Saudi Arabia Plant-Based Seafood Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Plant-Based Seafood Market Summary:

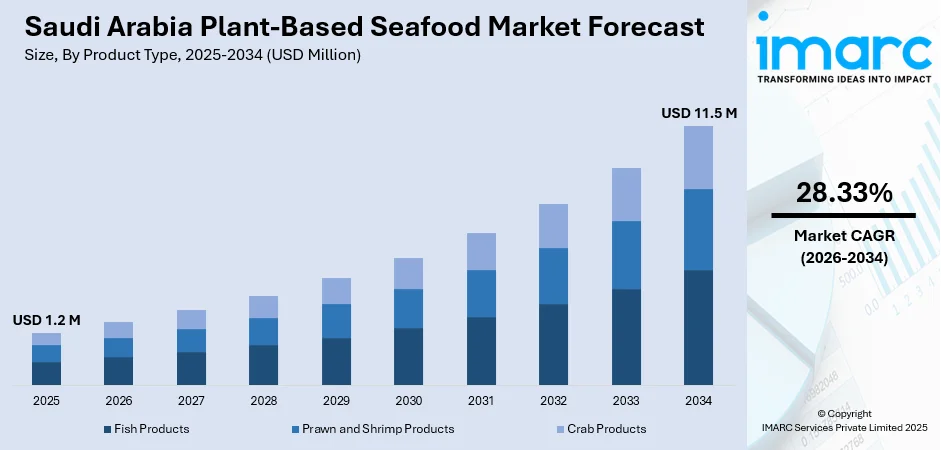

The Saudi Arabia plant-based seafood market size was valued at USD 1.2 Million in 2025 and is projected to reach USD 11.5 Million by 2034, growing at a compound annual growth rate of 28.33% from 2026-2034.

The Saudi Arabia plant-based seafood market growth is influenced by a heightened interest in alternative proteins, greater health consciousness, and a demand for sustainable food options. Consumers are looking for products that match their dietary preferences emphasizing nutrition, lower environmental impact, and ethical sourcing. The increased exposure to international food trends, the rise of contemporary retail formats, and accessibility via foodservice channels are enhancing market visibility. Support for food innovation under national diversification initiatives, along with a young, urban population open to new cuisines, is further encouraging adoption of plant-based seafood products.

Key Takeaways and Insights:

- By Product Type: Fish products dominate the market with a share of 56% in 2025, establishing themselves as the dominant segment due to consumer familiarity with fish-based alternatives and advanced replication technologies that mimic the texture and nutritional profile of conventional fish varieties.

