Saudi Arabia Powder Metallurgy Market Size, Share, Trends and Forecast by Type, Material, Manufacturing Process, Application, and Region, 2026-2034

Saudi Arabia Powder Metallurgy Market Overview:

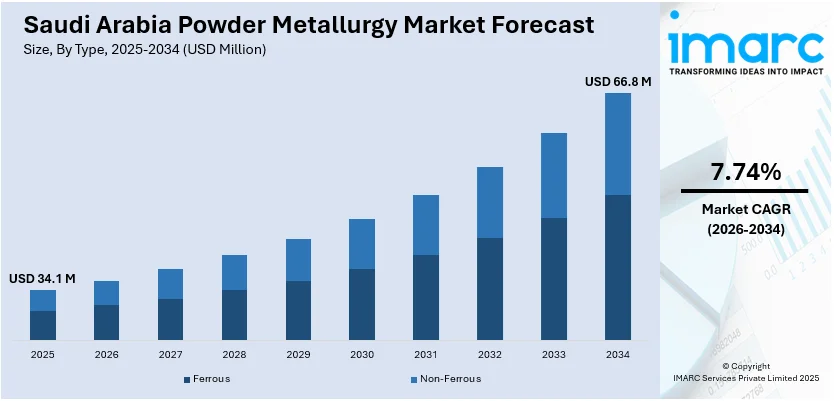

The Saudi Arabia powder metallurgy market size reached USD 34.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 66.8 Million by 2034, exhibiting a growth rate (CAGR) of 7.74% during 2026-2034. The market is driven by increasing demand from the automotive, aerospace, and industrial sectors, due to the rising need for lightweight, high-performance components. The implementation of government initiatives promoting industrial diversification, local manufacturing, and advanced material technologies under Vision 2030 is further supporting market growth. Additionally, expanding investments in electric vehicles, 3D printing, and additive manufacturing are important factors augmenting Saudi Arabia powder metallurgy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34.1 Million |

| Market Forecast in 2034 | USD 66.8 Million |

| Market Growth Rate 2026-2034 | 7.74% |

Saudi Arabia Powder Metallurgy Market Trends:

Expansion of Automotive and EV Manufacturing Base

Saudi Arabia's emphasis on developing a strong domestic automobile sector, especially in the electric vehicle (EV) space, is having a positive impact on the market. In the national agenda for sustainability, the Kingdom plans to transform 30% of Riyadh's total vehicles into electric vehicles by 2030, a target aligned with its broader objective of reducing carbon emissions in the capital by 50%. This change is not only transforming the industry for manufacturing vehicles but also pushing demand for top-tier, localized component production technologies. Powder metallurgy is known for its capacity to create light, strong, and geometrically intricate components with very little material waste. Therefore, it is gaining traction as an ideal solution. Besides this, consumer survey results in 2024 indicate that more than 40% of Saudi consumers are planning to buy an EV in the next three years, which indicates a significant rise in local EV uptake. This expected growth in demand is spurring automakers and component manufacturers to invest in newer manufacturing technologies such as powder metallurgy, which allows cost-effective production of critical components like gears, bushings, and structural assemblies vital to EV powertrains. In addition, vehicle weight reduction due to PM parts helps reduce energy consumption, an important contributor to EV performance. As the nation aims to decrease its import dependence and establish end-to-end value chains locally within the Kingdom, powder metallurgy is coming forward as a strategic technology. This surge is further complemented by strategic partnerships with international OEMs and suppliers, transferring sophisticated material processing capabilities to local plants.

