Saudi Arabia Pharmacovigilance Market Size, Share, Trends and Forecast by Service Provider, Product Life Cycle, Type, Process Flow, Therapeutic Area, End Use, and Region, 2026-2034

Saudi Arabia Pharmacovigilance Market Overview:

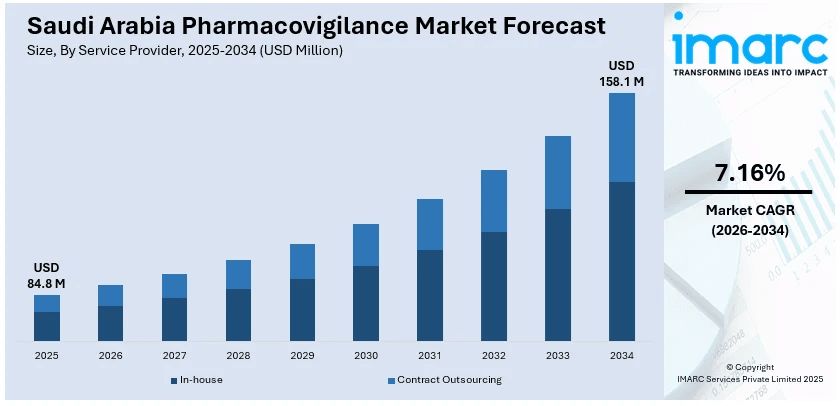

The Saudi Arabia pharmacovigilance market size reached USD 84.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 158.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.16% during 2026-2034. The market is driven by the focus of the government on strengthening regulatory framework and implementing initiatives, heightened innovations in Saudi Arabia’s pharmaceutical industry and research and development (R&D) activities, and rising public and professional recognition of the significance of adverse drug reaction (ADR) reporting.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 84.8 Million |

| Market Forecast in 2034 | USD 158.1 Million |

| Market Growth Rate 2026-2034 | 7.16% |

Saudi Arabia Pharmacovigilance Market Trends:

Strengthening Regulatory Framework and Government Initiatives

The Saudi Food and Drug Authority (SFDA) is taking bold steps to upgrade pharmacovigilance practice, making it a keystone of national health policy. Enforcement of rigorous regulations in accordance with international norms is becoming instrumental. Pharmaceutical firms have to report adverse drug reactions (ADRs) and establish sound risk management systems. In addition, the SFDA is introducing facilities to concentrate ADR reporting and review. Regulatory activity is influencing healthcare players to treat safety monitoring with priority, thus driving the demand for pharmacovigilance services. As the regulatory environment evolves, pharmaceutical companies conducting business in Saudi Arabia are actively investing in compliance infrastructure, such as pharmacovigilance software and expert teams. This is also resulting in increased public-private partnerships and cross-country collaborations to develop capacity, train professionals, and enhance general drug safety monitoring. Moreover, in 2024, TVM Capital Healthcare launch Afiyah Fund, which is a $250 million initiative created to improve the healthcare services in Saudi Arabia.

To get more information on this market Request Sample

Expanding Pharmaceutical Industry and Research and Development (R&D) Activities

Heightened innovations in Saudi Arabia's pharmaceutical industry, driven by government policies under Vision 2030, is a major motivator for the growth of the pharmacovigilance market. The Vision 2030 policy prioritizes the local production of pharmaceuticals and the encouragement of foreign direct investment (FDI) to cut the reliance on imported drugs. Consequently, both local and multinational pharma companies are increasing R&D investments and introducing new drug products in the nation. Every new drug introduction necessitates stringent pharmacovigilance measures to track safety and efficacy, thus heightening the demand for post-marketing surveillance in a thorough manner. Furthermore, localization of clinical trials and biosimilar development is rising the demand for collection and analysis of real-time safety data. As per the data of the IMARC Group, the Saudi Arabia generic drug market size is expected to reach USD 8.0 Billion by 2033. This will further create the need for effective pharmacovigilance services.