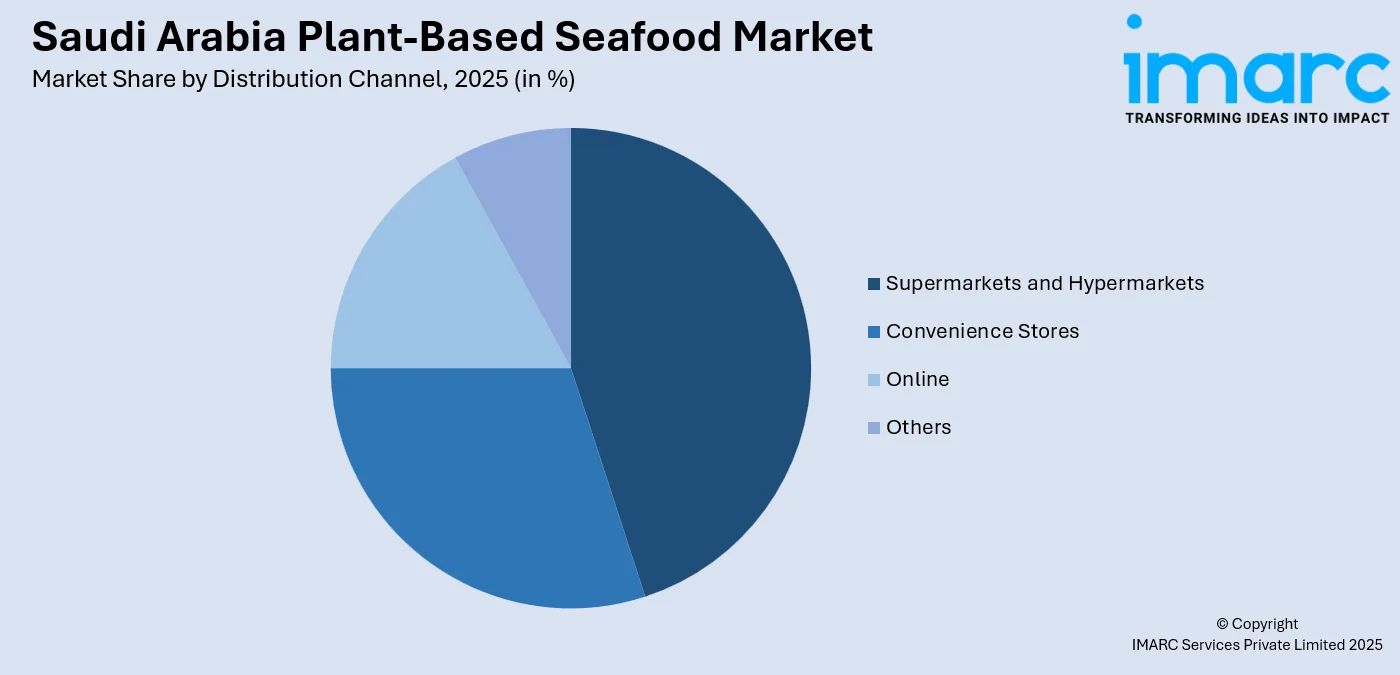

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 45% in 2025, owing to their extensive reach, dedicated shelf space for specialty products, and growing consumer preference for one-stop shopping destinations that offer diverse plant-based options.

- By Region: Western Region represents the largest segment with a market share of 34% in 2025, driven by concentrated urban populations in Jeddah and Makkah, robust tourism activities, superior retail infrastructure, and heightened health consciousness among metropolitan consumers.

- Key Players: The Saudi Arabia plant-based seafood market exhibits an emerging competitive landscape characterized by international alternative protein specialists entering the market alongside regional food conglomerates diversifying their portfolios to capture the growing consumer demand for sustainable seafood alternatives.

To get more information on this market Request Sample

The Saudi Arabia plant-based seafood market is driven by rising concern around diet-related health outcomes and the growing interest in healthier protein alternatives. Consumers are increasingly reassessing traditional eating habits as lifestyle-related conditions gain visibility across the population. This shift is reinforced by public health data, with the 2024 National Health Survey from the General Authority for Statistics (GASTAT) reporting that 23.1% of adults and 14.6% of children in Saudi Arabia are affected by obesity. Such figures are resulting in higher attention on calorie intake, fat consumption, and overall nutritional balance. Plant-based seafood is gaining attention as it offers seafood-style meals with lower saturated fat and no cholesterol, while fitting familiar culinary preferences. Increased availability through modern retail, improved product quality, and clearer nutritional labeling further support adoption. Together, health-driven decision-making and accessible alternatives are steadily encouraging consumers to incorporate plant-based seafood into regular diets.

Saudi Arabia Plant-Based Seafood Market Trends:

Rising Health Awareness

The growing awareness about diet-related health risks is encouraging consumers in Saudi Arabia to reassess dietary choices and explore alternatives to animal-based foods. Increased concerns regarding cholesterol levels, heart health, and lifestyle-related conditions are supporting interest in plant-based seafood as a lighter and perceived healthier option. This trend is underscored by findings from the 2024 National Health Survey and the Woman and Child Health Survey, which reported that 18.95 percent of adults have at least one chronic illness, including diabetes at 9.1 percent and high cholesterol at 3.6 percent. Such health indicators are reinforcing demand for plant-based dietary alternatives.

Expanding Retail Infrastructure and E-commerce Penetration

The rapid expansion of modern retail infrastructure and e-commerce platforms is significantly improving accessibility of plant-based seafood products across Saudi Arabia. Supermarkets and hypermarkets are allocating dedicated shelf space for plant-based and health-focused offerings, while online grocery platforms enable convenient access to niche products beyond physical store limitations. This distribution shift is supported by strong digital adoption, with the International Trade Administration projecting 33.6 million internet users participating in e-commerce by 2024. Enhanced retail visibility and online reach are reducing market entry barriers, supporting broader consumer awareness, higher trial rates, and sustained growth in the plant-based seafood market.

Growing Adoption of Flexitarian Diets

Urban consumers in Saudi Arabia, particularly younger demographics, are increasingly adopting flexitarian eating habits that emphasize nutrition while avoiding strict dietary limitations. Plant-based seafood products appeal to this group due to perceived benefits such as lower saturated fat content, absence of mercury, and cleaner ingredient profiles. This demographic influence is significant, with GASTAT's 2024 report indicating that 71 percent of Saudi citizens are below the age of 35, with an average age of 26.6 years. Greater access to nutrition information through digital platforms and transparent retail labeling further supports informed choices, contributing to steady demand for plant-based seafood across urban markets.

