Saudi Arabia Patient Monitoring Market Report by Type of Device (Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Respiratory Monitoring Devices, Remote Monitoring Devices, and Others), Application (Cardiology, Neurology, Respiratory, Fetal and Neonatal, Weight Management and Fitness Monitoring, and Others), End User(Home Healthcare, Hospitals, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia patient monitoring market size reached USD 476.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 777.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.59% during 2026-2034. The increasing adoption of telemedicine, as it enables healthcare providers to monitor patients' vital signs and health conditions remotely, enhancing accessibility, and reducing the need for in-person visits is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 476.5 Million |

| Market Forecast in 2034 | USD 777.1 Million |

| Market Growth Rate (2026-2034) | 5.59% |

Patient monitoring is a crucial component of modern healthcare, involving the continuous or periodic observation and measurement of a patient's vital signs, physiological parameters, and medical data to assess their health status and well-being. This process typically employs a range of medical devices and technologies, such as electrocardiograms (ECGs), blood pressure monitors, pulse oximeters, and telemetry systems, to track variables like heart rate, blood pressure, oxygen levels, and more. The collected information provides healthcare professionals with real-time data and trends, enabling them to make informed decisions about a patient's care. Patient monitoring plays a critical role in various clinical settings, including hospitals, intensive care units, emergency rooms, and even remote telehealth environments, helping to detect and respond to medical issues promptly, optimize treatment plans, and improve patient outcomes.

Saudi Arabia Patient Monitoring Market Trends:

Rising Burden of Chronic Diseases

Increasing incidence of chronic ailments, such as diabetes, cardiovascular conditions, and respiratory disorders, is a primary driver of the patient monitoring market. In Saudi Arabia, the prevalence of diabetes (% of the population aged 20 to 79) was noted at 23.1% in 2024, as per the World Bank's collection of development indicators sourced from officially acknowledged entities. With lifestyle changes, urbanization, and dietary habits, non-communicable diseases are on the rise, creating an urgent need for continuous and real-time health monitoring. Devices like glucose monitors and wearable sensors are becoming essential for early detection, preventive care, and effective disease management. Saudi Arabia’s healthcare system is also prioritizing long-term disease management programs to reduce hospital admissions and overall treatment costs. Patient monitoring solutions allow healthcare professionals to track conditions remotely, enabling timely interventions and improving patient outcomes.

Increasing Adoption of Telemedicine and Remote Care

Telemedicine and remote care are gaining momentum in Saudi Arabia, driving higher demand for patient monitoring technologies. As per the IMARC Group, the Saudi Arabia telemedicine market size reached USD 842.1 Million in 2024. Remote monitoring tools, such as wearable devices, mobile health apps, and connected sensors, allow physicians to track patients’ vital signs and treatment adherence without requiring frequent hospital visits. This is especially valuable in managing chronic illnesses, post-operative recovery, and elderly care, where continuous monitoring reduces risks and improves outcomes. Remote solutions also ease the burden on urban hospitals by extending care into rural and underserved areas. As patients and providers are adopting digital healthcare, patient monitoring systems are becoming critical to the telehealth ecosystem, enabling efficient, real-time communication and bridging the gap between patients and medical professionals.

Technological Advancements and Integration of Artificial Intelligence (AI)

Rapid technological advancements are significantly fueling the market growth in Saudi Arabia. AI-based monitoring systems, predictive analytics, and the Internet of Things (IoT)-enabled devices are enabling healthcare providers to detect anomalies earlier and make data-driven decisions. As per the NIH, a study conducted in Saudi Arabia revealed that 5.88% and 8.82% of significant hospitals in the country set up dedicated AI centers and utilized AI in patient care, respectively, as of May 2025. These smart monitoring tools improve accuracy, minimize errors, and provide actionable insights for both acute and chronic care management. Wearables and implantable devices equipped with AI capabilities are expanding the possibilities for continuous, real-time monitoring, making healthcare more personalized and responsive. Additionally, cloud integration ensures that patient data is securely stored and easily shared across different healthcare providers. The growing availability of advanced, user-friendly monitoring devices is increasing adoption rates among both healthcare professionals and patients.

