Saudi Arabia Patient Handling Equipment Market Size, Share, Trends and Forecast by Product, Type Of Care, End User, and Region, 2026-2034

Saudi Arabia Patient Handling Equipment Market Overview:

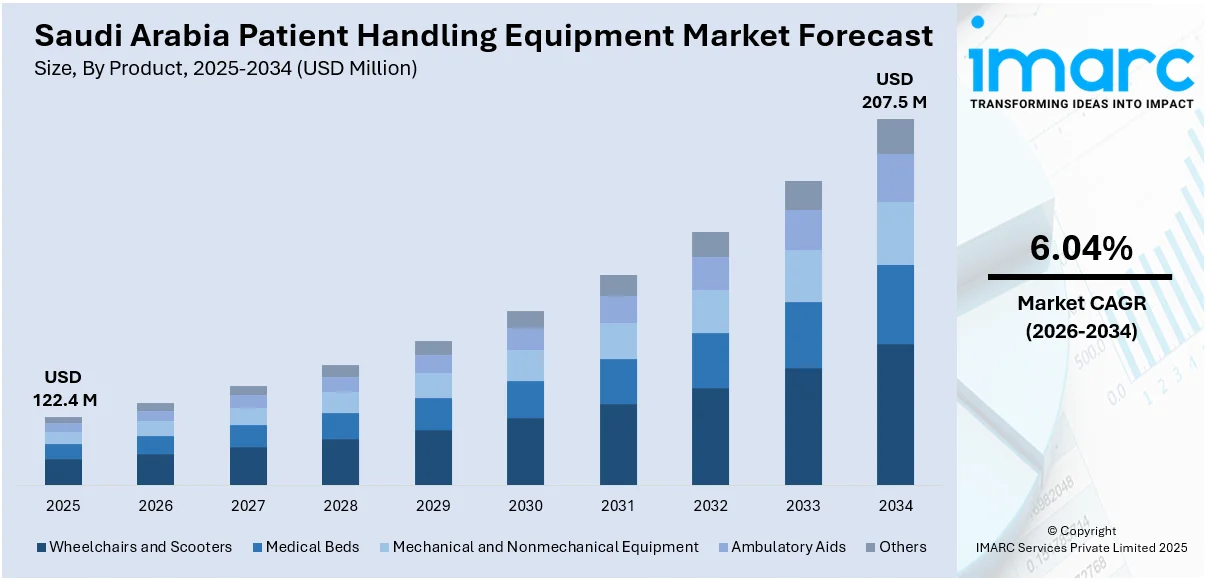

The Saudi Arabia patient handling equipment market size reached USD 122.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 207.5 Million by 2034, exhibiting a growth rate (CAGR) of 6.04% during 2026-2034. The market is witnessing significant growth, driven by the increasing demand for healthcare services, the aging population, and technological advancements. Rising healthcare infrastructure development and the adoption of advanced medical equipment are contributing to market expansion, boosting the Saudi Arabia patient handling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 122.4 Million |

| Market Forecast in 2034 | USD 207.5 Million |

| Market Growth Rate 2026-2034 | 6.04% |

Saudi Arabia Patient Handling Equipment Market Trends:

Technological Advancements in Patient Handling

Technological advancements are playing a crucial role in the evolution of patient-handling equipment in Saudi Arabia. With increasing healthcare needs, the market is transforming towards more efficient, safer, and easier-to-use equipment. Electric patient lifts, mobility aids, and automated transfer devices are being introduced more and more to improve patient and caregiver safety. These devices minimize the risk of manual handling injury, providing better functionality and efficiency. Besides, new intelligent systems that track patients' movements are being incorporated, offering real-time information that supports healthcare professionals to make sound judgments and enhance patients' care results. Such development in patient-handling equipment design is enhancing overall care quality alongside operational efficiency. Increased emphasis on automation within the healthcare industry is also contributing immensely to this movement. As new technologies develop, Saudi Arabian healthcare facilities will need to adopt more advanced solutions to address the increasing need for enhanced patient handling. With the constant focus on patient safety and staff welfare, the Saudi Arabia patient handling equipment market growth is expected to expand further in the coming years.

To get more information on this market Request Sample

Growing Demand Due to Aging Population

The aging population of Saudi Arabia remains a major key driver of increasing demand for patient-handling devices. With an ever-growing older population in Saudi Arabia, solutions that provide efficient and safe care for older adults are increasingly in demand. Older individuals tend to be afflicted with conditions like arthritis, osteoporosis, and dementia, which will impede movement and independence. Therefore, the demand for patient-handling equipment such as lifts, transfer aids, and adjustable beds to assist patients with limited mobility is greater. These items not only enhance patient comfort but also avoid potential injury to caregivers by reducing manual handling. An increase in chronic diseases like diabetes and cardiovascular disease has also increased the demand for specialized patient-handling equipment in Saudi Arabia. Healthcare centers are increasingly implementing advanced patient-handling equipment to deliver more efficient care with less physical burden on medical professionals. Moreover, home healthcare services are becoming more popular, with patients opting to receive treatment in the comfort of their own homes. This has fueled the demand for portable and home-compatible patient-handling equipment that allows caregivers to offer high-quality care without sacrificing safety or efficiency. Government spending on healthcare infrastructure and the growing focus on elderly care are also driving the market growth.

