Saudi Arabia Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2026-2034

Saudi Arabia Pallet Market Summary:

The Saudi Arabia pallet market size was valued at USD 642.75 Million in 2025 and is projected to reach USD 987.45 Million by 2034, growing at a compound annual growth rate of 4.89% from 2026-2034.

The pallet market serves as a critical infrastructure component supporting the kingdom's ambitious logistics modernization and economic diversification initiatives. Additionally, driven by expanding warehousing facilities, flourishing e-commerce penetration, and sophisticated supply chain requirements across industrial sectors, the market demonstrates robust momentum aligned with Vision 2030 objectives promoting non-oil economic activities, regional trade connectivity, and advanced material handling capabilities throughout the kingdom's evolving distribution networks. Apart from this, the growing food security programs is expanding the Saudi Arabia pallet market share.

Key Takeaways and Insights:

- By Type: Wood dominates the market with a share of 54% in 2025, attributed to their cost-effectiveness, repairability, load-bearing strength, and widespread acceptance across traditional and modern logistics operations throughout the kingdom's diverse industrial landscape.

- By Application: Food and beverages lead the market with a share of 39% in 2025, driven by stringent hygiene requirements, cold chain expansion, growing retail modernization, and increasing consumer demand for packaged goods across Saudi Arabia's rapidly urbanizing population centers.

- By Structural Design: Block represents the largest segment with a market share of 56% in 2025, owing to their superior four-way forklift access, enhanced load distribution capabilities, and compatibility with automated warehouse systems increasingly deployed throughout the kingdom's logistics infrastructure.

- By Region: Northern and central region leads the market with a share of 48% in 2025, reflecting Riyadh's industrial concentration, major distribution hubs, government procurement activities, and strategic positioning as the kingdom's commercial nerve center connecting diverse regional markets.

- Key Players: The Saudi Arabian pallet market features a competitive landscape characterized by established local manufacturers, international suppliers, and specialized recycling enterprises competing across quality tiers, sustainability credentials, and customization capabilities to serve diverse industrial requirements. Some of the key players include Al Moajil Holding, Al Rashed Wood Products Factory, AlDhana Wood Industries Factory, KraftPal Technologies, PalletBiz, and RePall.

Saudi Arabia's pallet market expansion reflects the kingdom's transformation into a regional logistics powerhouse, supported by substantial infrastructure investments in ports, airports, and inland terminals that facilitate growing import-export volumes. The market benefits from increasing warehouse automation adoption, particularly in Jeddah Islamic Port and King Khalid International Airport cargo facilities, where standardized pallet systems enable efficient material handling and inventory management. The sector also experiences momentum from expanding pharmaceutical cold chain networks, automotive parts distribution centers, and construction material supply chains that require durable, standardized load unitization solutions. Furthermore, the government's focus on developing industrial cities like Jubail and Yanbu creates sustained demand for pallet systems supporting petrochemical, manufacturing, and mining operations across the kingdom's diversifying economic base. Moreover, Saudi Arabia has granted 1,346 new industrial licenses in 2024, drawing in more than SR50 billion ($13.3 billion) in fresh investments. Investments from the private sector in industrial cities and zones reached SR1.9 trillion, and there were 1.09 million licensed workers in the sector, reflecting a 36 percent Saudization rate, according to the Kingdom’s Ministry of Industry and Mineral Resources analysis. The latest statistics align with the country's initiative to revamp its industrial sector, aiming to increase the number of factories to 36,000 by 2035, including 4,000 that will be fully automated. The objective is a component of the Kingdom's plan to promote a vibrant, innovation-focused industrial sector.

