Saudi Arabia PET Packaging Market Size, Share, Trends and Forecast by Packaging Type, Form, Pack Type, Filling Technology, End User, and Region, 2026-2034

Saudi Arabia PET Packaging Market Summary:

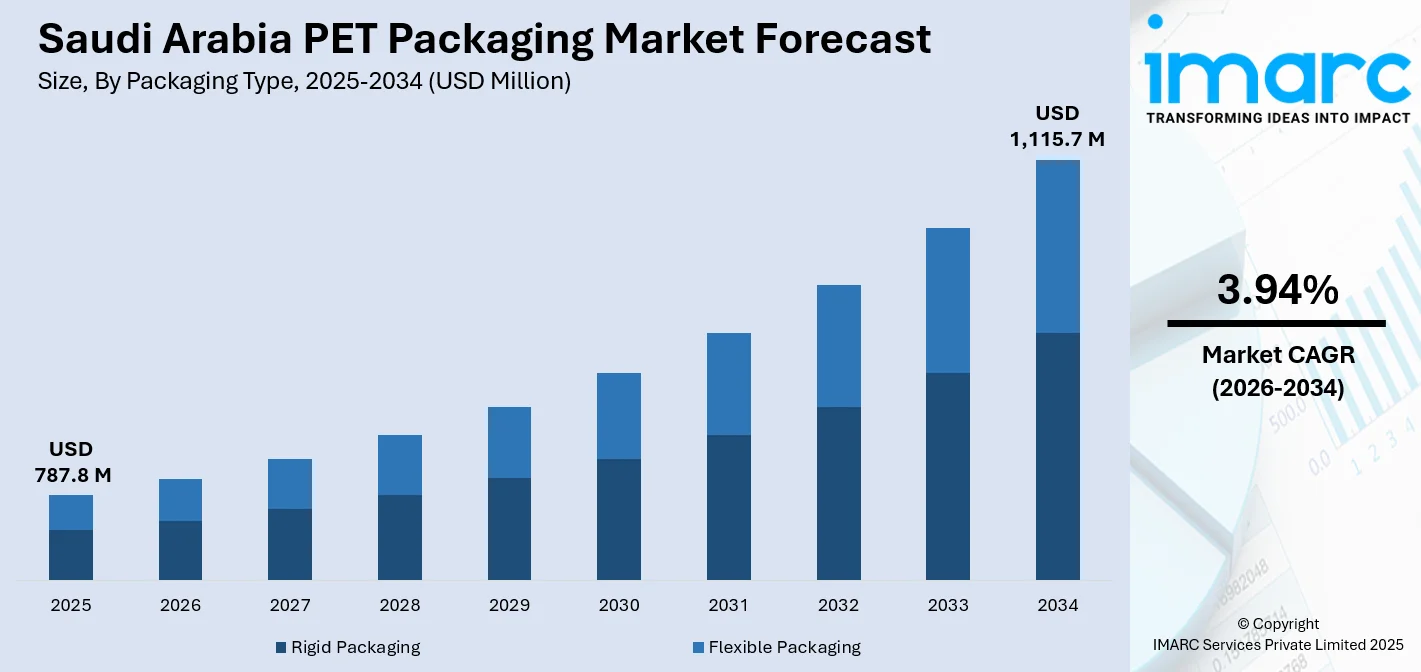

The Saudi Arabia PET packaging market size was valued at USD 787.8 Million in 2025 and is projected to reach USD 1,115.7 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

The Saudi Arabia PET packaging market exhibits a positive outlook, supported by expanding food and beverage (F&B) consumption, growing bottled water demand, and rising preferences for lightweight, shatter-resistant packaging solutions. PET’s recyclability and compatibility with sustainability initiatives align well with Vision 2030 environmental goals. Rapid urbanization, modern retail expansion, and increasing use of PET in personal care and pharmaceutical packaging further strengthen market prospects.

Key Takeaways and Insights:

- By Packaging Type: Rigid packaging dominates the market with a share of 61% in 2025, owing to its superior durability, excellent product protection, and widespread application across the F&B industry. The growing demand for PET bottles and containers supports this segment's continued leadership in the Saudi Arabia market.