Saudi Arabia Patient Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on product, type of care, and end user.

Product Insights:

- Wheelchairs and Scooters

- Medical Beds

- Mechanical and Nonmechanical Equipment

- Ambulatory Aids

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes wheelchairs and scooters, medical beds, mechanical and nonmechanical equipment, ambulatory aids, and others.

Type of Care Insights:

- Bariatric Care

- Fall Prevention

- Critical Care

- Wound Care

- Others

A detailed breakup and analysis of the market based on the type of care have also been provided in the report. This includes bariatric care, fall prevention, critical care, wound care, and others.

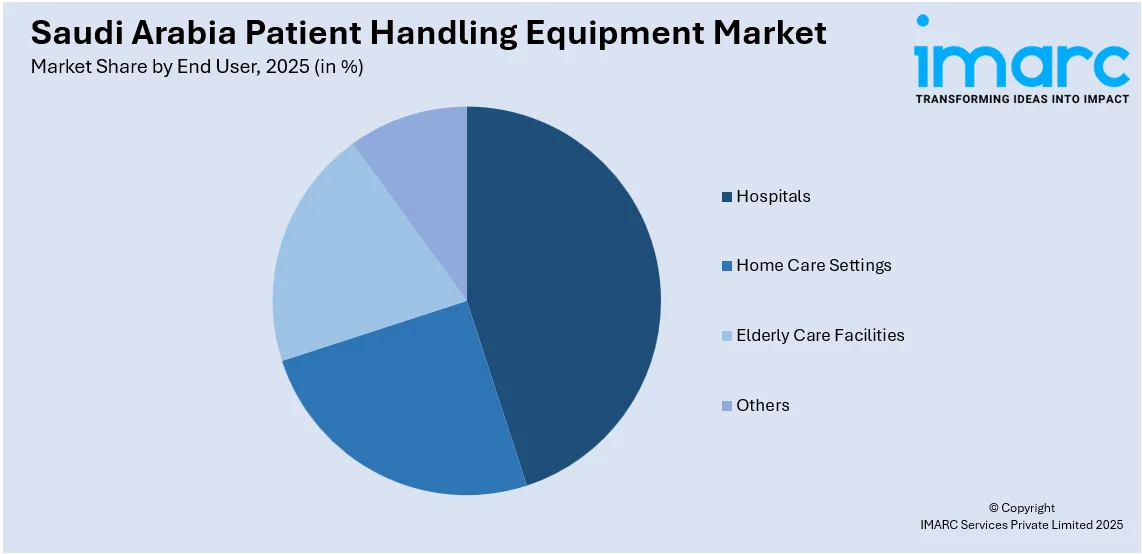

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Home Care Settings

- Elderly Care Facilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, home care settings, elderly care facilities, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Patient Handling Equipment Market News:

- April 2025: Mölnlycke Health Care announced that its joint venture, Tamer Mölnlycke Care, began production in Saudi Arabia. This development strengthened local manufacturing capabilities for healthcare products, including patient handling solutions, supporting market growth by improving regional access, lowering costs, and enhancing healthcare infrastructure.

- July 2024: UFP Technologies acquired AJR Enterprises, a leading manufacturer of single-use safe patient handling systems. This acquisition strengthened UFP’s patient surfaces portfolio, expanding capabilities in safe patient handling. The move is expected to drive market growth by enhancing manufacturing and design expertise in this sector.

Saudi Arabia Patient Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs and Scooters, Medical Beds, Mechanical and Nonmechanical Equipment, Ambulatory Aids, Others |

| Types of Care Covered | Bariatric Care, Fall Prevention, Critical Care, Wound Care, Others |

| End Users Covered | Hospitals, Home Care Settings, Elderly Care Facilities, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia patient handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia patient handling equipment market on the basis of the product?

- What is the breakup of the Saudi Arabia patient handling equipment market on the basis of the type of care?

- What is the breakup of the Saudi Arabia patient handling equipment market on the basis of end user?

- What is the breakup of the Saudi Arabia patient handling equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia patient handling equipment market?

- What are the key driving factors and challenges in the Saudi Arabia patient handling equipment market?

- What is the structure of the Saudi Arabia patient handling equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia patient handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia patient handling equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia patient handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia patient handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)