Saudi Arabia Plastic Caps and Closure Market Size, Share, Trends and Forecast by Product Type, Raw Materials, Container Type, Technology, End Use, and Region, 2025-2033

Saudi Arabia Plastic Caps and Closure Market Overview:

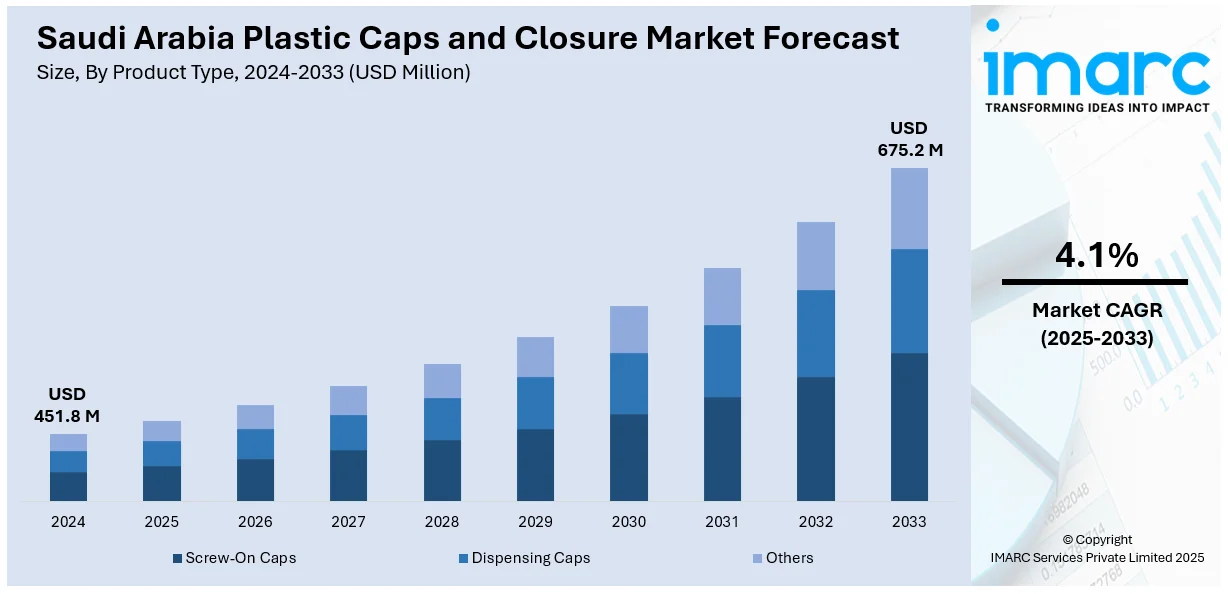

The Saudi Arabia plastic caps and closure market size reached USD 451.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 675.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. Growing demand from the beverage and pharmaceutical sectors, rising packaging innovation, increasing hygiene awareness, expansion of bottled water consumption, and government-led initiatives to diversify the economy and support non-oil manufacturing industries are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 451.8 Million |

| Market Forecast in 2033 | USD 675.2 Million |

| Market Growth Rate 2025-2033 | 4.1% |

Saudi Arabia Plastic Caps and Closure Market Trends:

Thriving Beauty and Personal Care Industry

The beauty and personal care sector in Saudi Arabia is driving the demand for plastic caps and closures in lotions, shampoos, and perfumes. As per the IMARC Group, the Saudi Arabia beauty and personal care market size was valued at USD 4.6 Billion in 2024. Women and youth are increasingly investing in grooming and beauty products, influenced by global trends and social media. Plastic closures provide functionality, convenience, and aesthetic appeal, which are critical in personal care packaging. Flip-top caps, pumps, and sprayers enhance product usability while maintaining a premium brand experience. Manufacturers are also innovating with eco-friendly and lightweight closures to attract sustainability-conscious consumers. The strong demand for perfumes and skincare products, particularly among women, is making cosmetics a major growth driver. With the Kingdom emerging as a beauty and lifestyle hub in the region, the rising popularity of personal care products is catalyzing the demand for plastic caps and closures.

