Saudi Arabia Polyols Market Size, Share, Trends and Forecast by Type, Application, Industry, and Region, 2026-2034

Saudi Arabia Polyols Market Overview:

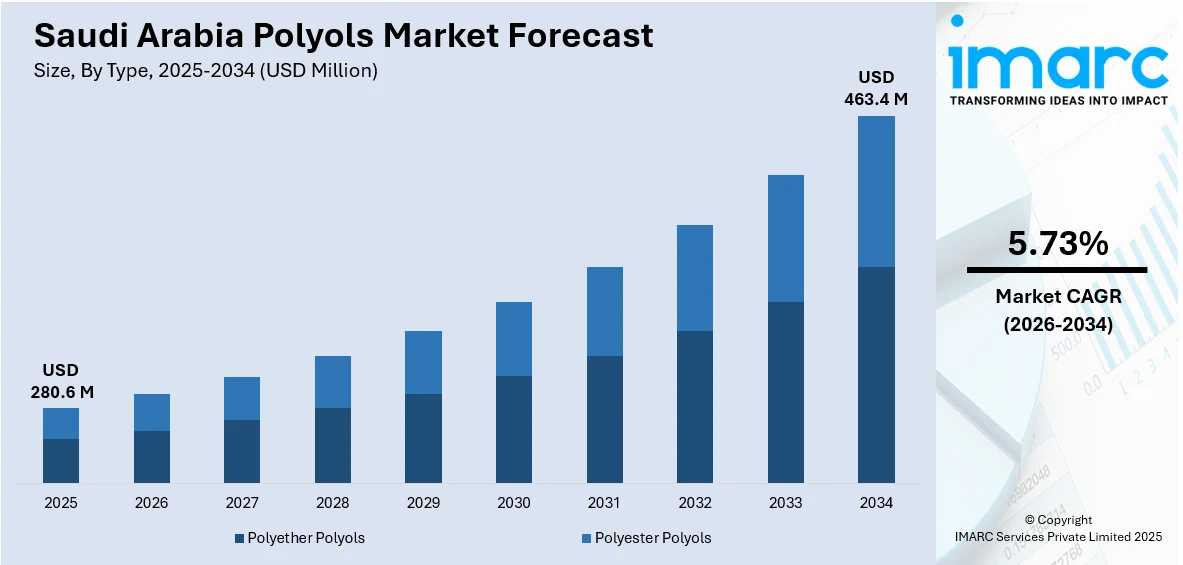

The Saudi Arabia polyols market size reached USD 280.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 463.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.73% during 2026-2034. Growth in the construction, automotive, and furniture industries is boosting demand for polyurethane foams made from polyols. Government support for domestic manufacturing, rising insulation needs, and sustainability initiatives using CO₂-based polyols are further driving market expansion in Saudi Arabia across flexible and rigid foam applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 280.6 Million |

| Market Forecast in 2034 | USD 463.4 Million |

| Market Growth Rate 2026-2034 | 5.73% |

Saudi Arabia Polyols Market Trends:

Expanding Construction and Infrastructure Projects

The market is strongly driven by the thriving construction sector, fueled by mega-infrastructure projects under Vision 2030. In July 2025, Saudi Arabia’s National Water Company (NWC) launched 38 projects focused on water and sanitation in the Asir region, as part of a strategic plan to enhance infrastructure and increase service availability. These initiatives, encompassing the development of networks and lines, entail an expenditure of almost SR2 Billion (USD 532 Million). The demand for polyurethane foams, which rely on polyols as a key raw material, is increasing for applications, such as insulation panels, sealants, and adhesives. Energy efficiency standards in new buildings further support polyurethane insulation adoption, driving steady demand for polyols. With large-scale projects like NEOM and Red Sea developments underway, the use of lightweight, durable, and versatile materials has become essential. Polyols also contribute to improved thermal performance and sustainability in construction materials. As the Kingdom continues to expand urban housing, commercial complexes, and smart infrastructure, the need for polyol-based products is rising significantly.

