Saudi Arabia Power Extension Cord Market Size, Share, Trends and Forecast by Gauge Type, Application, Distribution Channel, and Region 2026-2034

Saudi Arabia Power Extension Cord Market Summary:

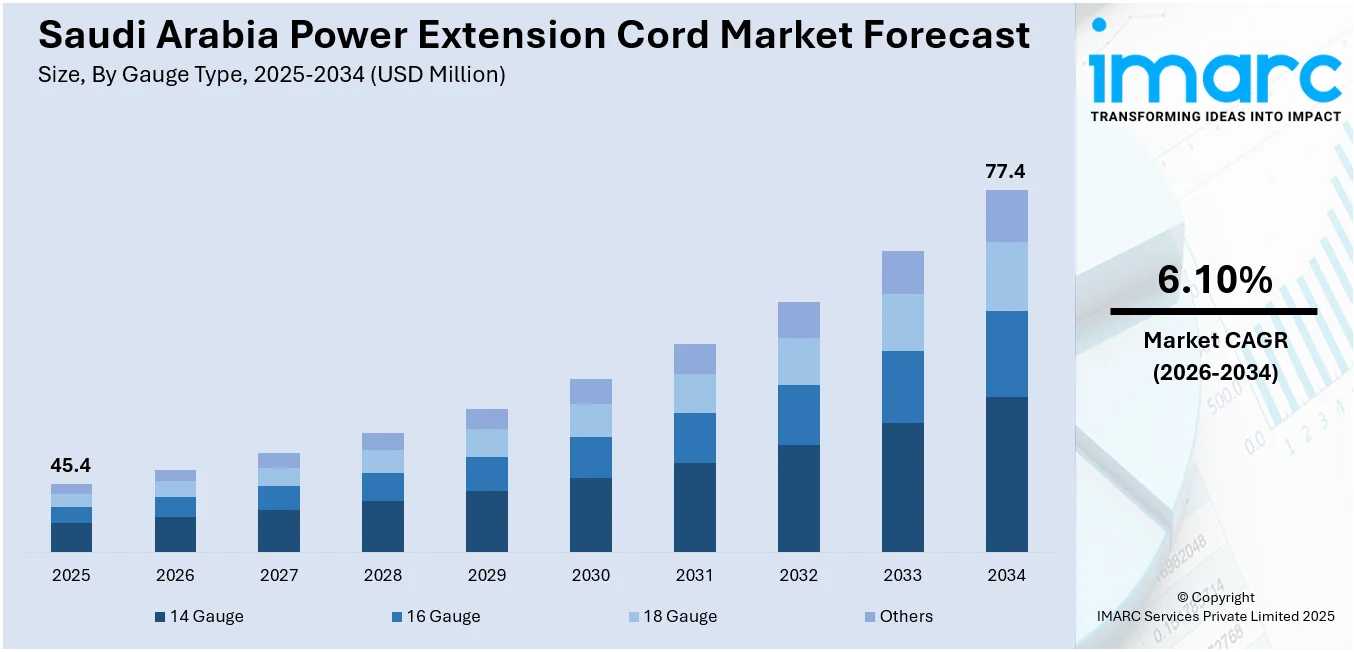

The Saudi Arabia power extension cord market size was valued at USD 45.4 Million in 2025 and is projected to reach USD 77.4 Million by 2034, growing at a compound annual growth rate of 6.10% from 2026-2034.

The Saudi Arabia power extension cord market is advancing as the Kingdom undergoes rapid urbanization, large-scale construction development, and accelerating adoption of smart home technologies. Expanding residential and commercial infrastructure under Vision 2030 is generating sustained demand for reliable electrical accessories. Strengthening regulatory frameworks governing product safety, rising consumer electronics penetration, and the growing e-commerce distribution channels are further contributing to the Saudi Arabia power extension cord market share.

Key Takeaways and Insights:

- By Gauge Type: 14 gauge represents the largest segment with a market share of 31% in 2025, due to its suitability for heavy-duty residential and commercial applications requiring higher amperage capacity for power tools, kitchen appliances, and industrial equipment across expanding construction sites.