Rising Awareness About Patient Safety and ADR Reporting

The growing public and professional recognition of the significance of adverse drug reaction (ADR) reporting is playing a major role in bolstering the market growth in Saudi Arabia. Educational campaigns led by healthcare organizations and educational institutions are making both healthcare professionals and patients aware about the dangers of medication use. Increased training programs for doctors, pharmacists and nurses is ensuring a stronger safety culture of being vigilant and accountable in the administration of drugs. Furthermore, the integration of digital platforms and mobile apps for ADR reporting is making it easier and more convenient, and hence increasing the number of submissions of safety data. These advances are emphasizing the utility of pharmacovigilance as an instrument of public health and not just a regulatory requirement. In addition, as patient-centric care models gain more prominence, healthcare professionals are placing an increased focus on early detection and handling of drug-related problems. According to the IMARC Group, the Saudi Arabia patient monitoring market size is expected to reach USD 753 Million by 2033. This is encouraging healthcare companies to focus on improving pharmacovigilance services.

Saudi Arabia Pharmacovigilance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on service provider, product life cycle, type, process flow, therapeutic area, and end use.

Service Provider Insights:

- In-house

- Contract Outsourcing

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes in-house and contract outsourcing.

Product Life Cycle Insights:

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

A detailed breakup and analysis of the market based on the product life cycle have also been provided in the report. This includes pre-clinical, phase I, phase II, phase III, and phase IV.

Type Insights:

- Spontaneous Reporting

- Intensified ADR Reporting

- Targeted Spontaneous Reporting

- Cohort Event Monitoring

- EHR mining

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes spontaneous reporting, intensified ADR reporting, targeted spontaneous reporting, cohort event monitoring, and EHR mining.

Process Flow Insights:

- Case Data Management

- Case Logging

- Case Data Analysis

- Medical Reviewing and Reporting

- Signal Detection

- Adverse Event Logging

- Adverse Event Analysis

- Adverse Event Review and Reporting

- Risk Management System

- Risk Evaluation System

- Risk Mitigation System

A detailed breakup and analysis of the market based on the process flow have also been provided in the report. This includes case data management (case logging, case data analysis, and medical reviewing and reporting), signal detection (adverse event logging, adverse event analysis, and adverse event review and reporting), and risk management system (risk evaluation system and risk mitigation system).

Therapeutic Area Insights:

- Oncology

- Neurology

- Cardiology

- Respiratory Systems

- Others

A detailed breakup and analysis of the market based on the therapeutic area have also been provided in the report. This includes oncology, neurology, cardiology, respiratory systems, and others.

End Use Insights:

.jpeg)

Access the comprehensive market breakdown Request Sample

- Pharmaceuticals Companies

- Biotechnology Companies

- Medical Device Companies

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes pharmaceuticals companies, biotechnology companies, medical device companies, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Pharmacovigilance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | In-house, Contract Outsourcing |

| Product Life Cycles Covered | Pre-clinical, Phase I, Phase II, Phase III, Phase IV |

| Types Covered | Spontaneous Reporting, Intensified ADR Reporting, Targeted Spontaneous Reporting, Cohort Event Monitoring, EHR Mining |

| Process Flows Covered |

|

| Therapeutic Areas Covered | Oncology, Neurology, Cardiology, Respiratory Systems, Others |

| End Uses Covered | Pharmaceuticals Companies, Biotechnology Companies, Medical Device Companies, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia pharmacovigilance market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia pharmacovigilance market on the basis of service provider?

- What is the breakup of the Saudi Arabia pharmacovigilance market on the basis of product life cycle?

- What is the breakup of the Saudi Arabia pharmacovigilance market on the basis of type?

- What is the breakup of the Saudi Arabia pharmacovigilance market on the basis of process flow?

- What is the breakup of the Saudi Arabia pharmacovigilance market on the basis of therapeutic area?

- What is the breakup of the Saudi Arabia pharmacovigilance market on the basis of end use?

- What are the various stages in the value chain of the Saudi Arabia pharmacovigilance market?

- What are the key driving factors and challenges in the Saudi Arabia pharmacovigilance market?

- What is the structure of the Saudi Arabia pharmacovigilance market and who are the key players?

- What is the degree of competition in the Saudi Arabia pharmacovigilance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia pharmacovigilance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia pharmacovigilance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia pharmacovigilance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)