Saudi Arabia Pallet Market Trends:

Sustainable Material Innovation and Circular Economy Integration

The Saudi Arabian pallet market witnesses accelerating adoption of environmentally conscious alternatives and recycling programs as organizations align with national sustainability frameworks and corporate responsibility commitments. Manufacturers increasingly introduce corrugated paper pallets for lightweight shipments, recycled plastic variants with extended service life, and refurbishment services extending wood pallet utility. This trend reflects growing environmental awareness among logistics providers and retailers who recognize reputational benefits alongside operational cost savings through reduced disposal expenses and landfill diversion strategies. In 2024, DP World and the Saudi Ports Authority, referred to as Mawani, started building a new SR900 million ($250 million) logistics park at Jeddah Islamic Port. The center will offer advanced storage and distribution services, while also enhancing trade in Saudi Arabia and the surrounding area. The 415,000-square-meter greenfield site will include 185,000 square meters of warehouse space and an extensive multi-purpose storage area, establishing it as the largest integrated logistics park in the Kingdom. It will possess the capability for over 390,000 pallet slots, providing clients with an effective system for the smooth movement of products to and from Jeddah.

Smart Pallet Technology and IoT Integration

Advanced tracking capabilities emerge as logistics operators deploy pallets embedded with RFID tags, GPS sensors, and condition monitoring systems that provide real-time visibility throughout supply chains. These intelligent units enable predictive maintenance scheduling, theft prevention, temperature monitoring for sensitive cargo, and automated inventory reconciliation across warehouse networks. The technology adoption particularly accelerates among pharmaceutical distributors, high-value electronics logistics providers, and cold chain operators serving Saudi Arabia's expanding healthcare and perishable goods distribution requirements. In 2025, Acme showcased its latest system for high-throughput pallet storage at the Saudi Warehousing & Logistics Expo from May 27 to 29 at the Riyadh International Convention & Exhibition Center

Customization and Industry-Specific Design Solutions

Pallet manufacturers increasingly develop specialized configurations addressing unique sectoral requirements including chemical-resistant materials for petrochemical handling, heavy-duty metal variants for construction equipment transport, and hygiene-certified designs for food processing facilities. This trend toward application-specific engineering reflects sophisticated customer demands for optimized load configurations, compatibility with automated storage systems, and compliance with international shipping standards facilitating the kingdom's growing export activities across manufacturing and agricultural sectors. In the third quarter of 2025, Saudi Arabia's overall international trade hit SR540.5 billion ($144.3 billion), reflecting an annual increase of 8.6 percent, or SR43 billion, compared to SR497.5 billion during the same timeframe last year, as reported by the latest international trade bulletin from the General Authority for Statistics. Merchandise exports represented 56.1 percent of the total, amounting to SR303.3 billion, whereas imports constituted 43.9 percent, valued at SR237.2 billion, leading to a trade surplus of SR66.1 billion.

How Vision 2030 is Transforming the Saudi Arabia Pallet Market:

Saudi Vision 2030 is reshaping the pallet market in Saudi Arabia by accelerating industrial growth, logistics expansion, and local manufacturing. Large-scale infrastructure projects, new industrial zones, and giga projects like NEOM and the Red Sea Project are driving higher movement of construction materials, food products, and consumer goods, all of which depend on pallets for storage and transport. The push to localize manufacturing has encouraged domestic pallet production, reducing reliance on imports and supporting SMEs. Growth in warehousing, cold storage, and e-commerce logistics has increased demand for standardized, durable pallets, especially wooden and plastic variants. Sustainability goals under Vision 2030 are also influencing material choices, with rising interest in recyclable pallets and reuse models. Stricter logistics efficiency targets and improved port and rail connectivity are raising pallet turnover rates and quality requirements. Together, these shifts are turning pallets from a basic handling item into a critical component of Saudi Arabia’s modern supply chain.

Market Outlook 2026-2034:

The Saudi Arabian pallet market demonstrates promising expansion prospects underpinned by accelerating warehouse construction, particularly in strategic economic zones and logistics parks supporting regional distribution ambitions. Infrastructure megaprojects including NEOM's cargo facilities, Red Sea ports development, and nationwide cold storage network expansion create sustained demand for standardized material handling solutions. The market generated a revenue of USD 642.75 Million in 2025 and is projected to reach a revenue of USD 987.45 Million by 2034, growing at a compound annual growth rate of 4.89% from 2026-2034. The market trajectory benefits from increasing manufacturing localization initiatives, growing pharmaceutical production, and expanding agricultural processing capacity requiring sophisticated supply chain infrastructure.

