Saudi Arabia Paneer Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2026-2034

Saudi Arabia Paneer Market Summary:

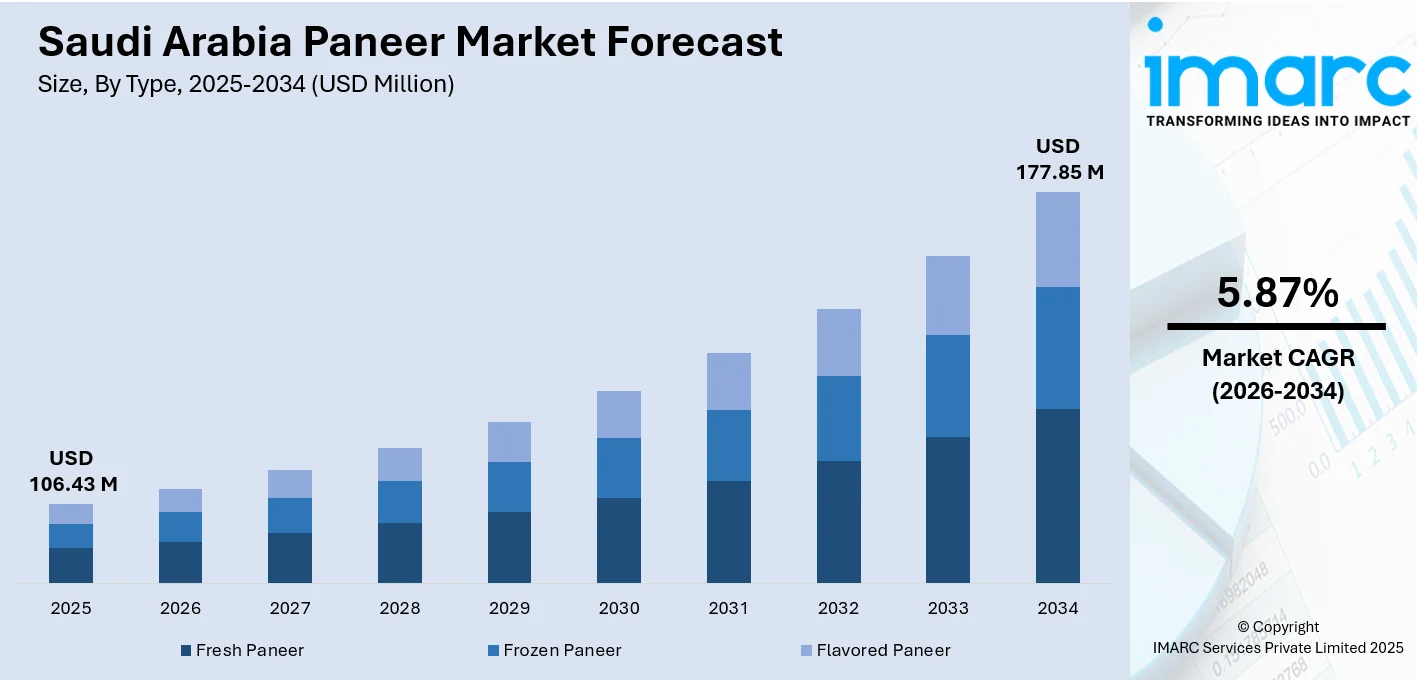

The Saudi Arabia paneer market size was valued at USD 106.43 Million in 2025 and is projected to reach USD 177.85 Million by 2034, growing at a compound annual growth rate of 5.87% from 2026-2034.

The Saudi Arabia paneer market is experiencing robust growth, driven by the substantial South Asian expatriate community and expanding vegetarian dietary preferences across the Kingdom. Rising health consciousness among consumers seeking high-protein, low-fat dairy alternatives is accelerating demand, while the flourishing foodservice sector and modern retail infrastructure are enhancing product accessibility. The integration of paneer into local cuisines and growing awareness about its nutritional benefits are reshaping consumption patterns and driving the market share.

