Saudi Arabia OSS & BSS Market Size, Share, Trends and Forecast by Component, OSS & BSS Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2026-2034

Saudi Arabia OSS & BSS Market Overview:

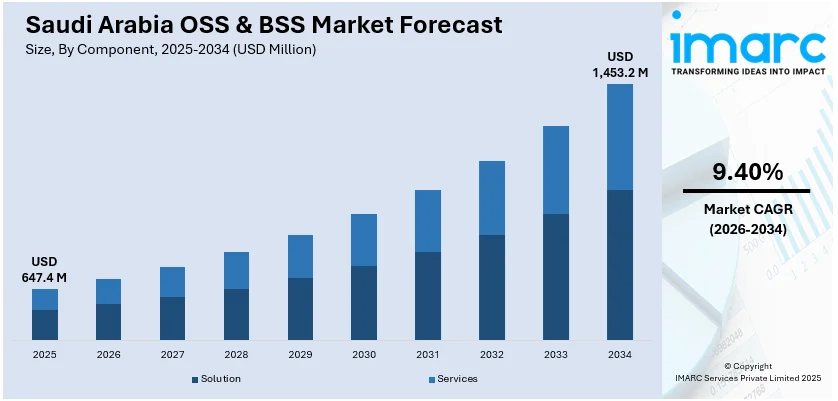

The Saudi Arabia OSS & BSS market size reached USD 647.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,453.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.40% during 2026-2034. The market is expanding owing to increased mobile network penetration, substantial investments in digital infrastructure, the nation's strategic push toward smart city initiatives, and the growing need to manage complex networks, enhance customer experiences, and support the rapid deployment of 5G technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 647.4 Million |

| Market Forecast in 2034 | USD 1,453.2 Million |

| Market Growth Rate 2026-2034 | 9.40% |

Saudi Arabia OSS & BSS Market Trends:

Increased Adoption of 5G and Smart Cities Initiatives

Saudi Arabia’s OSS and BSS market is experiencing strong growth, fueled by the rapid deployment of 5G networks and government-led initiatives under Vision 2030. The rollout of advanced 5G infrastructure, alongside mega smart city projects like NEOM, is creating a surge in demand for scalable, real-time OSS/BSS solutions capable of managing complex networks, high data traffic, and integrated services across sectors. These platforms play a vital role in automating operations, maintaining service quality, and supporting customer-centric innovations. At 77%, Saudi Arabia’s 5G coverage in 2024 was almost double the global average of 42%, significantly increasing the need for advanced analytics and network monitoring. Moreover, Vision 2030’s focus on seamless digital integration across public services and energy systems further underscores the importance of robust OSS/BSS capabilities. Moreover, Saudi Arabia’s telecom infrastructure investments are growing and the broader telecom market is rapidly expanding, expected to reach USD 22.7 billion by 2033, exhibiting a growth rate (CAGR) of 3.4% from 2025 to 2033. As such, the OSS & BSS market is well-positioned for sustained growth in Saudi Arabia, driven by digital transformation and the evolving needs of its next-generation communication networks.

To get more information on this market Request Sample

Cloud-Native Transformation and Network Virtualization

The transition to cloud-native architectures and network virtualization is another significant trend driving growth within Saudi Arabia's OSS/BSS industry. Telecom operators are increasingly turning to cloud-based solutions to upgrade their OSS/BSS infrastructure, with the goal of improving operational efficiency, scalability, and cost savings. Network Functions Virtualization (NFV) and Software-Defined Networking (SDN) enable network operators to design more flexible and cost-effective network infrastructures. This is critical to meeting the increasing demand for data-intensive services such as 5G, IoT, and cloud-based apps. Virtualized networks provide better flexibility, automated resource management, and improved performance, all of which are used by OSS/BSS systems. Additionally, a growing number of telecom companies are prioritizing NFV and SDN technologies, underscoring the Kingdom’s push toward more agile and scalable networks. This transformation not only boosts operational efficiency but also enables telecom operators to provide innovative services to meet the growing demand for digital services.