- By Form: Amorphous PET leads the market with a share of 54% in 2025, driven by its exceptional transparency, ease of processing, and cost-effectiveness for beverage packaging applications. The material's versatility in blow molding processes makes it ideal for high-volume bottle production across multiple industries.

- By Pack Type: Bottles and jars comprise the largest segment with a market share of 38% in 2025, demonstrating strong consumer demand for bottled water and packaged food items. International brands increasingly prefer PET bottles for their lightweight properties and cost-effective transportation benefits.

- By Filling Technology: Hot fill exhibits a clear dominance in the market with 31% share in 2025, fueled by its ability to preserve beverage quality and extend shelf life for heat-pasteurized products, including juices, teas, and functional beverages, in Saudi Arabia's demanding climate conditions.

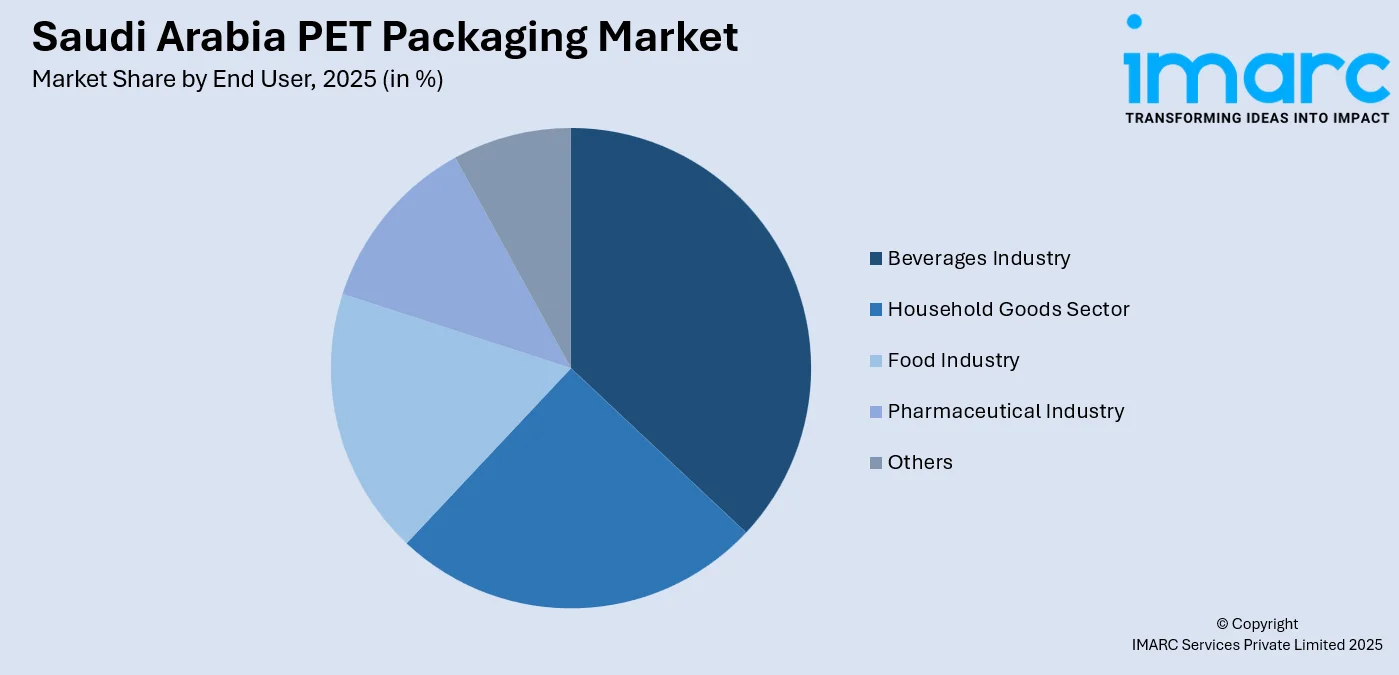

- By End User: Beverages industry prevails the market with a share of 36% in 2025, driven by increasing consumption of bottled water, soft drinks, and functional beverages. Rising health consciousness and the Kingdom's hot climate continue to fuel demand for packaged hydration solutions.