Saudi Arabia Pallet Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Wood |

54% |

|

Application |

Food and Beverages |

39% |

|

Structural Design |

Block |

56% |

|

Region |

Northern and Central Region |

48% |

Type Insights:

To get detailed analysis of this segment, Request Sample

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

Wood dominates with a market share of 54% of the total Saudi Arabia pallet market in 2025.

Wood pallets maintain their commanding market position through unmatched economic advantages and universal acceptance across Saudi Arabia's diverse industrial landscape. The material's inherent properties including natural load-bearing strength, repair simplicity, and widespread availability through both domestic sawmills and international suppliers ensure continued preference among cost-conscious logistics operators. Traditional industries including construction material distribution, agricultural product handling, and general merchandise warehousing particularly favor wood variants due to established handling protocols and compatibility with existing forklift fleets throughout the kingdom's transportation infrastructure.

The segment's dominance persists despite emerging alternatives due to wood's exceptional friction characteristics preventing load shifting during transport, its disposability advantages in one-way shipping scenarios, and its thermal properties providing insulation benefits for certain cargo types. Saudi Arabia's increasing focus on local manufacturing capabilities further strengthens wood pallet production through investments in sawmill infrastructure and timber processing facilities that reduce import dependency. Additionally, the growing pallet recycling sector extends wood variant service life through repair and refurbishment operations, enhancing the material's overall value proposition for budget-conscious enterprises across manufacturing, retail distribution, and warehousing sectors throughout the kingdom.

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

Food and beverages lead with a share of 39% of the total Saudi Arabia pallet market in 2025.

The food and beverages sector's substantial pallet consumption reflects Saudi Arabia's rapidly modernizing retail landscape and expanding cold chain infrastructure serving the kingdom's growing population centers. Modern supermarket chains, hypermarkets, and convenience store networks require standardized pallet systems for efficient distribution of packaged goods, beverages, and perishable items from regional distribution centers to retail outlets across urban and remote locations. The segment's growth particularly accelerates through dairy processing facilities, bottled water production plants, and packaged food manufacturers who depend on hygienic, food-grade pallet solutions meeting stringent regulatory standards for consumer product handling.

This application segment benefits from increasing organized retail penetration, rising consumer preference for packaged and branded food products, and government initiatives promoting food security through strategic reserves and distribution networks. The expanding restaurant and hospitality industry further drives demand as hotel supply chains, catering operations, and food service distributors require efficient material handling solutions. Additionally, Saudi Arabia's growing food processing industry, including dates packaging facilities, seafood processing units, and halal meat production centers, creates sustained pallet demand for domestic consumption and regional export activities supporting the kingdom's agricultural sector development and value addition objectives.

Structural Design Insights:

- Block

- Stringer

- Others

Block exhibits a clear dominance with a 56% share of the total Saudi Arabia pallet market in 2025.

Block pallets' substantial market leadership stems from their superior operational versatility and compatibility with modern automated warehouse systems increasingly deployed throughout Saudi Arabia's logistics infrastructure. The four-way entry configuration enables forklift and pallet jack access from all sides, significantly enhancing warehouse efficiency, reducing handling time, and minimizing product damage during material movement operations. This structural advantage proves particularly valuable in high-throughput distribution centers, automated storage and retrieval systems, and cross-docking facilities where rapid load manipulation directly impacts operational productivity and labor cost management.

The design's popularity intensifies among pharmaceutical distributors, electronics logistics providers, and automotive parts warehouses where precise inventory management and minimal handling incidents represent critical operational requirements. Block pallets' enhanced load distribution characteristics reduce floor stress in stacked configurations, enabling higher warehouse storage density and improved space utilization in Saudi Arabia's expensive urban warehousing facilities. The structural design also demonstrates superior durability under repeated forklift handling, extending service life and reducing replacement frequency for logistics operators managing large captive pallet pools across national distribution networks serving the kingdom's geographically dispersed consumer markets.