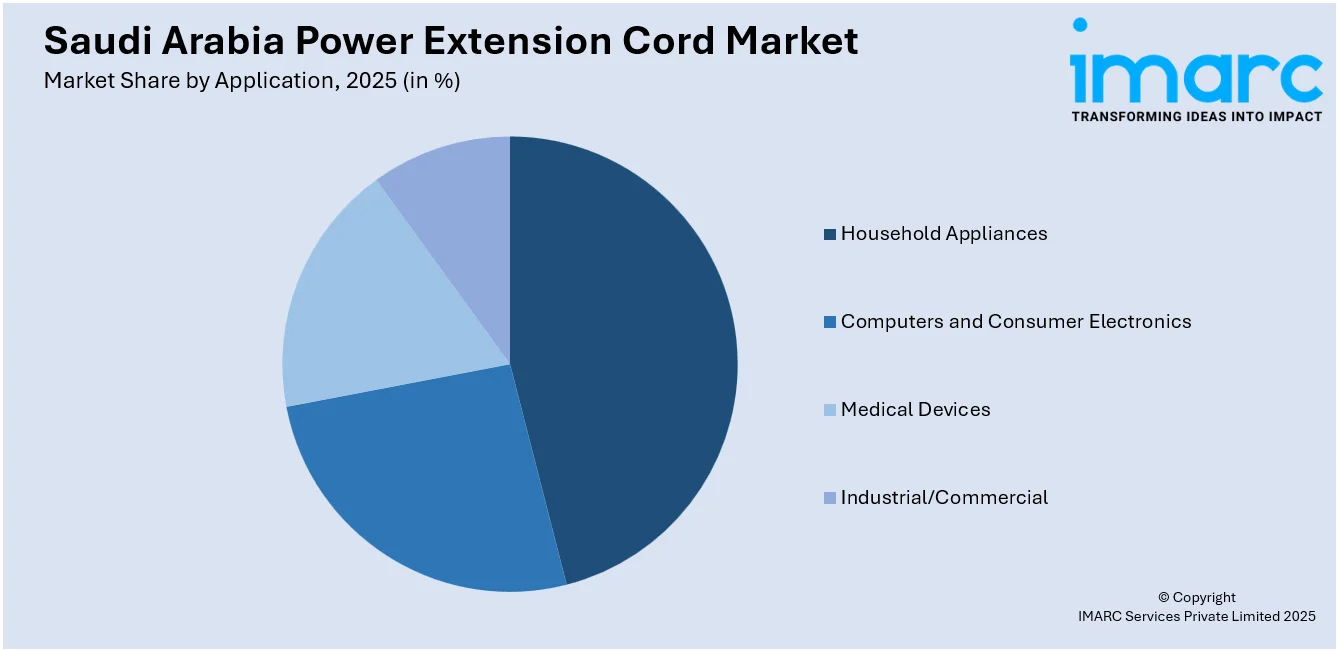

- By Application: Household appliances lead the market with a share of 35% in 2025, owing to the proliferation of home appliances driven by rising residential construction, the growing smart home adoption, and increasing individual spending on modern kitchen and cleaning equipment.

- By Distribution Channel: Offline dominates the market with a share of 60% in 2025. This dominance is because of user preference for physically examining electrical safety products before purchase, established retail networks, and the trust associated with specialized electrical supply stores.

- By Region: Northern and Central Region represent the largest segment with a market share of 28% in 2025, supported by Riyadh's position as the economic hub, concentrated construction activity in the capital, and high population density driving household and commercial demand.

- Key Players: The Saudi Arabia power extension cord market features a moderately fragmented competitive landscape, with established electrical manufacturers competing alongside regional distributors through product innovation, safety certification compliance, and expanding retail and digital distribution networks.

To get more information on this market Request Sample

The Saudi Arabia power extension cord market is driven by expanding construction activity, industrial diversification, and rising electrification across residential and commercial environments. Large scale infrastructure development under Vision 2030 is driving the demand for reliable electrical connectivity solutions to support tools, lighting, and temporary installations at worksites. Residential growth is reinforced by housing expansion initiatives, including the 2024 launch of a USD 213 Million housing development in Jeddah by the National Housing Company, which aimed to deliver more than 1,000 units within the Al-Sadan Community of over 5,500 homes. Furthermore, industrial diversification and the expansion of factories, warehouses, and service facilities are creating steady requirements for heavy duty extension cords suited to high load operations. The growing tourism, hospitality investments, and event based infrastructure further strengthen commercial demand. In addition, stricter electrical safety standards and user preference for certified, durable products are encouraging replacement purchases. Product innovation, including multi socket designs and enhanced safety features, continues to support the market growth.