To get more information on this market, Request Sample

Expansion of Retail and E-commerce Distribution

The growth of organized retail and e-commerce channels in Saudi Arabia is significantly contributing to the demand for plastic caps and closures. As per the ITA, by 2024, the count of Saudi internet users engaging in e-commerce (buying and selling) was projected to hit 33.6 Million. Packaged food items, beverages, cosmetics, and pharmaceuticals are increasingly sold through supermarkets, hypermarkets, and online platforms, requiring standardized and secure packaging solutions. People purchasing through these channels demand products that are safe, durable, and convenient to use, highlighting the role of closures. E-commerce, in particular, emphasizes the need for tamper-proof and leakage-resistant packaging to maintain customer trust during delivery. Brands are investing in closures that improve shelf appeal while ensuring safety during distribution.

Burgeoning Packaged Food and Beverage (F&B) Industry

The rapid growth of Saudi Arabia’s packaged food and beverage sector is a major driver of the market expansion. As urbanization is increasing and lifestyles are becoming busier, people are shifting towards ready-to-eat (RTE) food items, bottled beverages, juices, and dairy products, which require reliable packaging. The annual percentage of urban population growth in Saudi Arabia was recorded at 4.891% in 2024, as per the World Bank's development indicators. Plastic caps and closures ensure product safety, prevent leakage, and maintain freshness, making them indispensable for the F&B industry. Rising disposable incomes and changing dietary preferences are increasing the demand for bottled water and carbonated drinks, further fueling cap consumption. Additionally, international and local brands are investing in attractive, user-friendly, and tamper-proof closures to enhance consumer convenience and brand appeal.

Key Growth Drivers of Saudi Arabia Plastic Caps and Closure Market:

Rising Demand for Bottled Water Consumption

Saudi Arabia has one of the highest per capita bottled water consumption rates globally, due to hot climatic conditions and limited freshwater resources. This growing dependency on bottled water is driving the demand for plastic caps and closures, which ensure product safety, hygiene, and portability. Caps provide secure sealing that prevents contamination and preserves water quality, which is essential in a region where safe drinking water alternatives are limited. With bottled water being a daily necessity, from household utilization to hospitality and workplace use, the volume demand for closures continues to rise. Companies in the sector are also innovating with lightweight, recyclable closures that align with sustainability goals while maintaining performance.

Growth of Pharmaceuticals and Healthcare Packaging

The expansion of Saudi Arabia’s healthcare and pharmaceutical industries is catalyzing the demand for high-quality plastic caps and closures. With rising investments in hospitals, clinics, and drug manufacturing facilities, there is growing need for packaging that ensures product safety, integrity, and compliance with stringent regulations. Plastic closures are widely used in bottles for syrups, tablets, and liquid medications, offering tamper-evidence and child-resistant features critical for patient safety. As pharmaceutical exports and domestic drug production are rising, packaging manufacturers are scaling their offerings to meet demand. Moreover, closures with advanced designs, such as dosing caps and droppers, are being adopted for specialized medicines. This alignment between healthcare growth and packaging innovations is catalyzing consistent demand for plastic caps and closures in Saudi Arabia.

Technological Advancements in Packaging Solutions

Technological innovations are reshaping the Saudi plastic caps and closures market, as manufacturers are investing in automation, precision molding, and advanced materials. Modern production techniques enable closures that are lightweight yet durable, offering cost efficiency and reduced material use. Additionally, smart closures with tamper-evident seals, child-resistance features, and customized branding options are being adopted across industries. These advancements improve functionality, enhance safety, and cater to changing consumer demands. The rise of 3D printing and digital prototyping is also enabling faster design cycles and tailored solutions for niche markets like pharmaceuticals and cosmetics. Automation in production ensures consistent quality and large-scale output, meeting the growing demand from F&B, healthcare, and personal care sectors.

Saudi Arabia Plastic Caps and Closure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, raw materials, container type, technology, and end use.

Product Type Insights:

- Screw-On Caps

- Dispensing Caps

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes screw-on caps, dispensing caps, and others.

Raw Materials Insights:

- PET

- PP

- HDPE

- LDPE

- Others

A detailed breakup and analysis of the market based on the raw materials have also been provided in the report. This includes PET, PP, HDPE, LDPE, and others.

Container Type Insights:

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the container type. This includes plastic, glass, and others.

Technology Insights:

- Injection Molding

- Compression Molding

- Post-Mold Tamper-Evident Band

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes injection molding, compression molding, and post-mold tamper-evident band.