Key Growth Drivers of Saudi Arabia Patient Monitoring Market:

Aging Population and Rising Demand for Elderly Care

Saudi Arabia is experiencing demographic changes, with an increasing proportion of elderly citizens. As life expectancy is rising, age-related health issues, such as hypertension, heart disease, and mobility disorders, are becoming more common. Elderly care requires consistent monitoring of vital parameters to ensure timely medical intervention, making patient monitoring devices indispensable. Remote monitoring and wearable technologies allow seniors to live more independently while maintaining regular connection with healthcare providers. In addition, home-based monitoring solutions are gaining popularity, as families are seeking convenient and cost-effective alternatives to long-term hospital stays. The Kingdom’s healthcare policies are also focusing on expanding geriatric care services, creating new opportunities for patient monitoring technologies. As the elderly population is growing, the demand for reliable and easy-to-use monitoring systems is rising, making them central to improving quality of life and reducing healthcare system pressures.

Rising Healthcare Digitalization and Smart Hospitals

Digital transformation in Saudi Arabia’s healthcare sector is driving increased adoption of patient monitoring solutions. Smart hospitals are integrating advanced technologies, such as cloud-based platforms, to streamline healthcare delivery. These systems enable continuous monitoring of patients both within hospital settings and at home, ensuring accurate real-time data collection and analysis. Healthcare providers benefit from data-driven insights that enhance diagnostics, treatment planning, and preventive care. This shift towards digital healthcare is also supported by government initiatives and partnerships with global technology companies. The adoption of electronic health records (EHRs) is further strengthening the role of monitoring devices, as patient data is seamlessly integrated into clinical decision-making. With digitalization accelerating across hospitals, clinics, and home care settings, Saudi Arabia is building a healthcare environment where patient monitoring technologies form the backbone of modern medical practices.

Growing emphasis on Preventive Healthcare

Preventive healthcare is gaining prominence in Saudi Arabia, as the Kingdom is working to reduce the burden of non-communicable diseases and lower long-term healthcare costs. Patient monitoring solutions play a vital role in early detection, lifestyle management, and preventive interventions. Devices, such as blood pressure monitors, wearable activity trackers, and glucose sensors, help individuals manage their health proactively while providing doctors with continuous insights. Employers and insurers are also promoting preventive health programs that utilize monitoring technologies to track employee wellness and encourage healthier habits. Preventive strategies not only improve individual outcomes but also decrease costly hospital admissions and treatment expenditures. With public awareness campaigns and government backing, the shift towards prevention is accelerating the adoption of monitoring tools.

Saudi Arabia Patient Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type of device, application, and end user.

Type of Device Insights:

To get more information on this market, Request Sample

- Hemodynamic Monitoring Devices

- Neuromonitoring Devices

- Cardiac Monitoring Devices

- Respiratory Monitoring Devices

- Remote Monitoring Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the type of device. This includes hemodynamic monitoring devices, neuromonitoring devices, cardiac monitoring devices, respiratory monitoring devices, remote monitoring devices, and others.

Application Insights:

- Cardiology

- Neurology

- Respiratory

- Fetal and Neonatal

- Weight Management and Fitness Monitoring

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, neurology, respiratory, fetal and neonatal, weight management and fitness monitoring, and others.

End User Insights:

- Home Healthcare

- Hospitals

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes home healthcare, hospitals, and others.

