Saudi Arabia Paper Cups Market Size, Share, Trends and Forecast by Cup Type, Wall Type, Application, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Paper Cups Market Overview:

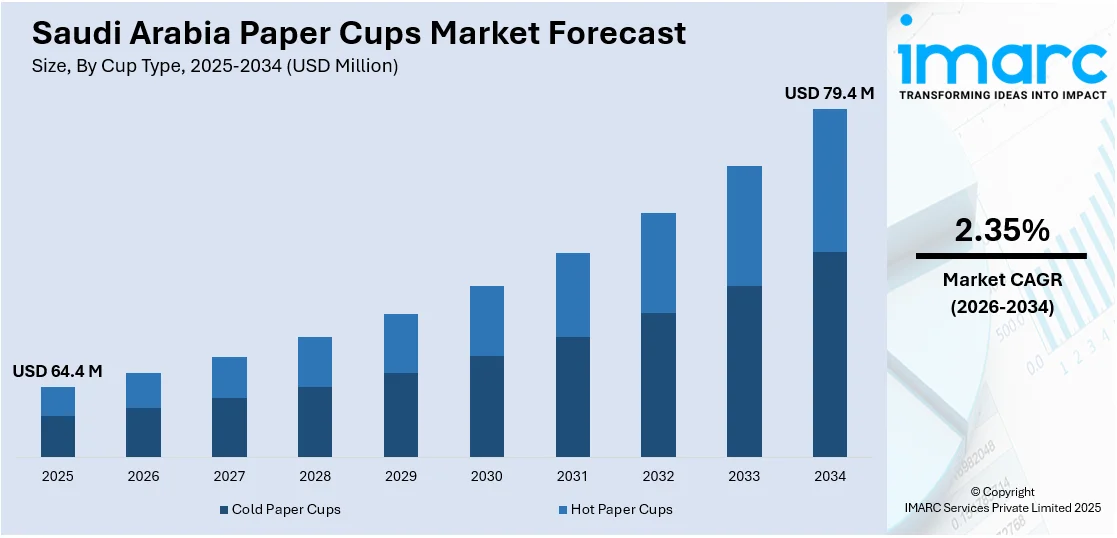

The Saudi Arabia paper cups market size reached USD 64.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 79.4 Million by 2034, exhibiting a growth rate (CAGR) of 2.35% during 2026-2034. The market is experiencing robust growth due to growing café culture, rising demand for sustainable packaging, and government restrictions on single-use plastics. Moreover, urbanization and increased food delivery services further support consumption across commercial and institutional segments, thereby creating a positive outlook for the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 64.4 Million |

| Market Forecast in 2034 | USD 79.4 Million |

| Market Growth Rate 2026-2034 | 2.35% |

Saudi Arabia Paper Cups Market Trends:

Government Push for Sustainable Packaging

Saudi Arabia is actively implementing sustainability-focused regulations to curb the use of single-use plastics, creating strong momentum for paper-based alternatives across the packaging sector. As part of the national environmental strategy, government bodies have introduced policies restricting plastic disposables in retail, hospitality, and foodservice industries. These measures are pushing businesses to seek eco-friendly solutions, with paper cups emerging as a preferred option for beverages due to their recyclability and consumer appeal. Municipal initiatives and awareness campaigns further reinforce this shift, encouraging both producers and end users to adopt compostable or recyclable alternatives. The regulatory framework is also prompting investment in local production facilities and packaging innovations, ensuring steady supply to meet the rising demand. This transition, strongly influenced by policy intervention, is playing a critical role in shaping the evolving Saudi Arabia paper cups market share.

To get more information on this market Request Sample

Rising Popularity of Coffee Chains and Cafés

The booming café culture in Saudi Arabia, particularly in cities like Riyadh, Jeddah, and Dammam, is significantly increasing the demand for hot beverage paper cups. The country has seen a surge in international coffee chains, local specialty cafés, and boutique coffee shops, fueled by a young, urban population with changing lifestyles and a growing interest in premium coffee experiences. Takeaway coffee is becoming a daily habit for many, prompting cafés to invest in high-quality, insulated paper cups that ensure heat retention and brand visibility. This demand is further supported by increasing consumer preference for sustainable and aesthetically appealing packaging. With a sharp rise in coffee consumption and growing competition among beverage outlets, the need for disposable hot cups continues to climb. This trend is playing a substantial role in accelerating Saudi Arabia paper cups market growth across both retail and foodservice segments.