- By Region: Northern and Central Region represents the largest region with a market share of 30% in 2025, propelled by Riyadh's concentration of manufacturing plants, significant consumer base, and robust retail infrastructure supporting packaged F&B consumption across the capital region.

- Key Players: Key players drive the Saudi Arabia PET packaging market by expanding manufacturing capacities, investing in advanced blow molding technologies, and strengthening sustainability initiatives. Their focus on recycled PET integration, innovative packaging designs, and strategic partnerships with beverage manufacturers enhances market penetration and supports the Kingdom's circular economy objectives.

To get more information on this market Request Sample

The Saudi Arabia PET packaging market is experiencing robust expansion, driven by increasing urbanization, rising consumer preference for lightweight and recyclable packaging solutions, and significant growth across the F&B sector. The Kingdom's Vision 2030 initiative has accelerated investments in sustainable packaging innovations, reinforcing economic diversification while addressing environmental sustainability goals. Growing health and wellness consciousness among consumers has intensified demand for bottled water and ready-to-drink (RTD) beverages. As per IMARC Group, the Saudi Arabia health and wellness market size reached USD 38,747.7 Million in 2025. The pharmaceutical and personal care industries are also contributing to market expansion through increasing requirements for safe, hygienic, and durable packaging solutions. Furthermore, the government's commitment to establishing a circular economy through various organizations has strengthened domestic recycling infrastructure, with the Kingdom exporting recycled PET flakes to European markets.

Saudi Arabia PET Packaging Market Trends:

Expansion of Domestic Manufacturing Capabilities

The Saudi Arabia PET packaging sector is experiencing significant investment in localized production infrastructure, with new facilities incorporating advanced blow molding and injection molding technologies. The ongoing shift towards domestic manufacturing reduces import dependency while enhancing supply chain resilience. In June 2024, Arabian Plastic Industrial Company unveiled its new 34,000 square meter factory in Al-Kharj Industrial City, featuring advanced PET production lines to fulfill increasing local demand.

Rising Integration of Recycled PET Materials

In Saudi Arabia, the market is witnessing accelerated adoption of recycled PET materials, as sustainability is becoming central to packaging strategies. Leading beverage companies are transitioning towards bottles made from recycled content to meet environmental targets. In April 2024, Nova Water launched Saudi Arabia's first water bottle crafted entirely from 100% recycled materials, aligning with the country’s Vision 2030 objectives and demonstrating the industry's commitment to circular economy principles.

Growing Demand for Premium Beverage Packaging

Consumer preferences are shifting towards premium and functional beverage products, driving innovations in PET packaging designs. Health-conscious consumers increasingly favor vitamin-enriched waters and low-calorie beverages packaged in visually appealing PET containers. Brands are responding by adopting ergonomic bottle shapes, transparent designs, and resealable caps to enhance convenience and shelf appeal. Lightweight PET formats support on-the-go consumption patterns while maintaining product safety. Advanced labeling and smart packaging features further improve brand differentiation and consumer engagement.

How Vision 2030 is Transforming the Saudi Arabia PET Packaging Market:

Vision 2030 is transforming the Saudi Arabia PET packaging market by driving industrial diversification, sustainability adoption, and domestic manufacturing expansion. The program’s focus on reducing import dependence and strengthening local production is encouraging investments in PET resin processing, bottle manufacturing, and packaging conversion facilities. Rising consumption of packaged food, beverages, and pharmaceuticals under Vision 2030 lifestyle shifts is increasing demand for lightweight, durable PET packaging solutions. Sustainability objectives are accelerating the adoption of recyclable and lightweight PET formats, along with investments in collection and recycling infrastructure. Regulatory emphasis on waste reduction and circular economy practices is pushing manufacturers to improve material efficiency and introduce recycled PET content.

Market Outlook 2026-2034:

The Saudi Arabia PET packaging market demonstrates strong growth potential, supported by increasing consumption across the F&B sector, expanding pharmaceutical manufacturing, and government-led sustainability initiatives. Rising urbanization and changing consumer lifestyles continue to accelerate demand for convenient, portable packaging solutions. The market generated a revenue of USD 787.8 Million in 2025 and is projected to reach a revenue of USD 1,115.7 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034. Continued investments in recycling infrastructure, domestic manufacturing expansion, and innovations in sustainable packaging materials position the market for sustained growth throughout the forecast period. Increasing adoption of lightweight, cost-efficient, and recyclable PET formats across food, beverage, and personal care applications will further strengthen market resilience and long-term demand.