Key Takeaways and Insights:

-

By Type: Fresh paneer dominates the market with a share of 59% in 2025, owing to its superior texture, authentic taste, and preferred use in traditional Indian cuisines. The segment benefits from strong consumer preference for minimally processed dairy products and increasing availability through modern retail channels across the Kingdom.

-

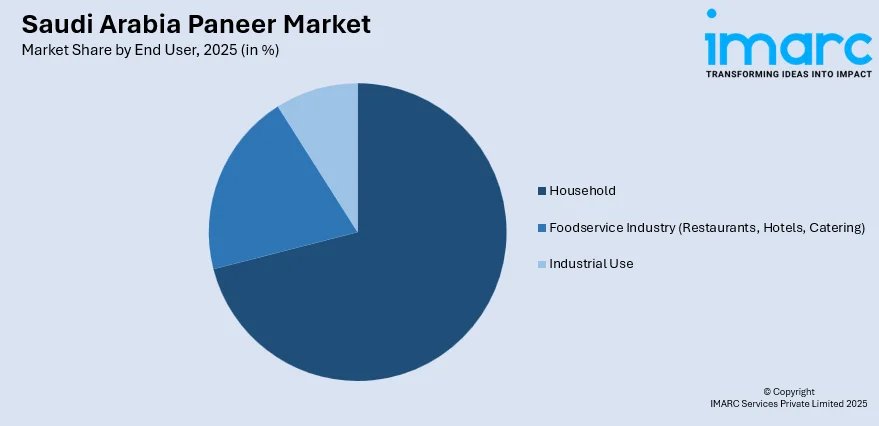

By End User: Household leads the market with a share of 71% in 2025. This dominance is driven by the large Indian expatriate population preparing traditional home-cooked meals, rising health consciousness, and the growing preferences for protein-rich vegetarian alternatives among Saudi consumers.

-

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 52% in 2025, reflecting the widespread presence of modern retail formats, enhanced cold-chain infrastructure, and consumer preference for one-stop shopping experiences with diverse product assortments.

-

By Region: Northern and Central Region comprises the largest region with 36% share in 2025, driven by Riyadh's concentration of expatriate workforce, higher disposable incomes, and extensive modern retail penetration serving the capital's diverse population base.

-

Key Players: Key players drive the Saudi Arabia paneer market by expanding product portfolios, strengthening distribution networks, and investing in cold-chain infrastructure. Their focus on product freshness, halal certification, and competitive pricing accelerates market penetration across diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabia paneer market is poised for sustained expansion as demographic dynamics and evolving dietary preferences converge to create favorable growth conditions. The Kingdom hosts Indian expatriates who represent a significant consumer base with strong cultural affinity for paneer-based cuisines. This demographic foundation, combined with increasing adoption of vegetarian protein sources among health-conscious Saudi consumers, is driving market momentum. The foodservice industry serves as a crucial demand driver, as Indian and South Asian restaurants proliferate across major urban centers. Retail infrastructure continues to expand, with supermarkets and hypermarkets providing enhanced product accessibility and cold-chain capabilities essential for fresh dairy distribution. As per IMARC Group, the Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Additionally, the growing trend of home cooking, particularly among dual-income households seeking nutritious meal options, reinforces household consumption patterns.

Saudi Arabia Paneer Market Trends:

Rising Demand for Vegetarian Protein Alternatives

Rising demand for vegetarian protein alternatives is driving the growth of the Saudi Arabia paneer market as consumers seek nutritious, meat-free food options. Increasing health awareness, lifestyle-related dietary shifts, and interest in balanced protein intake are encouraging adoption of dairy-based proteins like paneer. The growing expatriate population familiar with vegetarian cuisines further supports demand across households and foodservice outlets. Paneer’s versatility in traditional and modern recipes makes it attractive to home cooks, positioning it as a convenient, protein-rich alternative within evolving dietary preferences.

Expansion of Modern Retail Infrastructure

The proliferation of supermarkets and hypermarkets across Saudi Arabia is enhancing paneer accessibility and driving Saudi Arabia paneer market growth. Panda Retail Co. is planning 20 new store openings in 2025 within Saudi Arabia, particularly in Riyadh and remote areas. This retail broadening, coupled with advanced cold-chain logistics and refrigerated storage systems, ensures product freshness and availability across urban and suburban locations, fundamentally transforming consumer purchasing patterns.