Consumer Preference for Eco-Friendly Products

In Saudi Arabia, rising environmental awareness among consumers is leading to increased demand for eco-friendly paper cup options. As sustainability becomes a key purchasing factor, both individuals and businesses are moving away from plastic-based disposables in favor of biodegradable and recyclable alternatives. This shift is especially evident in the foodservice, hospitality, and event sectors, where customers increasingly expect brands to reflect their environmental values. Paper cups with compostable linings or made from responsibly sourced materials are gaining traction, supported by better labeling and transparency about recyclability. Retailers and beverage outlets are responding by offering greener packaging solutions to stay competitive and align with evolving consumer expectations. This growing environmental consciousness, combined with regulatory support and changing market behavior, is expected to significantly influence purchasing patterns and product innovation, contributing positively to the Saudi Arabia paper cups market outlook.

Key Growth Drivers of Saudi Arabia Paper Cups Market:

Expansion of Food Delivery and Online Platforms

The broadening of e-commerce portals and online food delivery services is catalyzing the demand for paper cups in Saudi Arabia. With digital apps gaining widespread popularity, restaurants and cafés increasingly rely on disposable packaging for safe and hygienic delivery of beverages. Paper cups are preferred for their ability to maintain beverage quality during transport while being lightweight and affordable. Rising preferences for home dining, especially among busy urban families and young professionals, are further accelerating the trend. Seasonal peaks, such as Ramadan and festive occasions, see a sharp increase in beverage deliveries, directly boosting paper cup utilization. As online platforms are expanding their reach and more restaurants are adapting to delivery-focused models, paper cups remain an integral part of the packaging ecosystem, ensuring reliability and convenience in Saudi Arabia’s evolving foodservice market.

Branding and Customization Opportunities

Paper cups offer businesses unique opportunities for branding and customization, making them an attractive packaging solution in Saudi Arabia’s competitive food and beverage (F&B) sector. Restaurants, coffee chains, and beverage outlets frequently use paper cups to display logos, slogans, and promotional messages, turning them into cost-effective marketing tools. In a market where café culture is booming and consumers are highly brand-conscious, customized paper cups help businesses strengthen visibility and create lasting impressions. Event organizers and corporate businesses also prefer personalized paper cups for conferences, exhibitions, and cultural gatherings, where branding plays a vital role. Seasonal themes, special promotions, and limited-edition designs further enhance consumer appeal and engagement. This combination of practicality and marketing utility ensures businesses view paper cups not only as packaging but also as a strategic branding medium.

Rising Hygiene and Safety Concerns

In the wake of heightened hygiene awareness, Saudi consumers are increasingly prioritizing disposable and safe packaging options, which is driving the demand for paper cups. Compared to reusable alternatives, paper cups reduce the risk of contamination, making them ideal for public gatherings, cafés, and restaurants. Businesses are also emphasizing hygienic serving methods to meet user expectations and build trust. Paper cups are widely accepted in offices, hospitals, and events due to their single-use nature, ensuring safety while maintaining convenience. The focus on cleanliness extends to the food delivery sector, where people expect packaged beverages in secure, tamper-free containers. This preference for hygiene-driven choices has solidified paper cups as a staple in Saudi Arabia’s foodservice sector.

Saudi Arabia Paper Cups Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on cup type, wall type, application, distribution channel, and end user.

Cup Type Insights:

- Cold Paper Cups

- Hot Paper Cups

The report has provided a detailed breakup and analysis of the market based on the cup type. This includes cold paper cups and hot paper cups.

Wall Type Insights:

- Single Wall

- Double Wall

- Triple Wall

A detailed breakup and analysis of the market based on the wall type have also been provided in the report. This includes single wall, double wall, and triple wall.