Saudi Arabia PET Packaging Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Packaging Type |

Rigid Packaging |

61% |

|

Form |

Amorphous PET |

54% |

|

Pack Type |

Bottles and Jars |

38% |

|

Filling Technology |

Hot Fill |

31% |

|

End User |

Beverages Industry |

36% |

|

Region |

Northern and Central Region |

30% |

Packaging Type Insights:

- Rigid Packaging

- Flexible Packaging

Rigid packaging dominates with a market share of 61% of the total Saudi Arabia PET packaging market in 2025.

Rigid packaging maintains its leadership position through exceptional durability, superior barrier properties, and widespread application across the beverage, food, and pharmaceutical industries. The format offers excellent product protection against moisture, oxygen, and contaminants while maintaining visual transparency that allows consumers to inspect contents. Its lightweight nature supports cost-efficient transportation and reduced logistics expenses across long supply chains. High design flexibility enables diverse bottle shapes and sizes, supporting brand differentiation and shelf appeal.

The segment's dominance is reinforced by increasing investments in domestic blow molding facilities and growing demand from the bottled water sector. Manufacturers are integrating advanced production technologies to enhance efficiency while meeting sustainability requirements. The rigid format's ability to withstand Saudi Arabia's high temperatures during transportation and storage makes it particularly suitable for the Kingdom's logistics infrastructure and consumer distribution networks. Growing use in personal care and household products is further strengthening demand.

Form Insights:

- Amorphous PET

- Crystalline PET

Amorphous PET leads with a share of 54% of the total Saudi Arabia PET packaging market in 2025.

Amorphous PET maintains market leadership due to its exceptional optical clarity, superior processability in blow molding operations, and cost-effectiveness for beverage packaging applications. The material's transparent properties make it ideal for showcasing product contents, a critical factor for consumer purchasing decisions in the competitive beverage market. Its lightweight nature supports easy handling and lower transportation costs across supply chains. Amorphous PET also offers good impact resistance, ensuring package integrity during filling, distribution, and retail handling.

The segment benefits from ongoing technological advancements in manufacturing processes that enable faster production cycles and reduced material wastage. Amorphous PET's lower processing temperatures compared to crystalline variants result in energy savings and enhanced production efficiency. The material's compatibility with recycling processes also supports manufacturers' sustainability commitments, as recycled amorphous PET can be effectively reprocessed into new packaging applications without significant quality degradation. Increasing adoption in functional beverages and flavored drinks is further supporting segment growth.

Pack Type Insights:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

Bottles and jars exhibit a clear dominance with a 38% share of the total Saudi Arabia PET packaging market in 2025.

Bottles and jars maintain the leading position, driven by substantial demand from the bottled water and beverage sectors. International brands prefer PET bottles for their lightweight properties, enabling cost-effective transportation across the Kingdom's extensive distribution networks. Their shatter-resistant nature enhances safety during handling and distribution across retail and hospitality channels. PET bottles also support a wide range of sizes and shapes, allowing brands to address diverse consumption occasions. High compatibility with recycling systems further strengthens their acceptance among regulators and environmentally aware consumers.

The segment's growth is supported by increasing consumption of packaged water, which has become essential given Saudi Arabia's desert climate and limited freshwater resources. Religious tourism during Hajj and Umrah seasons creates seasonal demand spikes, with millions of pilgrims requiring portable hydration solutions. The Ministry of Hajj and Umrah announced a 30% rise in pilgrim arrivals in 2025, compared to 2024, and a 27% increase in visa grants. Manufacturers are responding by investing in high-speed production lines, with facilities achieving high capacities to meet domestic and regional requirements.

Filling Technology Insights:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

Hot fill comprises the leading segment with a 31% share of the total Saudi Arabia PET packaging market in 2025.