To get more information on this market Request Sample

Growth in Aerospace and Defense Manufacturing

Saudi Arabia's aerospace and defense sectors are witnessing accelerated development as part of national strategies to localize military production and enhance self-sufficiency in advanced technologies. This industrial push is directly supporting Saudi Arabia powder metallurgy market growth, as advanced component manufacturing becomes a critical requirement. Also, the Vision 2030 initiative mandates that 50% of military equipment spending be sourced domestically, driving the establishment of local manufacturing hubs and defense research and development (R&D) centers. Powder metallurgy, particularly metal injection molding and hot isostatic pressing, plays a crucial role in producing complex, high-strength, and wear-resistant components used in aircraft engines, missile systems, and defense-grade electronic enclosures. These parts require tight tolerances and material uniformity, which PM technologies can deliver at scale. The industry is also moving toward additive manufacturing for prototyping and short-run production, in which PM serves as a key input material. International collaborations—such as joint ventures between Saudi Arabian Military Industries (SAMI) and global aerospace firms—are fostering the transfer of PM technologies into local contexts. As precision components become central to defense logistics and aerospace maintenance, demand for PM parts is set to grow significantly.

Saudi Arabia Powder Metallurgy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, material, manufacturing process, and application.

Type Insights:

- Ferrous

- Non-Ferrous

The report has provided a detailed breakup and analysis of the market based on the type. This includes ferrous and non-ferrous.

Material Insights:

- Titanium

- Steel

- Nickel

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes titanium, steel, nickel, aluminum, and others.

Manufacturing Process Insights:

- Additive Manufacturing

- Powder Bed

- Blown Powder

- Metal Injection Molding

- Powder Metal Hot Isostatic Pressing

- Others

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes additive manufacturing, powder bed, blown powder, metal injection molding, powder metal hot isostatic pressing, and others.

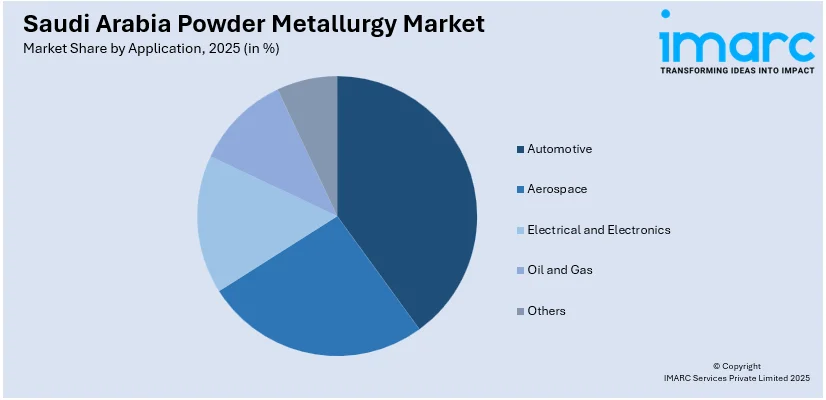

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace

- Electrical and Electronics

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace, electrical and electronics, oil and gas, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Powder Metallurgy Market News:

- On June 26, 2024, 6K Additive, a division of 6K, announced the expansion of its international distribution network to enhance global access to its sustainable metal powders for additive manufacturing. The company has hired Intelligent AM for Israel, the UAE, and Saudi Arabia, with plans to add more partners dependent on market need.

Saudi Arabia Powder Metallurgy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ferrous, Non-Ferrous |

| Materials Covered | Titanium, Steel, Nickel, Aluminum, Others |

| Manufacturing Processes Covered | Additive Manufacturing, Powder Bed, Blown Powder, Metal Injection Molding, Powder Metal Hot Isostatic Pressing, Others |

| Applications Covered | Automotive, Aerospace, Electrical and Electronics, Oil and Gas, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia powder metallurgy market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia powder metallurgy market on the basis of type?

- What is the breakup of the Saudi Arabia powder metallurgy market on the basis of material?

- What is the breakup of the Saudi Arabia powder metallurgy market on the basis of manufacturing process?

- What is the breakup of the Saudi Arabia powder metallurgy market on the basis of application?

- What is the breakup of the Saudi Arabia powder metallurgy market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia powder metallurgy market?

- What are the key driving factors and challenges in the Saudi Arabia powder metallurgy market?

- What is the structure of the Saudi Arabia powder metallurgy market and who are the key players?

- What is the degree of competition in the Saudi Arabia powder metallurgy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia powder metallurgy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia powder metallurgy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia powder metallurgy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)