Saudi Arabia Pharmaceutical Labeling Market Size, Share, Trends and Forecast by Label Type, Material, Application, End Use, and Region, 2026-2034

Saudi Arabia Pharmaceutical Labeling Market Overview:

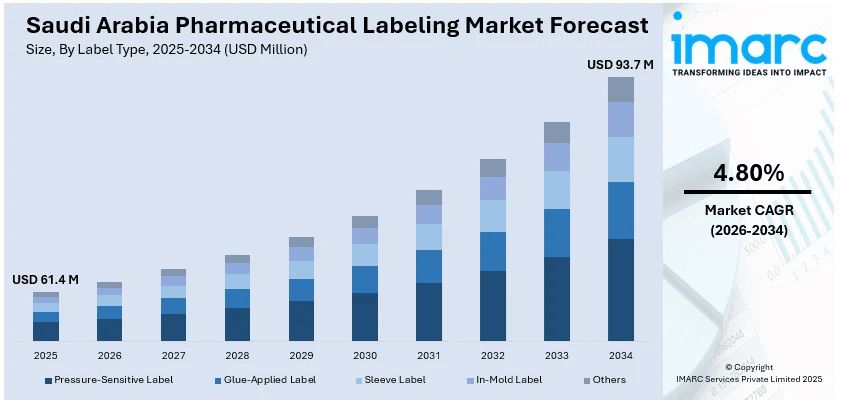

The Saudi Arabia pharmaceutical labeling market size reached USD 61.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 93.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.80% during 2026-2034. Stringent regulatory requirements, progress in domestic pharmaceutical manufacturing, increasing focus on anti-counterfeiting measures, rising healthcare investments under Vision 2030, and expanding exports of locally made drugs are among the key factors driving the Saudi Arabia pharmaceutical labeling market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 61.4 Million |

| Market Forecast in 2034 | USD 93.7 Million |

| Market Growth Rate 2026-2034 | 4.80% |

Saudi Arabia Pharmaceutical Labeling Market Trends:

Regulatory Reforms and Stringent Compliance Standards

One of the most significant drivers in the pharmaceutical labeling market in Saudi Arabia is the government's strong regulatory reforms that seek to ensure product safety, transparency, and traceability. The Saudi Food and Drug Authority (SFDA) has established progressively stringent labeling standards for pharmaceuticals, keeping pace with best international practices. These regulations include certain requirements for drug identification, storage instructions, dosage instructions, expiration dates, and barcode serialization. Under Vision 2030, the Kingdom has prioritized modernization of the healthcare system, including strengthening pharmaceutical traceability and minimizing counterfeit drugs. This, in turn, requires the application of sophisticated labeling technologies like tamper-evident seals, smart labels, and digital serialization. In addition to this, compliance with the RSD (Drug Track and Trace System) is now compulsory. Such a system allows monitoring of pharmaceuticals from the point of manufacture to the end-user through distinct barcoding, further necessitating labeling services that incorporate such capabilities. The manufacturers and suppliers will need to make significant investments in high-quality, regulatory compliant labeling solutions to keep up with such changing rules, avoid fines, and retain access to markets.

To get more information on this market Request Sample

Growth of the Domestic Pharmaceutical Manufacturing Sector

Another factor driving Saudi Arabia's pharmaceutical labeling market growth is the acceleration of local pharmaceutical manufacturing. In a bid to lower dependency on foreign drugs and develop national healthcare resilience, the Saudi government has been encouraging localization through policy support, tax breaks, and financial grants. This localization push has resulted in a clear increase in the number of pharmaceutical manufacturing facilities within the country. As a result, there is an elevating need for integrated labeling solutions specifically designed to meet the operational requirements and branding objectives of local manufacturers. As local companies raise their product offerings to include generics, branded generics, biologics, and specialty drugs, the demand for varied, high-quality labeling options expands exponentially. Local manufacturers need flexible, cost-effective, and scalable label systems that will support diverse dosage forms—i.e., tablets, injectables, and topicals—and adhere to both domestic and international labeling standards. Local companies are also paying more attention to product differentiation in a competitive market, and labeling is being utilized as a marketing and identity vehicle. This encompasses the implementation of attributes like personalized packaging appearance, multilingual labeling, and consumer-friendly formats, all of which require specialized labeling knowledge.