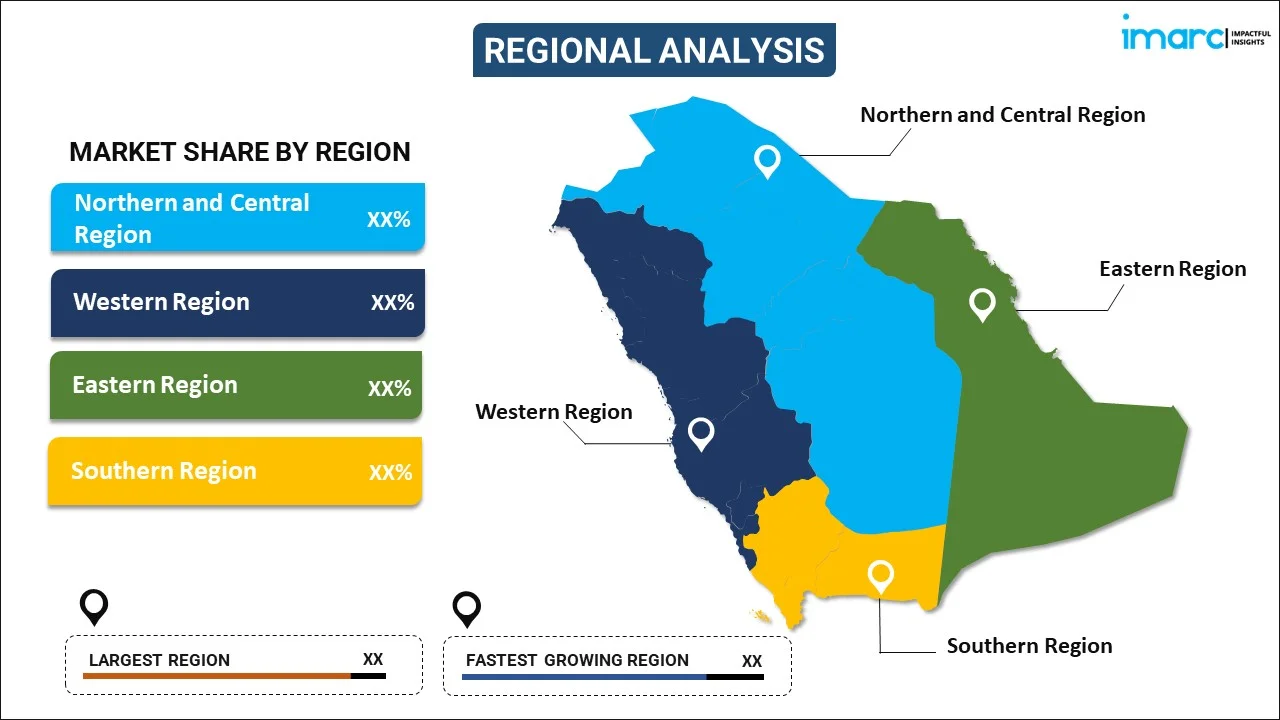

Regional Insights:

To get detailed regional analysis of this segment, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region lead with a share of 48% of the total Saudi Arabia pallet market in 2025.

The Northern and central region's commanding market position reflects Riyadh's status as Saudi Arabia's commercial and governmental hub hosting the kingdom's largest concentration of warehousing facilities, distribution centers, and industrial manufacturing operations. The region benefits from strategic geographic positioning connecting eastern oil-producing areas with western port cities, creating optimal logistics corridors for domestic and international cargo movement. Major retailers, pharmaceutical wholesalers, automotive distributors, and consumer goods importers maintain primary distribution facilities in Riyadh's industrial zones, generating sustained pallet demand across diverse sectoral applications requiring standardized material handling infrastructure.

