Saudi Arabia Personal Finance Software Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Saudi Arabia Personal Finance Software Market Overview:

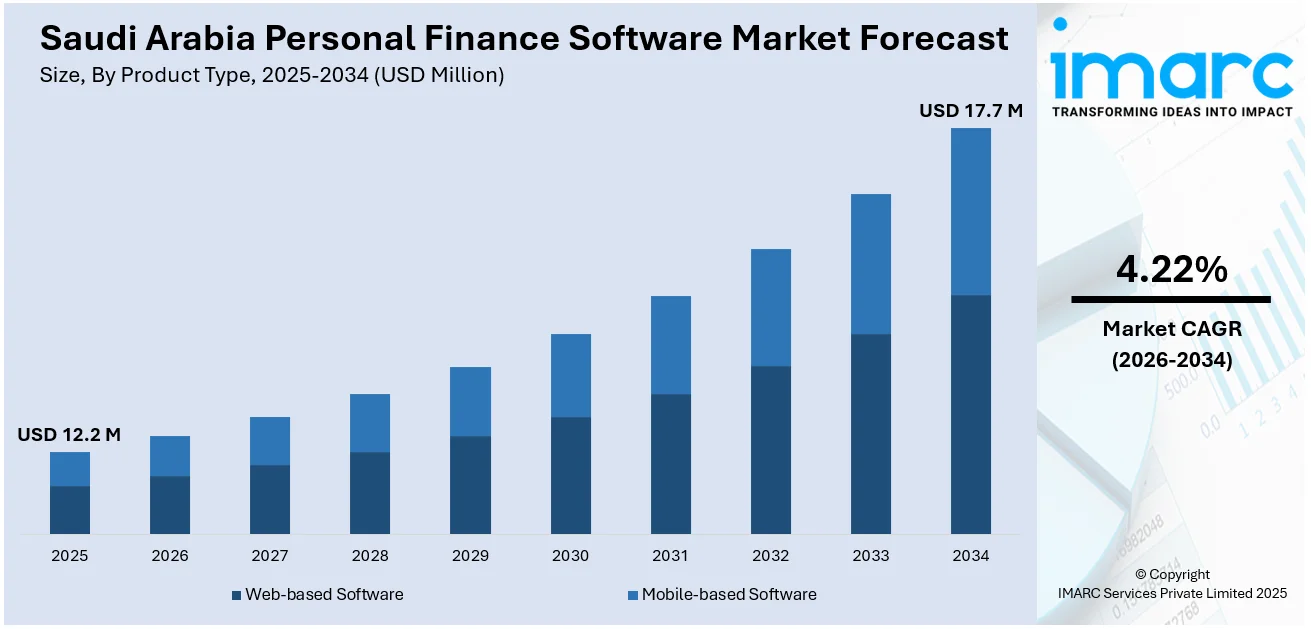

The Saudi Arabia personal finance software market size reached USD 12.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 17.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.22% during 2026-2034. The market is growing due to increasing digital banking adoption, rising financial literacy, smartphone penetration, and demand for money management tools. Government initiatives supporting digital transformation and fintech innovation further encourage consumers to adopt user-friendly budgeting, investment tracking, and financial planning applications for improved personal finance control.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.2 Million |

| Market Forecast in 2034 | USD 17.7 Million |

| Market Growth Rate 2026-2034 | 4.22% |

Saudi Arabia Personal Finance Software Market Trends:

Integration with Open Banking APIs for Enhanced User Experience

A key trend shaping the Saudi Arabia personal finance software market is the integration of Open Banking APIs, driven by regulatory support under the Saudi Central Bank’s open banking framework. This allows software providers to access secure, real-time financial data from multiple banks, delivering consolidated account views and personalized financial insights. Consumers can now manage accounts, monitor transactions, and receive spending analytics through a single platform. These capabilities enhance convenience and improve financial decision-making. Open Banking integration also enables predictive analysis features, such as forecasting cash flow or flagging unusual spending behavior. With fintech innovation gaining momentum in the Kingdom, software vendors are investing in secure and compliant API partnerships to ensure seamless functionality while adhering to data privacy and cybersecurity standards. For instance, in January 2025, STC Bank, a digital bank under Saudi Telecom Company, launched full services in Saudi Arabia after receiving approval from the Saudi Central Bank. Formerly STC Pay, it now offers personal and business accounts, transfers, expense tracking, and Sharia-compliant tools. With over 200,000 merchants registered, users are transitioning smoothly from wallets to full accounts. The launch supports Vision 2030 and likely aligns with Open Banking protocols through real-time data access and personal finance-style features.

To get more information on this market Request Sample

Customization and Localization of Financial Tools

Personal finance software in Saudi Arabia is increasingly offering localized features tailored to the financial habits, language preferences, and regulatory environment of the Kingdom. From Arabic language interfaces to tools that align with regional banking practices and Islamic finance principles, customization is becoming a competitive differentiator. Applications now include features such as zakat calculators, shariah-compliant investment tracking, and salary-based budgeting aligned with local pay cycles. These adaptations improve user engagement and trust by addressing cultural and financial expectations. As consumer demand grows for intuitive, relatable interfaces, software developers are focusing on incorporating local financial education content and alerts relevant to national holidays, economic events, and government benefits. This shift toward culturally attuned functionality reflects an effort to improve financial inclusion and build long-term user loyalty. For instance, in April 2025, SS&C Technologies opened a new office in Riyadh, expanding its presence in the Middle East. The office will help strengthen ties with the Capital Markets Authority and Saudi Arabian Monetary Agency. SS&C supports over 850 clients regionally, including 150 in Saudi Arabia, offering software for investment, risk, and automation. The move supports Saudi Arabia’s Vision 2030 and growing financial market. Long-term client Jadwa Investment welcomed the move, emphasizing improved access to tailored local support.

