Saudi Arabia Oxygen Cylinders Market Size, Share, Trends and Forecast by Type, Material Type, Source, Sales Channel, and Region, 2026-2034

Saudi Arabia Oxygen Cylinders Market Overview:

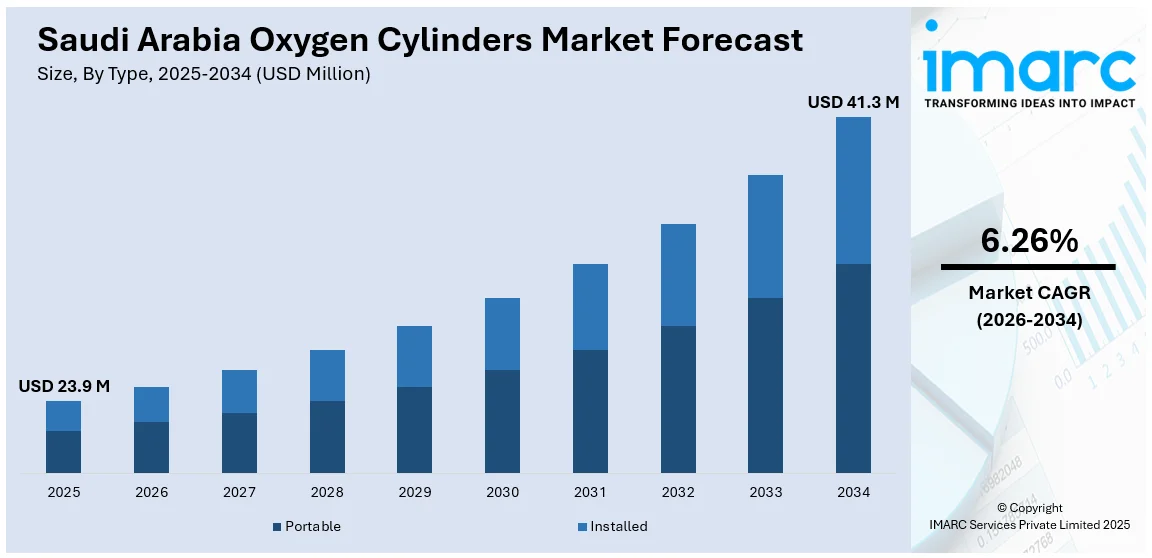

The Saudi Arabia oxygen cylinders market size reached USD 23.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 41.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.26% during 2026-2034. The market is witnessing rapid growth due to the rise in the incidence of chronic respiratory conditions, including chronic obstructive pulmonary disease (COPD) and asthma. Several advances in medical technology have also led to the introduction of portable and user-friendly oxygen delivery systems, thus driving the Saudi Arabia oxygen cylinders market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 23.9 Million |

| Market Forecast in 2034 | USD 41.3 Million |

| Market Growth Rate 2026-2034 | 6.26% |

Saudi Arabia Oxygen Cylinders Market Trends:

Home Healthcare Services Expansion

In Saudi Arabia, there is an observed trend toward home healthcare services due to the rising occurrence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma. The trend has resulted in a burgeoning demand for home-based oxygen therapy, prompting the utilization of portable oxygen cylinders. Improved medical technology has made it possible to create lightweight and easy-to-handle portable oxygen cylinders, making it easier for patients to move around comfortably. Recently, in January 2025, the Ministry of Health, via health clusters, broadened home healthcare services across the Kingdom, with the goal of enhancing quality of life, patient experience, and offering extensive treatment options. The ministry stated that essential home care services encompass wound and pressure sore care, management of chronic illnesses, home visits, post-surgery assistance, oral and dental health, and IV therapy. According to the Saudi Press Agency, the total number of individuals receiving various home care services has surpassed the amount of 58,000 active cases within a year, with over 71,000 beneficiaries since the beginning of the service. These services are offered by 244 home healthcare agencies, employing over 2,700 specialized personnel. Hence, the government's efforts to encourage home healthcare as part of its Vision 2030 initiative further endorse this trend, with the goal of minimizing hospital readmissions and offering patients more individualized care options. As a result, the market for portable oxygen cylinders is seeing substantial growth, mirroring a larger shift in healthcare delivery toward more patient-focused models.

To get more information on this market Request Sample

Technological Innovations in Oxygen Delivery Systems

Technological progress is a central factor in influencing the Saudi Arabian oxygen cylinders market. Technologies like the invention of portable oxygen concentrators and advanced gas delivery systems are making oxygen therapy more efficient and safer. These technologies facilitate continuous oxygen delivery without requiring multiple cylinder replacements, solving problems around oxygen supply deficits and logistics complications. Furthermore, the integration of smart technologies in oxygen delivery systems enables real-time monitoring of oxygen levels and usage patterns, providing healthcare providers with valuable data to optimize treatment plans. Such technological progress not only improves patient outcomes but also contributes to the overall sustainability and effectiveness of oxygen therapy in the Kingdom.

