Saudi Arabia Plastic Recycling Market Size, Share, Trends and Forecast by Type, Source, End User, and Region, 2026-2034

Saudi Arabia Plastic Recycling Market Summary:

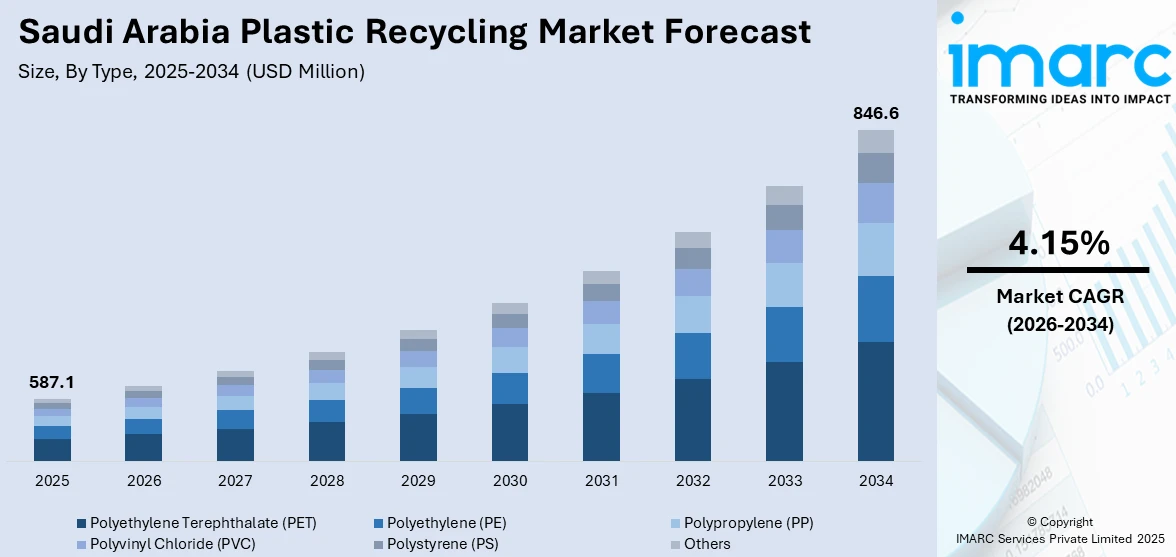

The Saudi Arabia plastic recycling market size was valued at USD 587.1 Million in 2025 and is projected to reach USD 846.6 Million by 2034, growing at a compound annual growth rate of 4.15% from 2026-2034.

The market is driven by increasing environmental awareness, government sustainability initiatives under Vision 2030, and rising industrial demand for recycled polymers. Technological advancements in chemical and mechanical recycling methods are enhancing processing capabilities across the Kingdom. Growing consumer consciousness about plastic pollution and expanding circular economy frameworks further support market expansion. Strategic investments in waste management infrastructure and regulatory frameworks promoting eco-friendly practices continue to strengthen the Saudi Arabia plastic recycling market share.

Key Takeaways and Insights:

- By Type: Polyethylene terephthalate (PET) dominates the market with a share of 28% in 2025, driven by widespread use in beverage containers, food packaging applications, and excellent recyclability through established mechanical processes.

- By Source: Bottles lead the market with a share of 35% in 2025, owing to high collection rates, well-established sorting infrastructure, consumer familiarity with recycling programs, and strong demand from packaging manufacturers.

