Saudi Arabia Power Electronics Market Size, Share, Trends and Forecast by Device, Material, Application, Voltage, End Use Industry, and Region, 2026-2034

Saudi Arabia Power Electronics Market Overview:

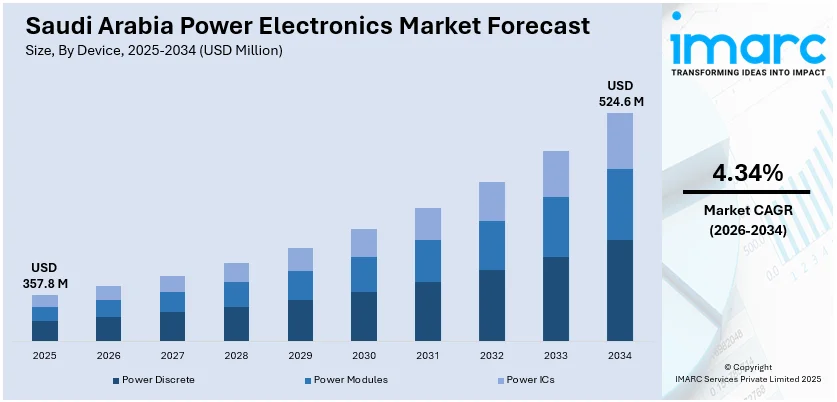

The Saudi Arabia power electronics market size reached USD 357.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 524.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.34% during 2026-2034. The market is fueled by Vision 2030's focus on infrastructure development, renewable energy implementation, and economic diversification. Major projects such as NEOM and Qiddiya, with their high demand for power distribution networks, are central initiatives. Moreover, government promotion of smart grids and integration of renewable energy accelerates the drive for power electronics, aiding the shift to a more sustainable and technology-driven energy future, and propelling the expansion of the Saudi Arabia power electronics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 357.8 Million |

| Market Forecast in 2034 | USD 524.6 Million |

| Market Growth Rate 2026-2034 | 4.34% |

Saudi Arabia Power Electronics Market Trends:

Smart Grid and Digital Technologies Integration

Saudi Arabia's power electronics industry is increasingly adopting digitalization, along with the use of smart grid technologies. Utilities and grid operators are installing advanced power transformers that are equipped with sensors, real-time monitoring, and communication features. These smart transformers support predictive maintenance, power flow optimization, and improved grid resilience. The use of digital technologies enables effective management of electricity distribution, minimizes downtime, and enables the smooth integration of renewable energy sources into the grid. This move toward automation and data-driven decision-making is in line with the kingdom's Vision 2030 goals of infrastructure modernization and enhancing energy efficiency. According to industry reports, Saudi Arabia and the UAE are two Gulf nations investing heavily into transforming their electricity grids into “smart” systems through artificial intelligence, while boosting their generation capacity from wind and solar energy. This portion is anticipated to nearly double in the Middle East and North Africa within the coming five years.

To get more information on this market Request Sample

Focus on Energy Efficiency and Sustainability

To address global environmental issues and national sustainability objectives, Saudi Arabia's power electronics industry is focusing on energy efficiency and environment-friendly solutions. The Saudi Energy Efficiency Center (SEEC) has introduced strict standards for electrical equipment and appliances, such as transformers, to minimize energy consumption and greenhouse gas emissions. Companies are coming up with creative solutions by designing transformers with higher efficiency levels, using new materials, and integrating biodegradable insulating fluids. Such moves satisfy regulatory requirements while also supporting the kingdom's overarching goals of minimizing its carbon footprint and upholding sustainable growth.

According to reports, by the year 2060, the Kingdom of Saudi Arabia (KSA) seeks to reach net zero greenhouse gas (GHG) emissions, aiming for 50% renewable energy and cutting 278 million tons of CO2 equivalent each year by 2030 as part of Vision 2030. This bold plan centers on economic variety, international involvement, and improved living standards. The electricity sector, boasting an installed capacity of 90 GW in 2020, is crucial for decarbonization, targeting a 55% decrease in emissions by 2030. The Energy Efficiency Action Plan of the Saudi Energy Efficiency Centre targets a 30% reduction in power intensity by 2030, while the NEOM project features a 4 GW green hydrogen facility, highlighting the nation’s dedication to sustainability and technological advancement.