Growing Influence of Foodservice Sector

The expanding foodservice industry is emerging as a significant demand driver for paneer products. Quick-service outlets and hotel catering operations increasingly incorporate paneer-based dishes into their menus, responding to diverse consumer preferences and the growing popularity of vegetarian meal options among both expatriate and local populations. This trend is supported by rising dine-out culture and the expansion of casual dining and cloud kitchen formats across urban centers. As per IMARC Group, the Saudi Arabia cloud kitchen market size reached USD 1,085.7 Million in 2025. Bulk procurement by foodservice operators further boosts consistent demand for standardized, high-quality paneer.

How Vision 2030 is Transforming the Saudi Arabia Paneer Market:

Vision 2030 is transforming the Saudi Arabia paneer market by strengthening domestic food production, supporting dairy sector localization, and reducing reliance on imports. Government focus on food security and self-sufficiency is encouraging investments in modern dairy processing facilities, cold chain infrastructure, and value-added milk products, such as paneer. Rising expatriate populations and growing acceptance of South Asian cuisines are expanding paneer consumption across households, restaurants, and foodservice outlets. Vision 2030 also promotes small and medium enterprise (SME) participation, enabling local producers to introduce fresh, hygienically packaged paneer tailored to regional taste preferences. Improvements in retail infrastructure, organized grocery chains, and online food platforms are enhancing product availability and visibility. Together, these initiatives are creating a structured, scalable, and demand-driven environment that supports steady growth of the paneer market in Saudi Arabia.

Market Outlook 2026-2034:

The Saudi Arabia paneer market demonstrates promising growth potential through the forecast period, underpinned by favorable demographic trends and evolving consumer preferences. Urbanization continues to concentrate consumption in major metropolitan areas where modern retail and foodservice channels thrive. The market generated a revenue of USD 106.43 Million in 2025 and is projected to reach a revenue of USD 177.85 Million by 2034, growing at a compound annual growth rate of 5.87% from 2026-2034. Rising disposable incomes, increasing health awareness, and the integration of e-commerce platforms are expected to further accelerate market expansion. Strategic investments in cold-chain infrastructure and product innovations by leading dairy players will enhance distribution capabilities and item variety, meeting diverse consumer needs across household and commercial segments.

Saudi Arabia Paneer Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Fresh Paneer | 59% |

| End User | Household | 71% |

| Distribution Channel | Supermarkets and Hypermarkets | 52% |

| Region | Northern and Central Region | 36% |

Type Insights:

- Fresh Paneer

- Frozen Paneer

- Flavored Paneer

Fresh paneer dominates with a market share of 59% of the total Saudi Arabia paneer market in 2025.

Fresh paneer leads the Saudi Arabia paneer market due to strong consumer preferences for natural taste, soft texture, and high nutritional value. Households and foodservice operators favor fresh paneer for its superior mouthfeel and versatility across a wide range of traditional and contemporary dishes. Fresh variants are perceived as minimally processed and healthier, aligning with growing demand for clean-label and wholesome food products. Daily cooking practices in expatriate households further support consistent demand for fresh paneer across urban retail channels.

The dominance of fresh paneer is also reinforced by its widespread availability through supermarkets, specialty stores, and local dairy producers across the country. Improved cold chain infrastructure ensures freshness and quality across distribution networks. Foodservice operators prefer fresh paneer for better cooking performance and flavor absorption, while consumers associate freshness with authenticity and quality. These factors collectively sustain fresh paneer’s leading position in the Saudi Arabia paneer market.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Foodservice Industry (Restaurants, Hotels, Catering)

- Industrial Use

Household leads with a share of 71% of the total Saudi Arabia paneer market in 2025.