Government Initiatives and Healthcare Infrastructure Development

The government's focus on improving the healthcare infrastructure is having a profound impact on the Saudi Arabia oxygen cylinders market growth. In the wake of Vision 2030, massive investments are being dedicated to upgrading healthcare centers, increasing hospital capacities, and enhancing the availability of medical services in the nation. All this growth requires more medical gas supplies, including oxygen, to ensure that the increased demand in both public and private sectors of healthcare is fulfilled. Moreover, the government's emphasis on regulatory reforms and standardization guarantees the quality and safety of medical gases, promoting a more dependable supply chain. While these efforts aid in the expansion of the oxygen cylinders market, they also help improve the overall delivery of healthcare in Saudi Arabia.

Saudi Arabia Oxygen Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, material type, source, and sales channel.

Type Insights:

- Portable

- Installed

The report has provided a detailed breakup and analysis of the market based on the type. This includes portable and installed.

Material Type Insights:

- Stainless Steel

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type has also been provided in the report. This includes stainless steel, aluminum, and others.

Source Insights:

- Import

- Domestic

The report has provided a detailed breakup and analysis of the market based on the source. This includes import and domestic.

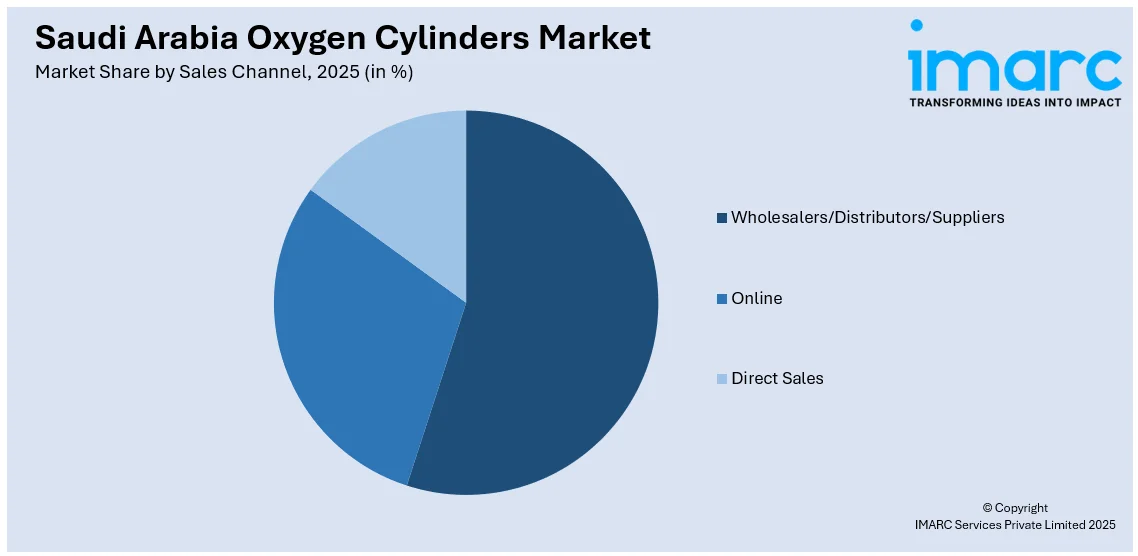

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Wholesalers/Distributors/Suppliers

- Online

- Direct Sales

A detailed breakup and analysis of the market based on the sales channel has also been provided in the report. This includes wholesalers/distributors/suppliers, online, and direct sales.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Oxygen Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable, Installed |

| Material Types Covered | Stainless Steel, Aluminum, Others |

| Sources Covered | Import, Domestic |

| Sales Channels Covered | Wholesalers/Distributors/Suppliers, Online, Direct Sales |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia oxygen cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia oxygen cylinders market on the basis of type?

- What is the breakup of the Saudi Arabia oxygen cylinders market on the basis of material type?

- What is the breakup of the Saudi Arabia oxygen cylinders market on the basis of source?

- What is the breakup of the Saudi Arabia oxygen cylinders market on the basis of sales channel?

- What is the breakup of the Saudi Arabia oxygen cylinders market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia oxygen cylinders market?

- What are the key driving factors and challenges in the Saudi Arabia oxygen cylinders market?

- What is the structure of the Saudi Arabia oxygen cylinders market and who are the key players?

- What is the degree of competition in the Saudi Arabia oxygen cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia oxygen cylinders market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia oxygen cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia oxygen cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)