How Vision 2030 is Transforming the Saudi Arabia Plant-Based Seafood Market:

Vision 2030 is transforming the Saudi Arabia plant-based seafood market by encouraging food innovation, sustainability, and dietary diversification. National strategies focused on food security and local manufacturing are creating opportunities for alternative protein producers to enter and scale within the Kingdom. Support for agri-food technology, investment incentives, and partnerships with global food companies are improving product availability and quality. The growing emphasis on environmental responsibility and reduced reliance on imports is also supporting interest in plant-based alternatives. In addition, lifestyle shifts among younger consumers and expansion of modern retail and foodservice formats are helping normalize plant-based seafood, strengthening market acceptance and long-term growth prospects.

Market Outlook 2026-2034:

The Saudi Arabia plant-based seafood market demonstrates exceptional growth potential throughout the forecast period, underpinned by irreversible health and sustainability trends reshaping consumer dietary preferences. The market generated a revenue of USD 1.2 Million in 2025 and is projected to reach a revenue of USD 11.5 Million by 2034, growing at a compound annual growth rate of 28.33% from 2026-2034. This trajectory reflects increasing product accessibility through expanding retail networks, the growing consumer acceptance driven by improved product quality, supportive governmental policies under Vision 2030, and rising environmental consciousness among consumers seeking sustainable protein alternatives.

Saudi Arabia Plant-Based Seafood Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Fish Products |

56% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

45% |

|

Region |

Western Region |

34% |

Product Type Insights:

- Fish Products

- Prawn and Shrimp Products

- Crab Products

Fish products dominate with a market share of 56% of the total Saudi Arabia plant-based seafood market in 2025.

Fish products hold the biggest market share owing to strong consumer familiarity with traditional fish-based dishes and established dining habits. Plant-based fish alternatives closely replicate expected taste and texture, encouraging trial among new consumers. Their alignment with everyday meals and local cuisine preferences supports repeat consumption and steady demand.

This segment also benefits from wide retail and foodservice availability, including frozen and ready-to-cook options. Digital sales channels are further expanding reach and convenience. The Ministry of Commerce reported 40,953 registered e-commerce companies in Saudi Arabia by Q4 2024, reflecting 10% annual growth, supporting market access.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets lead with a market share of 45% of the total Saudi Arabia plant-based seafood market in 2025.

Supermarkets and hypermarkets dominate the market due to their wide product assortments, reliable cold-chain infrastructure, and strong consumer confidence. These outlets allow shoppers to conveniently compare plant-based seafood with conventional alternatives, supporting informed purchase decisions and encouraging regular inclusion of alternative protein products in household consumption patterns.

The segment further benefits from strong customer footfall, structured shelf placement, and regular promotional activities that enhance product visibility. Presence within leading retail chains strengthens brand credibility and consumer confidence, while in-store promotions and sampling initiatives encourage trial among health-conscious and sustainability-oriented shoppers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Western Region exhibits a clear dominance with 34% share of the total Saudi Arabia plant-based seafood market in 2025.

Western Region represents the largest market segment, driven by dense urbanization, strong tourism inflows, and high exposure to international food trends. Cities like Jeddah show greater acceptance of alternative proteins, supported by a large expatriate presence. Government data indicates non-Saudi residents reached approximately 15.7 million in 2024, up from 14.5 million in 2023, accounting for 75.6 percent of national population growth, reinforcing diverse dietary preferences.

This region also benefits from a mature retail and foodservice ecosystem, supported by premium supermarkets, international restaurant chains, and hospitality-driven demand. High consumer awareness, lifestyle-led food choices, and strong presence of health-focused outlets encourage wider adoption of plant-based seafood. Continuous tourism activity further supports experimentation and repeat consumption across both retail and dining channels.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Plant-Based Seafood Market Growing?

Improved Cold Chain and Food Logistics Infrastructure

Ongoing improvements in cold chain and food logistics infrastructure are strengthening the distribution of plant-based seafood products across Saudi Arabia. Reliable temperature-controlled storage and transportation systems help preserve product quality across long distances and challenging climatic conditions. This progress is reinforced by a SR200 million agreement signed in 2025 to develop a major food logistics hub at King Abdulaziz Port in Dammam, aimed at strengthening national food supply chains. Enhanced logistics efficiency reduces spoilage risks and expands geographic reach, encouraging retailers and foodservice operators to stock frozen and chilled plant-based seafood with greater confidence, supporting steady market growth.