The region's dominance intensifies through substantial government procurement activities supporting public sector operations, military logistics requirements, and infrastructure project supply chains consuming significant pallet volumes. Riyadh's expanding airport cargo facilities, including King Khalid International Airport's freight terminals, drive pallet consumption for air cargo handling operations supporting the kingdom's growing e-commerce sector and express logistics services. Additionally, the region hosts major manufacturing clusters including pharmaceutical production facilities, food processing plants, and light industrial operations that generate captive pallet fleet requirements supporting internal material movement and finished goods distribution throughout Saudi Arabia's national market network.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Pallet Market Growing?

Infrastructure Expansion and Logistics Modernization Initiatives

Saudi Arabia's ambitious Vision 2030 transformation agenda drives unprecedented investments in logistics infrastructure including port capacity expansion, airport cargo facility upgrades, and inland dry port development that fundamentally require standardized pallet systems for efficient material handling. The kingdom's strategic positioning as a regional logistics gateway connecting Asia, Europe, and Africa stimulates warehouse construction across special economic zones, free trade areas, and industrial cities designed to attract multinational manufacturing and distribution operations. Projects like the King Abdullah Economic City logistics parks, Jeddah logistics zone development, and NEOM's futuristic cargo facilities incorporate advanced automated systems demanding compatible pallet infrastructure. The government's focus on developing multimodal transportation networks including railway cargo terminals and truck-rail transshipment hubs creates additional pallet consumption across intermodal freight operations. Investment from the private sector, both local and foreign, in Saudi Arabia's transportation and logistics industry has surpassed SR280 billion ($74.7 billion), accounting for 6.2 percent of the Kingdom's gross domestic product, according to the transport and logistics services minister. During the Supply Chain and Logistics Conference in Riyadh, Saleh Al-Jasser pointed out a 28 percent increase in jobs within transport and storage sectors by mid-2025 compared to the same timeframe last year, contributing 144,000 new positions for a total of 651,000 jobs in the sector.

E-commerce Proliferation and Last-Mile Delivery Network Growth

The explosive growth of online retail platforms and digital commerce ecosystems throughout Saudi Arabia fundamentally transforms distribution patterns and material handling requirements across fulfillment operations. E-commerce giants and regional online retailers establish sophisticated warehouse networks featuring pick-and-pack operations, sortation systems, and reverse logistics capabilities that consume significant pallet volumes for inventory storage and order consolidation processes. The sector's rapid expansion particularly accelerates demand for lightweight pallet variants including corrugated paper and plastic alternatives optimized for high-velocity inventory turnover and frequent handling cycles characteristic of modern fulfillment center operations. Saudi Arabia's young, tech-savvy population increasingly preferring online shopping for electronics, fashion, groceries, and household products drives continuous fulfillment infrastructure investment. Saudi Arabia e-commerce market is projected to attain USD 708.7 Billion by 2033, as per IMARC Group.

Food Security Initiatives and Cold Chain Infrastructure Development

Government priorities emphasizing food security and self-sufficiency stimulate substantial investments in agricultural infrastructure, food processing facilities, and cold storage networks that fundamentally depend on specialized pallet systems for temperature-controlled cargo handling. Saudi Arabia's strategic food reserves programs require massive warehousing capacity for grain storage, dried goods inventory, and emergency stockpiles demanding durable, hygienic pallet solutions meeting international food safety standards. In 2025, The Saudi government has authorized the General Authority for Food Security (GFSA) to increase its revenue streams via investment projects and strategic collaborations with the private sector. The recent initiative aims to boost the Authority’s ability to achieve its objectives, synchronize with national ambitions, and function within regulatory guidelines, while also fostering a competitive investment climate in the food security industry

Market Restraints:

What Challenges the Saudi Arabia Pallet Market is Facing?

