Saudi Arabia Plasma Fractionation Market Size, Share, Trends and Forecast by Product, Sector, Application, End User, and Region, 2026-2034

Saudi Arabia Plasma Fractionation Market Overview:

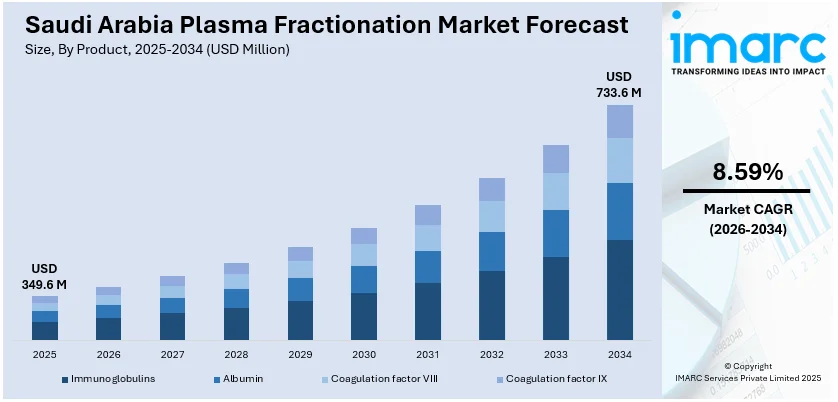

The Saudi Arabia plasma fractionation market size reached USD 349.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 733.6 Million by 2034, exhibiting a growth rate (CAGR) of 8.59% during 2026-2034. The growing reliance on plasma-based items to offer better therapeutic outcomes, along with rising investments in research and development (R&D) activities to create advanced methods, is contributing to the expansion of the Saudi Arabia plasma fractionation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 349.6 Million |

| Market Forecast in 2034 | USD 733.6 Million |

| Market Growth Rate 2026-2034 | 8.59% |

Saudi Arabia Plasma Fractionation Market Trends:

Rising aging population

The growing aging population is offering a favorable market outlook. Older individuals often have weaker immune systems, making them more susceptible to infections and requiring immunoglobulin treatments derived from plasma fractionation. Additionally, elderly patients are more prone to surgeries and hospitalizations, which further creates the need for plasma-based items like albumin and clotting factors. The healthcare system in Saudi Arabia is focusing on addressing the requirements of the senior population, leading to better access and greater demand for specialized treatments. Consequently, the plasma fractionation market is experiencing growth, supported by an expanding elderly demographic requiring consistent medical care. According to industry reports, by the year 2030, it is projected that over 11% of the Saudi population will be aged 60 and above.

To get more information on this market Request Sample

Increasing prevalence of chronic diseases

The rising incidence of chronic diseases is impelling the market growth. Conditions, such as hemophilia, primary immunodeficiency disorders, liver cirrhosis, and autoimmune diseases, require plasma-derived therapies for effective management. As the number of patients with these conditions rises, the demand for plasma fractionation increases. As per a research study conducted in the dermatology clinic of King Abdulaziz Medical City, Riyadh, Saudi Arabia, as of May 2024, a total of 839 cases of autoimmune diseases were analyzed, with women making up 56.4% of the participants. The most prevalent autoimmune condition was hypothyroidism (6.8%), which was more frequently observed in females. The second most prevalent autoimmune condition was alopecia areata (3.6%), succeeded by atopic dermatitis (2.9%). Plasma-based items like clotting factors, immunoglobulins, and albumin are essential in treating patients suffering from chronic and life-threatening illnesses. Healthcare providers in Saudi Arabia continue to rely on these items to offer better therapeutic outcomes, especially as awareness and diagnosis rates are improving. The government is supporting initiatives that enhance healthcare infrastructure and access to specialized treatments. With advancements in diagnostic technologies, more patients are diagnosed early, increasing the uptake of plasma-oriented medications. The country is also witnessing a rise in surgical procedures and trauma cases, creating a greater need for albumin and clotting factors.