Increasing Renewable Energy Infrastructure

The drive for diversifying the energy mix is leading to strong investments in renewable energy initiatives, thus fueling the Saudi Arabia power electronics market growth. The kingdom targets building considerable renewable energy capacity with specific targets for solar and wind power installations. This growth requires the installation of high-power electronic devices, including high-capacity transformers and inverters, to enable the integration of renewable energy into the national grid. The increasing need for these parts is spurring local manufacturing efforts and foreign partnerships, making Saudi Arabia a major player in the renewable industry.

Saudi Arabia Power Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on device, material, application, voltage, and end use industry.

Device Insights:

- Power Discrete

- Diode

- Transistors

- Thyristor

- Power Modules

- Intelligent Power Module

- Power Integrated Module

- Power ICs

- Power Management Integrated Circuit (PMIC)

- Application-Specific Integrated Circuit (ASIC)

The report has provided a detailed breakup and analysis of the market based on the device. This includes power discrete (diode, transistors, and thyristor), power modules (intelligent power module and power integrated module), and power ICs (power management integrated circuit (PMIC) and application-specific integrated circuit (ASIC)).

Material Insights:

- Silicon

- Sapphire

- Silicon Carbide

- Gallium Nitride

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes silicon, sapphire, silicon carbide, gallium nitride, and others.

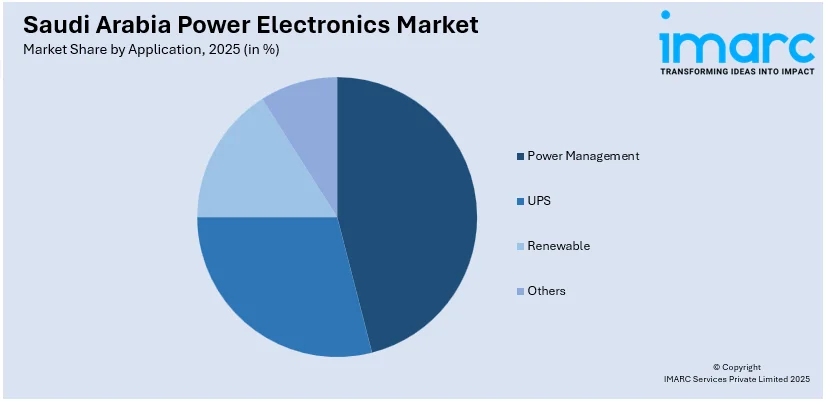

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Management

- UPS

- Renewable

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes power management, UPS, renewable, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

End Use Industry Insights:

- Automotive

- Military and Aerospace

- Energy and Power

- IT and Telecommunication

- Consumer Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, military and aerospace, energy and power, IT and telecommunication, consumer electronics, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Power Electronics Market News:

- In June 2023, Schneider Electric, a worldwide frontrunner in the digital transformation of energy management and automation, launched a new production line in Riyadh to produce equipment that will enhance Saudi Arabia’s energy efficiency and sustainability. The advanced production line will aid Saudi Arabia's Vision 2030 aim of establishing the Kingdom as a worldwide manufacturing center, enhancing chances to export energy management solutions to both regional and international markets.

Saudi Arabia Power Electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| Materials Covered | Silicon, Sapphire, Silicon Carbide, Gallium Nitride, Others |

| Applications Covered | Power Management, UPS, Renewable, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Use Industries Covered | Automotive, Military and Aerospace, Energy and Power, IT and Telecommunication, Consumer Electronics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia power electronics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia power electronics market on the basis of device?

- What is the breakup of the Saudi Arabia power electronics market on the basis of material?

- What is the breakup of the Saudi Arabia power electronics market on the basis of application?

- What is the breakup of the Saudi Arabia power electronics market on the basis of voltage?

- What is the breakup of the Saudi Arabia power electronics market on the basis of end use industry?

- What is the breakup of the Saudi Arabia power electronics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia power electronics market?

- What are the key driving factors and challenges in the Saudi Arabia power electronics?

- What is the structure of the Saudi Arabia power electronics market and who are the key players?

- What is the degree of competition in the Saudi Arabia power electronics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia power electronics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia power electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia power electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)