High Import Dependency and International Timber Price Volatility

The Saudi Arabian pallet market's substantial reliance on imported timber creates vulnerability to global lumber price fluctuations, international shipping cost volatility, and supply chain disruptions affecting raw material availability. Limited domestic forestry resources constrain local wood pallet manufacturing capacity, necessitating imports from Southeast Asian suppliers, European markets, and North American exporters whose pricing dynamics directly impact local production economics. Currency exchange rate fluctuations between the Saudi Riyal and supplier currencies introduce additional cost unpredictability for manufacturers and end-users managing pallet procurement budgets.

Limited Recycling Infrastructure and Circular Economy Development

The kingdom's underdeveloped pallet recycling ecosystem results in substantial waste generation as damaged units typically proceed to landfills rather than refurbishment or material recovery operations. Insufficient collection networks, limited repair facilities, and absent reverse logistics systems for pallet pool management reduce service life optimization and increase total cost of ownership for logistics operators. This infrastructure gap particularly affects sustainability-conscious multinational corporations establishing operations in Saudi Arabia who face challenges implementing circular pallet management programs consistent with global corporate environmental commitments.

Skilled Labor Shortages in Logistics and Material Handling Operations

The Saudi workforce's limited participation in logistics sector employment creates dependency on expatriate labor for warehouse operations, forklift operations, and pallet handling activities that affects operational efficiency and training continuity. Nationalization initiatives attempting to increase Saudi employment in logistics face challenges related to cultural perceptions of warehouse work, wage expectations exceeding regional norms, and limited vocational training infrastructure developing specialized material handling competencies. These labor market dynamics increase operational costs and potentially compromise handling standards affecting pallet service life and cargo damage rates.

Competitive Landscape:

The Saudi Arabian pallet market exhibits fragmented competitive dynamics featuring established local manufacturers serving regional demand alongside specialized international suppliers targeting premium segments and customized applications. Competition intensifies across price-performance positioning with local producers leveraging cost advantages through proximity to end-users and lower overhead structures while international entrants differentiate through superior quality standards, technical expertise, and innovative material solutions. The market structure accommodates diverse player types including dedicated pallet manufacturers focusing exclusively on standardized units, integrated wood processing companies producing pallets as value-added products, and specialized recycling enterprises offering refurbishment services and circular economy solutions. Competitive differentiation increasingly centers on sustainability credentials, customization capabilities, technical support services, and supply chain reliability rather than purely price-based competition. The emergence of smart pallet technology providers introduces new competitive dimensions as advanced tracking systems and IoT integration capabilities become valued differentiators for sophisticated logistics operators. Market consolidation remains limited with numerous small-scale regional manufacturers coexisting alongside larger industrial producers, creating opportunities for both specialized niche players and vertically integrated operations throughout the kingdom's diverse industrial landscape. Some of the key players include:

- Al Moajil Holding

- Al Rashed Wood Products Factory

- AlDhana Wood Industries Factory

- KraftPal Technologies

- PalletBiz

- RePall

Saudi Arabia Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Al Moajil Holding, Al Rashed Wood Products Factory, AlDhana Wood Industries Factory, KraftPal Technologies, PalletBiz, RePall, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia pallet market size was valued at USD 642.75 Million in 2025.

The Saudi Arabia pallet market is expected to grow at a compound annual growth rate of 4.89% from 2026-2034 to reach USD 987.45 Million by 2034.

Wood dominated the market with a commanding share of 54%, driven by their cost-effectiveness, universal compatibility with existing logistics infrastructure, repair simplicity, and widespread acceptance across traditional and modern supply chain operations throughout the kingdom's diverse industrial sectors.

Key factors driving the Saudi Arabia pallet market include ambitious logistics infrastructure expansion aligned with Vision 2030 objectives, explosive e-commerce growth requiring sophisticated fulfillment operations, government food security initiatives stimulating cold chain development, and increasing warehouse automation adoption across pharmaceutical, retail, and manufacturing sectors.

Major challenges include substantial dependency on imported timber creating vulnerability to international price volatility, underdeveloped recycling infrastructure limiting circular economy implementation, skilled labor shortages in logistics operations affecting handling efficiency, and increasing compliance requirements for specialized applications including food-grade and pharmaceutical-certified pallet variants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)