Saudi Arabia Pharmaceutical Labeling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on label type, material, application, and end use.

Label Type Insights:

- Pressure-Sensitive Label

- Glue-Applied Label

- Sleeve Label

- In-Mold Label

- Others

The report has provided a detailed breakup and analysis of the market based on the label type. This includes pressure-sensitive label, glue-applied label, sleeve label, in-mold label, and others.

Material Insights:

- Paper

- Polymer Film

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes paper, polymer film, and others.

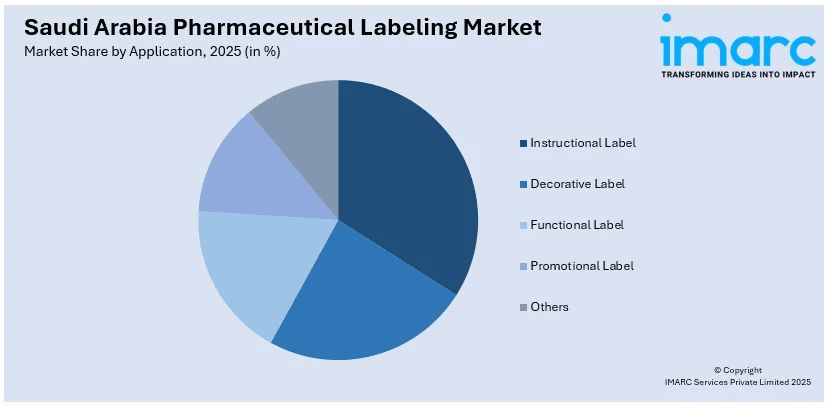

Application Insights:

Access the comprehensive market breakdown Request Sample

- Instructional Label

- Decorative Label

- Functional Label

- Promotional Label

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes instructional label, decorative label, functional label, promotional label, and others.

End Use Insights:

- Bottles

- Blister Packs

- Parenteral Containers

- Pre-Fillable Syringes

- Pre-Fillable Inhalers

- Pouches

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, pouches, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Pharmaceutical Labeling Market News:

- March 2025: United Pharmacies and Avalon Pharma entered into a strategic agreement to produce private-label pharmaceutical products. This collaboration also focused on developing customized labeling and packaging solutions that aligned with United Pharmacies' branding and regulatory standards.

- December 2024: At the CPHI Middle East event in Riyadh, six major investment agreements totaling USD 798 million were announced, aiming to bolster Saudi Arabia's pharmaceutical sector. These deals encompassed advancements in research, manufacturing, and logistics, and the agreements signified a comprehensive approach to strengthening the pharmaceutical industry in the country, including the labeling segment.

- January 2024: The Local Content and Government Procurement Authority of Saudi Arabia signed four agreements aimed at enhancing local pharmaceutical production. These agreements involved collaborations with companies like Jamjoom Pharma, MSD, Aja Pharma, and SAJA Pharmaceutical Co. with the focus being on localizing the production of medications such as sitagliptin phosphate and ticagrelor. As local pharmaceutical manufacturing scales up, there will be an increased demand for labeling solutions that ensure product authenticity, regulatory compliance, and effective supply chain management.

Saudi Arabia Pharmaceutical Labeling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Label Types Covered | Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, Others |

| Materials Covered | Paper, Polymer Film, Others |

| Applications Covered | Instructional Label, Decorative Label, Functional Label, Promotional Label, Others |

| End Uses Covered | Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia pharmaceutical labeling market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia pharmaceutical labeling market on the basis of label type?

- What is the breakup of the Saudi Arabia pharmaceutical labeling market on the basis of material?

- What is the breakup of the Saudi Arabia pharmaceutical labeling market on the basis of application?

- What is the breakup of the Saudi Arabia pharmaceutical labeling market on the basis of end use?

- What are the various stages in the value chain of the Saudi Arabia pharmaceutical labeling market?

- What are the key driving factors and challenges in the Saudi Arabia pharmaceutical labeling market?

- What is the structure of the Saudi Arabia pharmaceutical labeling market and who are the key players?

- What is the degree of competition in the Saudi Arabia pharmaceutical labeling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia pharmaceutical labeling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia pharmaceutical labeling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia pharmaceutical labeling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)