Saudi Arabia POS Device Market Size, Share, Trends and Forecast by Component, Terminal Type, Business Size, Industry Vertical, and Region, 2026-2034

Saudi Arabia POS Device Market Overview:

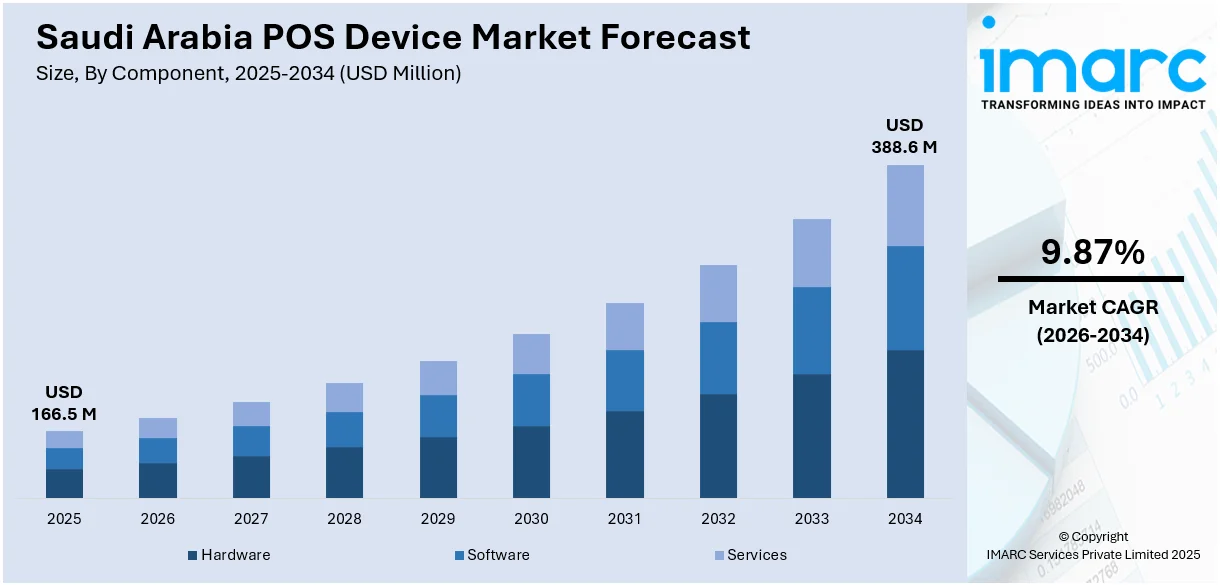

The Saudi Arabia POS device market size reached USD 166.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 388.6 Million by 2034, exhibiting a growth rate (CAGR) of 9.87% during 2026-2034. The market share is expanding, driven by the expansion of e-commerce and omnichannel businesses, along with the growing reliance on efficient technology in the hospitality sector, which is creating the need for user-friendly POS systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 166.5 Million |

| Market Forecast in 2034 | USD 388.6 Million |

| Market Growth Rate 2026-2034 | 9.87% |

Saudi Arabia POS Device Market Trends:

Growing digital payment adoption

Increasing digital payment adoption is fueling the Saudi Arabia POS device market growth. The rising popularity of credit and debit cards, along with mobile wallets, is accelerating the shift from traditional cash payments to digital alternatives. Besides this, high internet connectivity across urban and semi-urban areas is enabling seamless and fast transactions. According to the DataReportal, at the beginning of 2024, Saudi Arabia had 36.84 Million internet users, with internet penetration reaching 99.0%. Businesses are employing POS devices to keep up with evolving preferences and streamline their operations. These systems not only facilitate quick payments but also help retailers manage inventory, monitor sales, and track user behavior. As more people are becoming comfortable with digital banking and e-wallets, the demand for reliable POS infrastructure in retail and service outlets is increasing. The convenience of tap-and-pay, quick response (QR) code scanning, and integrated payment gateways is further boosting utilization. Small and medium enterprises are also adopting digital tools to stay competitive and cater to tech-savvy customers. Additionally, government initiatives promoting digital transformation and a cashless economy under Vision 2030 are contributing to the growing use of POS devices. The expansion of e-commerce and omnichannel businesses is also driving the demand for integrated POS solutions that bridge online and offline transactions.

To get more information on this market Request Sample

Increasing applications in hospitality sector

Rising applications in the hospitality sector are offering a favorable Saudi Arabia POS device market outlook. With an increasing number of international tourists and business travelers, the hospitality industry is seeking efficient systems to manage billing, orders, and inventory with accuracy and speed. As per the data released by the Saudi Ministry of Tourism, in 2024, the nation recorded 30 Million international arrivals. POS devices enable quick check-ins and check-outs at hotels, fast and convenient food ordering, and real-time payment processing, which improves customer satisfaction. Restaurants and cafés use POS devices to handle complex menu customizations, split bills, and monitor kitchen operations seamlessly. The growing trend of digital menus and table-side ordering is further driving the demand for mobile and tablet-based POS solutions. Integration with loyalty programs and customer feedback systems helps hospitality businesses build stronger customer relationships. As the sector is becoming more competitive and user-focused, the need for data-driven insights and smooth payment experiences is increasing, further promoting the use of POS devices.