Saudi Arabia Power Extension Cord Market Trends:

Rapid Growth in Construction and Infrastructure Development

The Saudi Arabia power extension cord market is strongly supported by large scale construction and infrastructure expansion across residential, commercial, and industrial developments. Ongoing projects increase the need for reliable electrical connectivity solutions for power tools, lighting systems, and on-site equipment. This demand is reinforced by industrial zone development, including the 2025 inauguration of major new projects in Dammam’s First and Second Industrial Zones, featuring 8-storey factory complex with 78 SME units and a ready built facility with 84 units for light industries, such as food, pharmaceuticals, electronics, and 3D printing. As Vision 2030 investments accelerate, there is a rise in the demand for durable, high-capacity extension cords suited for intensive applications.

Rise of E-Commerce and Organized Retail Distribution

The expansion of e-commerce platforms and organized retail networks in Saudi Arabia is improving accessibility and driving higher sales volumes of electrical accessories, including power extension cords. Individuals and businesses benefit from wider product availability, competitive pricing, and increased awareness of safety certified options. This trend is reinforced by the scale of digital participation, as the International Trade Administration (ITA) estimated that by 2024 around 33.6 million internet users in Saudi Arabia would engage in e commerce activities. The growing online distribution channels support demand for specialized extension cords across different load capacities and applications. The continued development of modern retail infrastructure strengthens market penetration, encourages replacement purchases, and supports sustained growth of the extension cord market.

Rising Demand from Hospitality and Tourism Infrastructure

Saudi Arabia’s robust tourism and hospitality sector is catalyzing the demand for power extension cords across hotels, resorts, entertainment venues, and major visitor facilities. These environments require flexible electrical connectivity for lighting systems, event arrangements, maintenance equipment, and temporary installations that support smooth operations. The strength of this driver is reflected in tourism growth, as a December 2024 UN Tourism announcement reported that Saudi Arabia ranked third globally in international tourist arrival growth, achieving a 61% increase in the first eight to nine months of 2024 compared with the same period in 2019. Rising hospitality activity is therefore driving the demand for durable, safe, and commercially suitable extension cord solutions.

How Vision 2030 is Transforming the Saudi Arabia Power Extension Cord Market:

Saudi Vision 2030 is reshaping the power extension cord market by accelerating infrastructure development, urban expansion, and industrial growth across the Kingdom. Large scale investments in residential housing, commercial complexes, data centers, healthcare facilities, and hospitality projects are catalyzing the demand for reliable power connectivity solutions. Localization initiatives under Vision 2030 support domestic manufacturing of electrical accessories, improving supply security and quality standards. Rapid expansion of smart cities, digital infrastructure, and renewable energy projects is also driving the need for advanced, safety compliant extension cords. Additionally, stricter regulations on electrical safety and product certification are encouraging the adoption of higher quality, durable, and standardized power extension cords across construction and end user segments.

Market Outlook 2026-2034:

The Saudi Arabia power extension cord market demonstrates strong growth potential throughout the forecast period, underpinned by sustained construction activity, rising electrification of households, and evolving user preferences for safety-certified products. Additionally, expanding residential infrastructure, smart home adoption, and strengthening product safety regulations will continue to drive revenue growth across all segments. The market generated a revenue of USD 45.4 Million in 2025 and is projected to reach a revenue of USD 77.4 Million by 2034, growing at a compound annual growth rate of 6.10% from 2026-2034.

Saudi Arabia Power Extension Cord Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Gauge Type |

14 Gauge |

31% |

|

Application |

Household Appliances |

35% |

|

Distribution Channel |

Offline |

60% |

|

Region |

Northern and Central Region |

28% |

Gauge Type Insights:

- 14 Gauge

- 16 Gauge

- 18 Gauge

- Others

14 Gauge dominates with a market share of 31% of the total Saudi Arabia power extension cord market in 2025.

14 gauge holds the biggest market share due to its balanced current carrying capacity, safety margin, and suitability for common residential and commercial applications. The gauge supports medium load equipment, air conditioners, power tools, and office electronics without excessive heat buildup. Its compatibility with standard sockets, ease of installation, and wide availability across retailers strengthen adoption. Contractors and facility managers prefer 14 gauge for routine construction, maintenance, and fit out activities, where reliability, compliance with safety norms, and cost control remain decisive purchasing considerations locally nationwide.