Growing Disposable Income and Premium Food Consumption

Rising disposable income levels in urban Saudi Arabia are driving the need for premium and specialty food products, including plant-based seafood. Consumers are showing greater willingness to spend on innovative offerings that provide perceived health, quality, and lifestyle benefits. This spending momentum is reflected in private consumption expenditures, which recorded a real increase of 2.4 percent in the first half of FY2024 compared to the same period of the previous year, according to the Mid-Year Economic and Fiscal Performance Report. Expansion of upscale supermarkets, gourmet retailers, and premium dining outlets further reinforces consumer openness to alternative protein products, supporting gradual market growth and brand differentiation.

Rising Tourism and Hospitality Sector Demand

Saudi Arabia’s expanding tourism and hospitality sector is catalyzing the demand for diverse and inclusive menu offerings across hotels, resorts, and large catering operations. International visitors, business travelers, and religious tourists introduce varied dietary expectations, encouraging foodservice operators to include plant-based options. This momentum is reflected in government data showing a 9.7% increase in international visitor spending during the first quarter of 2025 compared with the same period in 2024. To address this growing and diverse demand, hospitality venues are integrating plant-based seafood to deliver seafood-style dishes with greater supply consistency. Such adoption across entertainment zones and major events supports steady volume growth and sustained brand visibility.

Market Restraints:

What Challenges the Saudi Arabia Plant-Based Seafood Market is Facing?

Premium Pricing Constraints Limiting Mass Market Adoption

The elevated price point of plant-based seafood alternatives compared to conventional products presents significant barriers to broader market penetration, particularly among price-sensitive consumer segments. Higher production costs, limited local manufacturing capabilities, and reliance on imported ingredients contribute to retail pricing that restricts accessibility for mainstream consumers who may otherwise consider sustainable alternatives.

Limited Consumer Awareness and Cultural Acceptance Barriers

Despite increasing health awareness, consumer familiarity with plant-based seafood remains limited in Saudi Arabia, where traditional seafood consumption dominates dietary habits. Many consumers lack exposure to available product options, nutritional attributes, and preparation methods. This knowledge gap contributes to hesitation in trial and repeat purchases, slowing broader market adoption and moderating overall growth momentum.

Distribution Infrastructure Gaps in Emerging Retail Channels

Inadequate distribution networks and limited product availability outside major metropolitan areas is creating significant access barriers that constrain market expansion into secondary cities and underserved regions. The nascent stage of plant-based seafood category development means specialized cold chain requirements and niche product positioning limit distribution reach beyond established retail partners.

Competitive Landscape:

The Saudi Arabia plant-based seafood market exhibits an emerging competitive landscape characterized by the entry of international alternative protein specialists and regional food conglomerates seeking to capitalize on the growing consumer demand for sustainable protein alternatives. Market participants are focusing on product innovation, strategic partnerships, and distribution expansion to establish early market positioning. Competition is driven by investments in research and development (R&D) capabilities, local manufacturing exploration, and brand building initiatives that address consumer awareness gaps. Strategic collaborations between global plant-based food companies and established Saudi distribution networks are accelerating market entry timelines and enhancing product accessibility across diverse retail channels.

Saudi Arabia Plant-based Seafood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fish Products, Prawn and Shrimp Products, Crab Products |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia plant-based seafood market size was valued at USD 1.2 Million in 2025.

The Saudi Arabia plant-based seafood market is expected to grow at a compound annual growth rate of 28.33% from 2026-2034 to reach USD 11.5 Million by 2034.

Fish products hold the largest market share of 56%, driven by consumer familiarity with fish-based alternatives, advanced replication technologies, and growing health concerns about conventional seafood consumption including mercury contamination and microplastic presence.

Key factors driving the Saudi Arabia plant-based seafood market include rapid expansion of modern retail and e-commerce channels, increasing shelf space for plant-based products in supermarkets, and improved digital access. Strong online adoption supports growth, with 33.6 million internet users projected to participate in e-commerce by 2024, enhancing visibility and consumer trial rates.

Major challenges include premium pricing constraints limiting mass market adoption, limited consumer awareness and cultural acceptance barriers, distribution infrastructure gaps in emerging retail channels, and heavy reliance on imported ingredients affecting supply chain stability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)