Saudi Arabia POS Device Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, terminal type, business size, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Terminal Type Insights:

- Fixed POS Terminals

- Mobile POS Terminals

A detailed breakup and analysis of the market based on the terminal type have also been provided in the report. This includes fixed POS terminals and mobile POS terminals.

Business Size Insights:

- Turnover<5 Million INR

- Turnover 5 Million INR–50 Million INR

- Turnover 50 Million INR and Above

A detailed breakup and analysis of the market based on the business size have also been provided in the report. This includes turnover<5 million INR, turnover 5 million INR–50 million INR, and turnover 50 million INR and above.

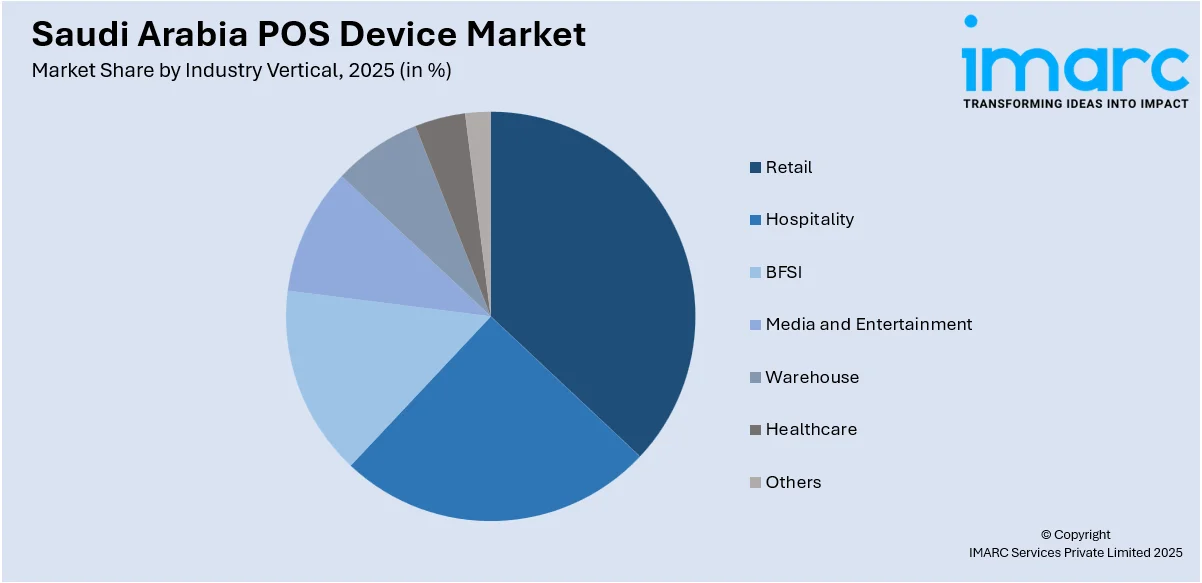

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Hospitality

- BFSI

- Media and Entertainment

- Warehouse

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes retail, hospitality, BFSI, media and entertainment, warehouse, healthcare, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia POS Device Market News:

- In September 2024, Alraedah unveiled TRAY, an innovative cloud-based platform and POS system, in Saudi Arabia. It was designed to transform the management of restaurants, cafés, and lounges in the food and beverage (F&B) industry. The POS platform was made available to Saudi SMEs at highly competitive rates.

- In September 2024, Yalla Plus, based in Saudi Arabia, secured USD 2.7 Million in seed funding for its POS system. The firm aimed to improve the POS system in the short term to provide food and hospitality business owners with additional features that could boost operational efficiency and customer interaction.

Saudi Arabia POS Device Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Terminal Types Covered | Fixed POS Terminals, Mobile POS Terminals |

| Business Sizes Covered | Turnover<5 Million INR, Turnover 5 Million INR–50 Million INR, Turnover 50 Million INR and Above |

| Industry Verticals Covered | Retail, Hospitality, BFSI, Media and Entertainment, Warehouse, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia POS device market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia POS device market on the basis of component?

- What is the breakup of the Saudi Arabia POS device market on the basis of terminal type?

- What is the breakup of the Saudi Arabia POS device market on the basis of business size?

- What is the breakup of the Saudi Arabia POS device market on the basis of industry vertical?

- What is the breakup of the Saudi Arabia POS device market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia POS device market?

- What are the key driving factors and challenges in the Saudi Arabia POS device market?

- What is the structure of the Saudi Arabia POS device market and who are the key players?

- What is the degree of competition in the Saudi Arabia POS device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia POS device market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia POS device market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia POS device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)