Saudi Arabia OSS & BSS Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, OSS & BSS solution type, deployment mode, organization size, industry vertical, and region.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

OSS & BSS Solution Type Insights:

- Network Planning and Design

- Service Delivery

- Service Fulfillment

- Service Assurance

- Billing and Revenue Management

- Network Performance Management

- Customer and Product Management

- Others

A detailed breakup and analysis of the market based on the OSS & BSS solution type have also been provided in the report. This includes network planning and design, service delivery, service fulfillment, service assurance, billing and revenue management, network performance management, customer and product management, and others.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

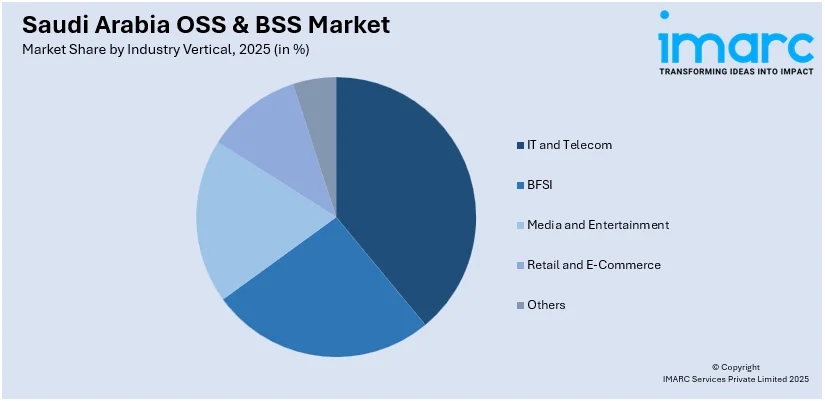

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- BFSI

- Media and Entertainment

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecom, BFSI, media and entertainment, retail and e-commerce, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia OSS & BSS Market News:

- March 2025: Saudi Telecom Company expanded its 5G services to 75 cities by modernizing its core network and data centers with Juniper Networks’ 400G routing solutions. This upgrade enhances the company’s OSS and BSS, increasing network capacity and efficiency. Key improvements include a 1,340% boost in 100G capacity, an 864-port increase in 400G capacity per rack, and significant reductions in power consumption and physical space requirements.

- March 2025: Zain KSA completed a comprehensive digital transformation with Netcracker Technology, overhauling its OSS and BSS across all business lines. This initiative, leveraging the Netcracker Digital Platform, transitioned Zain KSA to a cloud-native, AI-driven infrastructure, enhancing customer experiences and operational efficiency.

- November 2024: Aramco Digital announced that is it in talks to invest USD 1 billion in telecom software firm Mavenir. The deal supports Mavenir’s Open RAN and 5G/6G innovations while a separate USD 200 million joint venture could create Saudi Arabia’s first Open RAN R&D center.

Saudi Arabia OSS & BSS Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| OSS & BSS Solution Types Covered | Network Planning and Design, Service Delivery, Service Fulfillment, Service Assurance, Billing and Revenue Management, Network Performance Management, Customer and Product Management, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | IT and Telecom, BFSI, Media and Entertainment, Retail and E-Commerce, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia OSS & BSS market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia OSS & BSS market on the basis of component?

- What is the breakup of the Saudi Arabia OSS & BSS market on the basis of OSS & BSS solution type?

- What is the breakup of the Saudi Arabia OSS & BSS market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia OSS & BSS market on the basis of organization size?

- What is the breakup of the Saudi Arabia OSS & BSS market on the basis of industry vertical?

- What are the various stages in the value chain of the Saudi Arabia OSS & BSS market?

- What are the key driving factors and challenges in the Saudi Arabia OSS & BSS market?

- What is the structure of the Saudi Arabia OSS & BSS market and who are the key players?

- What is the degree of competition in the Saudi Arabia OSS & BSS market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia OSS & BSS market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia OSS & BSS market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia OSS & BSS industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)