Hot fill dominates the market, owing to its effectiveness in preserving beverage quality while extending shelf life for heat-pasteurized products. The technology is particularly suited for juices, teas, and functional beverages that require thermal processing to ensure food safety. It enables manufacturers to eliminate chemical preservatives while maintaining product freshness and flavor integrity. Hot fill processes also support aseptic-like safety standards using relatively simpler production setups. This makes the technology attractive for both large beverage producers and emerging brands focused on clean-label positioning.

The segment benefits from the Kingdom's challenging climate conditions, where temperatures regularly exceed 40°C during summer months. Hot fill packaging provides enhanced product stability without refrigeration requirements, enabling efficient distribution across remote areas. Manufacturers continue to invest in specialized heat-resistant PET formulations that maintain structural integrity during the filling process while delivering the clarity and recyclability consumers expect from modern packaging solutions. It also reduces cold-chain dependence, lowering logistics costs and improving supply reliability nationwide.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

Beverages industry prevails the market with a share of 36% of the total Saudi Arabia PET packaging market in 2025.

The beverages industry maintains dominant market share, driven by exceptional demand for bottled water, soft drinks, and functional beverages across Saudi Arabia. Growing health consciousness among consumers has accelerated demand for vitamin-enriched waters and low-calorie beverage options, creating new opportunities for innovative PET packaging designs. Brand owners increasingly focus on lightweight bottles, ergonomic shapes, and premium aesthetics to enhance shelf appeal and consumer convenience. Rising on-the-go consumption patterns further strengthen demand for single-serve and resealable PET formats.

The segment's growth is supported by Saudi Arabia's position among the top global consumers of bottled water per capita, driven by limited freshwater resources and high temperatures throughout the year. Major beverage manufacturers continue expanding production capacities, with facilities incorporating advanced PET bottling lines to meet domestic and export requirements. The introduction of healthier beverage alternatives, including date-based soft drinks and herbal infusions, is further diversifying PET packaging applications within this leading segment.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the largest region with a 30% share of the total Saudi Arabia PET packaging market in 2025.

Northern and Central Region maintains market leadership driven by Riyadh's substantial population base and concentration of manufacturing facilities. The population of Riyadh is expected to grow to 9.6 Million by 2030, indicating a 38% increase from 2025. The region benefits from integrated logistics parks and modern retail infrastructure that anchors one-third of Saudi Arabia's F&B consumption. Major beverage producers have established production facilities in the area, including advanced PET bottling operations servicing domestic and regional markets throughout the Gulf region.

Industrial development in areas like Al-Kharj Industrial City continues to attract packaging manufacturers seeking proximity to major consumer markets. The region's robust purchasing power and modern retail density support premium beverage products requiring sophisticated PET packaging solutions. Government investments in water treatment infrastructure and desalination facilities further strengthen regional demand, as the National Water Company expands drinking water supply networks serving growing urban populations across the Northern and Central Region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia PET Packaging Market Growing?

Expanding F&B Industry

The Saudi Arabia PET packaging market is experiencing robust growth, driven by significant expansion across the F&B sector. Rising urbanization and changing consumer lifestyles have accelerated demand for packaged beverages, ready-to-eat (RTE) foods, and convenient hydration solutions. The Kingdom's F&B industry is creating sustained demand for PET packaging across multiple product categories. Government initiatives under Vision 2030 are attracting substantial foreign investments into food manufacturing, with major multinational corporations establishing production facilities throughout the Kingdom. In April 2025, PepsiCo opened its new regional headquarters in Riyadh, having invested over USD 2.4 Billion in Saudi Arabia over the past eight years. The growing expatriate population has intensified consumption of packaged foods and beverages, particularly RTE meals requiring secure PET containers for distribution.

Rising Demand for Bottled Water and Hydration Products

Increasing bottled water consumption is a major growth catalyst for the Saudi Arabia PET packaging market. The Kingdom’s desert climate, scarce natural freshwater availability, and heavy reliance on desalination make packaged water an everyday necessity for households, workplaces, and travelers. PET bottles are widely preferred because they are lightweight, durable, and easy to transport across long distances. Demand rises further during religious tourism seasons, when pilgrims require safe, portable hydration solutions throughout their journeys. Urban lifestyles and busy work patterns also encourage on-the-go consumption, reinforcing single-serve packaging demand. At the same time, consumers are showing growing interest in functional and enhanced water products offering added vitamins, minerals, and wellness benefits. These premium beverages rely on high-quality, visually appealing PET packaging that supports branding, convenience, and shelf stability, expanding overall PET packaging usage across the Kingdom in modern retail environments nationwide.