To get more information on this market Request Sample

Rising Automotive Production and Demand

The thriving automotive industry in Saudi Arabia is positively influencing the market, as polyurethane foams and elastomers are widely used in vehicle interiors, seating, dashboards, and insulation components. In February 2024, Lucid Motors accelerated electric vehicle (EV) production in Saudi Arabia, aiming for a yearly output of 155,000 cars. With government initiatives to localize automotive production and encourage foreign investments in the sector, the demand for raw materials like polyols is increasing. Automakers are focusing on lightweight, durable, and energy-efficient materials to meet both comfort and environmental standards, and polyol-based products meet these requirements effectively. Additionally, rising demand for passenger vehicles, along with expanding public transportation and EV initiatives, is catalyzing the demand for polyurethane components.

Growth in Furniture and Bedding Industry

The furniture and bedding industry is a significant user of polyols, particularly in the production of flexible polyurethane foams used in mattresses, cushions, and upholstered products. As per the IMARC Group, the Saudi Arabia furniture market size reached USD 6.5 Billion in 2024. In Saudi Arabia, rising urbanization, increasing disposable incomes, and high demand for modern lifestyle products are fueling the growth in this sector. The thriving real estate industry, along with the growing population, is boosting the need for residential and commercial furniture, further increasing polyol demand. Polyurethane foams offer durability, comfort, and design flexibility, making them the material of choice for furniture manufacturers. Additionally, hospitality sector expansion, supported by tourism development initiatives under Vision 2030, is catalyzing higher demand for bedding and furnishing solutions. As user preferences are shifting towards premium and ergonomic products, polyols continue to play a vital role.

Key Growth Drivers of Saudi Arabia Polyols Market:

Burgeoning Packaging Industry

The growth of the packaging sector in Saudi Arabia, driven by e-commerce expansion, food and beverage (F&B) demand, and changing consumer lifestyles, is creating significant opportunities for polyols. Polyurethane foams and coatings derived from polyols are increasingly used in protective packaging, food-grade storage, and flexible packaging solutions. As more people are shifting towards online shopping, the demand for durable, lightweight, and protective packaging materials is rising sharply. Polyols offer versatility in producing packaging that is not only durable but also sustainable, aligning with the global trend of eco-friendly solutions. Additionally, the food industry relies on polyol-based packaging for maintaining product freshness, safety, and quality. With both user and industrial packaging needs on the rise, polyols play a critical role in ensuring reliable, high-performance materials.

Rising Demand in Appliances and Electronics

Polyols are essential in the production of rigid polyurethane foams used in appliances, such as refrigerators, freezers, air conditioners, and water heaters. In Saudi Arabia, rising household incomes, urban development, and lifestyle upgrades are driving strong demand for modern appliances. Energy-efficient appliances, in particular, rely on high-performance insulation materials derived from polyols to improve thermal regulation and reduce electricity usage. Additionally, the expansion of the electronics sector, including consumer gadgets and industrial equipment, is creating the need for polyurethane coatings and adhesives. With Saudi Arabia’s growing middle-class population and a thriving retail market, the demand for appliances continues to rise, directly influencing polyol utilization. As user preferences are transitioning to energy-efficient, durable, and modern appliances, polyols remain a critical raw material.

Shift Towards Sustainable and Bio-Based Polyols

Sustainability trends are increasingly shaping the polyols market, with rising interest in bio-based and environment-friendly alternatives to traditional petrochemical-derived products. Global and local manufacturers are investing in research and development (R&D) activities of polyols made from renewable resources, such as natural oils and agricultural by-products. This shift aligns with Saudi Arabia’s Vision 2030 focus on sustainability, circular economy practices, and reducing carbon emissions. The growing pressure from industries and users for eco-friendly materials is further accelerating this trend. Bio-based polyols are not only offering reduced environmental impact but also opening opportunities for innovations in construction, automotive, and packaging applications. Government support for greener industries and global partnerships in sustainable technologies are enhancing adoption in the Saudi Arabia market.

Saudi Arabia Polyols Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, application, and industry.

Type Insights:

- Polyether Polyols

- Polyester Polyols

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyether polyols and polyester polyols.