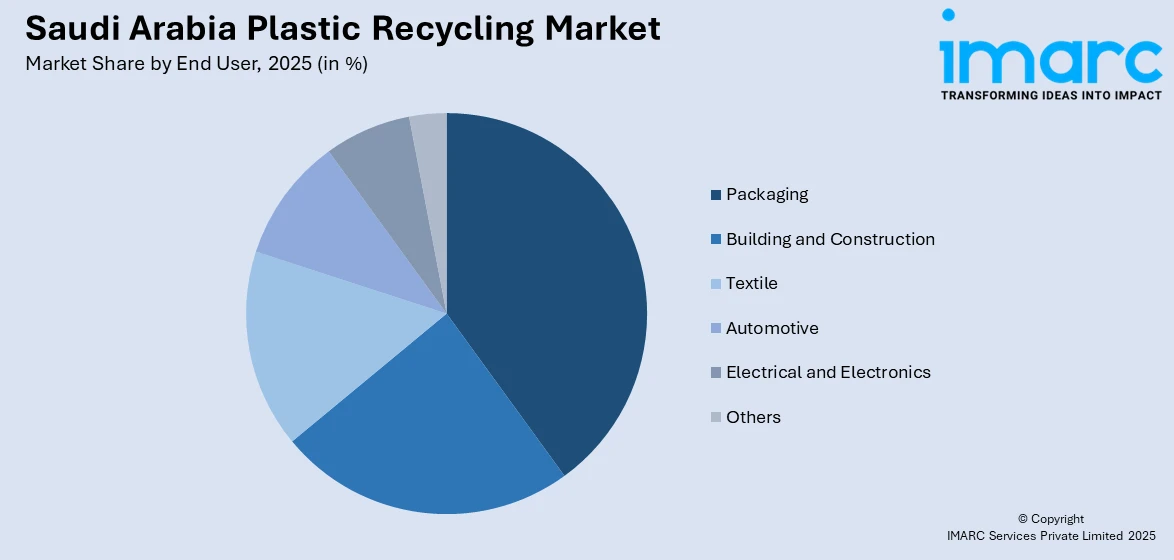

- By End User: Packaging represents the largest segment with a market share of 40% in 2025, driven by expanding food and beverage industry, stringent sustainability requirements from corporations, and rising recycled content adoption.

- By Region: Northern and Central Region leads the market with a share of 28% in 2025, owing to concentration of industrial activities in Riyadh, presence of recycling facilities, and proximity to manufacturing hubs.

- Key Players: The Saudi Arabia plastic recycling market exhibits a moderately concentrated competitive structure, with established domestic manufacturers competing alongside regional recyclers. Market participants are actively investing in advanced recycling technologies and forming strategic partnerships to strengthen positioning.

To get more information on this market Request Sample

The Saudi Arabia plastic recycling market is experiencing substantial growth fueled by the commitment to environmental sustainability and circular economy principles. Government initiatives under Vision 2030 have established ambitious waste management targets that prioritize recycling over landfill disposal, creating favorable conditions for market expansion. According to sources, Aramco, TotalEnergies and SABIC completed the Middle East’s first large-scale processing of oil derived from plastic waste into ISCC+ certified circular polymers at the SATORP refinery in Jubail, enabling advanced recycling of non-sorted plastics and supporting domestic circular value chains. Moreover, rising industrial demand from packaging, automotive, and construction sectors is driving manufacturers to seek recycled polymer alternatives to virgin materials. Enhanced environmental consciousness among consumers and businesses is accelerating the adoption of sustainable waste management practices across the Kingdom. The establishment of modern recycling facilities and material recovery centers across major urban areas is significantly improving collection and processing capabilities.

Saudi Arabia Plastic Recycling Market Trends:

Expansion of Chemical Recycling Technologies

Chemical recycling is emerging as a transformative solution for handling complex plastic waste streams that traditional mechanical processes cannot effectively process. This technology enables the breakdown of plastics into their base chemical components, allowing for production of high-quality recycled materials suitable for demanding applications. As per sources, SIRC announced plans to support advanced plastic recycling initiatives under Vision 2030, targeting landfill diversion, private-sector participation, and scalable chemical recycling infrastructure across major industrial hubs nationwide. Saudi Arabia is investing in pyrolysis and depolymerization facilities that can convert mixed and contaminated plastics into valuable feedstock. The Kingdom's strong petrochemical industry provides strategic advantages for integrating chemical recycling outputs into existing manufacturing infrastructure.