Household dominates the Saudi Arabia paneer market due to rising home cooking trends and increasing preferences for nutritious, vegetarian-friendly meals. Paneer is widely used in everyday cooking among expatriate families familiar with South Asian cuisines, as well as health-conscious local consumers exploring meat alternatives. Its ease of preparation, versatility across dishes, and suitability for regular meals make paneer a staple ingredient in household kitchens. Growing awareness about protein-rich diets further encourages families to incorporate paneer into balanced home-cooked meals.

The dominance of the household segment in the market is also supported by improved retail access and product availability. Supermarkets, hypermarkets, and neighborhood grocery stores offer fresh and packaged paneer in convenient pack sizes suited for home use. Cold storage facilities help maintain quality, encouraging repeat purchases. Additionally, cooking content on social media and food platforms inspires at-home experimentation with paneer recipes, reinforcing steady household demand across Saudi Arabia.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance in the market with 52% share in 2025.

Supermarkets and hypermarkets lead the Saudi Arabia paneer market due to their wide product assortment, consistent availability, and strong consumer trust. These retail formats offer fresh and packaged paneer from multiple brands, allowing customers to compare quality, pricing, and packaging in one location. Modern retail stores maintain proper refrigeration and hygiene standards, which are critical for dairy products like paneer. Their convenient locations and extended operating hours further encourage frequent household purchases.

The leadership of supermarkets and hypermarkets is reinforced by organized supply chains and effective cold chain management. These outlets partner directly with dairy producers to ensure steady supply and freshness. Promotional activities, in-store visibility, and bundled offers increase product awareness and trial rates. Additionally, the growing preference for organized retail shopping among urban consumers strengthens the role of supermarkets and hypermarkets in driving paneer sales across Saudi Arabia.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading segment with a 36% share of the total Saudi Arabia paneer market in 2025.

Northern and Central Region, anchored by Riyadh, dominates the paneer market due to its concentration of economic activities, expatriate workforce, and modern retail infrastructure. In 2024, Riyadh Province alone hosted over 33,399 restaurants, cafes, and bakeries, reflecting the capital's vibrant foodservice ecosystem. The region benefits from higher disposable incomes, superior logistics networks, and extensive supermarket penetration that ensures widespread product availability across diverse consumer segments seeking quality dairy products.

Urban development initiatives under Vision 2030 continue to strengthen the region's commercial infrastructure and consumer accessibility. Riyadh's population represents a substantial and growing consumer base with evolving dietary preferences. The concentration of multinational corporations and government institutions in the capital attracts skilled professionals, many from South Asian countries, who maintain cultural food preferences, including regular paneer consumption. Advanced cold-chain logistics and same-day delivery services further enhance market accessibility in this economic hub.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Paneer Market Growing?

Substantial South Asian Expatriate Population

The large South Asian community in Saudi Arabia is the primary base-demand driver for paneer within the Kingdom. The country maintained a presence exceeding 2.7 Million Indian nationals, as of February 2025, alongside significant Pakistani and Bangladeshi populations, collectively representing millions of consumers with deep cultural affinity for paneer-based cuisines. These demographics include traditional cultures which stick to their dietary habits with an emphasis on paneer in their cuisine. Moreover, the financial inputs of the expat community in sectors, such as the medical field, engineering services, information technology (IT), and the construction business, ensure the buying capacity for the desired quality product in the culinary industry as well. Preservation of traditional cooking through the Indian schools or religious institutions established for the community maintains the continuous demand for authentic products, such as paneer.

Expanding Foodservice Industry

The flourishing foodservice sector represents a significant growth catalyst for the Saudi Arabia paneer market. The Saudi Arabia foodservice market, valued at USD 28,669 Million in 2024, continues to expand at robust rates as dining-out culture gains momentum among younger demographics. Indian and Pakistani cuisine establishments rank among the most popular restaurant categories, representing majority of all foodservice outlets in major cities like Riyadh and Jeddah. Hotels, catering services, and quick-service restaurants (QSRs) increasingly incorporate paneer-based dishes to address vegetarian preferences and capitalize on the growing popularity of South Asian flavors. The sector's commercial demand for consistent, high-quality paneer supplies drives manufacturing investments and distribution network expansion, creating multiplier effects throughout the value chain while establishing paneer as a mainstream ingredient beyond traditional ethnic cuisine applications.