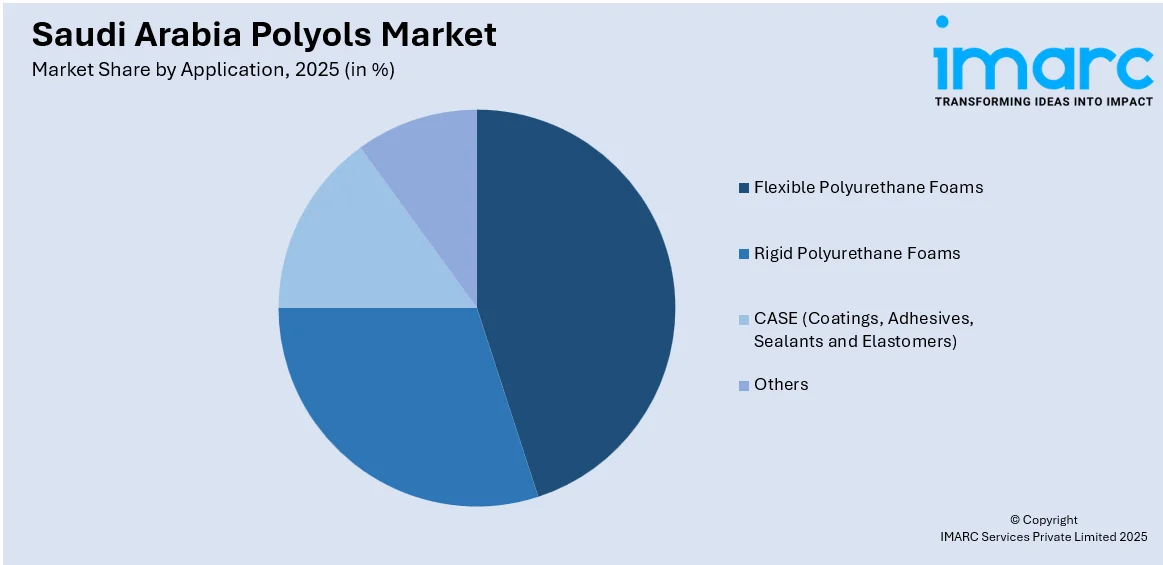

Application Insights:

Access the comprehensive market breakdown Request Sample

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- CASE (Coatings, Adhesives, Sealants and Elastomers)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes flexible polyurethane foams, rigid polyurethane foams, CASE (coatings, adhesives, sealants and elastomers), and others.

Industry Insights:

- Carpet Backing

- Packaging

- Furniture

- Automotive

- Building and Construction

- Electronics

- Footwear

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes carpet backing, packaging, furniture, automotive, building and construction, electronics, footwear, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Polyols Market News:

- March 2025: Econic Technologies and Saudi Aramco Technologies entered into a strategic global licensing agreement for the development of CO2-derived polyols. This collaboration seeks to promote carbon-neutral options in the polyols industry, aiding in sustainable product innovation.

- February 2025: The Ministry of Energy in Saudi Arabia provided the required feedstock for the establishment of industrial complexes by the National Industrialization Company (Tasnee) and Sahara International Petrochemical Company (Sipchem) in Jubail Industrial City. The complex by Tasnee would manufacture advanced phthalate-free plasticizers, innovative types of polyether polyols, and EO/PO copolymers for various uses in the local petrochemical sector.

- December 2024: BCI Group opened a state-of-the-art chemical production plant in Riyadh, enhancing Saudi Arabia’s downstream capacities. The facility would produce specialty chemicals, such as polyurethane-related substances, aiding local manufacturing of polyols required in insulation, automotive, and construction industries. This investment supports the Kingdom’s industrial strategy to boost local manufacturing and lessen reliance on imports.

Saudi Arabia Polyols Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyether Polyols, Polyester Polyols |

| Applications Covered | Flexible Polyurethane Foams, Rigid Polyurethane Foams, CASE (Coatings, Adhesives, Sealants and Elastomers), Others |

| Industries Covered | Carpet Backing, Packaging, Furniture, Automotive, Building and Construction, Electronics, Footwear, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia polyols market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia polyols market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia polyols industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polyols market in Saudi Arabia was valued at USD 280.6 Million in 2025.

The Saudi Arabia polyols market is projected to exhibit a CAGR of 5.73% during 2026-2034, reaching a value of USD 463.4 Million by 2034.

Rising infrastructure projects under Vision 2030, including mega developments such as NEOM and smart cities, are catalyzing significant demand for polyols-based insulation and construction materials. The automotive sector’s growth is further contributing to the market expansion, as polyols are essential in seating, interiors, and lightweight components. Additionally, increased need for flexible and rigid foams in the furniture, bedding, and consumer goods industries is driving steady adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)