Development of Integrated Waste Management Infrastructure

The Kingdom is witnessing significant investment in comprehensive waste management systems designed to improve plastic collection, sorting, and processing efficiency. In September 2025, Saudi Arabia announced that nearly 10 Million Tons of plastic waste are generated annually in the Gulf region, with only about 10 percent recycled, highlighting urgent need for improved infrastructure and recycling initiatives. New material recovery facilities are being established across major urban centers including Riyadh, Jeddah, and Dammam to handle growing waste volumes. Smart waste management technologies incorporating digital solutions are being deployed to optimize collection routes and enhance traceability throughout the recycling value chain.

Growing Adoption of Recycled Content in Manufacturing

Industries across Saudi Arabia are increasingly incorporating recycled plastics into their production processes to meet sustainability commitments and regulatory requirements. As per sources, in April 2024, SABIC, Napco National, and FONTE launched the Kingdom’s first bread packaging made with fully recycled post-consumer plastics using certified circular polyethylene from SABIC’s TRUCIRCLE™ portfolio, demonstrating industrial adoption of recycled polymers in consumer products. Moreover, the packaging sector is leading this transition with major brands specifying recycled content for consumer products and shipping materials. Automotive manufacturers are utilizing recycled polymers for interior components and non-structural parts.

How Vision 2030 is Transforming the Saudi Arabia Plastic Recycling Market:

Saudi Arabia’s Vision 2030 is reshaping the plastic recycling market by establishing comprehensive sustainability frameworks that prioritize circular economy principles and environmental protection. The national transformation agenda has set ambitious targets for diverting waste from landfills while promoting recycling as a cornerstone of sustainable development strategy. Government initiatives under the Saudi Green Initiative are driving substantial investments in recycling infrastructure, advanced processing technologies, and waste collection systems across the Kingdom. Regulatory frameworks mandating waste segregation and promoting extended producer responsibility are creating favorable market conditions for recycling enterprises. The establishment of dedicated regulatory bodies for waste management oversight ensures consistent implementation of sustainability policies while attracting private sector investment into the recycling value chain.

Market Outlook 2026-2034:

The Saudi Arabia plastic recycling market demonstrates strong revenue growth potential during the forecast period as sustainability initiatives mature and infrastructure investments yield operational capacity. Market revenue expansion will be supported by increasing industrial demand for recycled polymers, favorable regulatory frameworks, and technological advancements improving material recovery rates. The transition toward circular economy practices across key sectors including packaging, construction, and automotive will drive consistent demand for recycled plastic feedstock. The market generated a revenue of USD 587.1 Million in 2025 and is projected to reach a revenue of USD 846.6 Million by 2034, growing at a compound annual growth rate of 4.15% from 2026-2034.

Saudi Arabia Plastic Recycling Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Polyethylene Terephthalate (PET) |

28% |

|

Source |

Bottles |

35% |

|

End User |

Packaging |

40% |

|

Region |

Northern and Central Region |

28% |

Type Insights:

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

Polyethylene terephthalate (PET) dominates with a market share of 28% of the total Saudi Arabia plastic recycling market in 2025.

Polyethylene terephthalate (PET) leads the market owing to its widespread application in beverage containers, food packaging, and textile fibers. PET offers excellent recyclability characteristics with established collection and processing infrastructure across the Kingdom. According to sources, in August 2024, Saudi Investment Recycling Company (SIRC) shipped recycled PET flakes to European markets, supplying materials for new bottle production and reinforcing the Kingdom’s role in PET recycling exports. The polymer maintains material properties through multiple recycling cycles, making it economically attractive for reprocessing. Strong consumer awareness regarding PET bottle recycling contributes to higher collection rates compared to other plastic types.

The growing demand for recycled PET in packaging applications drives continuous investment in PET recycling facilities across Saudi Arabia. Beverage manufacturers increasingly specify recycled PET content in their containers to meet sustainability commitments and corporate environmental targets. The textile industry utilizes recycled PET fibers for apparel and furnishing applications, creating additional demand channels. Advanced sorting technologies enable efficient separation of PET from mixed waste streams, improving processing economics and material quality for downstream applications.

Source Insights:

- Bottles

- Films

- Fibers

- Foams

- Others

Bottles lead with a share of 35% of the total Saudi Arabia plastic recycling market in 2025.