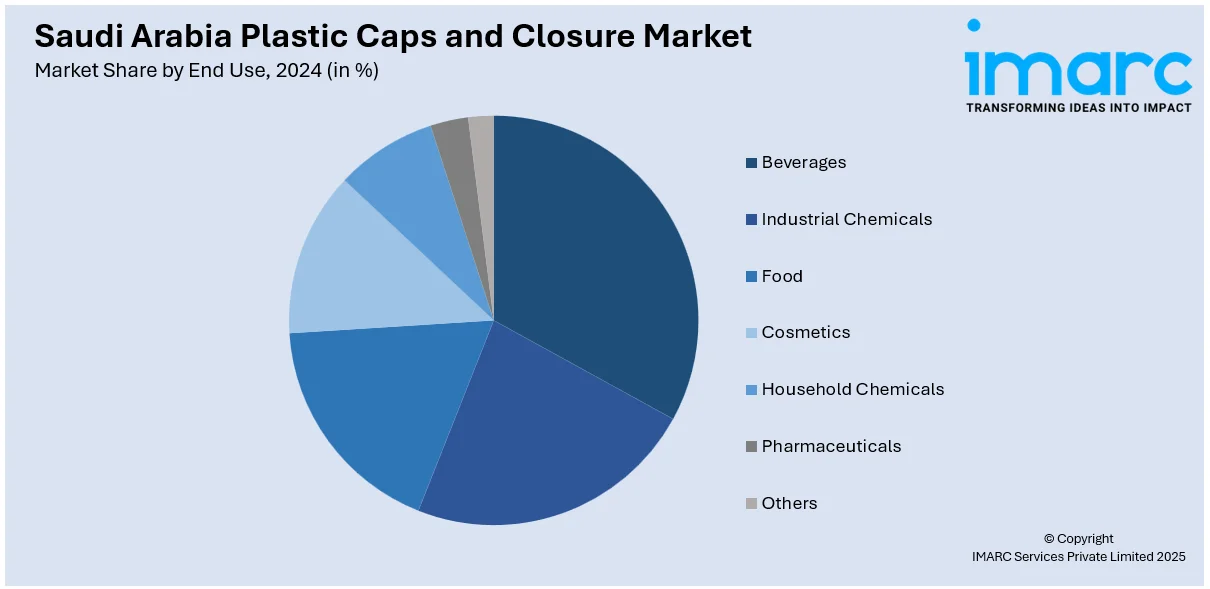

End Use Insights:

- Beverages

- Industrial Chemicals

- Food

- Cosmetics

- Household Chemicals

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes beverages, industrial chemicals, food, cosmetics, household chemicals, pharmaceuticals, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Plastic Caps and Closure Market News:

- In May 2024, Arabian Plastic Industrial Co. (APICO) began operating a new production line in Riyadh focused on plastic items, including caps and closures. This expansion aims to strengthen APICO’s supply capabilities across Saudi Arabia’s Central, Western, and Eastern regions. The move supports growing local demand for plastic packaging components in the food, beverage, and consumer goods sectors.

Saudi Arabia Plastic Caps and Closure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Screw-On Caps, Dispensing Caps, Others |

| Raw Materials Covered | PET, PP, HDPE, LDPE, Others |

| Container Types Covered | Plastic, Glass, Others |

| Technologies Covered | Injection Molding, Compression Molding, Post-Mold Tamper-Evident Band |

| End Uses Covered | Beverages, Industrial Chemicals, Food, Cosmetics, Household Chemicals, Pharmaceuticals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia plastic caps and closure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia plastic caps and closure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia plastic caps and closure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic caps and closure market in Saudi Arabia was valued at USD 451.8 Million in 2024.

The Saudi Arabia plastic caps and closure market is projected to exhibit a CAGR of 4.1% during 2025-2033, reaching a value of USD 675.2 Million by 2033.

Increasing demand for convenience packaging and enhanced shelf-life is fueling the adoption across beverages, dairy, and pharmaceutical sectors. Saudi Arabia’s hot climate is significantly boosting bottled water sales, making plastic caps and closures an essential component of the packaging industry. Furthermore, technological advancements in lightweight and recyclable closures align with sustainability goals, encouraging innovations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)