Rising Health Consciousness and Vegetarian Preferences

The growing health and wellness awareness among Saudi Arabian consumers is accelerating the demand for protein-rich, nutritious food alternatives, including paneer. Paneer's nutritional profile, featuring high protein content, essential calcium, and lower carbohydrate levels compared to conventional cheeses, appeals to fitness enthusiasts, weight-conscious consumers, and individuals managing specific dietary requirements. The trend of cleaner eating and minimally processed foods further enhances paneer's market positioning as a natural dairy product without artificial additives. Healthcare institutions and nutritionists increasingly recommend paneer as part of balanced diets, while social media influencers promote paneer-based recipes to health-focused audiences. This evolving consumer consciousness creates sustainable demand growth independent of demographic factors, expanding the addressable market to include local Saudi consumers alongside traditional expatriate segments.

Market Restraints:

What Challenges the Saudi Arabia Paneer Market is Facing?

Import Dependency and Supply Chain Vulnerabilities

Limited domestic paneer production capacity creates substantial reliance on imports, exposing the market to supply chain disruptions and price volatility. International shipping delays, customs procedures, and logistics complexities can impact product availability and freshness, particularly for fresh paneer variants requiring strict cold-chain maintenance. Currency fluctuations affect import costs, potentially constraining market growth during periods of economic uncertainty.

Perishability and Cold-Chain Requirements

Fresh paneer's inherent perishability presents significant distribution and storage challenges across Saudi Arabia's extensive geography and desert climate. Maintaining consistent refrigeration throughout the supply chain demands substantial infrastructure investments and operational expertise. Product spoilage risks increase distribution costs and limit shelf life, constraining market expansion in areas with less developed cold-chain capabilities beyond major metropolitan centers in the country.

Competition from Alternative Protein Sources

The Saudi Arabia paneer market faces increasing competition from alternative protein products, including plant-based dairy substitutes, tofu, and other vegetarian options gaining consumer attention. Multinational food companies are introducing innovative protein alternatives targeting health-conscious consumers, potentially diverting market share. Additionally, local cheese varieties and halloumi present competitive alternatives within the broader dairy category, requiring paneer manufacturers to differentiate through quality and pricing strategies.

Competitive Landscape:

The Saudi Arabia paneer market features a competitive mix of domestic dairy producers, international food companies, and specialized importers serving diverse consumer segments. Market participants compete on product quality, freshness, pricing, and distribution reach while emphasizing halal certification and compliance with Saudi food safety standards. Leading players are investing in cold-chain infrastructure, retail partnerships, and brand development to strengthen market positions. Strategic collaborations between manufacturers and modern retail chains enhance product visibility and consumer accessibility. Companies are increasingly focusing on product innovations, introducing flavored variants and convenient packaging formats to capture emerging consumer preferences. The market structure favors participants with established distribution networks and cold-chain capabilities essential for maintaining fresh dairy product quality across the Kingdom's extensive retail landscape.

Saudi Arabia Paneer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fresh Paneer, Frozen Paneer, Flavored Paneer |

| End Users Covered | Household, Foodservice Industry (Restaurants, Hotels, Catering), Industrial Use |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia paneer market size was valued at USD 106.43 Million in 2025.

The Saudi Arabia paneer market is expected to grow at a compound annual growth rate of 5.87% from 2026-2034 to reach USD 177.85 Million by 2034.

Fresh paneer dominated the market with a share of 59%, driven by consumer preferences for authentic texture, superior taste, and versatility in traditional South Asian cuisines commonly prepared in Saudi households.

Key factors driving the Saudi Arabia paneer market include the substantial South Asian expatriate population, expanding foodservice industry, rising health consciousness, modern retail expansion, and growing vegetarian dietary preferences.

Major challenges include import dependency and supply chain vulnerabilities, perishability requiring extensive cold-chain infrastructure, competition from alternative protein sources, price sensitivity among consumers, and limited domestic production capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)