Bottles represent the dominant source segment due to their high collection rates, standardized material composition, and established recycling infrastructure throughout the Kingdom. Consumer familiarity with bottle recycling programs ensures consistent feedstock supply for processors operating across major urban centers. In January 2024, PepsiCo partnered with Danube and Nadeera to expand the Yalla Return recycling programme in Jeddah, deploying smart bins and QR-code tracking to boost PET bottle collection and processing participation among consumers.

Beverage bottle collection programs have achieved significant participation rates across major Saudi cities including Riyadh, Jeddah, and Dammam. Deposit return schemes and public awareness campaigns continue expanding collection volumes throughout the Kingdom. The food and beverage industry represents the primary demand driver for bottle-sourced recycled materials requiring consistent quality. Processing facilities can achieve higher throughput rates when handling bottle feedstock compared to mixed plastic waste streams, improving operational efficiency and profitability.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Building and Construction

- Textile

- Automotive

- Electrical and Electronics

- Others

Packaging exhibits a clear dominance with a 40% share of the total Saudi Arabia plastic recycling market in 2025.

The packaging commands the largest market share driven by sustainability mandates from multinational brands and regulatory pressure to incorporate recycled content. Food and beverage packaging applications require consistent material quality and safety certifications that established recyclers can provide to manufacturers. As per sources, in June 2025, Nestlé Saudi Arabia partnered with NCWM to pilot recycled PET in beverage and food packaging, marking one of the Kingdom’s first large-scale commercial applications of recycled plastics. The expanding e-commerce sector generates substantial demand for shipping materials incorporating recycled plastics.

Packaging applications are increasingly incorporating recycled polymers as technology advances improve material compatibility and processing capabilities. Rigid packaging manufacturers benefit from mature recycling supply chains providing reliable feedstock for their production requirements. The personal care and cosmetics industry represents a growing demand segment with premium sustainability requirements from environmentally conscious consumers. Packaging converters are investing in specialized equipment capable of processing recycled materials while maintaining production quality standards and meeting regulatory compliance requirements.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 28% of the total Saudi Arabia plastic recycling market in 2025.

Northern and Central Region leads the market share due to the concentration of industrial activities and population centers around Riyadh. Major recycling facilities have been established in and around the capital to serve substantial waste generation volumes from residential and commercial sources. Proximity to manufacturing hubs requiring recycled polymer feedstock provides logistical advantages for processors operating in this region. The concentration of economic activities supports robust demand for recycled materials across multiple industries.

The region benefits from government investment in waste management infrastructure supporting Vision 2030 sustainability objectives and circular economy development. Strategic location facilitates efficient distribution of recycled materials to industries across the Kingdom through established transportation networks. Skilled workforce availability supports operation of advanced recycling technologies at modern processing facilities. The presence of regulatory bodies and industry associations in Riyadh facilitates policy development and implementation supporting continued market growth and infrastructure expansion.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Plastic Recycling Market Growing?

Government Sustainability Initiatives and Policy Support

The government has implemented comprehensive sustainability policies that create favorable conditions for plastic recycling market expansion. Vision 2030 establishes ambitious environmental protection targets prioritizing waste diversion from landfills and promoting circular economy principles across industries. According to reports, in January 2024, Saudi Arabia’s Ministry of Environment, Water, and Agriculture launched a national waste management plan aiming to enhance recycling infrastructure, improve waste collection efficiency, and promote circular economy practices across the Kingdom. Furthermore, regulatory frameworks mandate waste segregation and introduce extended producer responsibility mechanisms that incentivize recycling investments.

Rising Industrial Demand for Recycled Polymers

Industrial sectors across Saudi Arabia are increasingly incorporating recycled plastics into their manufacturing processes to meet sustainability commitments and reduce environmental footprints. The packaging industry leads demand growth as brands respond to consumer preferences for environmentally responsible products and corporate sustainability targets. Automotive manufacturers are expanding applications for recycled polymers in vehicle components where material specifications permit. Construction applications utilize recycled plastics in building products, drainage systems, and infrastructure materials. This industrial demand creates reliable offtake channels supporting investment in expanded recycling capacity.