Government Sustainability Initiatives and Circular Economy Development

Saudi Arabia’s sustainability agenda under Vision 2030 is reshaping the PET packaging market through strong emphasis on recycling and circular economy development. Government policies encourage waste reduction, material recovery, and responsible plastic use, creating a favorable environment for recyclable PET solutions. Investments in collection systems, sorting facilities, and recycling plants are strengthening domestic capabilities and reducing reliance on virgin materials. Collaborations between public entities, energy companies, and global sustainability organizations are accelerating technology transfer and operational expertise. Recycled PET is increasingly being positioned as a valuable industrial input rather than waste, supporting new downstream applications. These efforts improve supply chain resilience while aligning packaging growth with environmental priorities. As recycling infrastructure matures, manufacturers gain greater access to locally sourced recycled materials, supporting cost efficiency, regulatory compliance, and long-term sustainability across Saudi Arabia’s evolving packaging ecosystem for future industrial development nationwide.

Market Restraints:

What Challenges the Saudi Arabia PET Packaging Market is Facing?

Environmental Concerns and Plastic Waste Management

Growing environmental awareness and concerns over plastic waste accumulation present challenges for the Saudi Arabia PET packaging market. Saudi Arabia generates substantial plastic waste annually, creating pressure for sustainable alternatives. Regulatory requirements from the Saudi Arabian Standards, Metrology, and Quality Organization increasingly limit non-biodegradable plastics, requiring manufacturers to invest in recycling infrastructure and alternative material development.

Raw Material Price Volatility

Fluctuations in petroleum-based raw material prices impact PET production costs and market stability. PET resin prices are directly linked to crude oil and petrochemical feedstock markets, creating uncertainty for packaging manufacturers. This volatility affects profit margins and pricing strategies throughout the supply chain, requiring companies to implement hedging mechanisms and diversify sourcing arrangements to maintain competitive positioning.

Competition from Alternative Packaging Materials

Increasing competition from glass, aluminum, and paper-based packaging materials challenges PET market growth in certain applications. Premium beverage brands often prefer glass packaging for perceived quality advantages, while sustainability-focused consumers may choose aluminum for its infinite recyclability. Paper-based packaging continues to gain traction in foodservice applications across the country.

Competitive Landscape:

The Saudi Arabia PET packaging market features a competitive landscape, characterized by both established regional manufacturers and international packaging corporations. Key players focus on capacity expansion, technological innovations, and sustainability initiatives to strengthen market positions. Companies are investing in advanced blow molding and injection molding technologies to enhance production efficiency and product quality. Strategic partnerships between packaging manufacturers and major beverage companies are becoming increasingly common, enabling customized solutions for specific product requirements. The market is witnessing consolidation activities as larger players acquire regional facilities to expand geographic coverage and production capabilities.

Saudi Arabia PET Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Rigid Packaging, Flexible Packaging |

| Forms Covered | Amorphous PET, Crystalline PET |

| Pack Types Covered | Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, Others |

| Filling Technologies Covered | Hot Fill, Cold Fill, Aseptic Fill, Others |

| End Users Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia PET packaging market size was valued at USD 787.8 Million in 2025.

The Saudi Arabia PET packaging market is expected to grow at a compound annual growth rate of 3.94% from 2026-2034 to reach USD 1,115.7 Million by 2034.

Rigid packaging dominated the market with a share of 61%, driven by superior durability, excellent product protection, and widespread application across the beverage and food industries requiring robust container solutions.

Key factors driving the Saudi Arabia PET packaging market include expanding F&B sector, rising bottled water consumption, government sustainability initiatives, increasing urbanization activities, and growing pharmaceutical industry investments.

Major challenges include environmental concerns regarding plastic waste management, raw material price volatility linked to petroleum markets, competition from alternative packaging materials, regulatory compliance requirements, and the need for continuous investment in recycling infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)