Industrial and commercial end users further reinforce the leaderships of 14 gauge owing to consistent performance across varied environments and operating hours. The gauge offers lower voltage drop over moderate distances, improving equipment efficiency and reducing power losses. Manufacturers favor 14 gauge since they balance copper usage with durability, enabling competitive pricing without compromising safety ratings. The growing demand from workshops, retail spaces, events, and temporary power setups supports volume sales. Alignment with national electrical standards, certification requirements, and importer preferences also ensures 14 gauge remain the default specification for large scale procurement programs across sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Appliances

- Computers and Consumer Electronics

- Medical Devices

- Industrial/Commercial

Household appliances exhibit a clear dominance with a 35% share of the total Saudi Arabia power extension cord market in 2025.

Household appliances lead the market because of widespread ownership of electrical devices across urban and semi-urban households. High usage of refrigerators, washing machines, air coolers, televisions, and kitchen appliances increases everyday reliance on extension cords for flexible power access. Rising residential construction, apartment living, and home renovations under national housing programs further support the demand. People prefer extension cords to manage limited wall sockets, improve convenience, and support temporary appliance placement. Seasonal usage peaks during summer months also boost demand for safe, heat-resistant cords suited for continuous household operation.

The growing adoption of smart home devices and personal electronics further strengthens the dominance of the segment. Products like routers, chargers, entertainment systems, and small appliances require accessible power points, often exceeding fixed outlet availability. This trend is supported by the expanding user base, as IMARC Group estimated the Saudi Arabia home appliances market will reach USD 9.4 billion by 2034. Furthermore, the rising safety awareness is leading to a preference for certified cords with overload protection, grounding, and durable insulation, ensuring steady replacement and repeat purchases.

Distribution Channel Insights:

- Online

- Offline

Offline leads with a market share of 60% of the total Saudi Arabia power extension cord market in 2025.

Offline represents the largest segment, driven by strong user preference for physical inspection before purchase. Buyers value the ability to assess build quality, cable thickness, plug design, and safety markings directly in stores. Hardware shops, electrical wholesalers, and hypermarkets offer immediate product availability, trusted brands, and after sales support. Contractors and electricians rely on offline channels for bulk purchases and urgent project requirements. Established retail networks across cities and industrial zones ensure consistent supply, while in store guidance from sales staff builds confidence in product selection and compliance with local electrical standards.

Traditional retail channels also benefit from long standing relationships with commercial buyers, facility managers, and small businesses. Offline outlets often provide flexible pricing, bulk discounts, and credit terms that online platforms rarely match. For industrial and construction use, buyers prioritize quick replacement, reliability, and warranty clarity, which are easier to manage through physical stores. Government projects and large contractors commonly source extension cords through approved offline suppliers to meet procurement norms. These factors collectively reinforce offline channels as the preferred distribution route across residential, commercial, and industrial end users in Saudi Arabia.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 28% of the total Saudi Arabia power extension cord market in 2025.

Northern and Central Region leads the market attributed to high population concentration, urban development, and dense residential infrastructure. Major cities within this region support strong demand from households, offices, retail outlets, and small businesses requiring flexible power connectivity. Ongoing housing projects, commercial construction, and public infrastructure expansion under national development programs continue to increase electricity usage. For instance, in 2025, Saudi Arabia’s National Housing Company (NHC) launched major premium real estate developments in Tabuk, including Tabuk Hills and the second phase of Tabuk Valley.

The region also benefits from stronger retail penetration and distribution networks compared to other parts of the Kingdom. Concentration of electrical wholesalers, hypermarkets, and specialized hardware stores ensures easy product access and competitive pricing. Industrial zones, workshops, and service centers across central cities generate recurring demand for durable extension cords. Higher disposable income levels and greater awareness about electrical safety standards encourage purchase of certified products. Proximity to logistics hubs and import gateways further improves supply efficiency, reinforcing Northern and Central Region leadership in the market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Power Extension Cord Market Growing?

Rising Demand for Smart Home and Connected Devices

Saudi Arabia’s increasing adoption of smart home technologies is driving the demand for flexible and reliable power access solutions across residential settings. As households install connected appliances, home automation systems, security devices, and advanced entertainment equipment, the need for additional power connectivity continues to rise. This shift is supported by strong market growth, estimated by the IMARC Group, with the Saudi Arabia smart homes market reaching USD 1.4 Billion in 2025, reflecting widespread technology adoption. In modern apartments and technology intensive homes, extension cords remain a practical solution for managing multiple devices. The growing preference for products with integrated safety features, surge protection, and multi socket designs is catalyzing the demand for power extension cord.