Environmental Awareness and Consumer Consciousness

Growing environmental awareness among Saudi consumers is driving behavioral changes that support plastic recycling market development. Public education campaigns highlighting plastic pollution impacts have increased participation in recycling programs and waste segregation initiatives across major cities. According to reports, in May 2025, King Abdulaziz University’s ‘Green Spots’ initiative collected and sorted hundreds of tons of waste during Hajj, promoting recycling, eco-conscious behavior, and circular economy practices among pilgrims and staff. Moreover, corporate sustainability reporting requirements push businesses to demonstrate environmental responsibility through recycled material adoption. Media coverage of environmental issues maintains public attention on waste management practices and recycling importance.

Market Restraints:

What Challenges the Saudi Arabia Plastic Recycling Market is Facing?

Limited Collection and Sorting Infrastructure

The Saudi Arabia plastic recycling market faces constraints from insufficient waste collection and sorting infrastructure in many areas. Currently, a significant portion of plastic waste ends up in landfills due to limited segregation at source and inadequate collection systems. Without convenient recycling options, consumers may not prioritize proper waste disposal, reducing feedstock availability for recyclers. The absence of comprehensive deposit return schemes limits consumer incentives for recycling participation.

Quality Inconsistency in Recycled Materials

The quality of recycled plastics often varies significantly, creating challenges for manufacturers requiring consistent material specifications. Contamination in feedstock reduces the quality of recycled outputs, limiting applications where virgin-equivalent performance is required. This variability can undermine manufacturer confidence in recycled materials and hinder adoption across industries. Achieving consistent quality requires substantial investment in sorting and processing technologies.

High Capital Investment Requirements

Establishing modern recycling facilities requires substantial capital investment that can deter market entry and limit capacity expansion. Advanced recycling technologies including chemical recycling systems demand significant upfront expenditure before generating returns. Smaller recyclers may struggle to access financing necessary for equipment upgrades and facility modernization. The economic viability of recycling operations depends on achieving scale efficiencies that require substantial initial investment.

Competitive Landscape:

The Saudi Arabia plastic recycling market features a moderately concentrated competitive structure with established domestic processors competing alongside regional enterprises across various polymer segments. Market participants are differentiated by processing capabilities, geographic coverage, and specialization in specific plastic types. Competitive dynamics are shaped by access to feedstock supply chains, technological capabilities, and relationships with end-user industries requiring recycled materials. Investment in advanced recycling technologies represents a key competitive factor as processors seek to expand capabilities and improve material quality. Strategic partnerships between recyclers, waste management companies, and manufacturing enterprises are strengthening market positioning.

Recent Developments:

- In July 2024, MVW Lechtenberg & Partner Middle East, in collaboration with Empower and SIRC, launched a transformative plastic waste management project in Saudi Arabia. The initiative will process 3 Million Tonnes of municipal solid waste annually into refuse-derived fuels across six governorates, integrating blockchain tracking and Plastic Credits for circular economy advancement.

Saudi Arabia Plastic Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Others |

| Sources Covered | Bottles, Films, Fibers, Foams, Others |

| End Users Covered | Packaging, Building and Construction, Textile, Automotive, Electrical and Electronics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia plastic recycling market size was valued at USD 587.1 Million in 2025.

The Saudi Arabia plastic recycling market is expected to grow at a compound annual growth rate of 4.15% from 2026-2034 to reach USD 846.6 Million by 2034.

Polyethylene terephthalate?(PET) held the largest market share, owing to its widespread use in beverage containers and food packaging, excellent recyclability characteristics, established collection infrastructure, and strong demand from manufacturers seeking sustainable packaging solutions.

Key factors driving the Saudi Arabia plastic recycling market include government sustainability initiatives under Vision 2030, rising industrial demand for recycled polymers, growing environmental awareness, technological advancements in recycling methods, and expanding circular economy frameworks.

Major challenges include limited collection and sorting infrastructure, inconsistent quality of recycled materials, high capital investment requirements, lack of consumer awareness in some regions, complex plastic waste streams, and insufficient waste segregation at source.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)