Growing R&D activities

Increasing R&D activities are fueling the Saudi Arabia plasma fractionation market growth. Researchers and pharmaceutical companies are investing in R&D activities to develop advanced methods and enhance the efficiency and safety of plasma-derived products. As per industry reports, Saudi Arabia's targeted R&D expenditure is set to rise to 2.5% of GDP by 2040. These efforts are resulting in the creation of new therapies for conditions like immune deficiencies, hemophilia, and other blood-related disorders. Continuous innovations are improving the purification processes, increasing yield, and reducing the risk of contamination. Saudi Arabia's rising focus on biotechnology and healthcare modernization is supporting research initiatives and encouraging partnerships with international firms. As R&D activities are progressing, it is expanding the range of applications for plasma products and enhancing their availability across the healthcare system. This ongoing development is positively influencing the market by offering better treatment options and increasing confidence in plasma therapies.

Saudi Arabia Plasma Fractionation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, sector, application, and end user.

Product Insights:

- Immunoglobulins

- Albumin

- Coagulation factor VIII

- Coagulation factor IX

The report has provided a detailed breakup and analysis of the market based on the product. This includes immunoglobulins, albumin, coagulation factor VIII, and coagulation factor IX.

Sector Insights:

- Private Sector

- Public Sector

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes private sector and public sector.

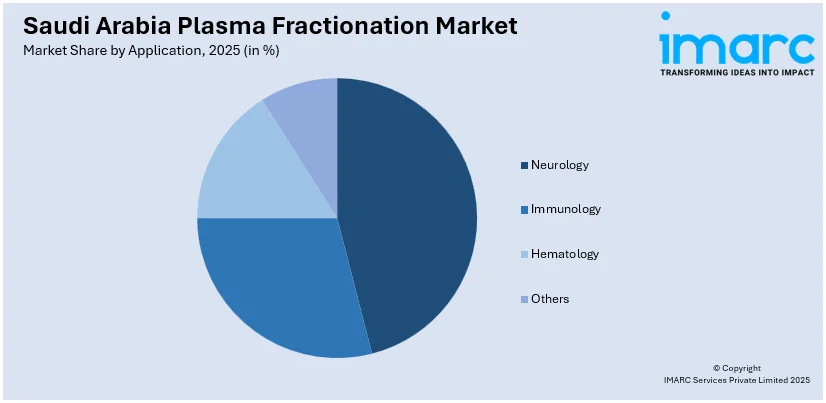

Application Insights:

Access the comprehensive market breakdown Request Sample

- Neurology

- Immunology

- Hematology

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes neurology, immunology, hematology, and others.

End User Insights:

- Hospitals and Clinics

- Clinical Research Laboratories

- Academic Institutes

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, clinical research laboratories, and academic institutes.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Plasma Fractionation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Immunoglobulins, Albumin, Coagulation factor VIII, Coagulation factor IX |

| Sectors Covered | Private Sector, Public Sector |

| Applications Covered | Neurology, Immunology, Hematology, Others |

| End Users Covered | Hospitals and Clinics, Clinical Research Laboratories, Academic Institutes |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia plasma fractionation market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia plasma fractionation market on the basis of product?

- What is the breakup of the Saudi Arabia plasma fractionation market on the basis of sector?

- What is the breakup of the Saudi Arabia plasma fractionation market on the basis of application?

- What is the breakup of the Saudi Arabia plasma fractionation market on the basis of end user?

- What is the breakup of the Saudi Arabia plasma fractionation market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia plasma fractionation market?

- What are the key driving factors and challenges in the Saudi Arabia plasma fractionation market?

- What is the structure of the Saudi Arabia plasma fractionation market and who are the key players?

- What is the degree of competition in the Saudi Arabia plasma fractionation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia plasma fractionation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia plasma fractionation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia plasma fractionation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)