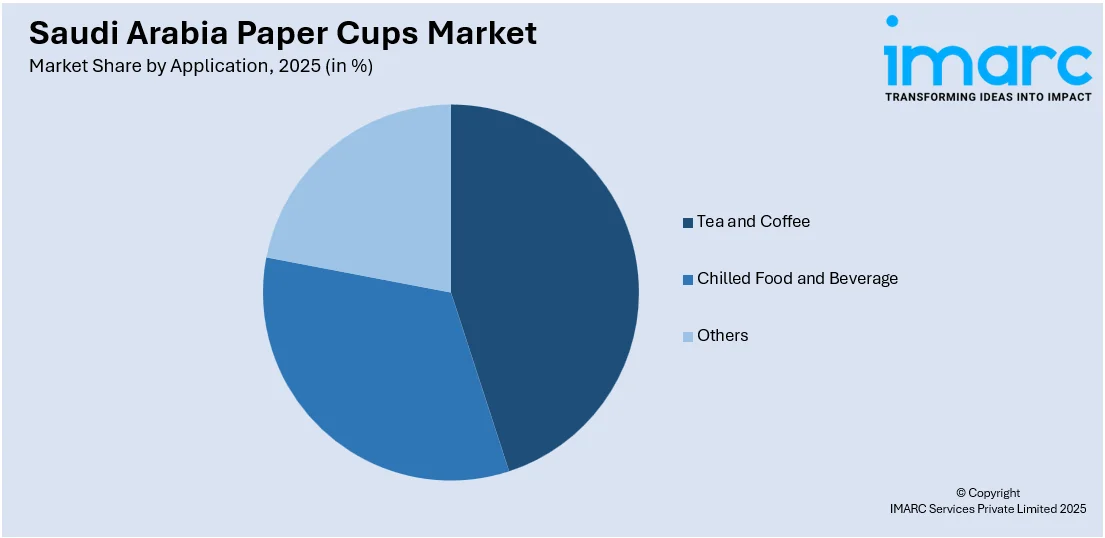

Application Insights:

Access the comprehensive market breakdown Request Sample

- Tea and Coffee

- Chilled Food and Beverage

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes tea and coffee, chilled food and beverage, and others.

Distribution Channel Insights:

- Institutional Sales

- Retail Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes institutional sales and retail sales.

End User Insights:

- Coffee and Tea Shops

- QSR and Other Fast Food Shops

- Offices and Educational Institutions

- Residential Use

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes coffee and tea shops, QSR and other fast food shops, offices and educational institutions, residential use, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Paper Cups Market News:

- January 2025: Saudi paper cup producer Jawhra Alawraq Factory Co. (CUPSA) set up Canon ImagePRESS V1350. The investment followed a strong demand for premium disposable paper cups in Saudi Arabia. The imagePRESS V1350 was a quick, resilient, premium, and high-capacity digital color press.

Saudi Arabia Paper Cups Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cup Types Covered | Cold Paper Cups, Hot Paper Cups |

| Wall Types Covered | Single Wall, Double Wall, Triple Wall |

| Applications Covered | Tea and Coffee, Chilled Food and Beverage, Others |

| Distribution Channels Covered | Institutional Sales, Retail Sales. |

| End Users Covered | Coffee and Tea Shops, QSR and Other Fast Food Shops, Offices and Educational Institutions, Residential Use, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia paper cups market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia paper cups market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia paper cups industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper cups market in Saudi Arabia was valued at USD 64.4 Million in 2025.

The Saudi Arabia paper cups market is projected to exhibit a CAGR of 2.35% during 2026-2034, reaching a value of USD 79.4 Million by 2034.

The growth of the foodservice sector, including QSRs and coffee shops, is driving the requirement for paper cups, as disposable and eco-friendly packaging has become a necessity. Events, offices, and institutional sectors are additional demand generators for paper cups. Moreover, international brands expanding in the Kingdom are adopting eco-friendly packaging strategies, adding momentum to the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)