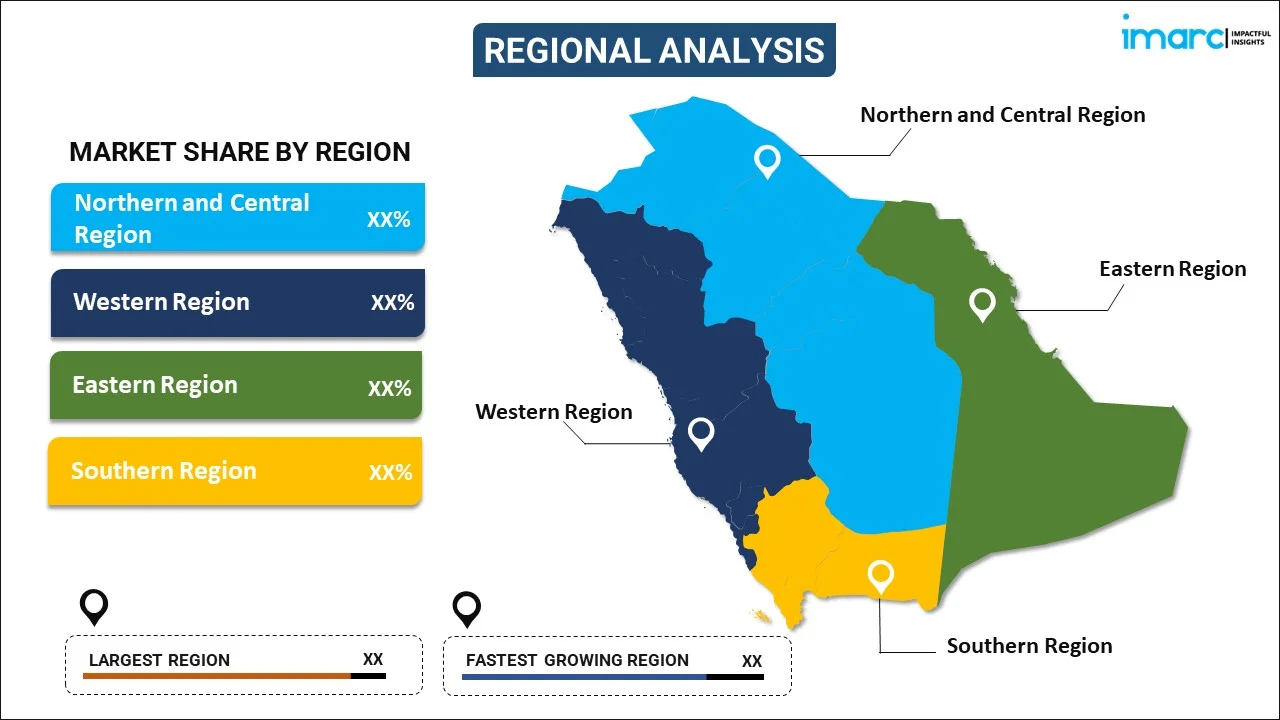

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Patient Monitoring Market News:

- September 2025: Fakeeh Care Group from Saudi Arabia entered into a memorandum of understanding (MoU) with the UK’s HealthGuardian AI to establish a strategic partnership. The collaboration would test AI-powered remote patient monitoring throughout the organization’s system. Additionally, the partnership reinforced Saudi Arabia’s ‘Vision 2030’ initiative.

- November 2024: At the 2024 Global Health Exhibition, HMG, a prominent healthcare service provider in the Middle East, revealed its investment in state-of-the-art radiology advancements from GE HealthCare to offer its patients access to top-tier diagnostic and interventional radiology services, promote healthcare equity, and aid the Kingdom's Vision 2030 healthcare transformation objectives. The partnership between GE HealthCare and HMG encompassed cutting-edge patient care solutions (PCS) focused on enhancing patient monitoring abilities.

Saudi Arabia Patient Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Devices Covered | Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Respiratory Monitoring Devices, Remote Monitoring Devices, Others |

| Applications Covered | Cardiology, Neurology, Respiratory, Fetal and Neonatal, Weight Management and Fitness Monitoring, Others |

| End Users Covered | Home Healthcare, Hospitals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia patient monitoring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia patient monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia patient monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The patient monitoring market in Saudi Arabia was valued at USD 476.5 Million in 2025.

The Saudi Arabia patient monitoring market is projected to exhibit a CAGR of 5.59% during 2026-2034, reaching a value of USD 777.1 Million by 2034.

The growing adoption of advanced medical technologies, coupled with increasing healthcare spending, is catalyzing the demand for portable and remote monitoring devices. Government initiatives under Vision 2030 to modernize healthcare infrastructure and promote digital health solutions are also contributing significantly. Rising geriatric population, which requires frequent monitoring, is further supporting the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)