Increasing Popularity of Home Improvement and Do-It-Yourself (DIY) Activities

Saudi Arabia’s rising interest in home improvement, renovation, and DIY activities is driving the need for power extension cords in the residential segment. Homeowners require portable and flexible power solutions for tools, outdoor lighting, and household upgrades, driving higher product usage beyond basic appliances. This trend is reinforced by improving individual spending conditions, as the Mid-Year Economic and Fiscal Performance Report FY2024 noted that private consumption expenditure grew by 2.4 percent in real terms during the first half of FY2024 compared to the previous year. Higher disposable incomes and wider access to organized retail outlets further encourage purchases of safe, versatile, and durable extension cords, sustaining residential market demand.

Technological Improvements and Product Innovation

Manufacturers in Saudi Arabia’s power extension cord market are introducing products with improved load capacity, ergonomic designs, multiple socket configurations, smart safety mechanisms, and enhanced durability to meet evolving user requirements. Innovation is driven by demand for specialized extension cords suitable for industrial environments, outdoor conditions, and high-power applications where reliability is essential. As residential, commercial, and industrial users seek more convenient and secure power distribution solutions, technological advancements are encouraging replacement purchases and greater adoption of premium products. Continuous product development also strengthens competitive differentiation among suppliers, supporting the market growth and higher value growth across the extension cord industry.

Market Restraints:

What Challenges the Saudi Arabia Power Extension Cord Market is Facing?

Proliferation of Counterfeit and Substandard Products Undermining Market Quality

The presence of low-cost counterfeit and non-certified power extension cords in Saudi Arabia’s market poses safety risks and creates unfair competition for legitimate manufacturers. These substandard products often fail to meet safety specifications, compromising user protection and eroding trust in the broader product category, while pressuring compliant brands on pricing, margins, and market credibility across retail and contractor procurement channels.

Price Sensitivity Among Cost-Conscious Individuals and Contractor Segments

Significant price sensitivity among residential users and small-scale contractors constrains adoption of premium, safety-certified extension cord products. Many buyers prioritize upfront cost over quality and safety features, limiting demand for advanced extension cords offering surge protection, USB ports, and heavy gauge wiring, and slowing penetration of higher value products across price driven retail segments.

Extreme Climate Conditions Accelerating Product Degradation and Replacement Cycles

Saudi Arabia’s harsh climatic conditions, including extreme heat and high UV exposure, accelerate degradation of extension cord insulation and reduce product lifespan. Outdoor use at construction sites and industrial locations is especially affected, leading to cracking, reduced flexibility, and reliability concerns, while frequent replacement cycles increase total ownership costs for end users.

Competitive Landscape:

The Saudi Arabia power extension cord market exhibits a moderately fragmented competitive structure, with established multinational electrical product manufacturers competing alongside regional brands and local distributors. Market participants are differentiating through product safety certifications, gauge variety, innovative features, such as built-in surge protection and USB charging ports, and expanding multi-channel distribution strategies. The competitive landscape is increasingly shaped by compliance with evolving safety standards, localization of manufacturing capabilities aligned with the Made in Saudi program, and the growing importance of e-commerce platforms in reaching buyers beyond traditional retail networks.

Saudi Arabia Power Extension Cord Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gauge Types Covered | 14 Gauge, 16 Gauge, 18 Gauge, Others |

| Applications Covered | Household Appliances, Computers and Consumer Electronics, Medical Devices, Industrial/Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia power extension cord market size was valued at USD 45.4 Million in 2025.

The Saudi Arabia power extension cord market is expected to grow at a compound annual growth rate of 6.10% from 2026-2034 to reach USD 77.4 Million by 2034.

14 gauge holds the largest revenue share of 31% in 2025, driven by its superior current-carrying capacity suitable for heavy-duty residential and commercial applications requiring higher amperage support.

Key factors driving the Saudi Arabia power extension cord market include strong construction and industrial expansion, supported by Vision 2030 developments such as the 2025 Dammam industrial zone projects featuring 78 SME factory units and 84 ready built facilities, increasing demand for durable electrical connectivity solutions.

Major challenges include proliferation of counterfeit and substandard products, price sensitivity among cost-conscious user segments, extreme climate conditions accelerating product degradation, limited individual awareness about safety certification importance, and distribution gaps in remote and secondary urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)