consumer engagement across diverse market segments.

Saudi Arabia Organic Dairy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Organic Fluid Milk, Organic Yogurt, Organic Cheese, Organic Butter, Organic Cream, Others |

| Packaging Types Covered | Pouches, Tetra-packs, Bottles, Cans, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discount Stores, Convenience and Grocery Stores, Organic Specialty Stores, Online/E-Retailing, Direct Sales, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia organic dairy market size was valued at USD 267.16 Million in 2025.

The Saudi Arabia organic dairy market is expected to grow at a compound annual growth rate of 5.64% from 2026-2034 to reach USD 437.58 Million by 2034.

Organic fluid milk dominates the market with 42% share, driven by the essential role of milk in the Saudi diet, strong cultural traditions prioritizing dairy consumption, and the growing consumer preference for hormone-free and antibiotic-free natural dairy options.

Key factors driving the Saudi Arabia organic dairy market include rising health consciousness among consumers seeking safer food alternatives, government support through Vision 2030 agricultural initiatives and subsidies, expanding modern retail infrastructure, growing e-commerce penetration, and increasing awareness about organic product benefits.

Major challenges include higher production costs associated with organic farming practices resulting in premium pricing, limited domestic organic farming infrastructure and reliance on imports, arid climate conditions constraining agricultural expansion, cold chain logistics requirements, and consumer education needs regarding organic certification standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)