Saudi Arabia Personal Finance Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Web-based Software

- Mobile-based Software

The report has provided a detailed breakup and analysis of the market based on the product type. This includes web-based software and mobile-based software.

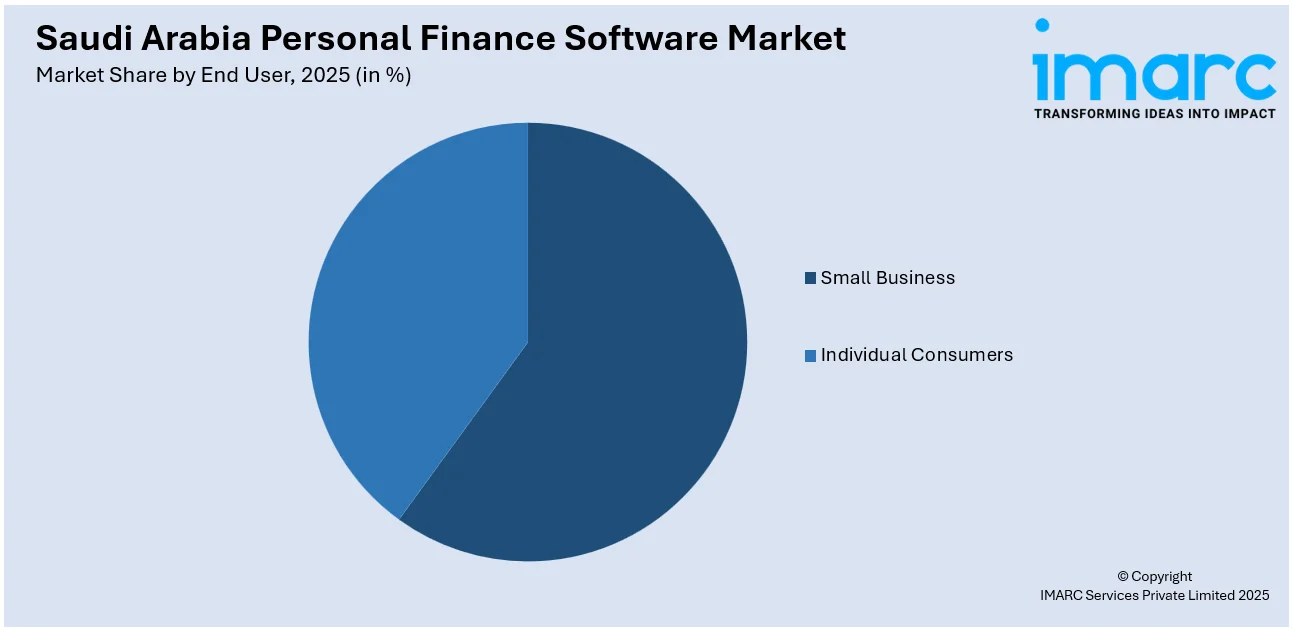

End User Insights:

Access the comprehensive market breakdown Request Sample

- Small Business

- Individual Consumers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small business and individual consumers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Personal Finance Software Market News:

- In February 2025, Saudi Arabia’s first three digital-only banks, namely D360 Bank, Vision Bank, and STC Bank, have officially been launched following regulatory approval by the Saudi Central Bank (SAMA). The move represents a major shift in the Kingdom’s banking sector, aligning with growing consumer demand for mobile-first and personalized financial services.

- In November 2024, Silicon Valley’s General Catalyst, along with Bain Capital and Duquesne Family Office, made its first Saudi investment of over USD 100 Million by backing Riyadh-based fintech Lean Technologies. Lean offers infrastructure for secure account-to-account payments and data-sharing, operating under Saudi Central Bank oversight. With nearly 1 million bank accounts verified, it supports sectors like insurance and lending.

- In August 2024, Saudi fintech startup Barq entered the Saudi market and gained over 1 Million users within three weeks. The platform supports money transfers to more than 200 countries and provides virtual and physical Visa cards with no annual or international fees, spending controls, and travel benefits. Licensed by the Saudi Central Bank, Barq also offers a cashback-enabled marketplace and a game center. Its partnership with Thunes powers real-time cross-border payments to over 130 countries, highlighting rapid momentum in digital personal finance services.

Saudi Arabia Personal Finance Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Web-based Software, Mobile-based Software |

| End Users Covered | Small Business, Individual Consumers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia personal finance software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia personal finance software market on the basis of product type?

- What is the breakup of the Saudi Arabia personal finance software market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia personal finance software market?

- What are the key driving factors and challenges in the Saudi Arabia personal finance software market?

- What is the structure of the Saudi Arabia personal finance software market and who are the key players?

- What is the degree of competition in the Saudi Arabia personal finance software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia personal finance software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia personal finance software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia personal finance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)